Six Freedom-Crippling Retirement Planning Mistakes to Avoid

Ankita Rai

Thu 10 Apr 2025 6 minutesRetirement today comes with more choice—and more complexity. With longer lives, rising living costs, and more personal control over income, navigating this phase takes more than just a solid super balance.

And while many Australians enter retirement feeling confident, a few missteps can quietly chip away at their financial security.

Too often, retirees fall into avoidable traps—from missing out on entitlements to holding assets in the wrong structure. These may seem minor, but over time they can limit flexibility and reduce your quality of life.

Whether you’re a decade out from retirement or already easing into one, here’s how to avoid the financial pitfalls that could hold you back…

1. Leaving Superannuation in the Accumulation Phase Post-Retirement

A common oversight among retirees is failing to shift their super from the accumulation phase to the pension phase upon retirement. While accumulation-phase earnings are taxed at 15%, switching to pension mode makes them tax-free.

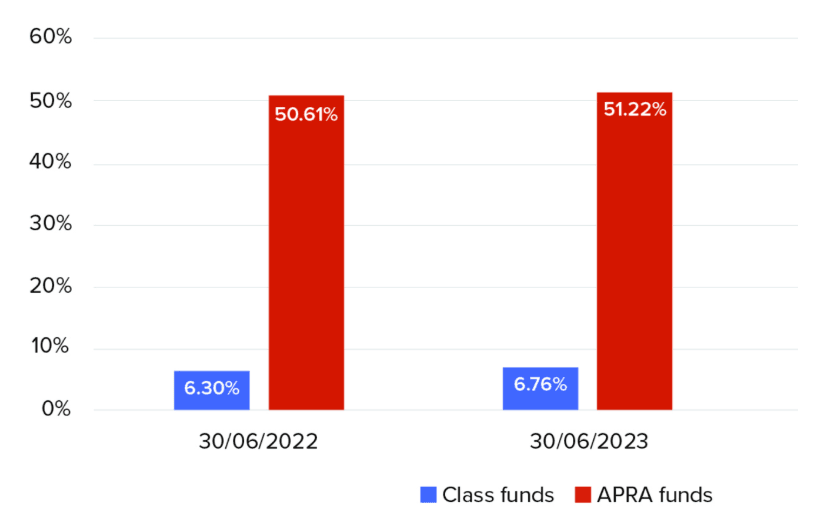

Despite the clear benefit, many don’t make the move. A Class Benchmark Report found that more than 50% of APRA fund members hadn’t converted any of their balance—leaving an estimated $225 billion exposed to unnecessary tax.

Members over 65 who are purely in accumulation phase

This lack of action often comes from poor communication, confusion around pension rules, or a default to lump-sum withdrawals.

As a result, many retirees are paying more tax than they need to—reducing the value and longevity of their retirement savings.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Delaying Application or Not Maximising Your Age Pension

The Age Pension provides a valuable income stream for retirees, yet many either delay applying or don’t maximise what they’re eligible for.

From age 67, payments are available to those who meet residency, income, and asset tests—thresholds that are often more generous than assumed.

Importantly, you don’t need to be fully retired to qualify. Even if you're still working part-time or think your assets are too high, it’s worth checking. Many retirees could be receiving at least a part pension or linked benefits but never apply.

Maximising your pension entitlement often comes down to how your finances are structured. Regularly updating the value of depreciating assets—such as your car—can increase your payments over time. For example, reporting a drop in value could boost your fortnightly amount.

Reducing assessable assets is another lever. Using savings to pay off debt, invest in home upgrades, or even gift within allowable limits can all improve pension entitlements.

Couples with a younger spouse can also benefit by shifting super to the younger partner, keeping it exempt from the means test—an often-overlooked tactic that can significantly lift pension payments.

3. Overlooking Eligibility for the Commonwealth Seniors Health Card

The Commonwealth Seniors Health Card (CSHC) is another key benefit, offering access to cheaper healthcare, prescription medicines, and other essential services.

Still, more than a million eligible Australians aren’t claiming it. And that’s a missed opportunity. Depending on your circumstances, the card could save you $2,000 to $3,000 each year—or as much as $60,000 over a 20-year retirement.

The best part? Eligibility is based on income alone, not assets. Right now, the income cap is $95,400 for singles and $152,640 for couples. You’ll also need to be of Age Pension age and living in Australia.

Yes, the application process can be a bit of a hassle. But given the potential savings, it’s absolutely worth the effort.

4. Neglecting Downsizer Contributions to Superannuation

For homeowners thinking about downsizing, the downsizer contribution is a smart opportunity.

If you’re aged 55 or over and have owned your home for at least 10 years, you can contribute up to $300,000 (each spouse) from the sale proceeds into super, outside the usual contribution caps.

These contributions aren’t taxed and don’t count towards your non-concessional limit. However, they do count toward your transfer balance cap, which will rise to $2 million from 1 July 2025. That’s particularly relevant if you're setting up a retirement income stream.

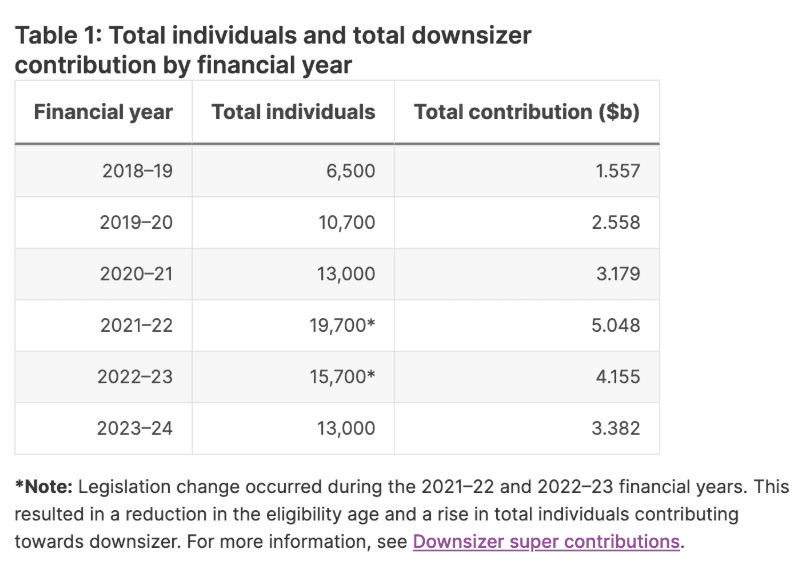

In 2023–24, over 13,000 Australians made a combined $3.38 billion in downsizer contributions—averaging around $243,000 in QLD.

That said, it’s not for everyone. It can affect Centrelink benefits like the Age Pension or Commonwealth Seniors Health Card. The contribution also can’t be claimed as a tax deduction. And if you're still working, locking away funds could reduce short-term flexibility.

5. Holding Back on Your Super Pension

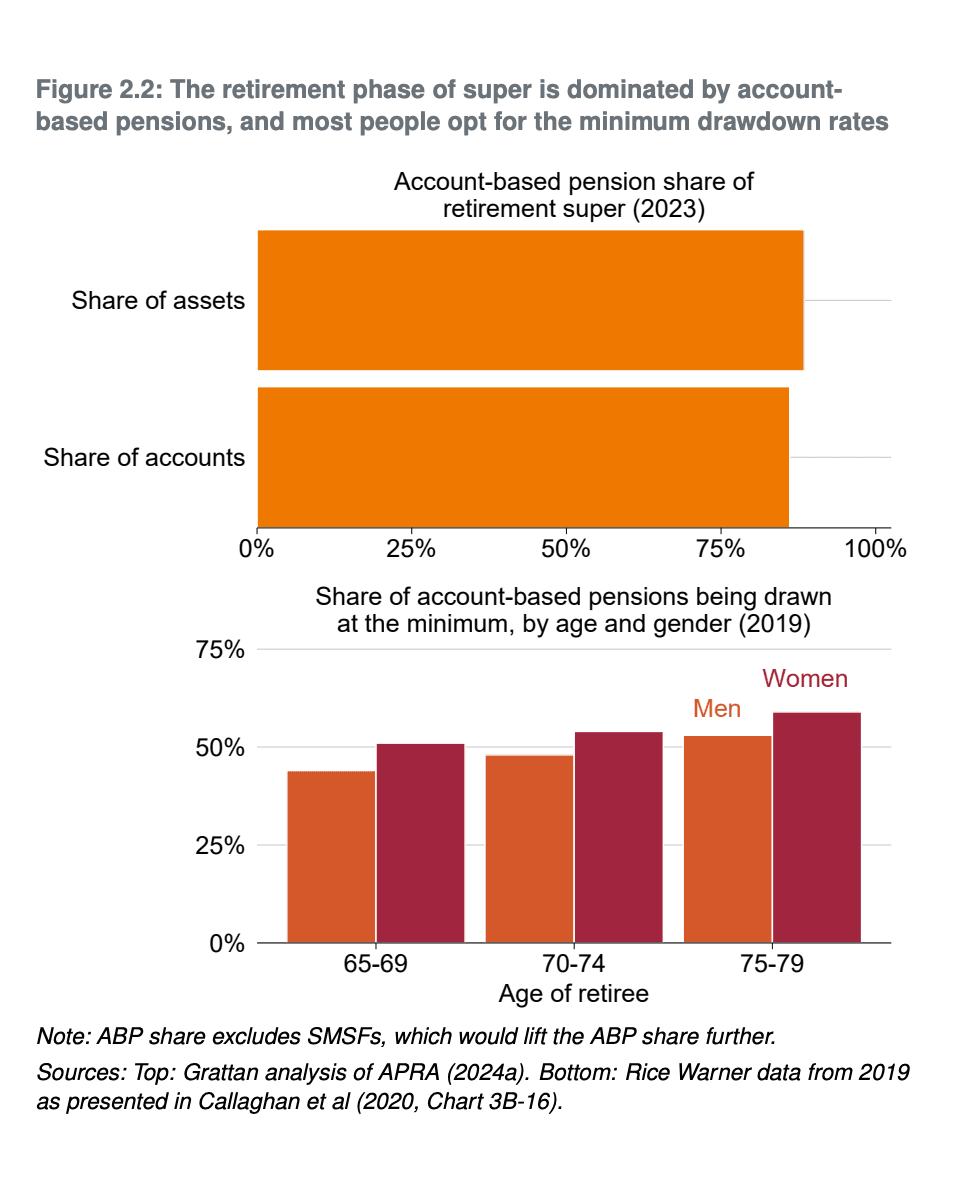

It’s common for retirees to play it safe with their super. Many retirees start an account-based pension and stick to the minimum drawdown rate—starting at 4% per year for those under 65 and rising to 14% for people in their 90s.

While these rates are designed to prevent premature depletion, they’ve become a psychological ceiling. As shown in the chart below, around half of retirees withdraw only the minimum—often mistaking it for guidance rather than what it really is: a tax rule.

In fact, Treasury modelling shows that retirees drawing at minimum rates often leave a quarter of their balance unspent. Uncertainty around how much is enough, combined with rising costs and longevity risk, continues to weigh on confidence.

It helps to remember that retirement spending typically peaks early—during the active years—before gradually tapering off. And even in the pension phase, your super remains invested.

Drawing a sensible, sustainable income doesn’t mean you’ll run out. It means you’re using your retirement savings the way they were meant to be used.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

6. Overlooking Investment Strategy

Retirement isn’t the end of investing—it’s just a shift in strategy. Yet many retirees leave their portfolios on autopilot.

Some withdraw their super as a lump sum, missing the chance to keep it growing in a low-tax environment.

Even in retirement, your super can stay invested. Most funds let you tailor your portfolio to suit your risk comfort and income needs. The right mix can help your savings last longer—especially as living costs continue to rise.

Costs like groceries, energy, healthcare, and insurance are always coming—retirement spending doesn’t stand still. That’s why your investment strategy needs to keep pace. Ignoring inflation or holding a too conservative portfolio can quietly erode your purchasing power over time.

Living More Intentionally in Retirement

Retirement isn’t a set-and-forget milestone—it’s about gaining the freedom to live on your terms by making smart choices.

Overlooking key decisions around super, entitlements or investment strategy can quietly reduce your financial flexibility over time. That’s why diversification, realistic budgeting, and timely drawdowns matter just as much as how much you’ve saved.

With the right planning, most pitfalls can be avoided—paving the way for a retirement that’s secure, flexible, and fulfilling.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.