Financial planning for big life events: What you need to know

Ankita Rai

Thu 13 Feb 2025 6 minutesFinancial planning isn’t just about growing wealth—it’s about being prepared for life’s unexpected turns. From marriage and divorce to receiving an inheritance, major life events can catch people off guard. Even planned milestones—such as buying a home, raising children, or retiring—can create financial strain without proper preparation.

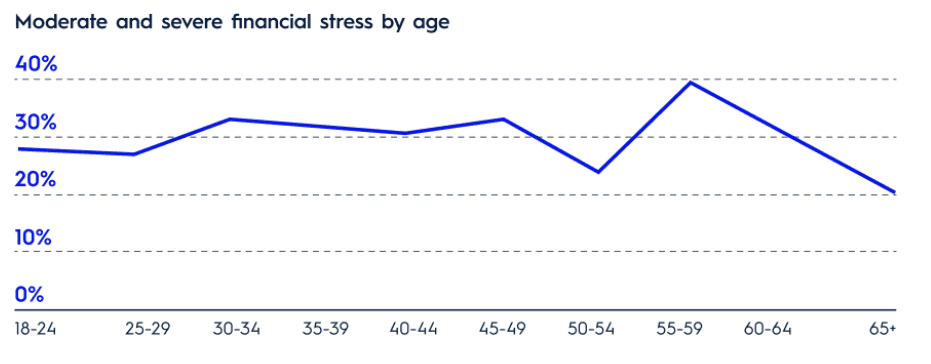

According to the AMP Financial Wellness Report 2024, financial stress often peaks between the ages 30 and 55 due to significant expenses like mortgage payments, childcare, and education.

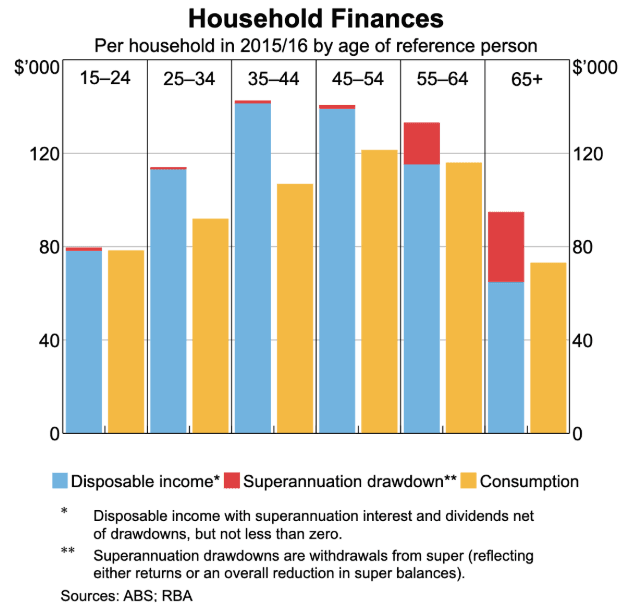

Household spending typically follows a hump-shaped pattern, increasing throughout the working years and peaking between ages 35 and 54—when families typically have children at home.

By the time most people reach their 50s, retirement planning becomes a primary concern, especially as longer life expectancies raise fears of running out of savings. However, after retirement, expenses often decline as typical daily costs decrease.

Understanding these spending patterns—such as peak household costs when children are at home or the shift in expenses pre- and post-retirement—while preparing for unexpected financial events can help individuals plan more effectively.

Each major life event brings with it a unique set of financial challenges and opportunities.

Whether it’s marriage, starting a family, buying a home, or planning for retirement, having a solid financial plan helps people prepare for upcoming financial responsibilities while ensuring long-term stability.

Adjusting insurance, investments, and estate plans as circumstances change can make transitions smoother and provide peace of mind.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Big life events that require financial planning

Financial priorities evolve over time, and big life events often call for careful planning. From protecting your family’s future to securing your retirement, being financially prepared helps investors better navigate these milestones.

Here are some common big life events that benefit from financial planning:

1. Receiving an inheritance

Inheritances often arrive unexpectedly, both in timing and amount. While Australia has no inheritance tax, beneficiaries may still face capital gains tax if they sell inherited property or shares.

Understanding the tax rules, especially for superannuation and how they differ for dependents and non-dependents, is important. Without careful planning, an inheritance can be mismanaged or lead to unrealistic financial expectations.

Making informed decisions about how to use the funds—whether for investments, paying off debt, or other financial goals—can help ensure long-term wealth preservation.

2. Getting married

Marriage marks the start of a financial partnership, bringing important discussions about shared expenses, savings, and investments.

Managing finances together can be simple or complex, especially in second or third marriages where blended families, existing debts, and assets are involved.

Aligning financial goals early helps prevent misunderstandings and creates a strong foundation for the future.

3. Starting a family and raising children

Welcoming a child is exciting but also comes with significant financial responsibilities.

The cost of raising a child includes everything from nursery setup and childcare to long-term education planning, including higher education expenses. Education costs—such as tuition fees, books, and accommodation—can become substantial as children grow.

Financial adjustments may also be necessary due to parental leave, increased household expenses, higher life insurance coverage, and potential home upgrades.

Creating a well-structured budget can help families prepare for both short-term and long-term financial needs, ensuring stability and reducing stress.

4. Retiring and estate planning

Planning for retirement goes beyond just saving—it’s about ensuring financial security for the years ahead. Setting clear savings goals, managing investments, and deciding when to retire all play a crucial role.

As retirement nears, priorities shift from wealth accumulation to generating steady income and preserving assets. Healthcare costs, travel plans, and the possibility of downsizing should also be considered to maintain financial stability.

At the same time, estate planning ensures that assets are smoothly passed on to loved ones. Having a will, setting up trusts, and managing tax implications can prevent complications and provide peace of mind for both retirees and their families.

5. Dealing with a serious illness

A serious illness can have both emotional and financial consequences.

Managing medical costs, insurance claims, and maintaining financial stability during this time can be demanding. Adequate health and life insurance coverage, along with an emergency fund, can help ease the financial burden.

Proper planning allows individuals and families to focus on recovery without additional financial stress.

6. Going through a divorce

Divorce is not just an emotional transition but also a financial one. Splitting assets, arranging child support, and adjusting to a single income can be challenging, especially for those who have taken time off work to raise children.

Rebuilding financial independence may take time, making it essential to establish a clear financial plan. Understanding the division of property, updating budgets, and reassessing financial goals can help provide stability.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Budgeting for major life events

Major life events come with significant financial commitments, and balancing them with everyday expenses can be challenging. Whether it’s buying a home or planning for retirement, having a clear financial plan can make all the difference.

The key is setting realistic goals, understanding costs, and incorporating them into a long-term strategy.

A good starting point is estimating total expenses and creating a realistic budget. Since unexpected costs are common, factoring in a buffer could provide extra security.

To stay on track, it helps to align savings goals with financial capacity.

For example, short-term priorities, such as saving for a home deposit, may require a conservative approach, while long-term goals, like retirement or a child’s education, can benefit from higher-yield investments.

Proactive financial planning is vital

Life’s major milestones—whether planned or unexpected—can be financially demanding, but with proactive planning, they don’t have to be overwhelming.

Setting realistic budgets, establishing clear time horizons, and choosing the right investment strategy all contribute to a well-rounded financial plan.

By regularly reviewing financial progress and adjusting strategies as needed, investors can ensure that major life changes don’t compromise their financial stability or long-term goals.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.