The US Bond Market is Telling a Worrying Story

Simon Turner

Wed 28 May 2025 4 minutesThe US bond market is sounding alarm bells at the moment. From rising Treasury yields to historic credit rating downgrades, the message is clear: the foundations of US economic credibility are under unprecedented strain.

We investigate the implications for investors below…

Treasury Yields Rising Amidst Uncertainty

The Fed has been cutting rates in recent months, so investors would be forgiven for thinking US rates are heading downwards.

However, the markets are singing from a different song-sheet. 10-year US Treasury yields have risen in recent weeks from 4% to the 4.5-4.6% mark that has historically prompted significant reactions from US policymakers.

In short, bond markets are worried about the state of the US Treasury’s finances as well as the US economic outlook. Despite these concerns, the Fed seems intent on pausing its recent rate cutting cycle in the face of ongoing inflationary risks.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

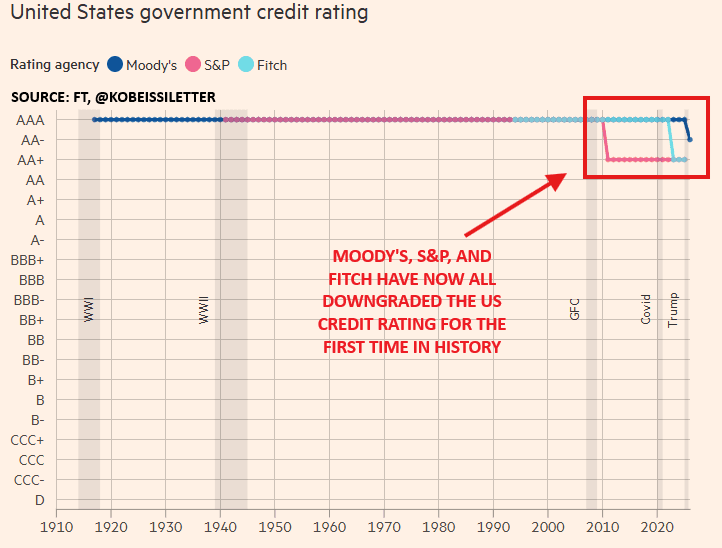

A Historic Credit Downgrade

Most startling of all is the recent downgrade of US credit ratings by Moody’s—the first in history.

Moody’s expressed deep concern over soaring US debt levels, projecting that interest payments could consume nearly 30% of US revenue by 2035.

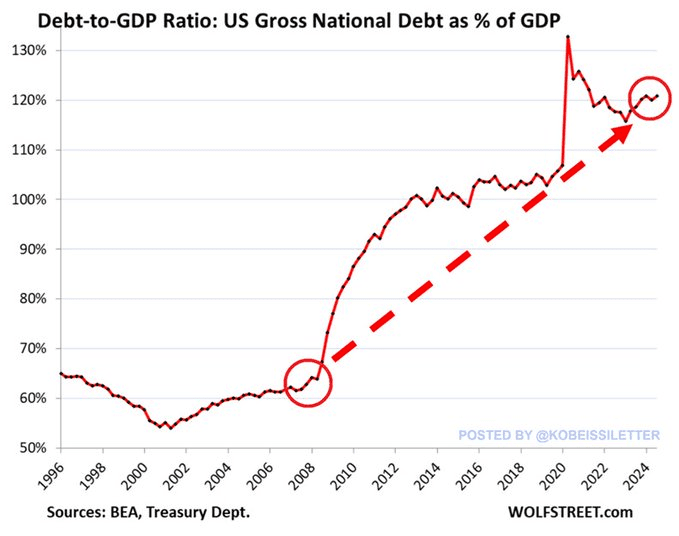

They also said: ‘We anticipate that the federal debt burden will rise to about 134% of GDP by 2035, compared to 98% in 2024.’ That’s a striking warning, given that during World War II, the US debt-to-GDP ratio never exceeded 120%.

Moody’s forecast signals an unsustainable fiscal trajectory for the US Government which few investors would argue with.

It’s noteworthy that this downgrade wasn’t isolated. Earlier this year, Fitch and S&P also lowered their ratings for the US, citing similar concerns about debt and fiscal management.

At the time, the market’s reaction was swift: stocks tumbled, with the S&P 500 dropping 10% over the three months following Fitch’s downgrade, while the Russell 2000 fell even more sharply. Conversely, bond yields surged—by as much as 23%—reflecting investor fears over rising debt and fiscal instability.

In contrast, markets shrugged off the news of Moodys’ downgrade as though US credit downgrades are now an assumed part of the 2025 playbook. That’s surely a warning sign that investors may not be as focused on the risks that led to the downgrade as they should be.

A Crisis of Confidence

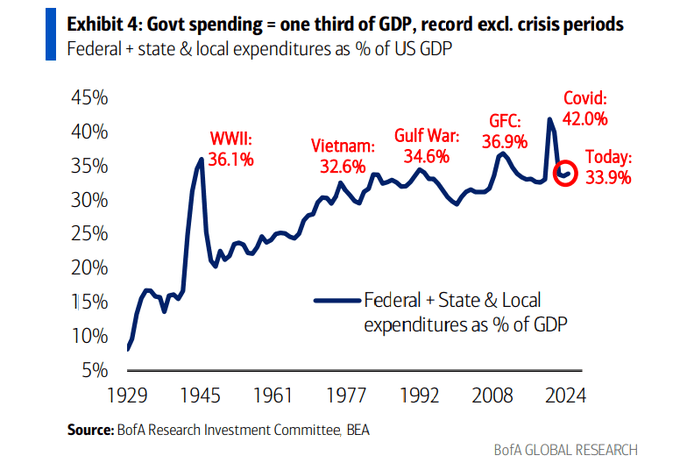

The Moodys downgrade underscores the perilous state of US government fiscal health, which has continuously been fuelled by relentless overspending. Government spending now represents over a third of the country’s GDP—as shown below.

Despite claims that US Government borrowing will persist regardless of credit ratings, history suggests otherwise. Long-term confidence in US debt could soon erode if fiscal discipline isn’t restored soon.

The recent political landscape exacerbates these concerns, with debates over budget bills and proposed spending cuts adding volatility to the mix.

Notably, Trump’s new budget proposal that would add over $US2.5 trillion to the deficit was recently rejected, highlighting markets’ growing concerns about US fiscal health.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Implications for Investors

Mounting US government debt and the associated rising yields pose tangible risks for markets. In particular:

- Pressure on global bond markets

In the absence of US fiscal control that’s at odds with the government’s current trajectory, US Treasury yields may continue climbing, impacting bond prices and creating volatility across global fixed-income markets.

Global economic growth is at risk

Higher US borrowing costs could impact US and global economic growth, especially interest rate-sensitive sectors like technology and real estate.

Inflation risks persist

Excessive US government spending continues to stoke global inflationary pressures, making inflation expectations more entrenched and harder to control.

Given these dynamics, investors may want to consider allocating a portion of their portfolios toward risk-off assets such as gold, infrastructure, and healthcare—sectors that tend to outperform in periods of rising rates and economic uncertainty.

A Barometer of Global Financial Stability

Ultimately, the US bond market remains an important barometer of global financial stability. Moody’s historic downgrade is not just a symbolic event; it signals a fundamental re-evaluation of US fiscal credibility. It also highlights that the government’s current trajectory is unsustainable.

Until meaningful US Government reforms are undertaken, investors should expect continued volatility and heightened uncertainty. The choices made today will shape the stability of markets tomorrow. In the meantime, be ready to take advantage of further volatility.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.