Are you and money getting along?

Simon Turner

Wed 12 Feb 2025 7 minutesAn important question for you … how are you and money getting along at the moment?

It’s an important question because money is a core part of success, and is hard for most of us to disconnect from success as a concept. Moreover, when you’re getting on well with money, you’re fuelling the lifeblood of your dreams, and you’re more likely to realise your financial and non-financial goals.

But when you and money aren’t getting on, the opposite is true. A bad money relationship can feel like a failure cycle with no end date in sight.

Regardless of the current state of your relationship with money, there’s no time like the present to improve it…

The tell-tale signs of a thriving money relationship

The foundation of a healthy relationship with money is rooted in the belief that money is your friend who is intent on enriching your life, supporting your wellbeing, and enabling you to live a fulfilling life.

People with a healthy relationship with money tend to:

Enjoy conscious saving & guilt-free spending

Since money is a force for good in their lives which they consciously save, they can enjoy spending, knowing they are living within their means.

Maintain manageable debt levels

Rather than being a source of stress, their debt is under control and on track to be repaid.

Ensure they have an emergency fund

Knowing that life is unpredictable, they ensure they have enough accessible cash (usually enough to cover 3+ months of living expenses) to mitigate against the risk of unforeseen events.

Talk openly about their finances without stress

Healthy communication is core to any healthy relationship and it’s the same with money.

Regularly review their financial goals

Life is always changing, so people with a healthy money relationship regularly check in to ensure their goals reflect their current circumstances and ambitions.

If you and money are in a healthy relationship like this, well done. But don’t become complacent. Like all relationships, a good relationship with money requires constant focus and effort.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The signs money has put you in the dog-house

If you’re like the vast majority of people, you’re more likely to need to work on your relationship with money.

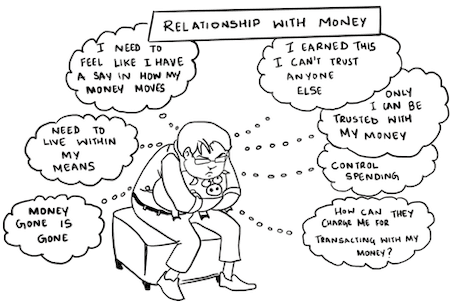

If you’re in this boat, you’re probably sometimes, or always, viewing money as an adversary who enjoys causing you stress and confusion.

People with an unhealthy relationship with money tend to:

Be afraid of spending money

They’re generally afraid to spend money due to their underlying stress about their financial position.

Exist in a state of constant financial struggle

Paying their bills is a weekly challenge, which results in constant financial stress.

Believe money is evil

By believing that pursuing wealth is bad, they often create a negative narrative in their minds which translates into a self-fulfilling prophecy.

Depend upon others financially

They often need financial help, which helps them avoid taking responsibility for their finances.

Lack confidence with their finances

They believe they’ll never master their finances, which evolves into a self-fulfilling prophecy.

Overspend

Despite their financial stress, they often overspend which leads to a cycle of regret.

If you tick some or all of these boxes, you’re in esteemed company. Mastering this part of our lives isn’t generally taught at school. We’re just expected to know what to do, despite how deeply psychological the challenge is.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

It’s time for you and money to reconnect on the therapist’s sofa

So how can you develop a healthier relationship with money?

There are 6 main steps…

1. Look in the mirror

The first step is to be brutally honest with yourself about the state of your relationship with money.

What are your thoughts and feelings about it? Do you view it as a friend or a foe? If you’re like most people, your answer may relate to the way your parents viewed money when you were growing up.

Also, how do you behave with money? What are your winning and losing financial habits?

And what do you want your relationship with money to be like? What changes need to happen to make this happen?

2. Accept where you are today

The hardest step for many people is forgive themselves for all their financial mistakes of the past, and thus accept where they are in the present moment.

The key here is to be kind to yourself, while acknowledging that to make mistakes is to be human. It can be helpful to read of others who’ve made similar mistakes en route to acceptance.

Once you start recognising each and every mistake you’ve made as an opportunity to learn and grow, you’ll know you’ve mastered this step.

3. Work on your mind-set

We all know our mind-set has a profound impact on our realities. It’s the same with our relationship with money. Mind-set is everything.

For example, by understanding our limiting beliefs and where they come from we’re often able to reframe them in a more positive light.

There are plenty of inspiring books which can help with this process. For example, I Will Teach You To Be Rich by Ramit Sethi is a useful starting point.

Financial advisors can also help. In fact, a good financial advisor will often view this mind-set transformation work as core to their service offering—since their clients will only become rich by mastering their mind-set.

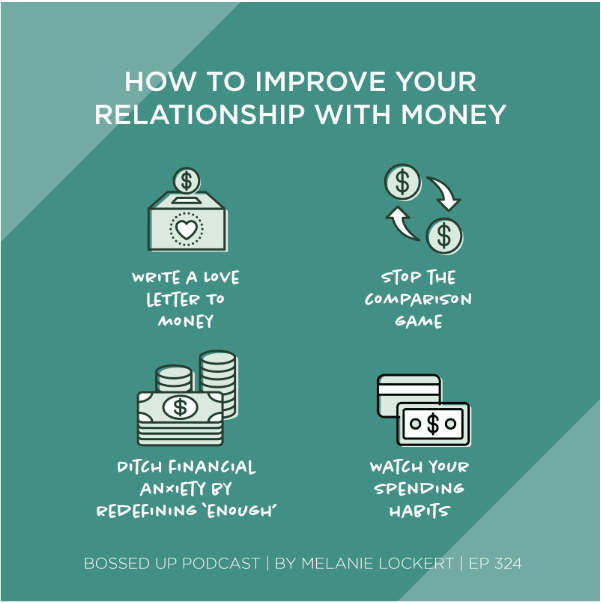

Other ideas which may help with this include: writing a love letter to money, avoiding all comparisons with others, redefining the concept of enough, and controlling your spending.

And if your mind-set challenges are deep-set and hard to shift, it may be worth consulting a therapist to untangle your limiting beliefs about money.

4. Set a SMART goal for your money relationship

So by now you’ve hopefully got a picture in mind of your healthy relationship with money.

It’s time to translate that picture into SMART (Specific, Measurable, Achievable, Realistic, and Timely) goals.

For example, your SMART goal may be to set up an emergency fund which covers 6 months of living expenses within the next year. Or it may be to set up an investment plan which entails investing 10% of your after-tax income each and every year.

The important thing is to ensure your goals align with your life, your values, and your ideal relationship with money.

5. Educate, educate, educate

Education is an under-rated part of maintaining a healthy relationship with money.

The truth is many of us incorrectly believe that we’re financially educated. But knowing how to buy and sell stocks and funds online isn’t a financial education, neither is knowing how to look at a chart. Being financially educated involves reading books written by genuine experts.

For example, books like The Smartest Investment Book by Daniel R. Solin, Psychology of Money by Morgan Housel, and A Random Walk Down Wall Street by Burton Gordon Malkiel provide a wealth of financial wisdom.

6. Allow money to enrich your life

By this point, you’ll have recognised who’s been stopping money from working its magic in your life up until now. Yes, it’s you. It’s me. It’s almost all of us.

But it’s time to allow money to work its magic for you.

With your positive mind-set, SMART financial goals, and healthy saving and investing habits, your relationship with money is about to thrive.

That means change is coming. By empowering money to enrich your life, it’s about to reveal itself as the friend you long wanted in your life.

An important relationship deserving of your attention

Like all healthy relationships, your relationship with money requires focus and time. Now’s the ideal time to dig deeper to ensure your mind-set and beliefs are positioned to create the healthy relationship with money you always wanted.

The benefits of getting this right can’t be overstated, and they expand well beyond the financial realm.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.