Commercial Property may be Ready to Play Defence

Simon Turner

Thu 24 Apr 2025 5 minutesAs Trump’s tariffs continue to scare global markets, investors are increasingly searching for defensive assets positioned to deliver regardless of what comes out of the American commander-in-chief’s mouth.

With interest rates appearing to have peaked, commercial property is ready to tick that box by playing defence for investors…

An Asset Class in Recovery Mode

Commercial property is emerging from a tough few years when higher interest rates took their toll on the sector’s cash flows and asset valuations.

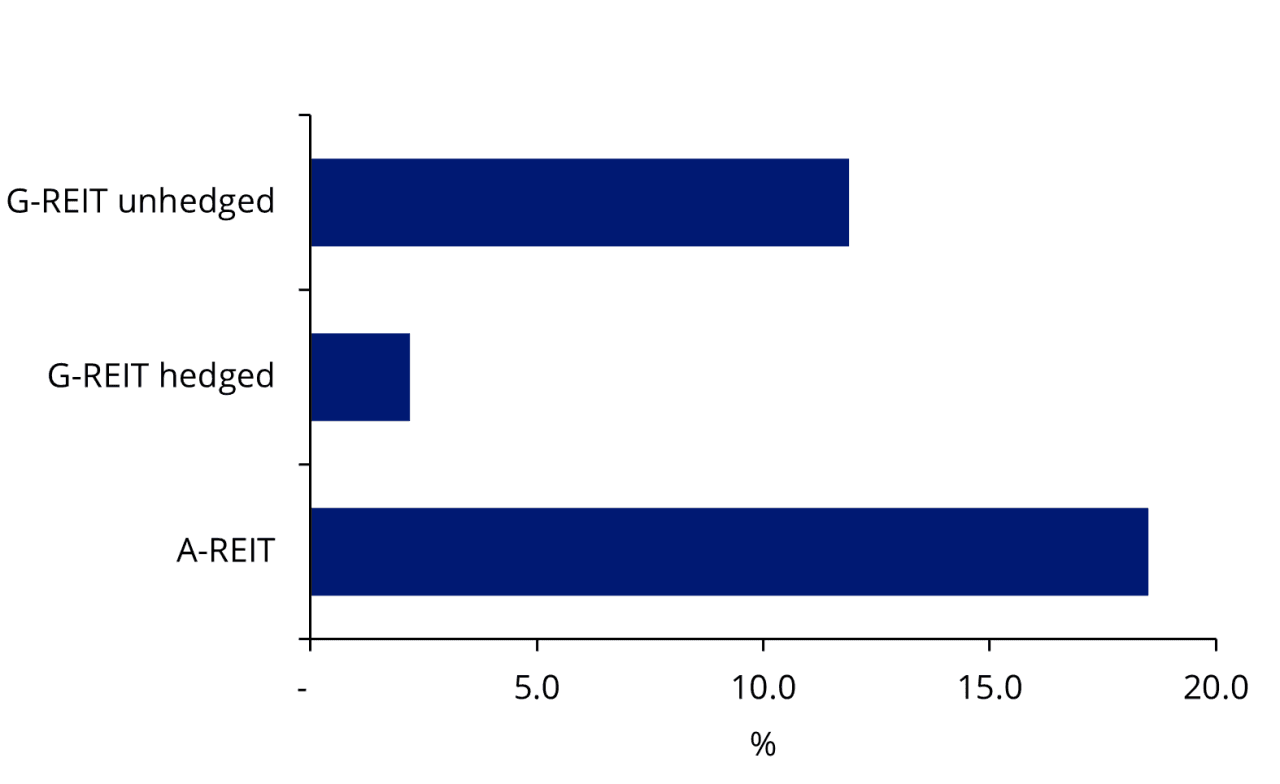

In fact, the sector’s recovery started in 2024. Listed commercial property funds, known as A-REITs, outperformed the S&P/ASX 200 by 8% last year, and they also outperformed their global counterparts (G-REITs)—as shown below.

There are two main reasons why commercial property fund performance is improving:

1. The RBA cash rate appears to have peaked

After the fastest rate raising cycle ever, the RBA has started cutting rates. Based on their recent rhetoric, it seems fair to assume the rate cycle has peaked—at least in the short term.

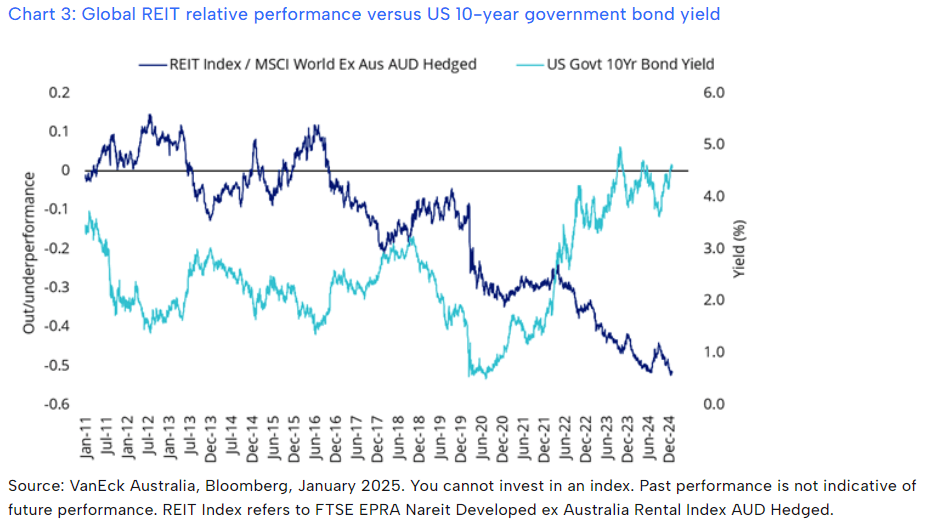

This is hugely important for commercial property since the sector’s cash flows and valuations are directly affected by interest rates. To this point, the inverse relationship between global REIT performance and US government bond yields is clearly correlated—as shown below.

2. Confidence in commercial property valuations is rising

After two-years of asset devaluations across the A-REIT and unlisted commercial property sectors, confidence in valuations has returned. Even in the hardest hit office sector, the negative valuation momentum has slowed.

This improving backdrop is driven by growing confidence that interest rates have peaked, as well as improving demand and supply dynamics at a sectoral level.

The general trend is clear: investment demand is once again on the rise while supply is constrained.

As a result, commercial property prices are rising and confidence in valuations is on the up.

This rising confidence in valuations is particularly important for unlisted commercial property funds which generally aren’t independently valued as often as their listed counterparts.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Defensive Attributes to the Fore

Of course, defensiveness requires more than a bright outlook. It requires a bright outlook regardless of what happens to the economy.

Whilst commercial property isn’t totally immune to global economic shifts, there are some compelling reasons to expect it to play defence for investors in the foreseeable future:

NAV support

Whilst A-REITs are listed and thus expose investors to market volatility, investors can take heart from growing investor confidence in their Net Asset Values (NAVs), as well as the prospect of NAV growth looking forward, particularly if the RBA continues cutting rates.

If the RBA cuts rates, commercial property valuations are likely to benefit

One of the strongest defensive arguments in favour of commercial property derives from the fact that the RBA are more likely to cut rates if the Australian economy further slows. That means commercial property is counter-cyclical and positioned to benefit from an economic slowdown.

“If the Reserve Bank implements further rate cuts, there should be a natural tailwind on inflows.” Simon Chan, Morgan Stanley

Weaker Australian dollar = growing commercial property demand

As you’ll be aware, the Aussie dollar has been weaker versus the US dollar over the past six months—due primarily to weaker demand for raw materials and the expected economic impact.

There’s a silver lining to this situation for commercial property investors: as the Aussie dollar weakens, global demand for Australian commercial property rises. That’s defensiveness in all its glory.

‘The recent decline in the Australian dollar will continue to make high-quality real estate assets attractive to overseas based investors.’ Damian Diamantopoulos, Australian Unity

Land is a scarce resource & the population is growing

Structurally, commercial property is positioned to benefit from the growth of the Australian population and the scarcity of land. Whilst this defensive angle doesn’t tend to support valuations in the short term, it’s a long-term tailwind which will benefit the asset class.

Commercial property is relatively immune from current problems in the US

And finally, commercial property is singing to a different song sheet to Trump and his tariff agenda. Surely, that’s a defensive argument in this strange new world in which we find ourselves.

‘What do US tariffs have to do with commercial property fundamentals? The answer, we believe, is likely very little … Investors seemingly haven’t had much interest in ‘defensive growth’ for several years, but perhaps this will now begin to change. Maybe their defensive characteristics make them even more attractive at an uncertain time.’ Guy Barnard, Janus Henderson

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Commercial Property’s Rising Appeal

With market volatility returning, the slow and steady returns of commercial property are gaining appeal with more investors. As such, now may be a good time to ensure your portfolio has sufficient exposure to the relatively defensive commercial property fund sector. Both A-REITs and unlisted commercial property funds are likely to outperform in this environment.

Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.