The great global earnings expectations divergence

Simon Turner

Tue 28 Jan 2025 5 minutesWe all know the US has been attracting investment capital from all around the world at an unprecedented rate.

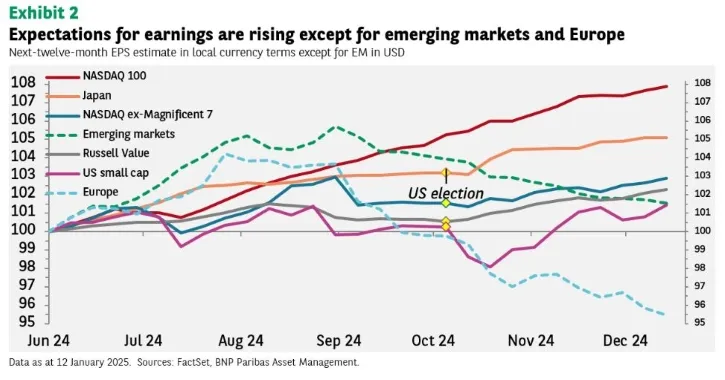

What may be more surprising to some investors are the growing global divergences of earnings growth expectations by region, as well as within the US.

It’s clear geographic exposure remains one of the most important asset allocation decisions investors need to make in 2025…

The US continues to benefit from earnings upgrades

The US remains the main investment game in town from an earnings upgrade perspective.

You’ll note the incredible straight ascending line at the top of the chart above which represents the NASDAQ 100’s earnings upgrades. That line trended upwards like clockwork throughout 2024 driven by The Magnificent 7 and AI as an emerging investment theme.

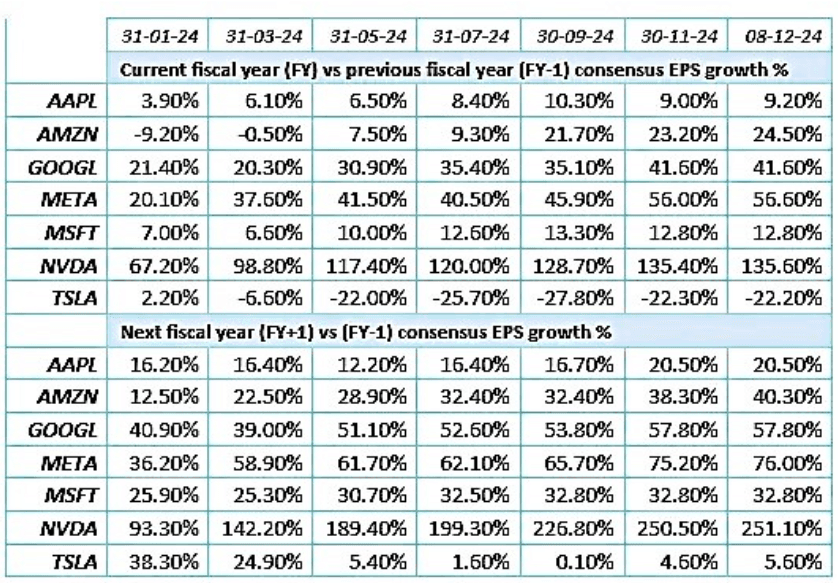

Check out the consistency of the Mag7 earnings upgrades throughout 2024 (apart from Tesla) …

But investors need to understand the glaring differences within the US market.

The two-speed American economy has not been leading to upgrades for all players across all sectors, particularly amongst smaller companies.

It’s noteworthy, however, that there’s been a trend shift in US small caps in recent months with a 4% earnings expectation increase off recent lows in anticipation of Trump’s proposed domestic demand stimulus measures such as on-shoring initiatives, tariffs, and expectations of a stronger dollar.

Whether those earnings upgrades turn out to be justified remains to be seen. So it’s good news for smaller cap investors, but there’s surely an element of political risk attached to some of those smaller companies benefitting from recent upgrades.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

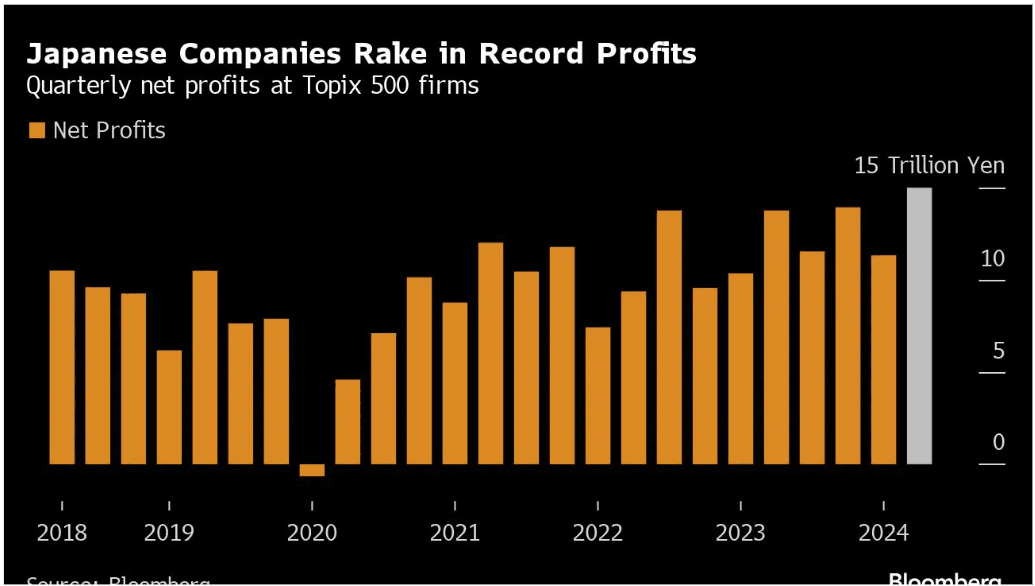

Japan benefitting from a stronger US dollar

Japan also stands out as a region which is benefitting from earnings upgrades on the back of four years of rising profitability.

The US dollar has played a key role. Japan exports $US145 billion to the US, so the country benefits from a stronger dollar, and the rally in the US dollar since September has generated a solid earnings tailwind.

After such a strong rally in the US dollar, there’s a risk that an earnings tailwind turns into a headwind at some point. That suggests there’s an element of currency risk attached to Japanese earnings estimates in the year ahead.

But for now, the earnings upgrade trend in Japan is impressive and intact.

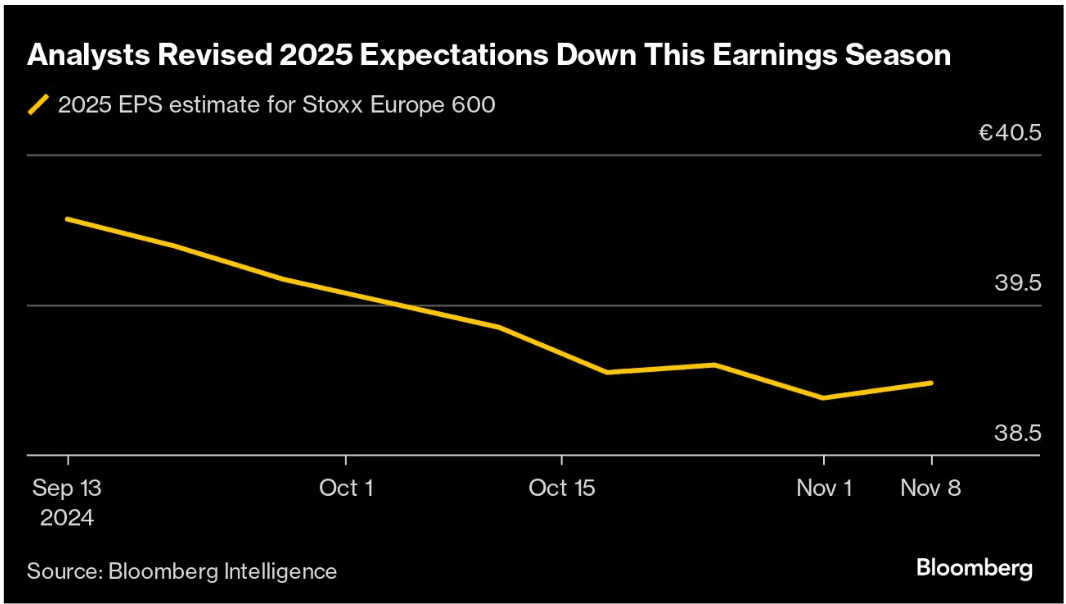

Europe is weak across the board

Europe is the standout poor performer in a global earnings revision context.

The downward earnings revisions have been happening for some time now, and have impacted every sector of the European economy.

Check out how bearishly analysts responded to last earnings season …

Bearing in mind Trump’s planned tariffs are expected to further impact the European economy, it’s hard to be positive about the earnings outlook.

Investors should probably expect more European earnings downgrades in the coming months.

Emerging Markets are a mixed bag

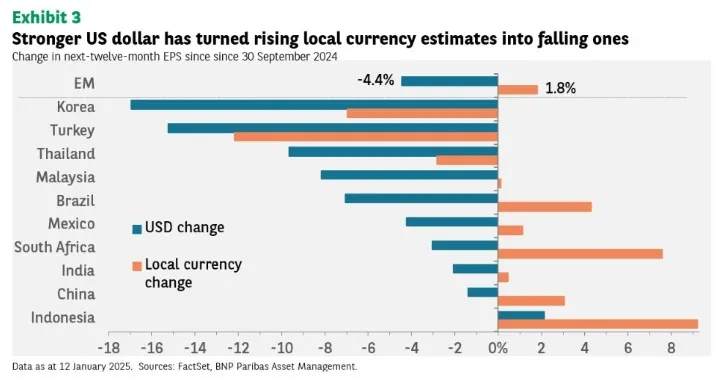

Emerging markets en masse have also navigated a period of negative earnings momentum in recent months.

The biggest issue has been the strengthening US dollar. In fact, the dollar had been so strong that a number of countries’ rising 2025 earnings estimates have translated into negative revisions in US dollar terms—as shown below.

China is interesting at the moment.

Despite market concerns about the impact of tariffs on the Chinese economy, there’s been an above-average increase in local currency estimates in recent months. This reflects the fact that only 2.8% of Chinese corporate revenues come from the US (according to Factset), whilst 86% of revenues are generated within the Chinese economy. That’s an important point to understand as it suggests further Chinese earnings upgrades may be coming regardless of US tariffs.

In general, whilst the US dollar will remain a key driver of emerging markets returns, investors are likely to benefit from picking their exposure based upon local earnings expectations.

Markets such as Indonesia, China, India, and South Africa stand out as well positioned on this front, whilst Korea, Turkey, and Thailand face a more challenging outlook.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

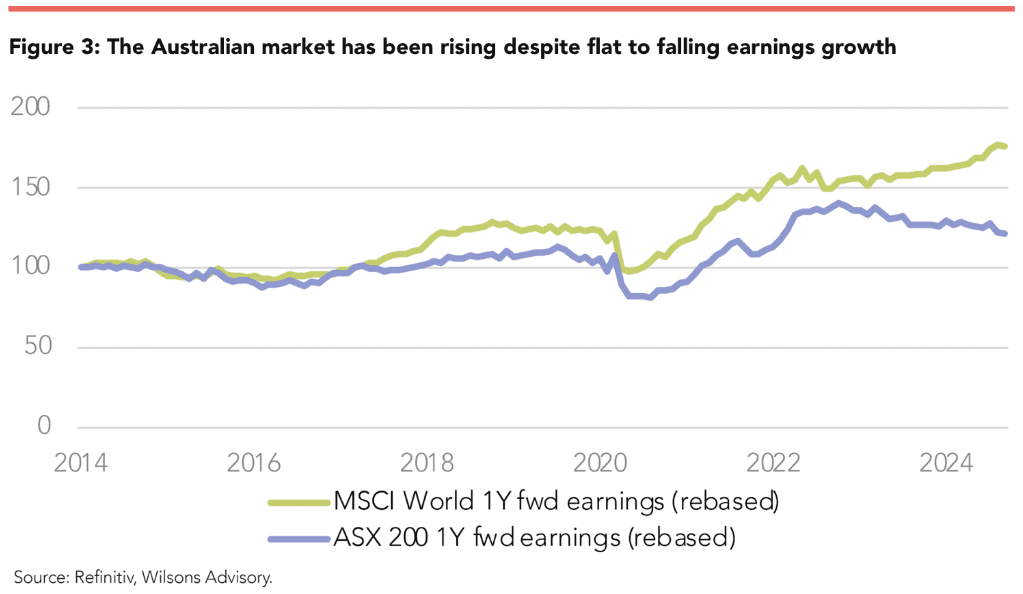

Australia remains a global laggard

What about the local market here in Australia? Sadly, it’s bad news.

Australian earnings estimates were revised downward during both 2023 and 2024, so the market backdrop has been more akin to Europe than the US.

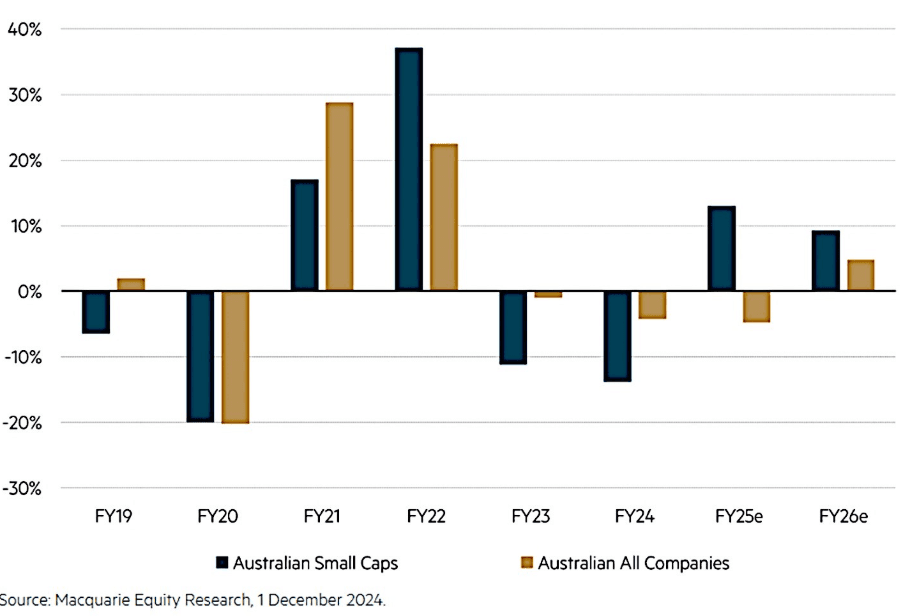

The FY25 outlook remains just as challenging—as shown in Macquarie’s estimates below.

You’ll note that Macquarie expect much stronger EPS growth from Australian smaller companies this year than from the market at large. That may translate into an opportunity for small cap investors despite the challenging backdrop.

Geography matters for investors

So the outlook for global earnings expectations is a decidedly mixed bag.

Earnings expectations continue to rise in the US and Japan, whilst Europe, Emerging Markets, and the local market here in Australia continue to face falling earnings expectations.

Being positioned with earnings upgrade momentum as a portfolio tailwind is generally a productive strategy, so picking your geographic exposure wisely remains an important investment decision in 2025.

Whatever your asset allocation goals, check out Australia’s best investment products at InvestmentMarkets.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.