What’s Keeping Ray Dalio Up at Night?

Simon Turner

Wed 14 May 2025 6 minutesThe financial world isn’t short of voices claiming the end is nigh. It’s always been the case, and always will be the case.

Historically, for every long-term bull in the market, there’s been a similarly passionate bear ready to warn investors to run for the hills. But right now, the AAII sentiment survey tells us there are around three bears for every bull. That’s close to a one-year high and is indicative of an extremely fearful market.

Ray Dalio is one of those bears. Given how bearish the market is, his recent warnings about a global monetary reset will be preaching to the converted for the vast majority of investors.

Nevertheless, when the founder of the world’s biggest hedge fund warns investors with such strong language, it’s worth listening so you’re prepared for what may be coming, or alternatively, ready to profit from what investors fear is coming…

The Long List of Issues Keeping Ray Dalio Up at Night

There’s a lot keeping Ray Dalio up at night these days.

In short, he believes:

Trump’s aggressive pursuit of tariffs is causing a ‘classic breakdown of the major monetary, political, and geopolitical orders. This sort of breakdown occurs only about once in a lifetime, but they have happened many times in history when similar unsustainable conditions were in place.’

Many exporters to the U.S. are already reducing their dealings with the U.S. in recognition that the tariff problem is here to stay. Reduced dependence upon with U.S. has become a necessity for many countries aimed at mitigating against a known risk.

In particular, businesses and investors on both sides of the US-China relationship are making alternative plans due to the breakdown of that relationship.

In this new world order, there’s a growing risk that U.S. is bypassed by the countries which can adapt to the trade flow shifts away from the U.S.—and take advantage of them.

The U.S. urgently needs to reduce its fiscal deficit, but not through tariffs. Trump’s government is on the wrong pathway and the resulting volatility is ‘teaching lessons that are leading to irreversible bad consequences.’

These enormous trade and capital imbalances are creating unsustainable U.S. economic conditions. As a result, the U.S. is ‘very close to a recession’ which may be ‘worse than the 2008 recession if this isn’t handled well.’

Trump’s pressuring of the Fed to cut rates is inappropriate. These actions have only led to a steeper yield curve, bond sell-offs, and increased borrowing costs, which could pressure Trump to reconsider his tariff strategy.

In response to these evolving risks, Ray Dalio favours hard assets like Bitcoin and gold over paper assets like bonds and equities.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Problem with Global Imbalances

Of course, the global economy always has imbalances within it, which tend to be resolved by free markets over the longer term.

So what makes the current imbalances particularly worrying to Ray Dalio and most bears?

In two words: interest rates.

To counteract the negative drag of trade deficits on demand, deficit countries like the U.S. almost always cut interest rates, which inadvertently amplifies the disequilibrium. This leads to excessive spending in deficit nations and insufficient spending in surplus ones like China.

However, the policy of using low-interest rates to stimulate demand has arguably reached its limits in the U.S., so further rate cuts may result in liquidity traps or stagflation, whereby increased money supply fuels inflation without significantly boosting growth.

This environment also encourages debt accumulation, speculation, and excessive risk-taking, manifesting in asset price volatility and other economic problems.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Key Takeaways for Investors

We see three key takeaways for investors…- These macro risks are hard to argue with, but for most investors they shouldn’t affect their investment long term plans.

There are always compelling reasons to be bearish on markets, and Ray Dalio is highlighting some of the most bearish arguments at present. Whilst these issues may well lead to more volatility in the coming months and years, most investors shouldn’t allow these risks to scare them out of their investment plans.

It’s worth remembering that with the market as extremely bearish as it is right now, some or all of these risks are already likely to be priced into markets.

In addition, if Ray Dalio is correct, both inflation and interest rates are likely to rise. The historical data shows that equities provide solid protection against inflation so changing your asset allocation based on these risks may ignore important associated macro developments.

- If you’re worried about these risks in the short term, hard assets are probably your best form of protection.

In particular, gold and Bitcoin are likely to benefit in the event of a monetary reset. Both assets are outside of government control, so if the U.S. dollar weakens as these risks eventuate, there’s like to be significant fund inflows into them, along with the commodities sector in general.

- Holding some cash in your portfolio is also likely to prove helpful if Ray Dalio is right.

Buying more of your favourite funds and stocks into weakness is generally a winning long term strategy. That can only happen if you’ve got some cash ready to take advantage of the opportunities.

Dalio May Be Right but…

A lot of issues are keeping Ray Dalio up at night at the moment. The good news is you don’t need to worry about these risks to the same extent.

Whilst there’s credence to Ray Dalio’s bearish arguments and volatility is likely to continue, sticking with your investment plan which is well-diversified across asset classes will allow you to think and act long term.

For most investors, keeping some powder dry for future buying opportunities may well be the best way to take advantage of what’s coming.

Gold/Resources Funds Worth Checking Out

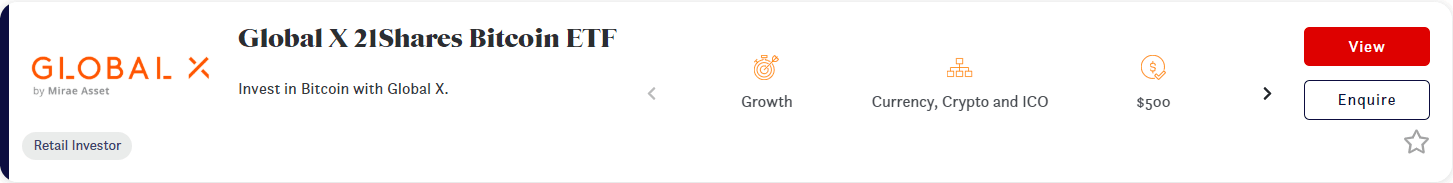

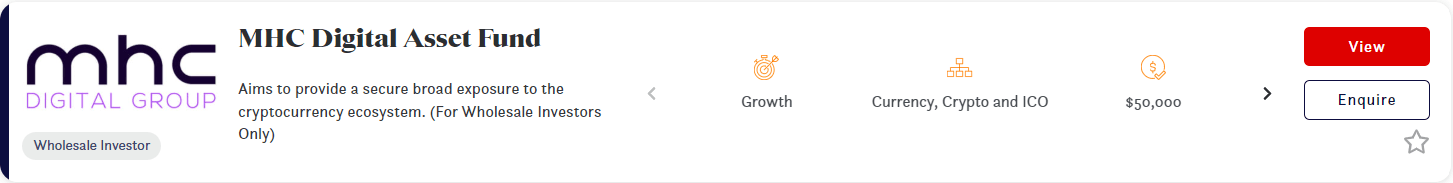

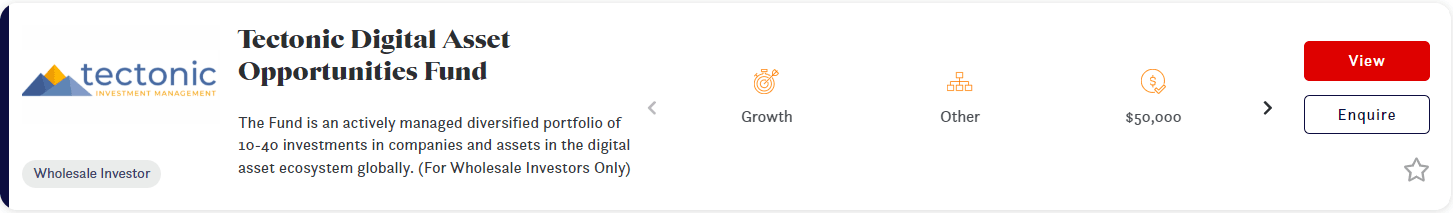

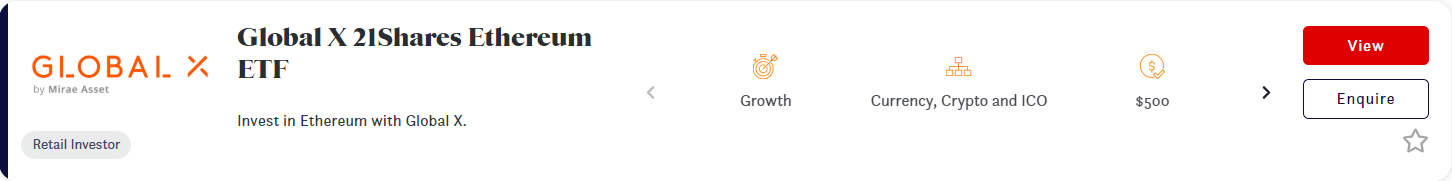

Crypto Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.