Don’t Drink Too Much of the Kool-Aid as Market Speculation Hits an Extreme

Simon Turner

Mon 4 Aug 2025 6 minutesSomething is in the air across global investment markets of late. It’s hard to mistake the smell: greed. Global stock markets are riding a wave of speculation not seen since the dotcom boom or the post-pandemic retail frenzy. From Wall Street to the ASX, risk appetite is back with a vengeance.

So what’s a steady-handed, long-term investor to do in the face of so much speculation?

Wall Street Speculation Hits Fever Pitch

According to Goldman Sachs, US speculative trading is at its highest level since 2021. Their proprietary ‘Speculation Index’ is flashing red.

Even more revealing is the recent explosion in options trading. More than 70% of recent US options trades are calls, indicating a one-way bet on continued rising stock prices.

According to Bank of America, a staggering 60% of that volume is in zero-day options. These are contracts that expire within 24 hours and are generally used for ultra-short-term speculation. They’re generally regarded as the roulette wheel of the stock market: fast, thrilling, and statistically stacked against you. Their mass usage suggests that traders rather than investors are in the driver’s seat of this recent rally.

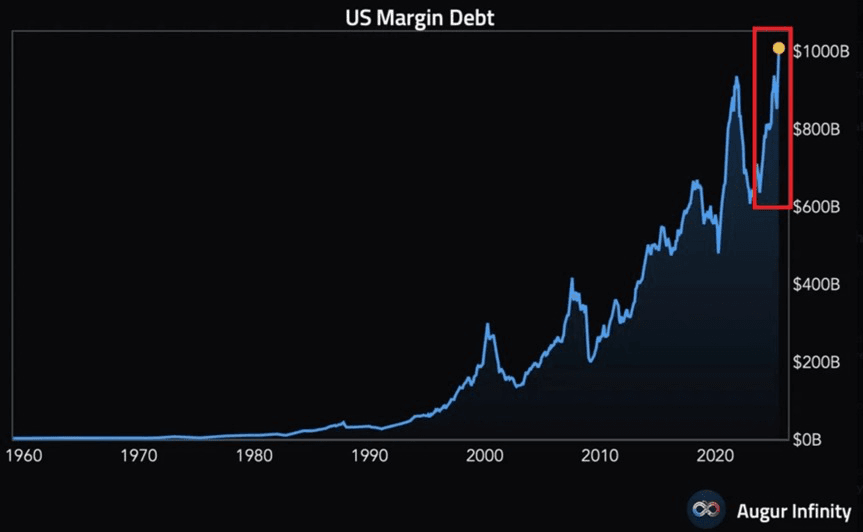

Margin investing is also skyrocketing. US margin debt recently jumped to a record $US1 trillion, the largest level in history.

In summary, risk appetite is through the roof. Retail investors have started treating the stock market like a casino.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Short Squeeze Tsunami

Short covering has also evolved into a market driver in recent weeks.

Goldman Sachs’ ‘most-shorted stocks’ index (companies that investors are betting against) is up more than 60% since mid-April, making it one of the sharpest short squeezes in over four decades. This is reminiscent of only two periods in recent history: the dotcom climax in 2000 and the 2021 meme-stock boom.

It’s not just Wall Street that’s experiencing a short squeeze. Matthew Ross, Australian Equity Strategist at Goldman Sachs, highlights that ASX-listed stocks with high short interest have surged 23% over the same period, with beaten-down miners rebounding by an average of 37%.

Whilst the numbers are less extreme, the ASX is singing from the same song sheet as Wall Street.

Retail Investors’ FOMO Returns in Force

So what’s triggered this speculative stampede?

Some point to former President Trump’s recent announcement of reciprocal tariffs sparking a short-term risk-on rally. Whilst tariff announcements are hardly bullish, it’s the transition from an unknown variable to a known one which may be fuelling some of the buying. After all, markets love certainty.

However, according to Goldman Sachs, this is more about momentum than fundamentals. ‘There’s little fundamental news to explain the strength,’ Ross says. ‘What we’re seeing is a global sentiment shift — Australia’s short squeeze is moving in lockstep with Wall Street’s.’

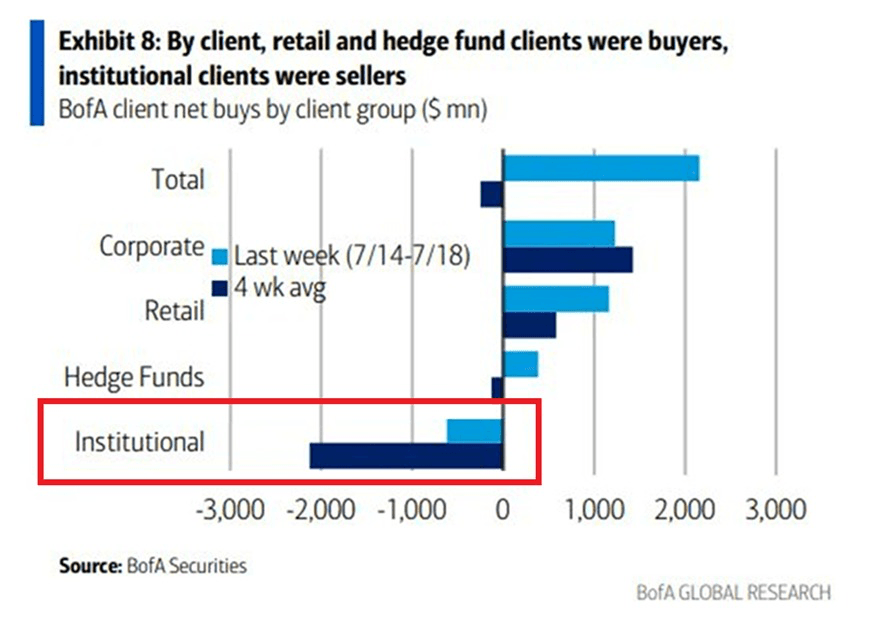

It’s noteworthy that retail investors are the ones buying while institutions are selling into recent strength.

For example, institutional investors have sold over $US8 billion worth of stocks and ETFs over the four weeks to July 18th. In contrast, retail investors have been strong net buyers for 30 out of the last 32 weeks. This is turning into a battle between Wall Street and Main Street.

The question is what’s driving Main Street’s confidence when global geopolitical risks and US economic risks have rarely been higher?

Four letters seem to cover it: FOMO. Fear of Missing Out has come to life with a vengeance. That’s the wrong answer for those expecting this rally to be sustainable.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What Should Australian Investors Do?

While in the short-term, this risk-on, ‘buy everything’ rally may continue, history shows the music doesn’t play forever. Goldman Sachs’ research shows that spikes in speculative activity are often followed by above-average 3–12 month returns, but two years out, those returns tend to fizzle, or worse, reverse.

For investors seeking to protect their wealth, here are a few tips to help navigate this speculative frenzy:

-

- Don’t Chase Momentum Blindly.

History has shown that speculative spikes and short squeezes can extend for days or weeks, but when they end, they do so violently.

So now’s not the time to be chasing momentum. It’s the time focus on fundamentals in the knowledge that they are likely to matter more in the short term. Look beyond the hype. Remember that global investment fundamentals haven’t shifted dramatically. China stimulus hopes are still fragile, and US domestic demand remains soft. Don’t mistake higher stock prices for improved fundamentals.

Successful investing is not just about what you own. It’s also about what you avoid. By stepping away from crowded trades in favour of unloved but fundamentally sound sectors such as emerging markets, global small caps, and commodities, investors can set themselves up for more sustainable long-term returns.

Speculative rallies often punish those concentrated in the overcrowded ‘hero trades’ (Nvidia comes to mind as an example). Balanced, diversified portfolios help mitigate against the risk of market selloffs by being exposed to a range of assets which perform differently in various economic and market scenarios.

- Be Aware of the Risks Posed by the US Market.

The ASX still dances to Wall Street’s tune. If the music stops there, Australia’s markets will likely follow. So whilst the ASX hasn’t participated as much on the upside as the S&P 500, it remains exposed to US-led downside risks.

- Hold Some Cash in preparation for Volatility.

When the market stops rewarding investors who invest based on fundamentals, often the worst thing to do is push harder. These periods of disconnect tend to signal a broader change is underway. Recognising when your advantage is gone and raising a solid cash weighting may be one of the most important skills an investor can cultivate.

Don’t Drink Too Much of the Kool-Aid

Global investment markets are deep into speculative territory. With US margin debt, short-dated options trading, and short covering soaring to record levels, retail-driven exuberance is at fever pitch.

These market conditions rarely end well. For long-term investors, now is the time to lean into discipline over FOMO. Markets may still run in the short-term, but chasing momentum this extreme is generally at odds with long-term wealth building.

So stay diversified, resist the noise, and focus on fundamentals. Enjoy this market strength while it lasts, but don’t forget your parachute.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.