How to Pick the Right Super Fund That Works for You

Ankita Rai

Thu 14 Aug 2025 6 minutesFor many Australians, superannuation is a set and forget investment. But the truth is, small differences in fees, performance, and features can snowball into hundreds of thousands of dollars in retirement savings.

In fact, the Productivity Commission inquiry into superannuation efficiency found that a fee difference of just 0.5% p.a. could cut a typical full-time worker’s final balance by 12%, which equates to more than $100,000 in many cases. That’s far too big to ignore.

That’s why choosing the right super fund and checking in on it regularly isn’t just good practice, it’s essential. It starts with understanding the true impact of fees.

The Real Impact of Fees

Australians pay more than $30 billion in super fees every year, excluding insurance premiums. Every dollar spent on fees is a dollar that isn’t being invested, resulting in a significant investment impact over the course of decades.

Yet most people don’t know what they’re paying. A Vanguard Australia survey found 61% aren’t aware their fund charges multiple fees, and 34% have never reviewed or compared them.

While fee structures vary between funds, they broadly fall into three buckets:

- Administration fees cover the cost of running the account, the day-to-day management, and many funds now cap these.

- Investment fees and transaction costs are the ongoing charges for running the investment options members choose. That means external manager fees, performance fees, and the costs of buying and selling assets. Some funds also add switching fees if a member moves from, say, a Growth option to a Balanced option.

- Advice fees come into play only if the fund’s advice service is used, and not every fund offers that service.

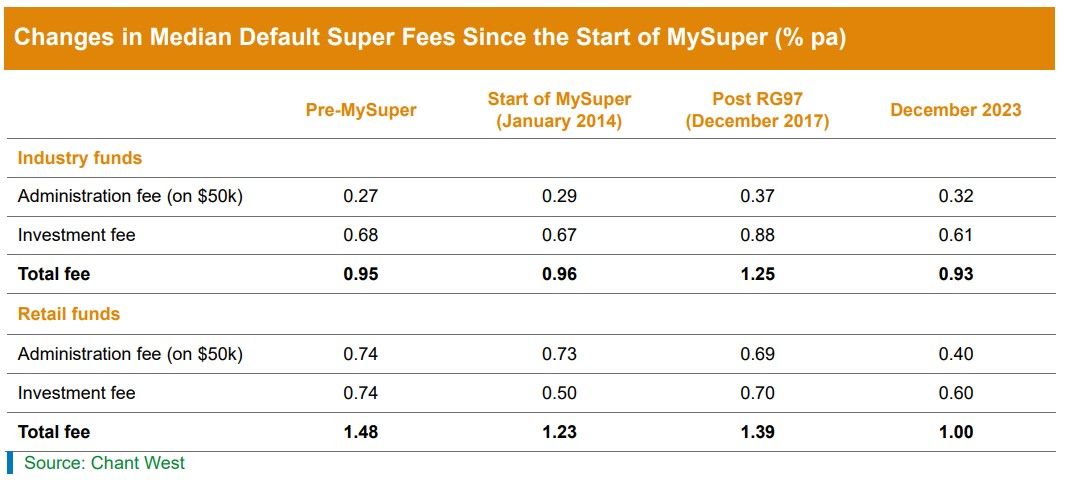

Of these, investment fees make up the lion’s share of total costs. Across both industry and retail funds, they are the biggest contributor to the median total fee as shown in the chart below.

This makes the choice of investment option, and how it’s managed, one of the main factors influencing what an investor ends up paying.

Keep this in mind when deciding on a fund or reviewing your current one, and make sure fee comparisons are like-for-like. For example, a Balanced index option with roughly 75% in growth assets isn’t comparable to a High Growth option in another fund. High-Growth portfolios often hold more actively managed shares and unlisted assets, which are more expensive to run, and those higher costs will show up in the fees charged to investors.

Understanding these differences helps put costs in context and assess whether the fees you’re paying are reasonable for the strategy, service, and outcomes your fund delivers.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Review Long-Term Investment Performance

Fees matter, but they’re only half the story. What the fund delivers in return is just as important.

Underperformance doesn’t just hurt in the short term; it compounds over the years into a much smaller balance at retirement.

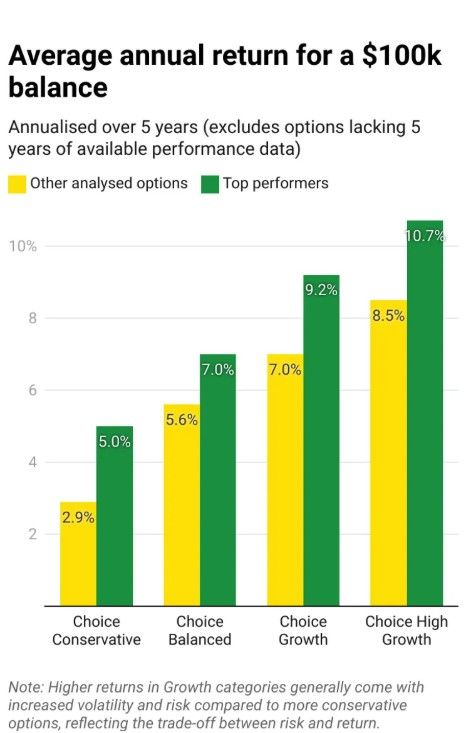

According to Mozo’s 2024 Superannuation Report, choosing a higher-performing fund could have boosted a balance by thousands, even tens of thousands, over just five years, depending on the fund type and starting amount.

Given what’s at stake, it’s worth looking at where most Australians actually have their super invested. By number of accounts, nearly 70% of Australians under 65 are in MySuper, but by asset value, APRA data (31 March 2025) shows $1,074 billion in MySuper products and $1,330 billion in Choice products.

Performance-wise, MySuper generally falls between the balanced and growth categories.

The gap between top performers and others in this category is narrower than in Choice products, indicating that MySuper effectively serves as a low-cost default for members who prefer a hands-off approach. Conversely, Choice products offer greater flexibility but come with a broader range of outcomes.

Ultimately, whether to choose MySuper or Choice depends on how involved the member wants to be and how well the fund’s investment menu aligns with their goals.

Choose the Right Investment Mix

Once you’ve decided how hands-on you want to be, the next step is choosing an investment mix that matches your goals and tolerance for risk. Most funds make this easier with pre-mixed portfolios such as: Growth (around 85% in shares/property), Balanced (about 70%), Conservative (around 30%), and Cash (100% deposits or capital-guaranteed). Many also offer ethical or ESG-screened options.

For those in Choice products, there’s even more flexibility. You can set your own asset mix or invest directly in shares, ETFs, or term deposits.

Whichever route you choose, understanding these options is essential before comparing features like insurance and member services, all of which can make a meaningful difference to your retirement outcomes.

Review Your Insurance and Multiple Accounts

Most funds automatically include cover for life, total and permanent disability and income protection. It’s often good value, but it’s rarely tailored. For some, that means paying for cover they don’t need. For others, it means not having enough when it counts.

That’s why it’s worth checking whether the cover is right for your situation, whether the premiums are competitive, and if there are any exclusions that could trip up a claim.

Having multiple accounts can make the problem even bigger. Around a third of all super accounts are unintentional duplicates, costing members $2.6 billion p.a. Consolidating can help, but it’s important to confirm you won’t lose valuable insurance cover in the process.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

It Pays to Stay Engaged

Choosing a super fund isn’t a one-off task. It is an ongoing process that benefits from regular attention. Keeping an eye on fees, checking performance, making sure your investment mix still fits your goals, and ensuring your insurance and account setup aren’t quietly draining your savings can all make a real difference to your retirement balance.

A few hours spent on these checks can be worth hundreds of thousands of dollars over a working life.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.