Why U.S. Family Offices Are Going Longer America

Simon Turner

Wed 4 Jun 2025 5 minutesWhile broader market sentiment remains clouded by geopolitical risks, rising U.S. government debt, and fears of a global economic slowdown, America’s wealthiest families are leaning into U.S. assets, not away from them.

According to the UBS Global Family Office Report, U.S.-based family offices have been ignoring market noise in favour of significantly increasing their domestic equities exposure, signalling their confidence in the country’s long-term fundamentals.

Let’s check out why they’re ignore the ‘Sell America’ narrative so many global investors have been listening to of late…

UBS Family Office Report Findings

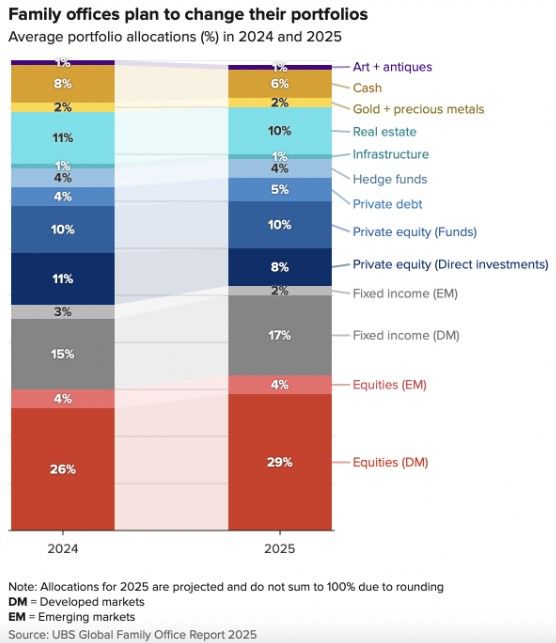

The UBS report, which surveyed 317 global family offices from January through early April, found that American family offices held a staggering 86% of their portfolios in North American assets, up from 74% in 2020. That figure stands far above any other region’s home bias.

So why the shift? In short, compared to the other investment alternatives, listed U.S. equities offer greater liquidity, quicker capital deployment opportunities, and alignment with structural growth themes like AI, the energy transition, and healthcare innovation.

In the words of explained John Mathews, head of UBS Private Wealth Management: ‘The U.S. remains the world’s most robust and conservative public market. Family offices see opportunity in the volatility—and access to large, liquid companies leading global innovation.’

These family offices, averaging a net worth of $2.7 billion and managing $1.1 billion per office, aren’t just hedging. They’re taking deliberate positions based on conviction, not fear. It’s also about investing in what they know best.

‘In times of uncertainty, investors fall back on what they understand,’ Mathews added. ‘U.S. families know this market, its structure, and its innovation cycle. That familiarity is guiding asset allocation decisions.’

Investor takeaway: Institutional capital could continue to support U.S. equities while investor sentiment is weak. This is a bullish signal for longer term investors who may want to follow the lead of these American family offices by investing in high quality funds and ETFs with U.S. exposure.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Private Equity: A Tactical Retreat, Not an Exit

After years of aggressive allocations to private equity, U.S. family offices are expecting to reduce their 35% private equity allocation by 8% this year.

But this is a rotation, not a retreat. Many family offices are awaiting delayed exits and are being more selective in their fund deployment. In fact, 37% of respondents plan to increase their direct private equity exposure over the next five years.

‘They’re not exiting private equity,’ Mathews noted. ‘They're just pausing. When the right deal comes along, they commit with conviction.’

Investor takeaway: A short-term moderation in U.S. private capital inflows is likely, but the long-term trend remains intact. The smart money is keeping some dry powder ready for the next cycle of private equity deals.

Global Diversification: Eyes on Asia-Pacific

While the U.S. still dominates allocations, the Asia-Pacific region is also gaining favour. Excluding Greater China, the region saw the highest projected allocation increase, with 35% of respondents looking to boost their exposure.

India’s emerging tech scene is a key driver, offering growth and innovation opportunities outside the U.S.-China axis.

Investor takeaway: There’s good reason for growing U.S. family office interest in the Asia-Pacific region. Investors should keep the region on their radar, particularly funds linked to scalable tech and digital infrastructure in India and Southeast Asia.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Real Estate: Contrarian Opportunities Emerging

Real estate allocations are also shifting among U.S. family offices. They plan to increase their real estate exposure from 10% to 18% this year.

‘If you’re not a real estate-focused family office, this could be your moment to buy,’ Mathews said. ‘They see opportunity in home debt and properties under pressure.’

Investor takeaway: U.S. commercial real estate may be entering a buyer’s market. Investors should probably keep their eyes peeled for selective, high-quality commercial property fund opportunities looking to capitalise on market dislocations. This is also arguably the case in Australia.

Positioning for the Long Game

Despite recent headlines and headwinds in America, U.S. family offices are sending a clear message: they’re investing through the noise, not reacting to it.

By leaning into the assets they know and trust like U.S. equities, selective U.S. real estate, and the best private deals, they’re positioning their portfolios for resilience and upside.

It’s a vote of confidence in America from some of the world’s most seasoned and wealthy investors.

‘This isn’t fear,’ Mathews concluded. ‘It’s clarity. They’re investing in what they trust.’

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.