End of Financial Year Tips for Investors: What You Need to Know

Ankita Rai

Thu 29 May 2025 6 minutesAs the 2024–25 financial year winds down, June offers a valuable opportunity for Australian investors to review their financial affairs, wrap up their tax strategies, and position their portfolios for the financial year ahead.

Because tax is assessed annually, the timing of when you receive income or realise capital gains can make a meaningful difference to your overall liability. Whether you’re holding shares, property, or managing an SMSF, now is the time to take stock and act on any outstanding issues.

Here are the five main considerations as you prepare for the end of the financial year (EOFY)…

1. Know Your Portfolio

The first step is simple: know what you own. That means more than just checking your trading app. It calls for a proper review of your listed and unlisted holdings, including shares, ETFs, managed funds, and alternative assets.

If you use multiple brokers, share registries can help you consolidate your listed holdings for a portfolio view.

For SMSF investors, this is also the time to check that all fund assets are up to date and valued correctly. The ATO requires everything to be reported at market value, including property, listed securities, managed funds, and private investments.

These valuations feed directly into each member’s total super balance, which determines contribution limits, transfer caps, and access to various strategies.

Bringing it all together into one clear view gives a more accurate picture of a fund’s position at financial year-end and helps inform any decisions that follow.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Understand Your Taxable Position

Next, it’s worth taking a clear look at where you stand tax-wise. Accurate records of income, dividends, and asset sales make all the difference when it comes to planning effectively.

Timing matters. The ATO treats each financial year as a standalone period, which means income and capital gains realised within that window are assessed accordingly.

Take capital gains tax (CGT) as an example. What matters isn’t just how much you made—it’s when the gain was realised. CGT is triggered based on the contract date, not settlement, which determines which financial year it falls into.

Even relatively modest asset sales can trigger CGT, depending on how long the asset was held. If it’s been held for less than 12 months, the full gain is taxed at your marginal rate. After 12 months, you may be eligible for a 50% discount.

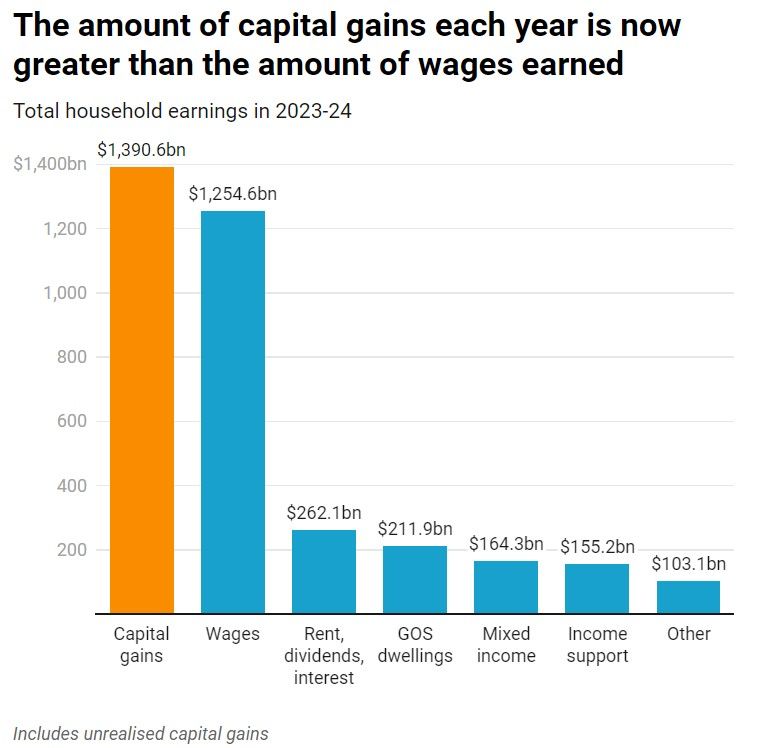

That makes timing crucial, especially in a landscape where capital gains now account for a larger share of household income than wages, according to ABS data.

For investors, it adds weight to the need for careful CGT management, particularly with potential changes to super tax rules on the horizon.

3. Use Capital Losses Strategically

EOFY also presents a narrow but meaningful window for what’s often called tax loss harvesting — the practice of realising capital losses to offset taxable gains.

If you locked in a strong return on one asset earlier in the year but are still holding something that’s underperformed, selling it before 30th June could help reduce your CGT and free up funds for better opportunities.

That said, it’s important not to sell purely for tax reasons. The ATO has strict rules around ‘wash sales’ — where an investor sells an asset at a loss and then quickly buys back the same (or a very similar) asset.

These are considered tax avoidance strategies and can trigger penalties.

4. Maximise Your Super Contributions

Super might not be something you check every day, but EOFY is an ideal time to give it some attention. If you have more than one account, consolidating them can help cut down on duplicated fees and unnecessary insurance premiums that slowly eat into your balance.

It’s also worth reviewing your beneficiary nominations, especially if there’s been a major life change like marriage, divorce, or a new family member.

While you are at it, take a look at how your fund is performing. If your returns have been falling behind similar funds, it might be time to explore other options.

Once the basics are in place, consider whether there's room to make additional contributions such as:

a) Concessional and Non-Concessional Contributions

You can contribute up to $30,000 in pre-tax (concessional) contributions this year. And if your super balance is under $500,000, you may be able to use unused caps from earlier years.

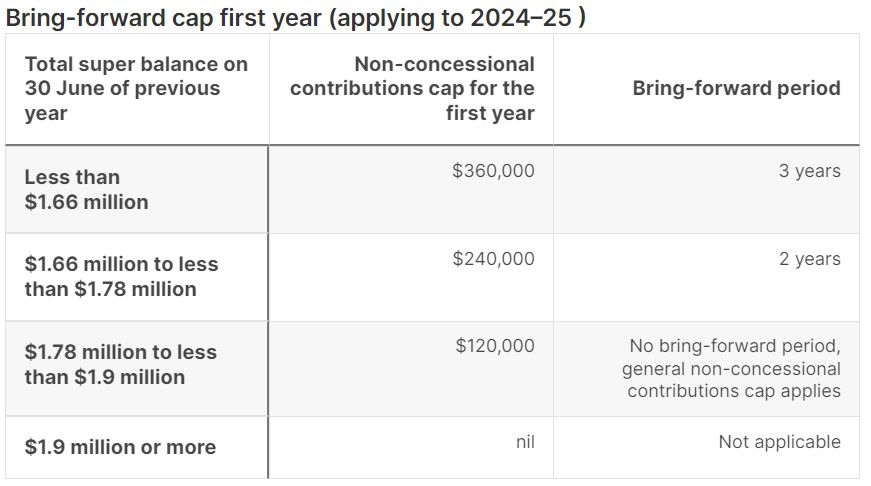

After-tax (non-concessional) contributions are also an option. Depending on your age and balance, you might be able to contribute three times the annual non-concessional contributions cap using the bring-forward rule as shown below:

b) Spouse and Downsizer Contributions

If your partner earns a lower income, making a spouse contribution can help grow their balance and may provide you with a tax offset.

Downsizer contributions are also available to individuals aged 55 and over who are selling their family home. You can contribute up to $300,000 into super, or $600,000 as a couple, without needing to meet work or contribution tests.

c) What’s Coming: The $3 Million Super Tax

From July 2025, super balances over $3 million may face a higher tax rate of 30%. While the changes haven’t been legislated yet, this is a good time to review your asset mix and consider the timing of capital gains. Being proactive now could help you stay ahead of the curve.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. Review Your SMSF

For SMSF trustees, in particular, there are specific obligations that must be met before 30th June. One of the most critical is ensuring that minimum pension payments are made. Missing these can result in a fund losing access to tax concessions on pension-phase earnings.

You will also need to check that all contributions for the year are within allowable caps.

This is also when SMSF audits come into focus. With increased scrutiny, auditors may expect clearer, independent evidence of asset values as at 30th June.

Finally, it’s a good time to revisit your fund’s investment strategy. The ATO expects it to reflect member needs, current market conditions, and fund objectives. If it hasn’t been reviewed in a while—or if your asset mix has drifted—now’s the time to bring it back on track.

Make EOFY Work for You

EOFY isn’t just about tax. It’s a chance to reset your finances and set the tone for the year ahead. It’s a natural checkpoint to review your portfolio, contributions, and overall financial health.

A bit of planning now—whether it’s topping up your super, managing capital gains, or reassessing where your money’s going—can make a real difference.

Use this window wisely.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.