What the Transfer Balance Cap Hike Means for Your Super Strategy

Ankita Rai

Thu 3 Jul 2025 5 minutesSuperannuation comes with its fair share of limits and thresholds designed to keep tax benefits in check. One of the big ones is the transfer balance cap. From 1st July, it has increased from $1.9 million to $2 million, raising the amount you can move into the tax-free pension phase of your super.

For anyone approaching retirement or planning ahead, this extra room could offer more flexibility and better tax outcomes. But to really make the most of it, it’s worth understanding how the transfer balance cap works.

Understanding the Transfer Balance Cap

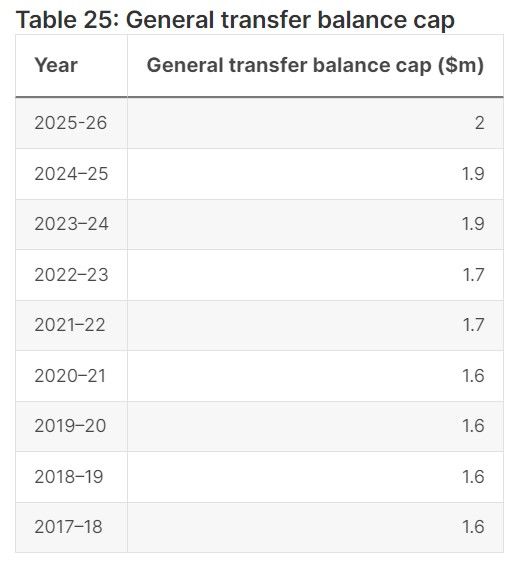

Put simply, the Transfer Balance Cap (TBC) is the limit on how much of your super you can move from accumulation mode into a retirement phase, where investment earnings and withdrawals are tax-free. It’s indexed over time to keep pace with inflation as shown below:

Anything above this cap stays in your accumulation account, where earnings are taxed at up to 15%.

With the general cap increasing from 1st July, investors now have an extra $100,000 of room in the tax-free zone, or $200,000 for couples.

However, it’s important to be aware of your personal transfer balance cap before making any decisions. This is locked in at whatever the general cap is when you start a retirement phase pension for the first time.

So, if you start after 1st July 2025, your personal cap will be set at $2 million.

Once your personal cap is set, it doesn’t automatically rise with future increases to the general cap. However, if you haven’t used all of it, you may qualify for proportional indexation when the cap lifts again.

You can also free up some transfer balance cap by withdrawing a lump sum from your pension, known as a commutation, especially if you’re expecting more super in the future, like a downsizer contribution. Commutations reduce the amount counted against your cap, which could allow you to move more super into the tax-free zone later.

Just remember, no matter how many super or pension accounts you have, you still only get one cap to work with.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Bigger Picture

As the higher cap comes into play, there’s more flexibility, not just for those starting a pension but across the board.

The change has a ripple effect across the broader super system, especially when it comes to making contributions:

1. Non-concessional contributions

More Australians will now be eligible to make their non-concessional (after-tax) contributions, simply because they’ll clear the total super balance test, which is based on the general transfer balance cap.

Under the rules, if your total super balance exceeds the general cap, your non-concessional contributions cap for that financial year drops to zero.

With the general Transfer Balance Cap rising to $2 million, that eligibility threshold has shifted. And for many, it’s created just enough room to top up what they couldn’t before.

2. Spouse contributions and tax offsets

There’s also a knock-on effect for spouse contributions and tax offsets. If your super balance is under the Transfer Balance Cap, your partner can contribute to your super and potentially claim a tax offset.

With the cap rising to $2 million, more couples can now access this strategy to grow their retirement savings together.

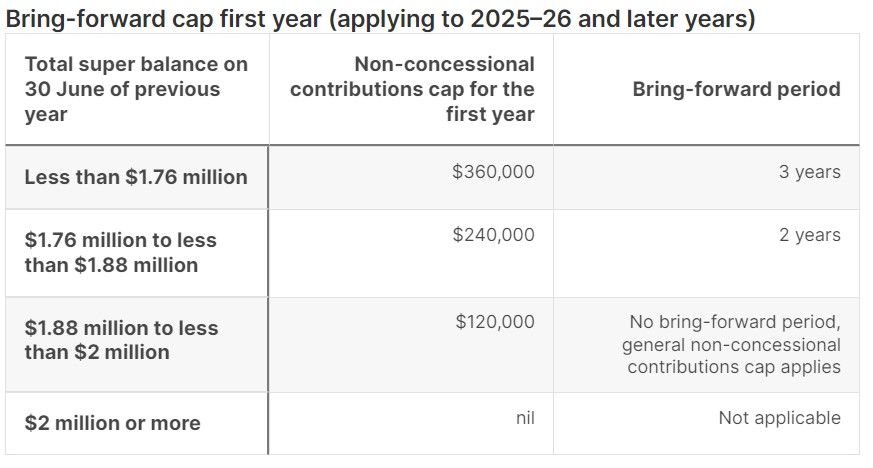

3. Bring-forward contributions

And if you’re under 75, the bring-forward rule might now be back on the table. The higher cap has nudged more people back into eligibility. This is something worth exploring if you've recently had a windfall or are looking to fast-track your contributions.

This rule lets you contribute up to three years’ worth of non-concessional contributions in one go, currently up to $360,000, as shown below:

To use it, your total super balance must be under the general Transfer Balance Cap as of 30th June of the previous financial year. With the cap rising, more people will be able to take advantage of it.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A number worth understanding

The general transfer balance cap is easily one of the trickiest figures in retirement planning, but wrapping your head around it could help you get more into your super.

It doesn’t just limit what you can move into the tax-free pension phase. It shapes your broader super strategy, from contributions and pension planning to how you boost your balance and stretch your spending power.

Getting the strategy right doesn’t just save you tax. It gives you more control over how your super supports you in retirement.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.