Can Impact Investing Sidestep the Challenges of its Big Brother, ESG?

Simon Turner

Mon 26 May 2025 6 minutesWe wrote recently about how the DEI backlash has affected the ESG investment landscape. Long story short: it’s had a detrimental impact on US flows into ESG assets, although the long term arguments in favour of ESG investing arguably remain unscathed.

Against this backdrop, it’s worth checking in on ESG’s little brother, impact investing, the purpose-focused segment of the sustainability world, for a gauge as to whether it’s being affected by the same issues…

Impact Investing Introduced

Let’s start with a brief introduction to impact investing since many investors aren’t aware of it.

Impact investing is a targeted, affirmative investment strategy that empowers investors to match their values with their capital by intentionally seeking meaningful social or environmental change while generating financial returns, often with sustainability mega trends as tailwinds.

Impact investing is a more focused, some would say extreme, form of sustainability investing than most ESG strategies for the simple reason business purpose is a main consideration. Investors in this space are committed to tracking and assessing the impact of their investments to ensure their efforts are effective and aligned with their goals.

For example, while a tobacco company may make it into an ESG portfolio because of scoring highly on most ESG factors, it wouldn’t form part of an impact investment portfolio as it wouldn’t align with the fund’s business purpose intentions. So impact investing is a great asset class for investors who are conscious of the ramifications of their investment decisions.

Impact investing also provides access to a theme many investors are interested in: diversified exposure to the private markets. By spanning a diverse range of asset classes, from private equity and venture capital to private credit, impact investing offers investors diversified exposure to a range of largely inaccessible private market asset classes.

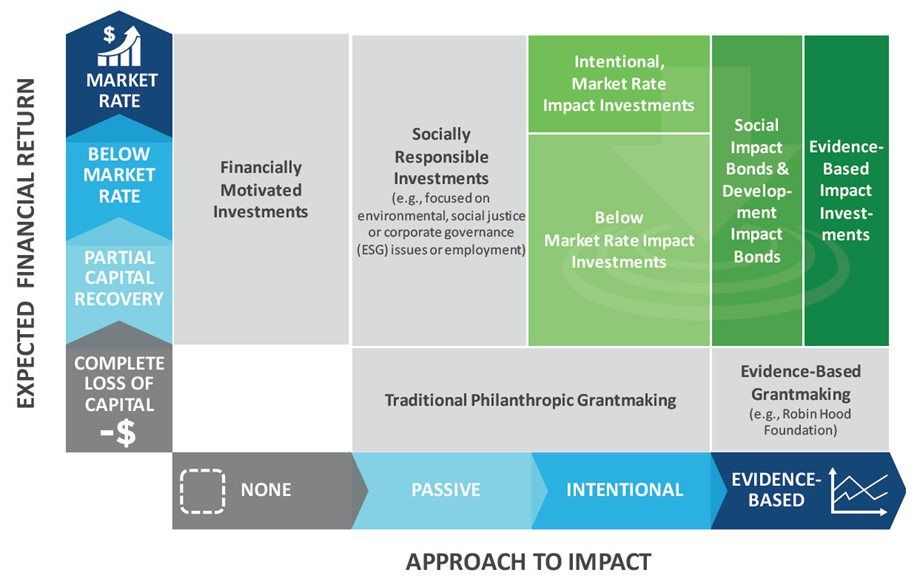

It’s also worth bearing in mind that within the impact investment world, there are a range of strategies which tend to be differentiated by their expected financial returns and impact approach—as shown below.

These days, most impact investors are focused on the top right-hand corner of the chart: evidence-based, market rate returns.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Impact Investing’s AUM Growing Fast

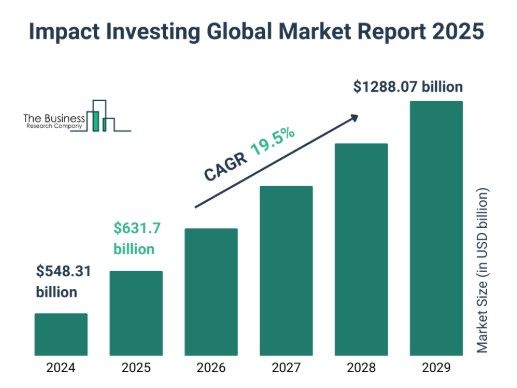

Impact investing’s assets under management (AUM) have been growing at a fast clip for many years driven by growing awareness of the sector’s attractions, particularly amongst millennials.

But what about looking forward? Have the DEI-related challenges of the ESG world translated into slower AUM growth for the global impact investment world of late?

In short, no.

The global impact investment sector’s AUM is expected to grow 15% to $US632 billion this year, while it’s expected to grow at a compound annual growth rate of 19.5% p.a. to the end of 2029.

The sector’s main growth drivers are: the renewable energy transition and climate change challenges in general, racial and gender equality, global resilience planning, circular economy initiatives, education and skills development (particularly in emerging markets), improving global healthcare outcomes, and nature-based solutions.

All of these challenges are structural and long term in nature. And importantly, solving such significant challenges is creating a vast array of business opportunities for purpose-driven businesses to benefit from.

As a result, the impact investment world has thus far managed to sidestep the challenges faced by its big brother, ESG.

But what about the Trump effect?

As discussed in our recent article, the backlash against DEI (diversity, equality & inclusion) has been centred on the US where issues of race, gender, and diversity are charged to say the least.

Trump’s re-election has clearly added fuel to this fire. Case in point: during his election campaign, Trump stated that he intends to use his second term to address a ‘definite anti-White feeling’.

In other words, DEI has evolved into a distinctly political issue.

As a result of this situation and DEI being a core ESG strategy, US ESG fund flows have become the innocent bystanders amidst this increasingly volatile political battlefield.

Thankfully for the impact investment sector, it’s not been caught up in the same crossfire. By focusing on business purpose rather than ESG scores which factor in DEI, it appeals to a different type of investor who typically has long term goals aligned with intentional positive change.

The other reason impact investing has been protected from the Trump effect thus far is that it represents a tiny fraction of ESG’s $US30 trillion+ AUM. Existing outside of the mainstream like this has proved beneficial for the asset class.

Institutions Warming to the Asset Class

There’s another noteworthy theme at play within the impact investment world: the increasingly institutionalised nature of the asset class.

In the words of Ben Thornley, managing partner of US-based consultancy Tideline: ‘Pension funds now comprise about 30% of the market – a number that was just 6% five years ago. Their growing influence will help stabilise this market by having it grounded in proven investment themes and strong returns. They will look at trends in healthcare, housing, climate technologies, to name but three, and then run the investment story through their conservative investment processes to ensure the numbers stack up. By doing this they are subjecting impact investing to an investment rigour that can only enhance its market credibility.’

So the growing institutional interest in impact investing is excellent news for the asset class as their presence enhances the sector’s credibility and makes it more investible for individual investors.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Australian Outlook for Impact Investing

With so many structural growth drivers in place and its relatively small presence in global markets, it’s easy to see the impact investment sector growing into a mainstream asset class.

Whilst most of the growth to date has occurred in the US and Europe, the sector’s growth prospects look particularly attractive in markets which have been slower to embrace the opportunity—like the Asia-Pacific region, the fastest growing economic region in the world. Australia is particularly well positioned to participate in and benefit from this trend.

Ben Thornley highlights the size of the opportunity: ‘Right now, Australia accounts for about 1% of this market’s assets. Yet its superannuation industry comprises about 4.5% of the global pension fund market. So, Australia really should be quadrupling its application to impact investing in the coming years.’

Impact Investing’s Outlook Remains Bright

Regardless of which regions will benefit most, with mega trends as pressing as climate change, biodiversity loss, and inequality as tailwinds, the impact investment world is extremely well positioned. AUM growth is expected to remain high looking forward, particularly in the nascent Australian market.

If you haven’t got impact investment exposure and are interested in values-driven investing, it’s worth investigating the sector’s opportunities.

Impact Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.