Prepare for a resurgence of the healthcare sector

Simon Turner

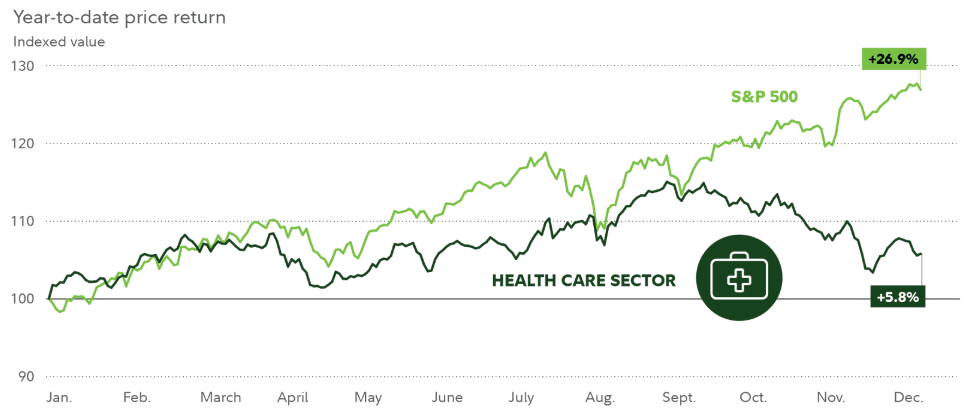

Wed 29 Jan 2025 6 minutes2024 was a bumpy ride for global healthcare investors with the sector lagging most economically sensitive sectors.

There were also sector-specific challenges to navigate in the form of margin pressure, workforce shortages, and digital disruption.

But at this juncture, the global healthcare sector’s fundamentals are stronger than ever thanks to a step-change in recent innovation as well as favourable demographic changes. Investors should arguably position themselves for a sector recovery…

A great place to invest over the long term

2024 was an annus horribilis for the global healthcare sector.

Check out the extent of the sector’s underperformance in the US, where most global healthcare leaders are based.

But here’s the important point the market seems to be forgetting … despite recent underperformance, the global healthcare sector has been a great place to invest over the long term—generating a return of 12% p.a. over the past 35 years.

It may be hard for younger investors to believe, but the global healthcare sector’s performance matches that of the global tech sector over the same timeframe.

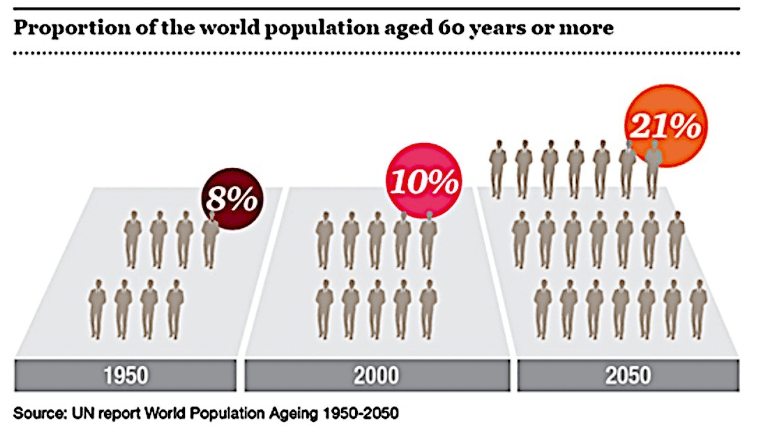

The ageing global population has provided a powerful structural tailwind which few sectors possess.

So the sector’s recent underperformance is an anomaly which arguably creates a great buying opportunity.

Innovation to drive growth across the sector

Importantly, the rate of innovation in the global healthcare sector has been impressive in recent years, with 2023 marking one of the busiest years for FDA approvals in the past three decades.

We've seen numerous new product launches across various treatment areas, including those often overlooked, like obesity and certain cancers, as well as crucial advancements in medical devices.

More generally we’re seeing five emerging innovation-driven trends across the sector which will start boosting growth rates this year…|

1. Personalised Healthcare Revolution

Healthcare will increasingly focus on personalised care leveraging AI and data to address individual patient needs, moving from reactive to preventative measures, which can help reduce costs and improve outcomes.

2. Future-Proofing Healthcare

AI will enhance healthcare systems' capacity to respond to challenges such as pandemics and demographic shifts. Decision-makers will have access to extensive data to understand global health trends and needs.

3. Innovative Mental Healthcare

There's potential for revolutionary changes in mental healthcare delivery through virtual reality, augmented reality, and AI chat-bots, promoting accessibility and reducing stigma.

4. Wearable Tech and Implants

The rise of implantable devices like brain-computer interfaces (BCIs) will introduce new solutions for chronic health issues, raising ethical considerations regarding data ownership.

5. Advancements in Genomics

Gene editing technologies, such as CRISPR, will gain real-world applications, offering targeted treatments for genetic diseases and possibly addressing cancer and cardiovascular conditions.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

It’s not all good news

The global healthcare sector is also facing three headwinds which are likely to remain a challenge…

1. Health Data Dilemma

The increase in health data presents security challenges for the sector, since sensitive information is a prime target for cybercriminals. So the healthcare sector faces substantial financial risks from data breaches, prompting a push for better data protection measures.

2. Tech Skills Crisis

A significant barrier to leveraging new technologies is the shortage of skilled professionals across the healthcare sector. The industry is expected to invest in training and partnerships to bridge this skills gap.3. RFK’s appointment

President Trump’s nomination of Robert F. Kennedy Jr. for the Secretary of Health and Human Services has stirred up some uncertainty in the sector due to potential policy changes which may be coming.Whilst most industry experts agree that the new government leadership is unlikely to create significant new approval or pricing headwinds in biopharma which is still digesting Medicare reforms as part of the Inflation Reduction Act, there’s a risk of policy reform in managed care which could impact some players.

For investors, it’s a case of watch this space.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

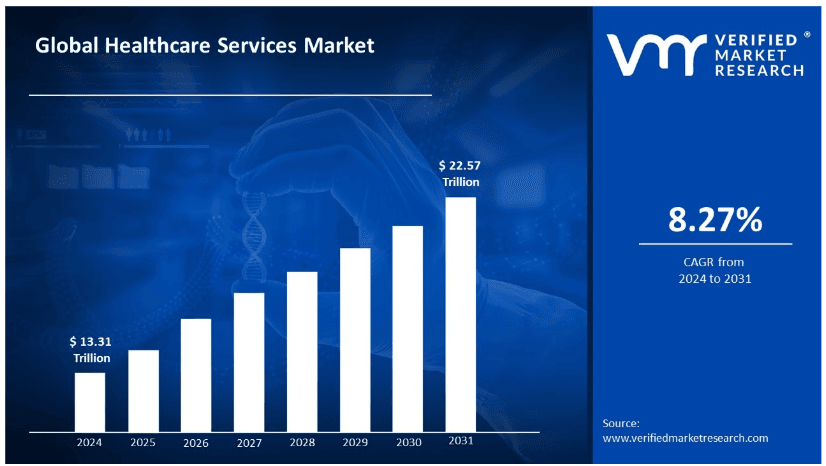

Global healthcare demand is soaring

As mentioned, the ageing global population is about as powerful a structural tailwind as you’ll come across in the investment world. It drives healthcare demand growth each year, and independently of what’s happening in the global economy. It’s the ultimate defensive growth.

Growing waiting lists are also an important demand driver. The pandemic left many countries with significant waiting lists for care, particularly in the UK, where the number of patients awaiting elective procedures has skyrocketed to between 8 and 11 million.

Another promising trend is growing healthcare demand in emerging markets. Nations like China and India are projected to lead the way in per capita healthcare spending growth for many years to come.

With such visible and structural demand drivers, the global healthcare sector is positioned for strong, predictable revenue growth in the coming years...

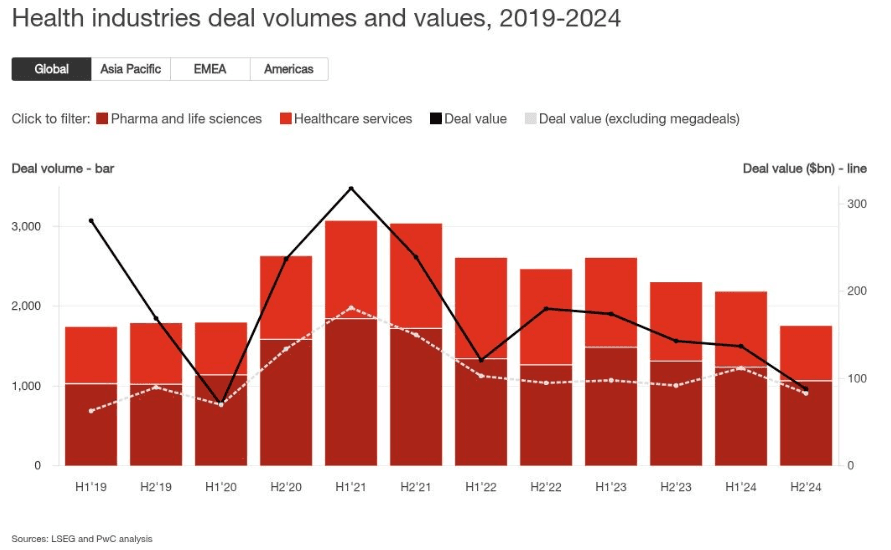

More M&A likely

Sector consolidation is also likely to drive growth as more companies build their research capabilities and expand into complementary technologies.

With a substantial number of products facing patent expiries soon, the sector’s leaders will need to be proactive in seeking out new opportunities through M&A sooner rather than later.

To Sum It Up

The global healthcare sector appears to be on the brink of making a comeback, starting in 2025.

The sector’s improving prospects are rooted in the strong fundamentals that drive this industry—innovation, new treatments, and growing demand—alongside predictable structural trends like population growth and emerging market growth.

All signs point to a promising new chapter for the sector.

Healthcare fund opportunities

If you’re interested in ways to increase your exposure to the global healthcare sector, check out some of the compelling fund opportunities positioned to benefit…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.