The Underappreciated World of Investment Bonds

Simon Turner

Wed 23 Apr 2025 5 minutesAs global markets swing between optimism and uncertainty like a pendulum, investors are increasingly on the lookout for alternative ways to fortify their portfolios.

Investment bonds are a defensive option which not all investors are aware of, and are worthy of consideration amidst recent volatility.

So what exactly are they, and why should investors consider adding them to their financial arsenal?

What Are Investment Bonds?

Investment bonds are long-term life insurance policies that have been designed with investment components. Unlike traditional shares or managed funds, they’re structured to provide stability while yielding tax-effective returns over time.

In Australia, they’re also uniquely beneficial because they’re subject to specific tax regulations that can work in your favour.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How Investment Bonds Work

When you purchase an investment bond, you’re essentially entrusting your funds to a fund manager who then invests in a diversified portfolio that can include shares, property, or fixed income investments.

The big selling point is that you don’t pay tax on your investment returns each year. Instead, the payable tax is deferred until you decide to cash in your investment bonds. Alternatively, if you hold your investment bonds for more than ten years, you may not have to pay any tax at all.

This tax deferred feature makes investment bonds appealing for high-income earners seeking ways to mitigate their tax liabilities.

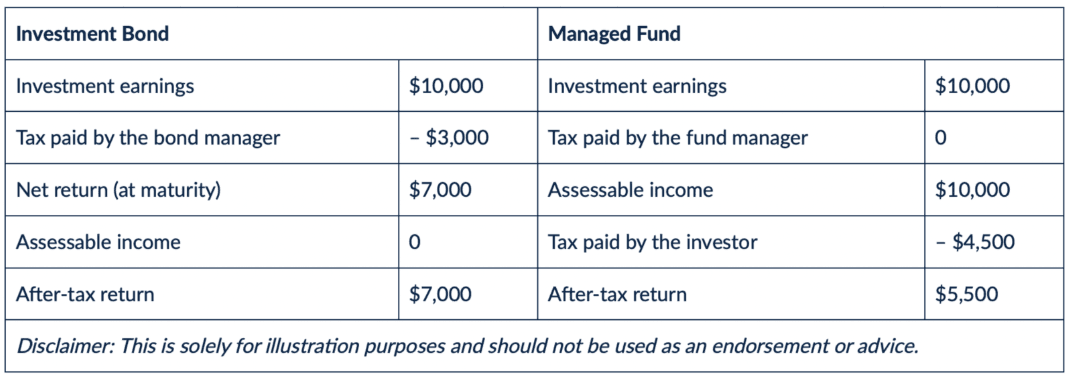

In addition, earnings within investment bonds are taxed at a flat rate of 30%. So if we compare the tax treatment of $10,000 of earnings from an investment bond versus a managed fund for a high income earner, the investment bond pays tax of 30% versus 45% for the managed fund.

That translates into a $1500 annual tax saving for the investment bond owner. Needless to say, that saving adds up to a significant amount over the long term which helps investors compound their returns.

Why Consider Investment Bonds Now?

As investors navigate a sea of global economic uncertainty sparked by fluctuating interest rates, geopolitical tensions, tariffs, and inflationary pressures, the stability that investment bonds offer is proving attractive for many investors.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Here’s why investment bonds could be a smart addition to your portfolio…

1. Stability Amidst Volatility

Investment bonds are designed for the long haul. While the stock market can experience sharp fluctuations, the value of investment bonds tends to be more stable over time. For investors worried about short-term market dynamics, this stability can be a welcome cushion against market shocks.

2. Tax Advantages

The tax benefits of investment bonds can’t be overlooked.

With tax paid at a flat rate of up to 30% on earnings within the bond, many investors use investment bonds to pay less tax than they would with traditional investment vehicles.

For those in higher tax brackets or investors anticipating significant gains, the tax-deferral benefit of investment bonds means you can keep more of your earnings working for you longer.

3. Investment Flexibility

Many investment bonds offer a myriad of investment options within them, catering to different risk appetites and time horizons. From equities to fixed-income securities, you can tailor the bond’s investment strategy to align with your financial goals.

This flexibility ensures that your investment stays relevant irrespective of market conditions.

4. Estate Planning Benefits

For families looking to manage their generational wealth, investment bonds can also be a powerful tool.

For example, the proceeds of an investment bond can pass to beneficiaries without going through the potentially drawn-out and costly process of probate. This means your heirs can receive their inheritance directly, and they can also benefit from the tax advantages if they wait until the investment bonds reach maturity.

5. A Hedge Against Inflation

As inflationary pressures continue, the purchasing power of cash can be eroded over time.

Investment bonds, with their potential for capital growth, can provide a hedge against inflation.

However, it’s important to choose your investment bond exposures wisely to ensure the underlying assets can keep pace with or outstrip inflationary pressures.

Getting Started in Investment Bonds

If you are considering investment bonds, it’s essential to do your research.

Look for investment bonds with lower fees and a strong long-term track record, and consider consulting with a financial advisor who understands your individual risk tolerance and financial situation.

Finally, remember that, like all investments, investment bonds come with their own unique risks such as default risk and potentially lower returns than equities.

Market fluctuations can still impact the value of investment bonds over time, and it’s crucial to align your investment strategy with your broader financial goals.

An Asset Class Worthy of Consideration

In the face of fluctuating markets, investment bonds offer investors an opportunity to achieve growth and financial security with tax advantages to boot. They stand out for their stability, long-term growth potential, and suitability in strategic estate planning.

With the right approach, investment bonds might just be the secret weapon you’re looking for to help you weather upcoming financial storms while navigating the complexities of the investment landscape. At the very least, they’re worth keeping on your radar.

Investment Bonds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.