What the US Sovereign Wealth Fund & Gold are warning us

Simon Turner

Wed 26 Feb 2025 6 minutesYou’ll have noticed that Trump’s presidency has started with Change with a capital C. He’s breaking laws, circumventing Congress, and encouraging Elon Musk to dismantle government departments. Most legal scholars agree the US is in a constitutional crisis.

Amidst the chaos, Trump announced he’s introducing a Sovereign Wealth Fund. The idea has been mooted for some time so this wasn’t a surprise, but it may mean more to investors that is apparent at this juncture…

Why launch a US Sovereign Wealth Fund?

Of course, asking why Trump is planning anything is unlikely to lead to a clear or rational answer.

In addition, Trump only issued the executive order for the creation of a US Sovereign Wealth Fund on February 3rd, 2025, so details on the prospective fund are scarce.

In general, sovereign wealth funds are pooled government funds which are invested in strategic assets with the objectives of stabilising government finances and saving for future generations.

Sovereign wealth funds are generally invested in alignment with national interests, development goals, and to improve international competitiveness—like in Saudi Arabia.

They are usually associated with the accumulation of great wealth. For example, Norway’s Oil Fund is estimated to be worth around $US1.7 trillion, which is extraordinary for a country with a population of 5.5 million people.

However, these generalities don’t help us define what the US Sovereign Wealth Fund will look like.

The key challenge is how unpredictable Trump is. No one really knows what he’s planning.

For example, Trump has already suggested that the new Sovereign Wealth Fund could buy TikTok. That would be hard to argue as advancing the competitiveness of the US.

Rhetoric like this makes it sound like Trump is viewing the prospective US Sovereign Wealth Fund as another tool in his personal toolkit aimed at further raising his power from current lofty levels.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Potentially part of a bigger picture plan involving gold

It hasn’t escaped the market’s notice that something strange is happening in the gold market, which may imply the Sovereign Wealth Fund idea is a part of a bigger systemic shift Trump is orchestrating.

In recent weeks, there have been large gold physical deliveries and shortages in London, while gold has been flowing into the U.S. at record levels. Someone with deep pockets is clearly scooping up gold—like the U.S. Treasury or the Fed for example.

If this is true, the question is: why?

One interpretation is that Trump’s government is preparing for a gold audit—meaning they’re re-shoring all the gold they might’ve leased out.

Once audited, that gold could form the backbone of a new monetary system in which the US Government has greater control of the US dollar’s value. This would signal a seismic shift in the dollar’s status.

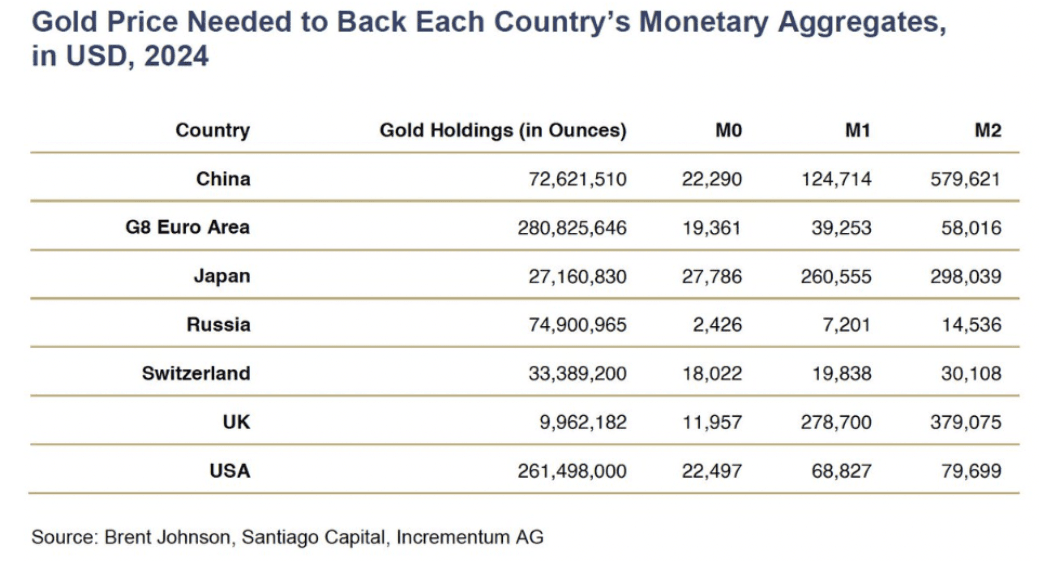

It could also have a dramatic impact on global gold demand—as shown below…

The idea theorised by some observers is that Trump wants to control and devalue the US dollar to improve America’s competitiveness and economic growth, and is even prepared to use the threat of tariffs to help achieve that goal.

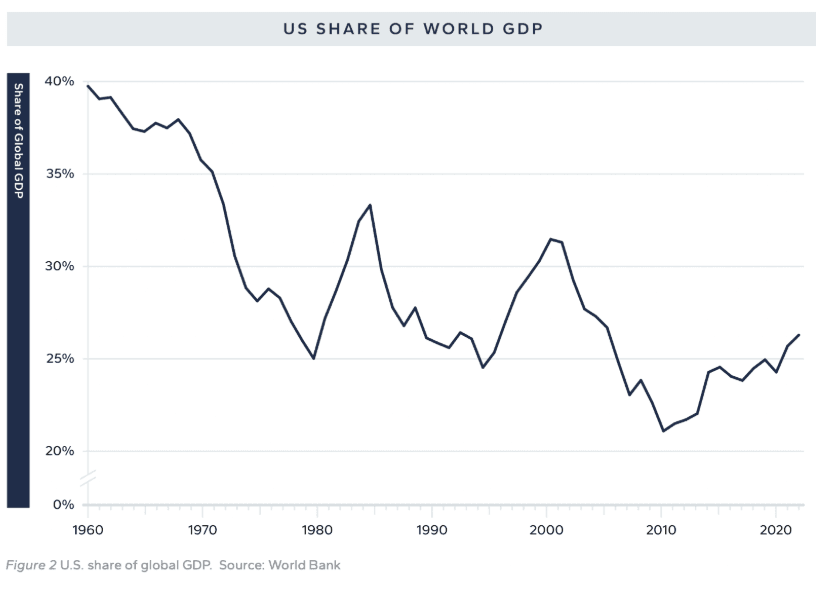

Greater US control of the global economy could be the over-riding name of this game driven an acute awareness that the US has lost a lot of global economic power over the past sixty-five years.

If this sounds like fiction to you, please read ‘A Users Guide to Restructuring the Global Trading System’ by Stephen Miran, one of Trump’s economic advisors. It’s clear that Trump and his team are focused on these issues.

How the sovereign wealth fund could fit in

If there’s any truth to this speculation, the introduction of a sovereign wealth fund could be connected with the US Government’s gold ownership ambitions, along with its plan to cede control of strategic global assets from financial markets.

In that scenario, the sovereign wealth fund would provide Trump with a vehicle to home the assets he views as essential for de-risking America’s future while improving the country’s wealth.

For example, Trump’s ambitions to own and control Greenland may be a part of this bigger picture resource ownership plan for the fund.

As the fund’s launch approaches, we’re like to hear the words ‘strategic interest’ more and more.

Implications for investors

We see 5 potentially important implications for investors:

Higher inflation likely

Like any CFO looking aiming to improve their balance sheet, Trump is no doubt hoping the sovereign wealth fund increases America’s assets relative to its liabilities. He’ll be acutely aware that higher inflation will improve the value of the country’s assets while concurrently reducing the value of its liabilities. It’s hard to imagine he won’t view that as supportive of his long term goals.

So investors should probably expect higher inflation in this new world order. We all know how the 70s played out on this front. Being positioned in funds positioned to benefit from higher inflation in assets such resources, infrastructure, and property may be prudent.

Supportive for global equities

As if global equity markets needed more buying support, the US Sovereign Wealth Fund will be another big buyer entering the market. That’s likely to be supportive of global equities, particularly funds exposed to globally strategic assets like resources and infrastructure.

Recent gold outperformance may continue

Regardless of whether the US is preparing to back the US dollar with gold or not, something significant appears to be afoot in the gold market. Ensuring you’re exposed to this under-owned sector may prove fruitful in the coming years. If the US dollar is manipulated downward in the future, owning gold and gold funds is likely to provide a powerful hedge.

Resources sector resurgence likely

The broader resources sector may also outperform in this new world order. Ensuring you have sufficient resources exposure ahead of this shift could form part of a sensible longer term strategy.

Higher geopolitical risk & volatility

Trump’s early strategic moves are geopolitically aggressive by historic standards. The changes being initiated are dramatic, and are likely to lead to global knock-on effects and unintended consequences. That’s likely to translate into higher investment risk and volatility.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Expect the unexpected during Trump 2.0

The implications of so much potential change are hard for most investors to fathom.

For now, investors should be prepared for the US to aggressively pursue all assets it regards as strategic in nature.

Whether or not the introduction of a sovereign wealth fund is connected with the bigger systemic changes the gold market is warning us of remains to be seen. At the very least, being aware of the risk of an orchestrated monetary system reset is likely to put you ahead of most investors.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.