Why Recontribution Matters More Than You Think

Ankita Rai

Thu 4 Sep 2025 6 minutesSuperannuation is one of the most effective ways to build wealth for retirement, but it doesn’t always pass to your loved ones tax-free.

In fact, adult children and other non-dependents can face a death benefits tax of up to 32% on the taxable portion of an inherited balance. For families with sizable super accounts, that can mean hundreds of thousands of dollars being lost to the ATO in death benefits tax.

Now that employer contributions are set at 12%, the taxable part of many super balances has become even bigger.

But it doesn’t have to be that way. With the right strategies and planning, these taxes can be legally minimised.

The Hidden Sting in Super Balances

Every super balance is divided into two components.

The taxable portion is usually the biggest part. It includes concessional contributions and the earnings on them, such as compulsory employer contributions and salary sacrifice. The government taxes this portion upon inheritance to recoup the initial tax break it provided.

The tax-free portion, on the other hand, comes from non-concessional contributions. These are amounts you’ve already paid tax on, so they pass to beneficiaries without any further tax.

This difference becomes critical when thinking about what happens to super after death. For retirees looking to preserve wealth for the next generation, building the tax-free component is one of the simplest ways to reduce the tax bite.

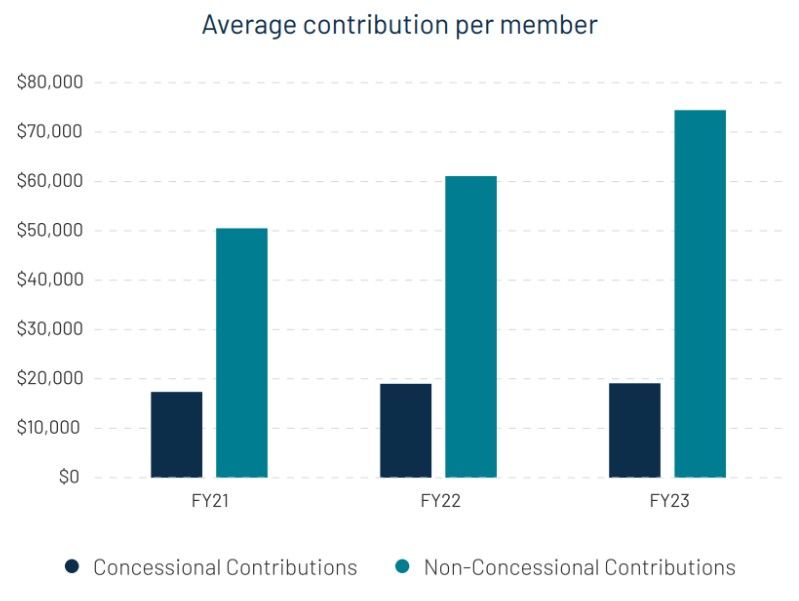

More Australians are acting on it. As the chart below shows, average non-concessional contributions per member have climbed 22% to $74,453.

More than half of these contributions now come from members aged 65 and over, highlighting how older Australians are increasingly using non-concessional contributions as a tactical tool to protect what eventually passes to the next generation.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How Recontribution Reshapes Your Super

While withdrawals after 60 are tax-free for members themselves, the story changes once super is paid out after death. If the beneficiaries are not dependants, the taxable portion can be taxed at 15% for the taxed element and 30% for any untaxed element.

The difference can be dramatic. A $1 million balance, comprising entirely a taxable component, can create a $150,000 liability for financially independent children. The same balance, if it is entirely tax-free, leaves them with the full amount.

That’s where recontribution makes a difference. It involves withdrawing funds from super and contributing them back as non-concessional contributions. The money stays in your account, but its classification changes, and over time, repeated withdrawals and recontributions can steadily shift a significant portion of an account into the tax-free bucket.

The strategy is particularly useful in these situations:

- Estate planning

Super often passes to adult children once both partners have died. While spouses can inherit super tax-free, non-dependents cannot. Using recontribution to increase the tax-free portion can reduce, or even eliminate, the tax they pay.

- Utilising both spouses’ caps

Each partner has their own cap on how much can be moved into the tax-free retirement phase, currently $2 million in 2025–26. Equalising balances between spouses can maximise what a couple can hold there together. Recontribution is one way to do it.

Recontribution can also play a role when couples have an age gap. Because super in the accumulation phase isn’t counted in Centrelink means tests until the owner turns 67, shifting money into a younger spouse’s account can boost the older partner’s entitlements.

- Downsizer contributions

Downsizer contributions add another lever. Selling the family home allows up to $300,000 per spouse to be added to super outside the normal caps. Used alongside recontribution, downsizer contributions can meaningfully increase the tax-free portion of a couple’s superannuation late in life.

- The $3 Million Super Tax

The proposed Division 296 makes strategies like recontribution even more important for high-net-worth individuals. Recontribution won’t eliminate this tax, but it can soften the impact. Keeping balances under the $3 million threshold and shifting more into the tax-free component reduces exposure to both Division 296 and death benefits tax.

The Limits To Be Mindful Of

Like any strategy, recontribution isn’t without its limits. Here are four to be aware of:

1. Eligibility

Age is the first factor. From 60 to 74, it’s possible to withdraw from super and put money back in, so long as a condition of release has been met, such as retiring, leaving a job after turning 60, or reaching 65.

Once you turn 75, you generally can’t make these contributions anymore (downsizer contributions are the exception). Even before then, there are rules about how much you can put back in. Your eligibility depends on your total super balance as at 30 June of the previous year. If it’s above the transfer balance cap — $2 million in 2025–26 — non-concessional contributions aren’t allowed.

2. The mechanics can bring surprises

If your fund has to sell assets to fund the withdrawal, transaction costs or capital gains tax can apply. And while no CGT is payable on withdrawals from the pension phase, it may apply if the money is withdrawn from the accumulation phase. That means recontribution is best done from a pension account, where the withdrawal itself is tax-free and cost-free.

3. Timing matters

For those nearing age 75, the fund can still accept contributions up to 28 days after the end of the month in which the birthday falls. Bring-forward arrangements can also catch people out. If you’ve already triggered one and the three years aren’t finished, you may not be able to recontribute without breaching your cap.

4. Then there’s the human reality

The point of recontribution is to reduce the tax your kids or other non-dependents might pay after you’re gone. But if you end up spending all your super during your lifetime, there’s no death benefits tax to worry about in the first place.

Therefore, recontribution makes sense for people with larger balances who expect they may not spend all their super during their lifetime, or if they simply want to future-proof their situation, avoiding a big tax bill for their kids.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A Simple Strategy with Lasting Impact

Recontribution won’t boost your investment returns or change how much you can take out in retirement. What it does is change the tax setup of your super, so more stays with the family and less goes to the ATO.

For people with larger balances, the savings can really add up. So, if it fits your situation, it makes sense to act sooner rather than later.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.