How the US Tech Capex Boom Could Play Out

Simon Turner

Mon 18 Aug 2025 7 minutesTired of hearing about AI being the main investment game in town? That’s understandable. Since ChatGPT’s launch in 2022, the market has been somewhat obsessed with all things AI.

This time, the market’s obsession appears to be for good reason. In the past couple of years, we’ve witnessed a monumental and structural shift in US corporate behaviour which has ignited a technological arms race fuelled by AI advancement.

The unprecedented AI capex boom by big tech is a case in point. Importantly, it’s different to the 2000 internet boom in that this it’s being funded by immensely profitable companies with rock solid balance sheets.

The upshot is that AI is changing the face of the US and global economies, and is here to stay as a dominant investment theme…

The Unstoppable AI Capex Boom

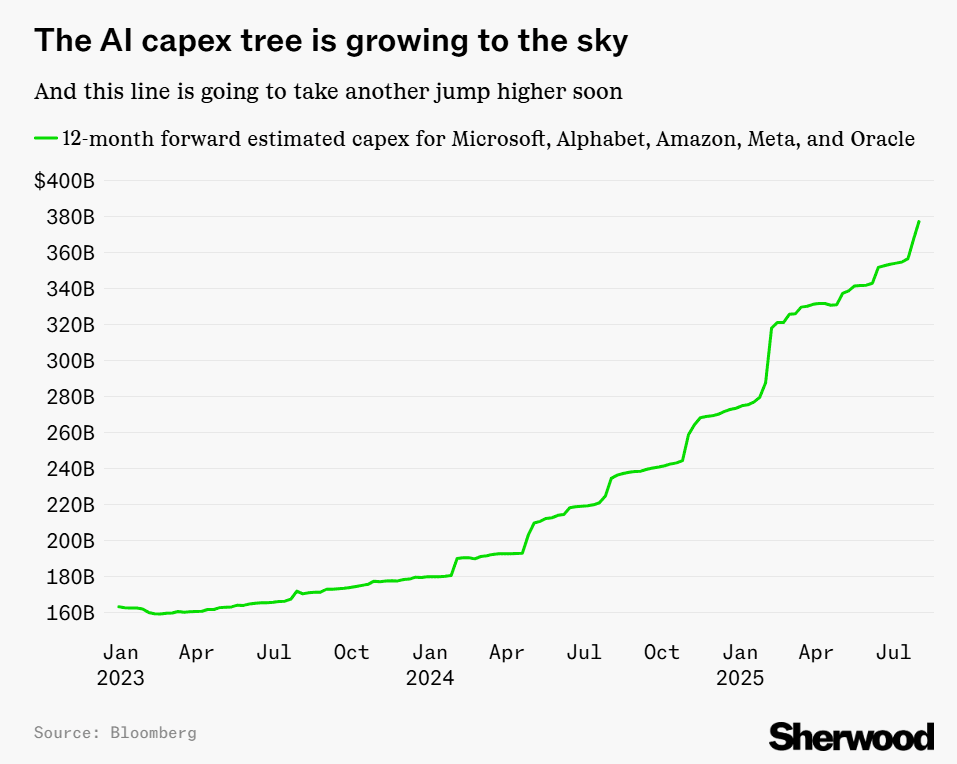

The AI capex numbers speak for themselves.

In 2023, Microsoft, Alphabet, Meta, Amazon, and Oracle spent a combined $US151 billion on capital expenditure, largely focused on AI development. That figure jumped to $US246 billion in 2024 and is expected to surpass $US320 billion in 2025, according to Bloomberg.

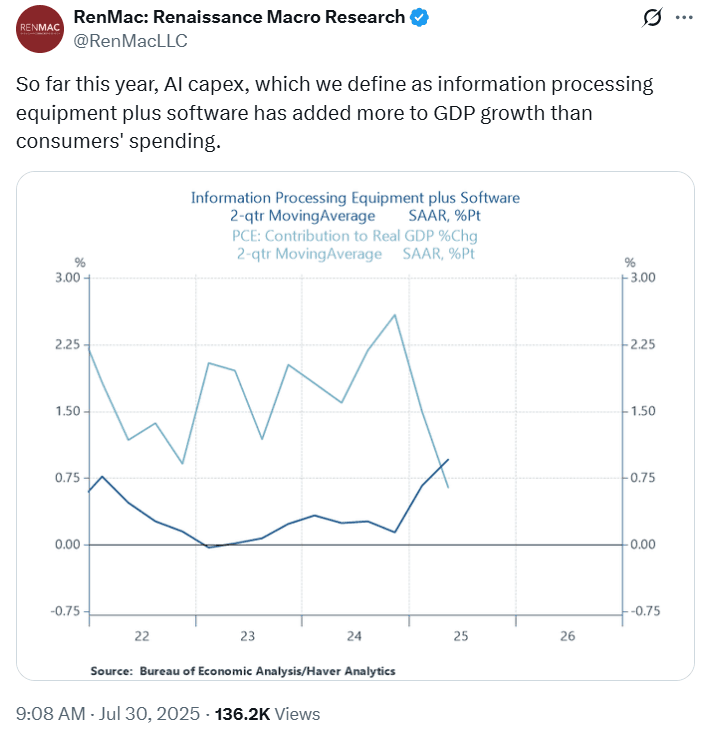

Let’s put those numbers into perspective. The largest US tech companies are now spending more on AI-related capex than the rest of the S&P 500 combined. Moreover, AI spending is contributing more to US GDP growth than consumer spending, which typically represents ~70% of the economy.

Take a moment to digest this strange but true state of affairs. A few years ago, the notion that AI capex would be contributing more to the US economy than consumer spending would have been regarded by most investors as absurd. But that’s the new reality markets are contending with.

Whether you’re bullish or sceptical, AI is already a structural force which is reshaping both the global economy and investment markets.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What’s Driving the AI Spending Boom?

So what’s that huge wave of AI capex is being spent on?

The world’s largest technology companies in an all-out sprint to build the infrastructure needed to establish a leading position in generative AI. The main areas of spend include:

- Massive data centres: utilising specialised AI chips, like Nvidia’s H100s and upcoming B100s.

- Custom silicon development: such as Amazon’s Trainium and Google’s TPU.

- Acquisitions and partnerships: with AI start-ups and model providers.

- Cloud platform integration: needed to sell AI-as-a-service at scale.

It’s important to understand that these investments are largely focused upon supporting existing operations, rather than investing in untested blue sky projects which may or may not succeed in the future.

For example, Microsoft is already monetising AI in Office 365 (Copilot), GitHub, Azure, and LinkedIn. Google is weaving Gemini into every layer of its products, and Meta is integrating Llama into its advertising engine.

So this historic AI capex cycle isn’t about preparing for a long-term future which may or may not eventuate. It’s about commercialising AI right now.

A Vast Range of Potential Outcomes

You may come across a fair amount of AI scepticism in your travels. That will always be the case when a new high-potential technology monopolises the market’s interest like this. And let’s be honest, those sceptics may be fully or partially correct in the coming years. No one knows the future.

For now, the market is digesting the range of potential outcomes between two extreme scenarios:

1. The Crash-and-Burn Scenario

In hindsight, big tech’s AI capex spending will be viewed as excessive. The expected returns failed to materialise, and a market downturn ensued. Everyone wonders why investors didn’t see it coming and lament about how foolish corporate America was.

2. The World-Changing Scenario

Looking back, AI transformed every industry with enhanced growth and profitability. The early leaders continue to dominate, and this AI capex cycle pays off spectacularly. Everyone wonders why big tech didn’t go all-in earlier.

More realistically, we may get a short-term scare about scenario 1 eventuating, followed by longer term structural gains confirming that some, but not all, of scenario 2’s promise is being realised. That means volatility is likely to be core part of the AI investment journey in the coming months and years.

Either way, we’re living through a pivotal moment, and the implications go far beyond the Nasdaq.

Use the Right Funds & ETFs to Ride the AI Capex Wave

Australian portfolios are generally underweight US tech and heavily tilted toward local banks, resources, and domestic REITs. That means most investors are missing out on the full benefits of the AI boom. They’re also potentially overexposed to sectors with limited AI tailwinds, or worse, facing AI headwinds.

If you’re in that boat, here are four strategies to position yourself to benefit from this unprecedented AI capex cycle:

1. US/Global Tech ETFs

Gain direct exposure to the Magnificent 7 and their AI build-out via international technology-focused ETFs such as Betashares Nasdaq 100 ETF (ASX: NDQ) and Global X FANG+ ETF (ASX: FANG).

✅ Great for: High-growth allocation within a diversified portfolio.

📊 Consider blending with lower-volatility assets to help manage risk.

2. Thematic AI & Robotics Funds

Want something more targeted?

For exposure to global automation and AI-enabling companies, a thematic ETF such as Global X ROBO Global Robotics & Automation ETF (ASX: ROBO) may be a solid choice for exposure to semiconductor makers, AI hardware enablers, cloud infrastructure providers, and enterprise software firms.

✅ Great for: Investors with a higher risk appetite seeking thematic exposure.

🔍 Use as a satellite holding to complement a core global equity holding.

3. Global Infrastructure & REITs

AI needs infrastructure investment. Not just chips and code, but also power, cooling, and space.

REIT ETFs focused on data centres and industrial property such as Resolution Capital Global Property Securities Fund may benefit from structural demand growth during the AI rollout.

Infrastructure funds with exposure to energy grids, transmission, and renewables such as Magellan Infrastructure Fund (Currency Hedged) - Active ETF and Resolution Capital Global Listed Infrastructure Fund also stand to gain.

✅ Great for: Defensive income investors who want indirect AI exposure. </>

4. Multi-Asset Actively Managed Global Funds

Rather than choosing sectors and themes, let an active multi-asset managers do it for you within a broader diversified strategy. This strategy is more balanced and holistic, and is likely to come with lower volatility.

Look for global growth managers such as Lakehouse Global Growth Fund and Tycoon Global Growth Equity Fund with high conviction, long-term AI allocations.

Consider hedged vs unhedged options depending on currency views. If you’re cautious on the AUD outlook, unhedged is a better choice, whereas if you’re bullish or agnostic on the AUD, hedged exposure is likely a better match.

✅ Great for: Set-and-forget investors, SMSFs, and retirement accounts.

💡 Look for global managers with a track record of tech sector insight.

🔍 Use the fund comparison function on InvestmentMarkets.com.au to compare performance, holdings, and costs.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Prepare, Don’t Predict

No one knows exactly how the AI boom will play out, but we know it’s here to stay as a leading global investment theme.

If you’re waiting for a perfect entry point into the AI trade, you may already be disappointed. The more prudent approach may be to prepare your portfolio today, not by betting the house on the AI boom continuing in a straight line, but by incrementally building smart AI exposure through diversified, transparent, and tax-efficient ETFs and funds which profitably harness the upsides of AI. Being ready to take advantage of future market selloffs is likely to help with this strategy.

Funds Mentioned

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.