Let the weaker Aussie dollar work for you

Simon Turner

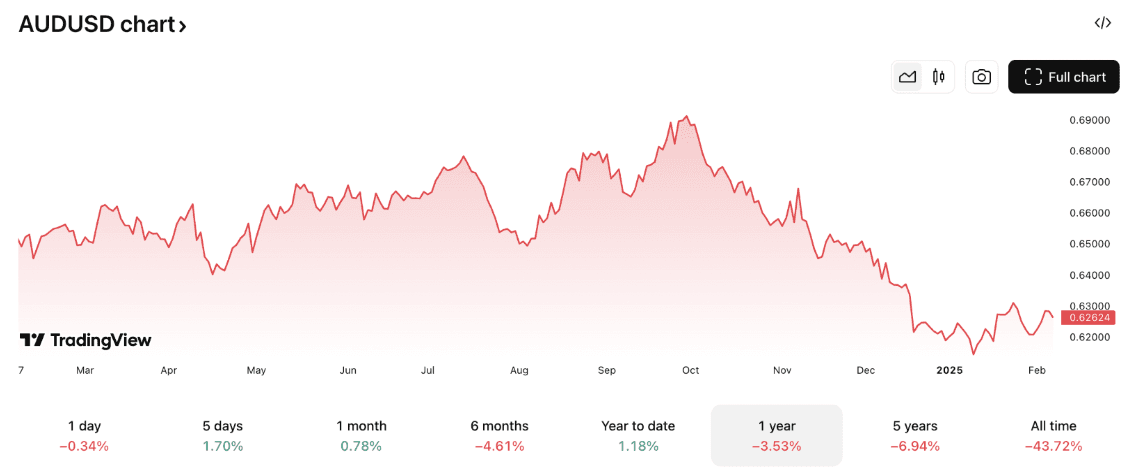

Mon 10 Feb 2025 5 minutesAs the US dollar continues its inexorable rise, the Aussie dollar has been left in its wake over the past four months.

Whilst that’s bad news if you want to travel to the US, it’s good news for investors who are positioned to benefit…

Why the Aussie dollar has been so weak

Let’s start by asking why the Aussie dollar has been so weak versus the US dollar.

Most experts agree this dynamic is more related to the strength of the US dollar than the weakness of the Aussie dollar. In the words of Matt Wacher, Morningstar Investment Management's Chief Investment Officer in Asia Pacific: ‘It's not necessarily been anything too fundamental with the Australian market. It's more the U.S. dollar has been super strong.’

In short, markets have been reacting to Trump’s pro-US dollar policies, and that trend appears likely to continue—at least in the short term.

In addition, Chinese economic growth remains relatively weak which is weighing on the Aussie dollar since China is Australia’s largest export market.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Could the Aussie dollar make a resurgence?

Most currency experts agree the Aussie dollar is currently looking reasonably cheap versus the US dollar.

However, the theme of US exceptionalism is so entrenched in financial markets at this point—and with US economic growth and interest rates running higher than other advanced economies, it’s hard to see that situation reversing in a hurry.

The joker in the US dollar’s pack is the impact of Trump’s tariff policies. Unfortunately, the consensual view of that impact is negative for the Aussie dollar: most analysts expect the Chinese economy to suffer, which is likely to lead to further Aussie dollar weakness.

So all told, the outlook for the US dollar remains bullish while the Aussie dollar outlook remains bearish. It seems prudent to expect a continuation of recent currency trends in the short to medium term.

The knock-on effects of a weaker Aussie dollar

A continuation of the recent Aussie dollar weakness is likely to lead to a few important consequences…

1. Australian economy to benefit

A higher currency makes Australia less globally competitive, and a weaker currency makes Australia more competitive. Australian companies who are net exporters to the US are positioned to benefit whilst net importers from the US are likely to take a financial hit. So the weaker Aussie dollar is likely to provide a welcome boost for the anaemic local economy.

2. More Australian companies are likely to be taken over by US companies

American businesses will surely aim to take advantage of the discounted prices of Australian corporates in US dollars. The recent offer by CC Capital Partners for Insignia Financial is a case in point. Watch out for more takeovers of local businesses with strong competitive advantages, marketing positioning, and IP.

3. More foreign buyers of Australian property to be expected

The weaker Aussie dollar is also likely to attract more foreign buyers of Australian property who are aiming to buy at a discount in US dollar terms. In the words of Kitty Parker, a property buyer’s agent: ‘Longer term, global capital tends to view Aussie assets like property, infrastructure and companies pretty cheaply when the Aussie is down in the low 60s. This influx could lead to further price increases, making it even tougher for first home buyers to enter the market.’

4. Higher inflation likely

A persistently weak Aussie dollar is likely to lead to higher inflation as the rising cost of imports feeds into the local economy. That’s likely to be bad news for future RBA cash rates, which may counteract against the positive economic effects of a weaker Aussie dollar.

5. Higher return on US investments for local investors

The value of local investors’ US holdings will have risen in Australian dollar terms in recent months, amplifying their investment returns from that market. That’s likely to lead to even higher demand for US assets from Australian investors looking forward.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Implications for investors

We see three main investment implications of the above…

1. Consider rebalancing your portfolio

If your US exposure has skyrocketed thanks to US outperformance and US dollar strength, now may be an opportune time to rebalance your portfolio to ensure you aren’t exposed to any outsized risks.

2. Ensure your international exposure is positioned to benefit from continued US dollar strength

That means picking your emerging markets exposure wisely as a rising US dollar can be a headwind to returns in many of these markets. A lower risk alternative may be to invest with a fund or ETF which provides diversified exposure to emerging markets as an asset class.

3. Invest in local funds and ETFs positioned to benefit from a weaker Aussie dollar.

For example, the mining sector is an obvious beneficiary of a weaker local currency, so funds and ETFs exposed to that sector are likely to experience a powerful tailwind this year.

Use the weak Aussie dollar to your advantage

With the Aussie dollar trading at unusually low levels against the US dollar now may not be the best time to plan a US trip. But the good news is you have more profitable options available such as investing in funds and ETFs positioned to benefit from a weaker local currency.

If recent trends continue, ensuring you’re on the right side of this trend may well make a big difference to your 2025 investment returns.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.