Make The Efficient Frontier Your Portfolio’s North Star

Simon Turner

Wed 20 Aug 2025 6 minutesAre you aiming for the type of enduring wealth accumulation that’s built upon optimising your long-term, risk-adjusted returns?

If the answer’s yes, you’ll probably be aware that long-term wealth building tends to be the result of small, consistent steps like systematic asset allocation, rigorous diversification, and unwavering discipline. It also tends to utilise the powerful concept known as the Efficient Frontier, a cornerstone of Modern Portfolio Theory (MPT).

Originating from Harry Markowitz’s pioneering work in the 1950s, the Efficient Frontier helps investors craft portfolios that deliver the highest expected return for their risk level. What makes it particularly valuable is its real world applicability…

What Is the Efficient Frontier?

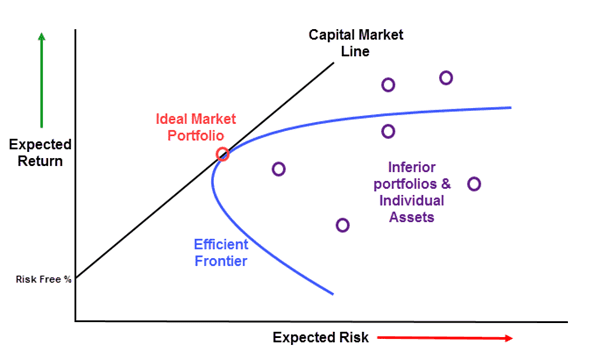

In short, the Efficient Frontier represents the set of portfolios that offer the highest expected return for each level of risk, or the lowest risk for a desired return (see the curve in the chart below).

Portfolios lying below the Efficient Frontier curve are considered suboptimal, as they generate a less than optimal return for the same risk.

Portfolios above the curve don’t tend to exist in efficient markets as they would imply higher returns were possible without taking on additional risk, which defies logic when markets are efficient. However, most investors would agree that markets are not efficient all the time, so occasional opportunities to move above the curve may present themselves.

Importantly, the Efficient Frontier is not universal. Each investor’s frontier is unique to them, and depends upon expected returns, volatilities, correlations, and their personal risk tolerance.

One of the Most Important Concepts in Finance

The Efficient Frontier curve is a powerful (and under-utilised) investment tool for four key reasons:

1. Maximises Your Return for Your Risk Level

The objective of most investment strategies is to maximise return for your chosen level of risk. Of course, that’s simple in principle, but complicated in practice. The Efficient Frontier is a game changer on this front. It helps investors identify the portfolio that delivers them optimal risk-adjusted returns.

2. Reinforces Diversification

Because the Efficient Frontier is generally derived from differing asset classes with low correlations, it underscores the value of combining diversified assets for smoother, risk-adjusted performance.

3. Guides Data-Driven Choices

The Efficient Frontier transforms portfolio construction into a quantitative framework instead of relying on intuition or guesswork. This benefit is hard to overstate as it helps investors create portfolios based on optimised real-world outcomes rather than the emotional biases which tend to sabotage our performance.

4. Addresses Home Market Bias

The Efficient Frontier helps avoid overexposure to your home market, otherwise known as home market bias. It also optimises the geography, equity vs bond, and volatility dimensions of your portfolio.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Putting the Efficient Frontier into Practice

To make the Efficient Frontier more tangible, let’s consider the example of a reasonably aggressive investor whose investment plan requires they invest in three broad-based funds/ETFs with the following weightings:

- An Australian fund/ETF such as Global X Australian 300 ETF (ASX: A300) – target weighting 40%.

- A Global Bond fund/ETF such as JP Morgan Global Bond Active ETF – target weighting 20%.

- A Global Growth fund/ETF such as Betashares Diversified All Growth ETF (ASX: DHHF) – target weighting 40%.

In theory, this looks like a simple but solid portfolio aimed at long-term wealth accumulation.

It’s time to test that theory by creating an Efficient Frontier aimed at identifying the optimal weightings of these three funds to maximise this portfolio’s risk-adjusted returns.

This is where accessing appropriate data to create a useful Efficient Frontier can be a challenge. In our experience, Portfolio Visualizer is the best available free Efficient Frontier tool. However, it lacks data on many of the funds and ETFs available to Australian investors. Never fear. It includes data on plenty of similar funds with similar correlations and performance. With an open mind, it’s still possible to use it for this purpose.

In this example, we found within Portfolio Visualizer a broad-based Australian ETF (iShares MSCI Australia), a global bond fund (JP Morgan Global Bond Opportunities), and a global growth ETF (Guardian i3 Global Quality Growth ETF), to represent the three funds this investor is aiming to invest in.

Thanks to Portfolio Visualizer, here are the all-important correlations of these three funds (key inputs for the efficient frontier):

You’ll notice the low correlation between the Australian and Global ETFs. That’s exactly what you’re looking for in this exercise. Low fund correlations tend to result in the Efficient Frontier providing much stronger risk-adjusted returns than pure guesswork would allow.

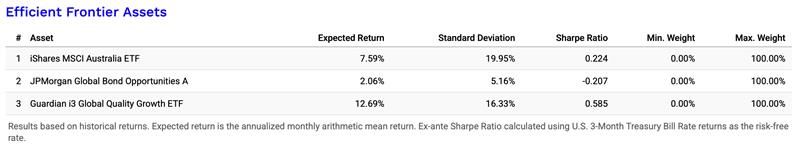

Here’s the expected return, standard deviations, and Sharpe ratios (risk-adjusted return measure) for these three funds (more key inputs for the efficient frontier):

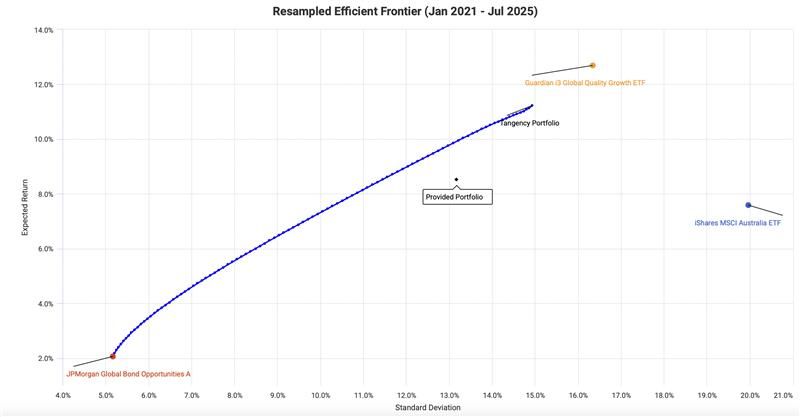

We now have all the information we need to create the Efficient Frontier for these three funds. And here it is:

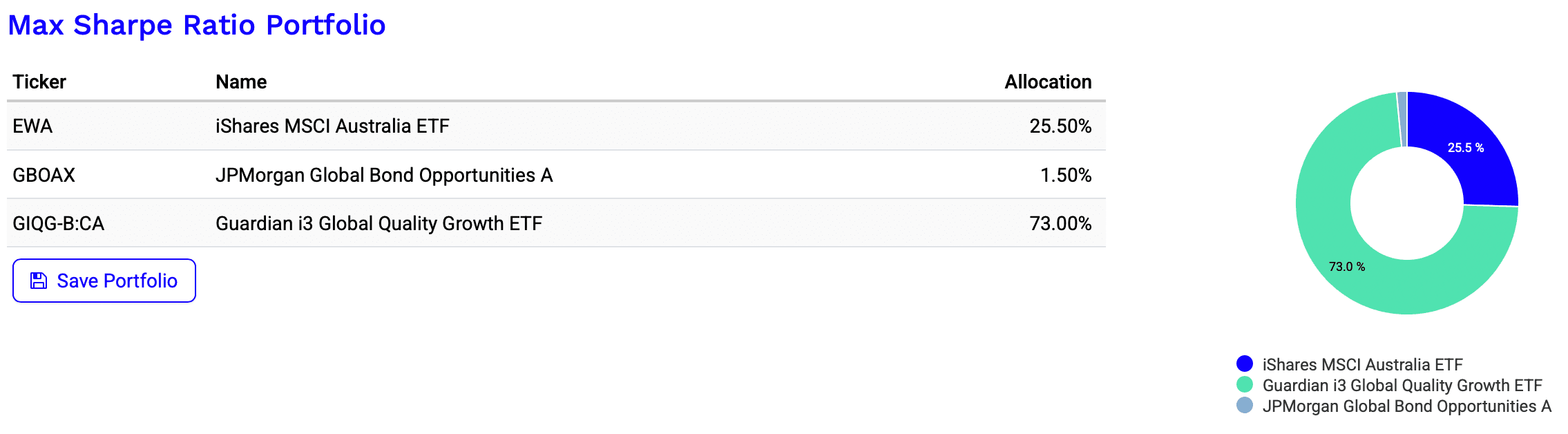

Here’s what that optimised portfolio looks like:

You’ll notice that those weightings are very different from the initial target weightings with a much higher Global Growth ETF weighting and a much lower Global Bond fund weighting.

Ready for the terms and conditions? This is where we have to mention the caveat that Efficient Frontiers depend on accurate historical data, and the assumption that future returns will reflect historic returns. Of course, neither may be true. Tax implications, transaction costs, liquidity, and investor behaviour can also distort the theoretical outcomes.

However, in the event that the past is a guide of what’s coming, this Efficient Frontier can improve this portfolio’s expected returns from 8.5% p.a. to 11.2% p.a., while the standard deviation of its returns is expected to fall. That translates into a 32% rise in risk-adjusted returns as measured by the Sharpe ratio, a significant improvement.

Those improved prospective outcomes are surely aligned with most investors’ long-term goals.

🔍 Tip: Markets change, so your optimal portfolio will drift over time. Periodic rebalancing, say annually, will help you maintain your position on your own unique Efficient Frontier.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A Portfolio Compass for Long-Term Enrichment

As shown above, the Efficient Frontier isn’t just an academic theory. It’s a strategic compass that helps investors turn fragmented asset choices into coherent, optimal portfolios aligned with their goals and risk tolerance. It helps investors elevate their strategy and their long-term investment outcomes. And it’s worthy of your attention.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.