The Case for Global Diversification in a Fractured World

Simon Turner

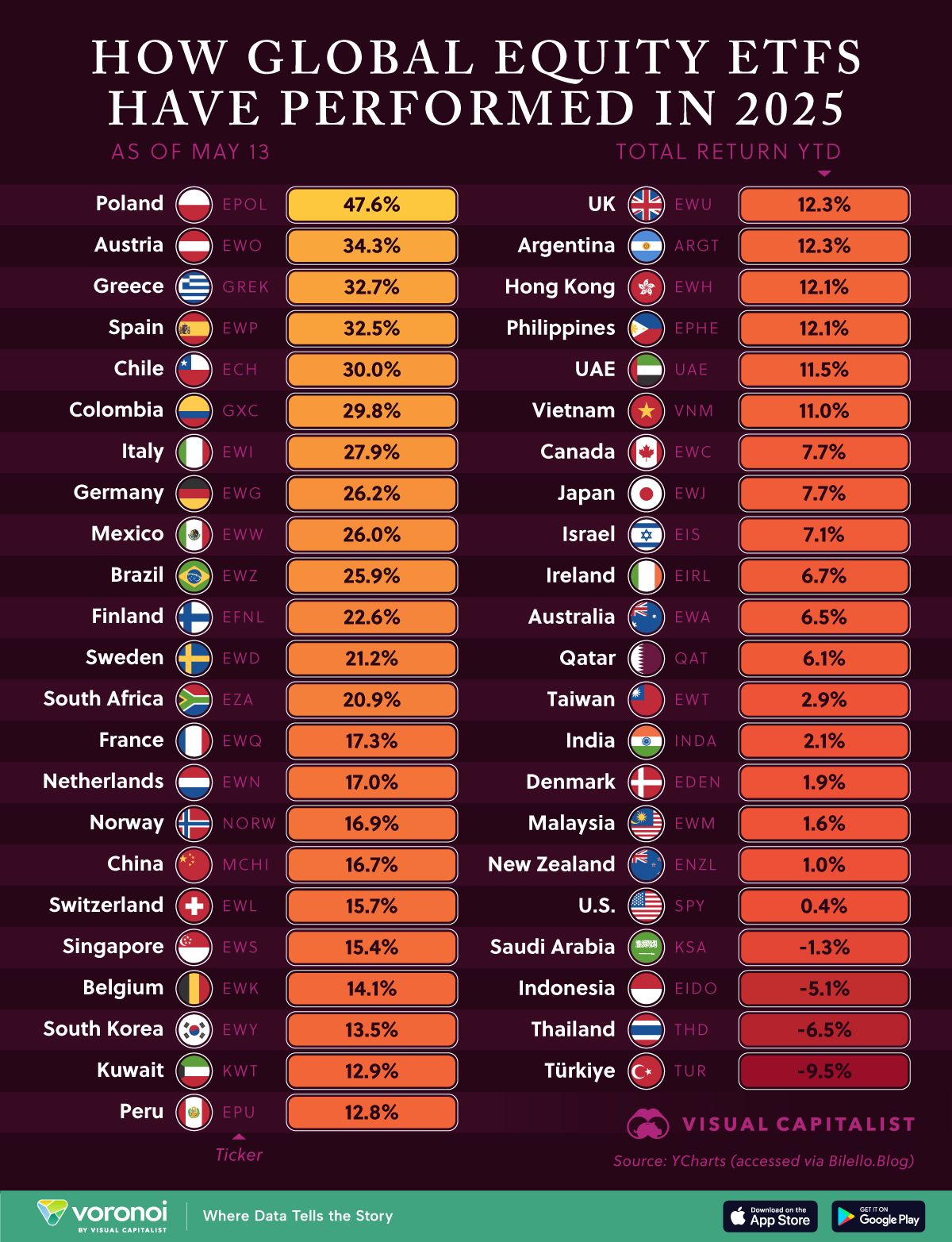

Mon 2 Jun 2025 5 minutesHow fast markets change. After more than a decade of U.S. equity market dominance, the MSCI EAFE index, which tracks developed markets across Europe, Australasia, and the Far East, has outperformed the S&P 500 by 15% year-to-date (as of May 1st).

In a world increasingly redefined by geopolitical tensions, inflation risks, and de-globalisation, investors are rightly asking: does this dramatic trend reversal signal a longer term turning point for the relative performance of U.S. versus global markets?

Historical Rebalance Underway

Starting in the wake of the 2008 financial crisis, U.S. equities, buoyed by supportive Fed policies and the rise of America’s tech giants, took centre stage in the markets. For the better part of fifteen years, focusing on U.S. equities paid off handsomely for investors.

However, as we approach the halfway point of 2025, the macroeconomic and policy factors that once favoured U.S. dominance aren’t as supportive as they once were. For example, zero interest rates, quantitative easing, and a strong U.S. dollar are no longer boosting U.S. economic growth. The upshot is that some of America’s inherent competitive advantages are arguably eroding.

In response, investors have been moving funds away from the U.S. toward a range of cheaper markets which had been previously been languishing in America’s shadows.

As shown below, European markets in particular have been beneficiaries of this shift with strong year-to-date outperformance from Poland, Austria, Greece and Spain.

In contrast, the U.S. is near the back of the global pack, a position it’s not been accustomed to in recent decades.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Five Compelling Reasons to Diversify Globally

With this shift in mind, there are five key reasons why international diversification has become more important for all investors:

1. Relative Attraction of Other Regions

Years of U.S. outperformance have left most international developed market undervalued by comparison.

Many of these markets now exhibit strong fundamentals coupled with pessimistic pricing: a classic setup for longer term investors to capitalise on investment markets’ tendency to mean revert.

2. Macro Divergence

Globalisation once connected the world’s economies, tightening their correlations, and limiting the benefits of diversification.

That convergence appears to have ended. If that’s the case, we’ve entered an era of macro divergence, with monetary policies, economic growth paths, and political agendas increasingly diverging.

As a result, diversification is back on the table as a genuine investment advantage.

3. Reduced Portfolio Concentration Risk

The top ten stocks in the MSCI U.S. Index make up 36% of its value which is a staggering level of concentration.

The equivalent figure for international developed markets is 13%.

So allocating internationally naturally dilutes investors’ exposure to a handful of U.S. mega-caps, reducing their portfolio fragility.

4. A Larger Alpha Opportunity Set

International markets also offer a broader universe of potential winners to generate alpha, especially in economies which are poised for recovery or transformation.

5. Geopolitics has Evolved into a Market Driver

For decades, political risk was largely absent from equity pricing models.

That’s no longer the case. From the Russia-Ukraine war to escalating U.S.-China trade tensions, geopolitical dynamics are now affecting market sentiment and economic policy in ways investors can’t afford to ignore. Tariffs, localised supply chains, and reshoring efforts are introducing a new game-theoretic dynamic to global trade.

This regulatory realignment brings with it uncertainty, but also opportunities, particularly for regions and sectors which are less exposed to U.S.-centric shocks.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A Strategic Inflection Point

In light of these shifts, 2025 could mark a strategic inflection point for global portfolios.

Regardless, the case for global exposure is compelling: despite political instability and economic headwinds, many developed markets are demonstrating resilient macro fundamentals, their equity valuations remain historically low, and institutional investors are still underexposed.

In the words of Dr Rory Knight from Jakota Capital: ‘Institutional allocations to developed markets are at historic lows—around 6% on average. We believe that number should be closer to 15%, given both the diversification benefits and the emerging return potential.’

Be Active but Selective

While international developed markets are rife with opportunity, they are not without risk.

They may expose investors to the very volatility and regulatory disruption they’re trying to hedge against.

For most investors, the simplest way to access global portfolios positioned to ride out any potential volatility is through well-diversified active and passive global funds with competitive fee structures (see below).

The Case for Global Diversification

Global diversification is no longer a theoretical benefit. It’s evolved into a practical necessity to mitigate against U.S.-centric risks, and gain exposure to a wider opportunity set.

The next decade won’t look like the last. As the world reorients around new power centres, regulatory regimes, and economic realities, investors’ portfolios must be ready to weather the associated market shifts.

Investors who position accordingly—early, intentionally, and globally—stand to benefit from diversification.

Global Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.