Active Fixed Income Management is Back in the Game

Simon Turner

Mon 14 Apr 2025 6 minutesAs markets wobble in the wake of President Trump’s tariffs, bonds are stepping up to the plate, providing a safe haven for investors while stocks plummet. Most bond ETFs and managed funds have started outperforming, with many reaching performance heights not seen in months.

Amidst the equity market volatility, there’s an interesting shift afoot amongst fixed income investors: they are increasingly turning to actively managed bond funds, breaking the long-standing consensual belief that active managers can’t consistently beat their benchmarks.

There’s more to this shift than meets the eye…

The Return of Active in Fixed Income

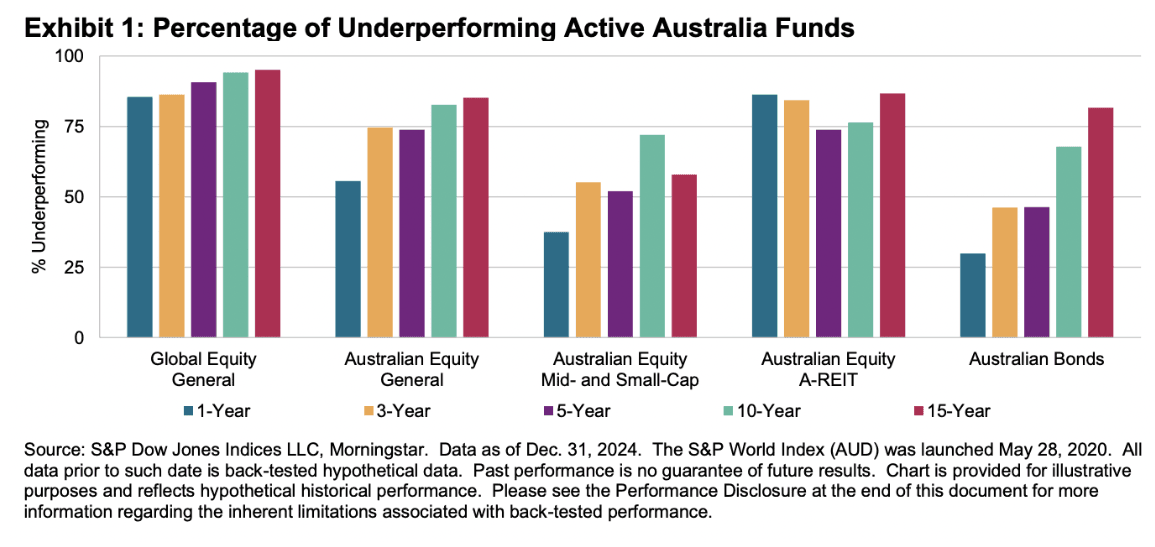

Last year was a rough ride for active stock-pickers, with only 38% of them outperforming their benchmarks, according to S&P Global’s SPIVA Scorecard.

However, the bond market has been dancing to a different tune. The majority of actively managed global fixed-income funds outperformed their benchmarks in 11 out of 16 categories—and with less underperformance (41%) across the board compared to U.S. large cap stocks (65%).

This story has been even more impressive in Australia.

Only 30% of active fixed income managers in the Australian Bonds category underperformed in 2024, after 26% underperformed in 2023. Last year, they delivered an asset-weighted average return of 3.9%, compared to a 2.9% return for the S&P/ASX Australian Fixed Interest 0+ Index. That’s impressive outperformance in a relatively conservative asset class.

Having said that, the longer term data remains firmly in favour of ETFs as 82% of Australian bond funds have lagged their benchmarks over the past fifteen years.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Enter Enhanced Core

Amidst the return of active fixed income outperformance, there’s another theme at play: the rise of enhanced core (also known as core plus) as a fixed income strategy.

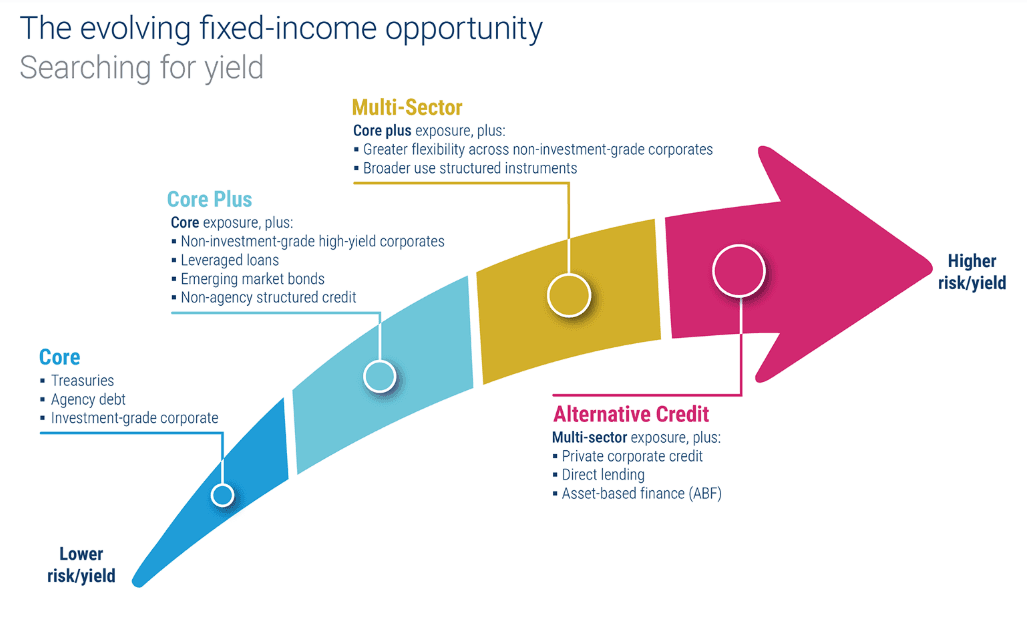

So what is enhanced core?

It’s a strategy which allows fixed income managers greater freedom to invest in a broader range of asset classes including non-investment grade high-yield corporate bonds, leveraged loans, emerging market bonds, and non-agency structured credit.

As shown below, enhanced core can also encompass a multi-sector strategy which allows greater flexibility in the form of structured instruments and non-investment grade corporate opportunities.

The great attraction of enhanced core as an active strategy is that fixed income fund managers can use it to better translate their in-house expertise into alpha (outperformance versus their benchmark)—since they have more investment avenues through which they can more accurately express their opinions.

So enhanced core is essentially customised to leverage the benefits of active management in the fixed income world.

The results speak for themselves. This year, global enhanced core bond funds have attracted a whopping five times more investor cash than their passive peers. This shift largely explains why active management is once again shining in the fixed income sphere.

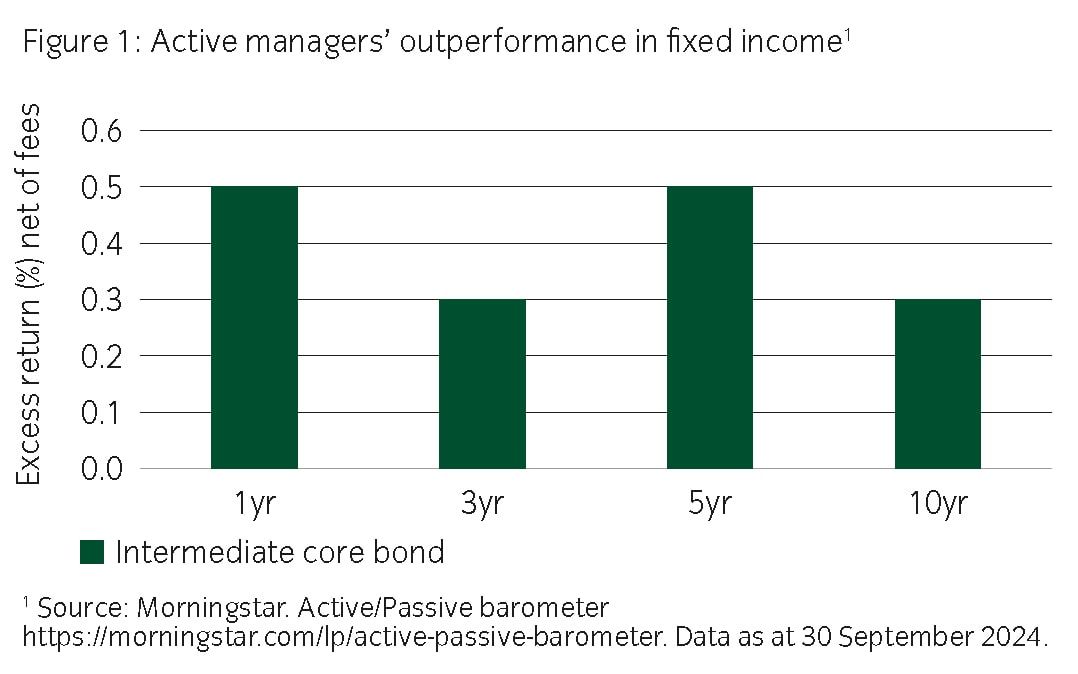

Enhanced core has been a key driver of fixed income outperformance in the short term. It’s also interesting to note that the longer term enhanced core global performance data is also positive—as shown below.

With such strong inflows and relative performance, enhanced core is here to stay as a leading active fixed income strategy.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Passive-Active Fixed Income Debate

So where does this leave us in the passive-active management debate within fixed income?

Let’s be honest, prior to recent active fixed income outperformance, the passive-active management argument appeared to have been won by the passive team.

However, these recent evolutions clearly favour active fixed income managers.

There’s also another angle worth mentioning.

A number of active global bond managers have recently criticized the Bloomberg U.S. Aggregate Bond Index, the benchmark for many fixed income ETFs, for being outdated and flawed. In particular, they’ve been highlighting that ETFs like this one miss out on investing in a dizzying array of $US26 trillion of bond opportunities.

According to Todd Sohn from Strategas: ‘The Bloomberg U.S. Aggregate Bond Index is flawed. If you’re a smart fixed income manager and you know your markets and you know the economics, you can get the exposures for that. I think that’s why you’re seeing this movement.’

Of course, it’s natural that active fixed income managers sing whilst they’re winning, but it’s worth investors being aware that most fixed income ETFs lack the breadth of opportunities that enhanced core managers are able to tap into.

Also remember, while actively managed bond funds have enjoyed a hot streak recently, long-term outperformance remains a tough nut to crack. SPIVA data shows that over the longer term, most active managers in bonds largely haven’t delivered better returns than passive strategies.

For most investors, maintaining exposure to both fixed income ETFs and managed funds may well be the most prudent strategy.

Active Fixed Income is Back in the Game

While many investors still feel more comfortable with equities, amidst recent volatility they’re leaning more toward active fixed income management. It’s good news for the active bond managers of the world who are making hay while the sun shines.

Here’s hoping active bond managers continue proving their worth against their benchmarks.

Active Fixed Income Funds Positioned to Benefit

Listen into our Debate on US equities

Until recently, the S&P 500 was the main investment game in town, including for Aussie investors looking for more bang for their buck than has been available on the ASX.

But Trump 2.0 has started with change with a capital C. He’s breaking laws, introducing tariffs, circumventing Congress, and encouraging Elon Musk to dismantle government departments. Most legal scholars agree the US is in a constitutional crisis.

Is it all noise or have we entered a different phase for the S&P 500?

In this debate, we’re privileged to be joined by two experts with extensive US equities experience.

Representing the US bulls’ side of the debate is George Clapham, a founding partner at Eight Bays investment management.

And representing the US bears’ side of the debate is Sam Chipkin, the Chief Investment Officer at 5AM Capital.

Listen in to learn more about this fascinating subject which has wide-ranging ramifications for investors.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.