The Mediocre Country Syndrome: How Australia is Positioned in this Strange New World

Simon Turner

Wed 16 Apr 2025 6 minutesAmidst this strange new world of trade wars and deteriorating geopolitical relationships, Australia finds itself in a peculiar position: a land of promise and opportunity wrestling with the spectre of mediocrity at a time when competitive advantage is everything.

More than ever, the country’s future depends on rising above the apathy that’s taken hold of the economy…

The Lowdown on US Tariffs on Australian Exports

First on our plate is the spicy issue of American tariffs.

Australia has recently been gifted—or cursed, depending on how you spin it—with a ten per cent tariff on our goods exported to the United States, courtesy of the Trump administration.

However, this might not be as bad as it sounds.

From the American viewpoint, this tariff is merely a friendly tax, a little nibble at Australia’s economic buffet. It’s akin to Trump suggesting that since Australia is enjoying a ten per cent clip on imported American goods, he deserves to do the same.

Some Australian politicians may have wished for an exemption from Uncle Sam, but let’s face it—that was extremely unlikely. Trying to dissuade a leader like Trump from reaping a tax windfall is akin to trying to convince a Wall Street banker to stop trading on margin.

The upshot is that Australia needs, more than ever, to prove its worth as an international trading partner. In a world in which exporting is becoming more expensive, the quality of exported goods and services need to represent value regardless of the higher price tag.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Mediocre Country Syndrome

At this point, it would be lovely to highlight how strong and innovative the Australian economy is.

However, that would be a lie.

Having once basked in the glow of being the ‘lucky country’, Australia now stands at a crossroads which raises the question: is the country slipping into mediocrity?

With GDP growth hovering around a lacklustre 0.6% (Q4, 2024) and per capita income declining for the past two years, it has become clear that Australia’s golden era of economic growth ended a while back.

The post-COVID revitalisation fizzled out faster than hoped, leaving consumers at the mercy of inflation, which is serving to crowd out growth opportunities while igniting anxiety among households.

In short, a kaleidoscope of challenges looms over the Australian economy. From energy shortages in a country that’s rich with natural resources, to severe bureaucratic red tape that stifles innovation, these challenges aren’t going to resolve themselves.

The corporate world is voting with its feet. More and more companies like Woodside and Orica are heading for greener pastures in the U.S., leaving Australia to ponder the lost opportunities during what's effectively a capital drought.

What Happened to Earnings Growth?

This mediocre economic reality is mirrored on the ASX.

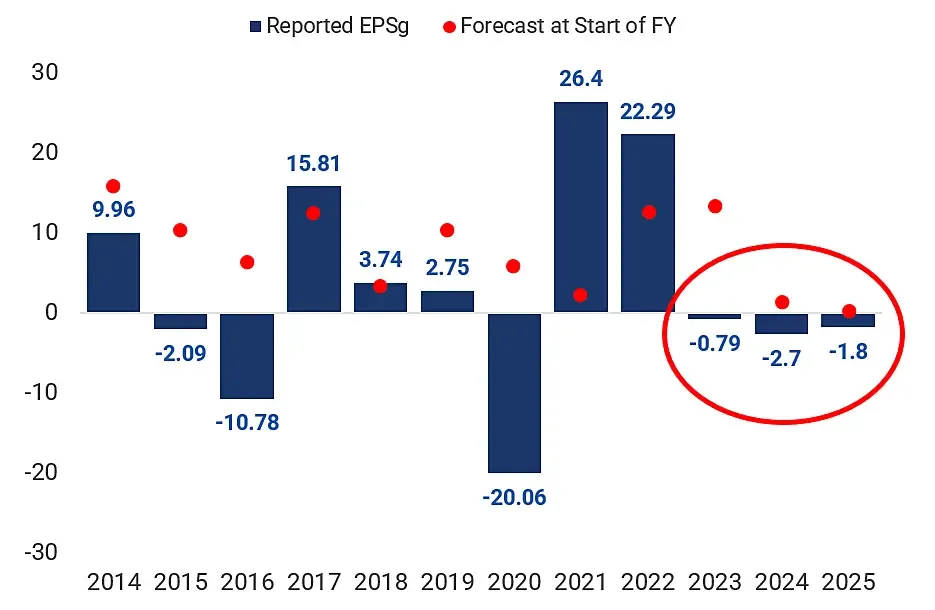

Notwithstanding a solid rally in 2024 (ASX 200 +11.4%) in anticipation of better times, the recent earnings season was mediocre at best. Moreover, FY25 is likely to mark the third consecutive year of ASX 200 aggregate earnings declines—as shown below.

Margin pressure is evident across most sectors of the Australian economy.

Worse, according to Yarra Capital Management, almost half the ASX 200 is ‘ex growth’ with the banking sector (24% of the ASX 200), the resources sector (17%), and the REIT sector (7%) all contending with earnings headwinds.

Lack of Investment = A Major Problem

As per the Chinese proverb: the best time to plant a tree was twenty years ago.

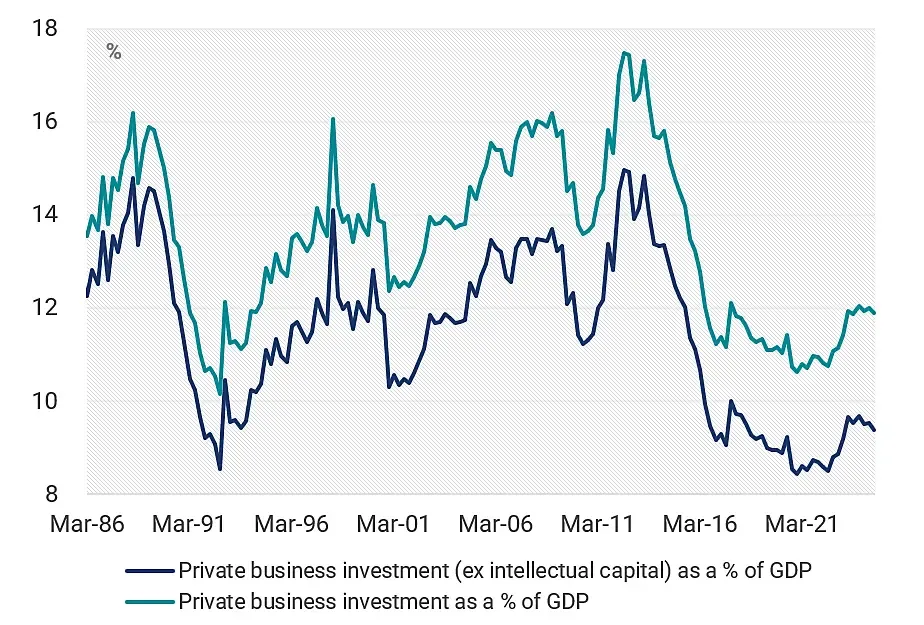

So after such a challenging period for the Australian corporate world, you’d be hoping that business investment was trending upwards in anticipation of better times ahead.

You’d be wrong.

Australian business investment is currently near multi-decade lows—as shown below.

So essentially, the Australian corporate world is in the midst of an investment drought driven by risk aversion and caution about the future. It doesn’t take an economic genius to see that this doesn’t bode well for future economic growth or corporate earnings growth.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Where to from here?

So where to from here? In short, structural change is needed.

Most economic experts agree it’s high time the country’s economic policies were re-evaluated, cumbersome taxes were eliminated, and the culture of ‘Yes Minister’-level bureaucracy was ended so as to reignite business and investor confidence.

More than ever, the country needs vision, courage, and execution from its leadership rather than a maintenance of the status quo.

What are Investors to do?

Investing in the hope that things will get better in the future is rarely a successful investment strategy.

So unfortunately, until the Australian Government (whoever that may be after the election) starts changing the tune, investors have to assume more of the same.

There are a two important implications:

- Ensure your portfolio is well-diversified geographically.

It’s tempting for most investors to overweight their local market (known as home market bias). After all, it’s the market they know best.

However, in the absence of significant policy change, being too overweight the Australian market may preclude investors from accessing better growth opportunities in other regions. Investing in high quality global funds is a great way of ensuring you’re accessing the best global opportunities.

- Within the Australian market, focus on the niches within the economy which are growing.

While the banking and resources sectors may indeed be ex-growth, not all parts of the Australian economy are in the same boat.

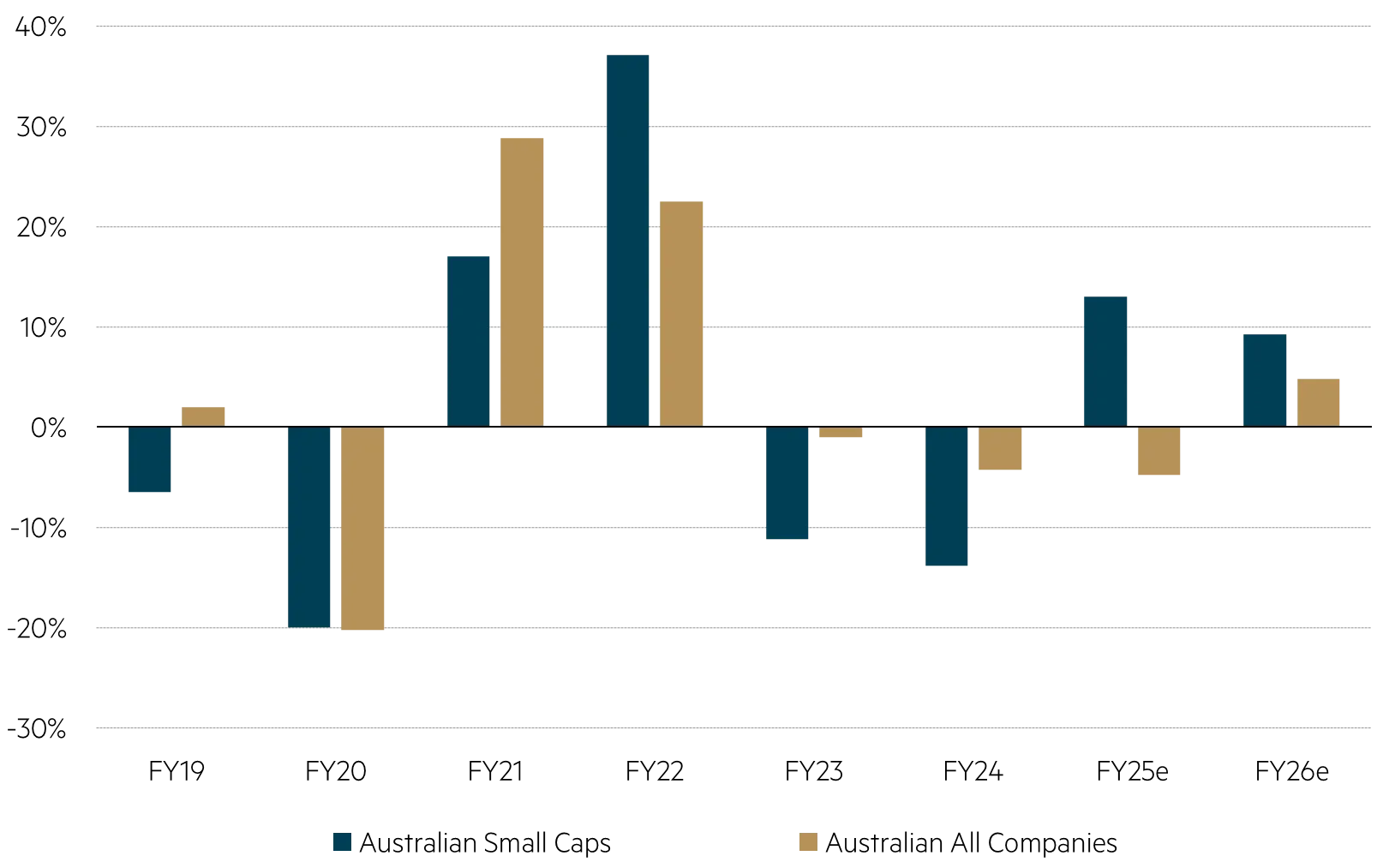

For example, now may be a good time to consider smaller companies funds. As shown below, Macquarie expect much stronger EPS growth from Australian smaller companies this financial year and next than from the market at large.

That may translate into an opportunity for small cap investors despite the challenging backdrop.

Conclusion

Australia stands at a pivotal juncture. The impact of the ten per cent tariff from the U.S. may be short-lived, but the country’s economic challenges are more structural in nature.

To transition from ‘the lucky country’ to a modern economy positioned to thrive requires waking up from this period of mediocrity, shaking off the complacency, and embracing intelligent policy reforms.

The future isn’t set in stone. It’s high time Australia forged a pathway toward resilience and prosperity in this strange new world.

Funds Positioned to Benefit

Global Funds:

Australian Small Cap Funds:

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.