Big Balances, Bigger Targets: Why Scammers Love Investors

Ankita Rai

Thu 17 Apr 2025 6 minutesFraud rarely makes the top of a portfolio review. But it should.

As scammers grow increasingly sophisticated, investors across Australia are finding themselves on the front line of financial crime—often without realising it until it’s too late.

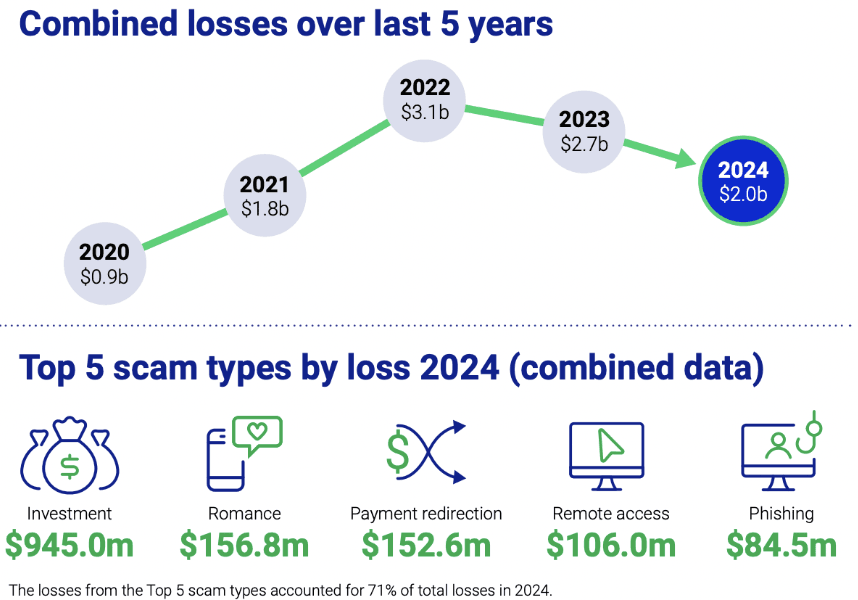

In 2024 alone, Australians lost more than $2 billion to scams, with investment fraud accounting for a staggering $945 million.

What’s more concerning is that new types of scams are emerging constantly—each tailored to the platforms, habits, and behaviours of everyday investors.

Here’s a closer look at the risks investors face today, and some simple steps to help keep your money safe…

Scamming on the rise across the investment world

The logic is simple: where money flows, scams follow.

The recent coordinated cyberattacks on major funds—AustralianSuper, REST, Hostplus, and Insignia—are a sharp reminder of how exposed the system really is.

Even if only a handful of member accounts were compromised, the financial and psychological impact can be significant.

Superannuation accounts are especially attractive to fraudsters. With retirees often holding larger balances and gaining greater access to funds after preservation age, the sector is ripe for exploitation.

According to the Australian Financial Complaints Authority, super-related scam complaints in FY23 averaged $89,000 in losses per victim, with the highest individual loss topping $344,000.

But super is just part of the picture. SIM swapping and fake investment platforms are all on the rise, as scammers refine their tools and tactics.

In 2024, Scamwatch received 249,448 scam reports. Social media was the most common point of contact, leading to $69.5 million in losses. Phone scams accounted for the highest total losses at $107.2 million, while bank transfers remained the most damaging payment method, with $141.7 million lost.

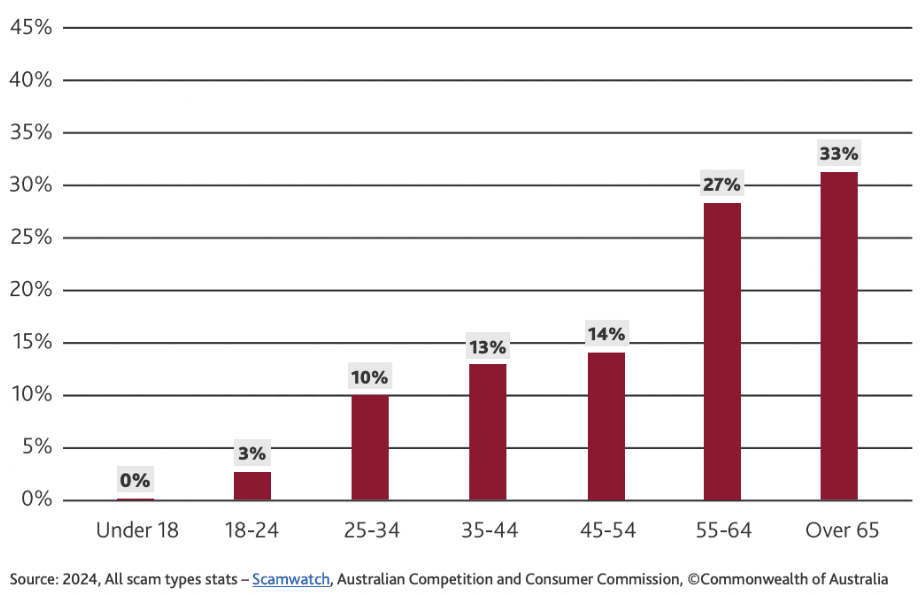

Older Australians were hit hardest, reporting $99.6 million in losses—the highest of any age group. It’s a clear sign of their increased vulnerability in an increasingly digital financial world.

How to Spot an Investment Scam Before It Finds You

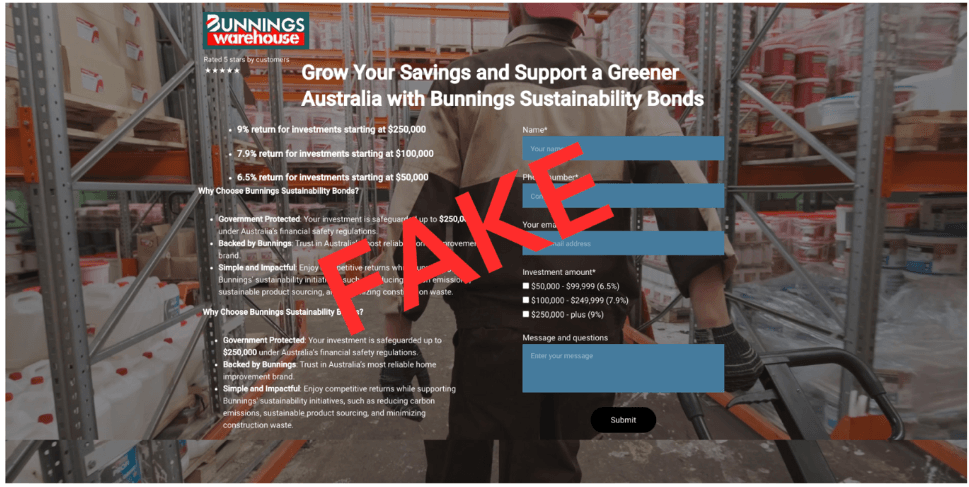

Modern scams don’t always look suspicious. Many now mimic legitimate investment offers—slick websites, fake documents, and even deep-fake videos of trusted figures promoting bogus schemes.

The tactics are evolving, but the formula is familiar. Scammers usually make the first move—via email, social media, or cold calls—armed with fake credentials, manufactured urgency, and a disappearing act once the money lands.

Here are some of the most common—and costly—scam types targeting investors today:

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

1. Impersonation emails and flash messages

Phishing scams have become harder to spot. Many now closely mimic alerts from banks or regulators, warning of ‘suspicious activity’ and urging quick action. The language is urgent, the branding looks official—and that’s what makes them so effective.

Flash SMS messages take it a step further. These alerts appear directly on your phone screen and disappear once dismissed, leaving no trace in your inbox. They’re designed to bypass your usual filters and prompt an immediate response.

ASIC’s 2024 warning about ‘imposter bond’ scams showed just how convincing these tactics can be. Scammers used cloned websites, fake customer service lines, and polished marketing materials to impersonate well-known institutions.

Sophistication doesn’t guarantee safety. If something feels rushed or too good to be true, pause—and verify.

2. Business Email Compromise

One of the most pervasive scams affecting businesses—especially small ones. Scammers hack or spoof a legitimate business email account, then hijack conversations to alter payment details.

It might look like a routine request from a supplier or colleague—just a quick update. But once funds are sent, they’re rerouted to a scammer-controlled account.

With AI generating highly convincing emails, red flags are harder to spot. That’s why awareness and team-wide scam literacy are more important than ever.

3. Crypto ATM Scams

Crypto use is rising—and so is its misuse. With more than 1,100 crypto ATMs active in Australia, scammers are taking advantage of the speed and anonymity they offer.

They often impersonate officials from the ATO, a utility, or even law enforcement, and instruct victims to deposit funds into a Bitcoin wallet.

AUSTRAC has linked crypto ATMs to a growing number of scams, including romance fraud and money mule operations.

4. SIM Swapping and Phone Porting

One of the stealthiest scams around, SIM swapping allows scammers to take control of your mobile number by transferring it to a new SIM or provider. Once done, they can intercept SMS-based two-factor authentication codes.

Sudden SOS-only messages or unexpected signal loss could mean your number’s been ported. If it happens, act quickly. Call your telco, set a security PIN, and shift to app-based authentication wherever possible.

Unusual phone behaviour might seem like a glitch—but it could be the start of a scam.

Smart Habits That Could Save Your Portfolio from a Scam

Once you know how scams work, the next step is strengthening your defences. While no system is foolproof, a few simple practices can significantly reduce your exposure and help you act decisively when something feels off.

These aren’t just good digital hygiene—they’re essential parts of managing money in a world where fraud is increasingly sophisticated:

1. Always pause before acting. Scammers rely on urgency to override your judgement.

2. Verify everything. Check that individuals are licensed with ASIC, websites aren’t flagged on Moneysmart or International Organization of Securities Commissions (IOSCO) investor alerts portal, and the domain wasn’t registered recently.

3. Confirm a company lists a valid ABN and Australian Financial Services Licence—and verify them via ASIC’s Professional Register search.

4. Rotate your passwords every 90 days and use a password manager to keep things secure. Enable multi-factor authentication. Avoid public Wi-Fi for financial activity, and use a VPN if needed.

5. Clean up your digital footprint - delete old accounts and files, and install cybersecurity software.

6. When in doubt, consult the Scamwatch website - it’s updated regularly with the latest threats.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Reframing Fraud as a Core Investment Risk

Fraud is no longer a fringe risk—it’s a central threat in today’s digital-first investment landscape. Scams are getting smarter, more targeted, and harder to detect. Even experienced investors are vulnerable to tactics like cloned websites and AI-generated impersonations.

In this environment, managing fraud risk is just as essential as managing inflation or volatility. While staying alert won’t eliminate every threat, asking the extra question and pausing before you act might just be the edge that makes the difference.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.