If Jesse Livermore were advising investors how to make money in 2025

Simon Turner

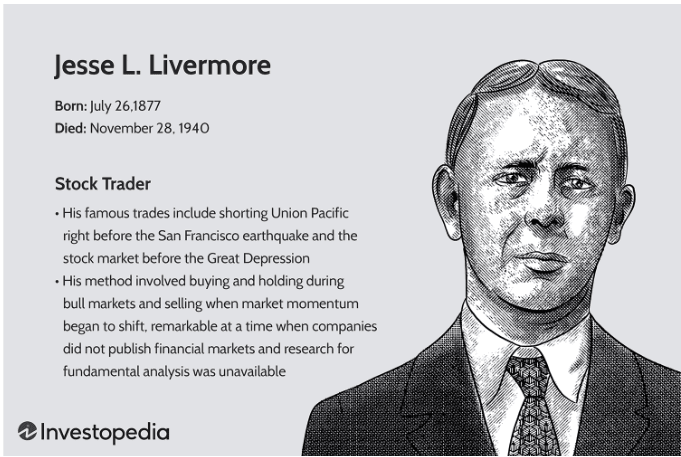

Mon 17 Feb 2025 5 minutesIf you’ve read many classic investment books, you’ve probably come across Reminiscences of a Stock Operator by Edwin Lefèvre, which brings to life Jesse Livermore’s fascinating journey as a stock investor and trader.

Whilst Jesse Livermore is famous for losing his money just as fast as he made it, many people regard him as one of the greatest traders and investors ever to have lived.

In the interest of learning from past masters, it’s worth asking how Jesse Livermore would advise investors to invest in 2025 if he were alive today.

So we’ve pieced together some of his classic advice into three pieces of new guidance from old wisdom…

Only invest in stocks and funds you are happy to hold for the long term.

In an expensive global equities market like we’re in at present, that translates into allocating your capital away from the herd into undervalued assets rather than chasing short term momentum.

Don’t react to short term volatility beyond using it as an opportunity to buy on weakness or reduce/rebalance into strength. Think and act long term.

Expect markets to go up and down this year, as they always do.

But once you’ve decided on your investment plan, the best thing you can do is stick with it. Trading in and out of the market is generally a poor investment strategy, even for a master trader.

Understand that your ability to sit on your investments rather than trade them will be the main driver of your investment returns.

For the majority of investors, the most effective strategy may be to invest a portion of their wealth in professionally managed funds and ETFs each year. This is an effective way to build long term wealth by leveraging fund managers’ cumulative investment knowledge and wisdom.

For the small portion of investors with a genuine passion for mastering direct investing, Jesse would no doubt advise them to read as many books about investing as possible with a view to mastering the investing game.

1. Master your biases if you want to outperform

One of Jesse Livermore’s greatest strengths was his awareness of his emotional biases which he recognised regularly conspired to hamper his investment results.

In particular, he was aware of an emotional bias known as the present bias which reflects our tendency to accept lower short term returns in the present day over higher returns in a year or longer. For example, when asked to choose whether to accept $500 now or $600 in a year, most people tend to opt for the lower present day pay-out.

However, this is a challenge when it comes to investing since the optimal investment returns tend to be generated by holding on for the longer term gains.

Jesse Livermore’s likely advice to 2025 investors:

2. Being disciplined is your safety net

Jesse Livermore was a proponent for being extremely disciplined as an investor.

In his eyes, that meant writing his investment strategy down and sticking with it regardless of what other investors were doing. It also meant mastering his emotions rather than following the herd during bouts of collective greed and fear.

Jesse learnt the hard way that a disciplined investor with a mediocre strategy is likely to build more wealth than an undisciplined investor with an extraordinary strategy.

He also learnt that doing nothing is the hardest thing for most investors to do—even though it’s generally the most profitable strategy.

Jesse Livermore’s likely advice to 2025 investors:

3. Financial knowledge is a powerful tool

Jesse Livermore was famous for his mastery of technical analysis, which he used to great effect.

But he also learnt that financial education extends well beyond technical analysis, and is incredibly valuable for investors. The more Jesse learnt about finance, including fundamental analysis, the more confident he became in making investment decisions.

So he was a huge proponent for improving financial knowledge as a foundational strategy for building long term wealth.

Jesse Livermore’s likely advice to 2025 investors:

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A wise voice from the past

Whilst the modern world is a very different place compared with when Jesse Livermore was alive, many elements of successful investing remains unchanged. So learning from investment masters of the past like Jesse Livermore provides a fount of valuable lessons.

Jesse’s advice today would probably be similar to his advice when he was alive: master your emotional biases, stay disciplined, invest for the long term, and improve your financial knowledge.

If you manage to follow that advice as well as Jesse in his heyday, you may be on track to accumulate similarly impressive amounts of wealth.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.