Super Trends Every Investor Should Watch

Ankita Rai

Thu 27 Mar 2025 6 minutesFor most Australians, superannuation is their most important financial asset after the family home—and the primary vehicle for funding their retirement.

The superannuation sector has grown rapidly in both scale and sophistication. As of December 2024, total assets under management reached $4.2 trillion—an 11.5% increase year-on-year—placing Australia among the owners of the largest pension pools globally.

But growth alone doesn’t capture the full picture. It’s also entering a period of structural change. Large funds are consolidating to achieve scale, SMSFs are becoming more sophisticated and tech-enabled, and digital transformation is reshaping how super is managed.

Meanwhile, regulatory and tax frameworks continue to evolve—most notably with the upcoming tax increase for balances over $3 million.

These shifts are redefining how superannuation is invested, administered, and experienced by members.

Whether you're invested through an industry fund or running your own SMSF, here are the key super trends worth being aware of…

1. The Rise of the Megafund

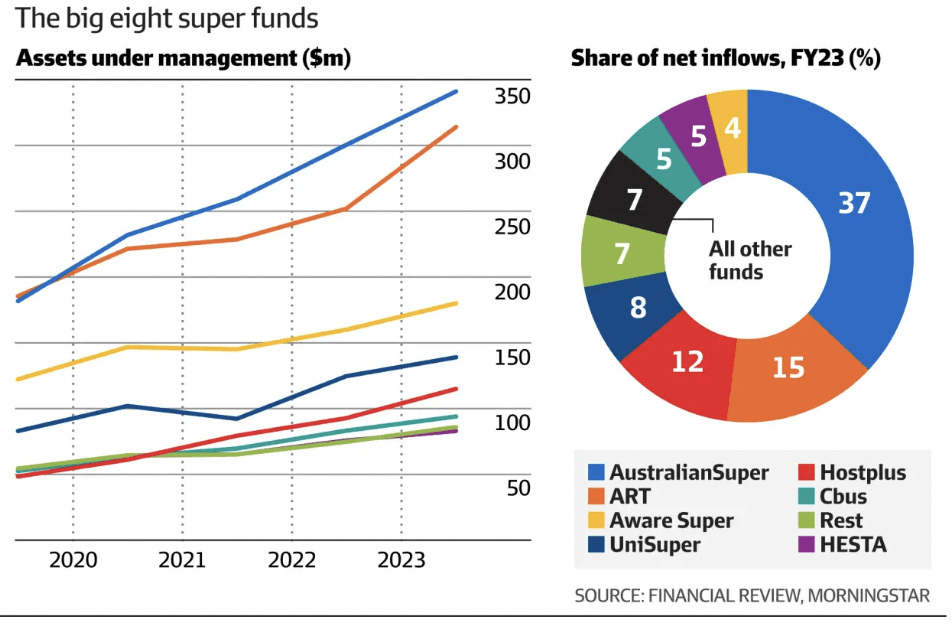

One of the clearest structural shifts in the super industry is consolidation. While assets have ballooned, the number of funds has shrunk dramatically. More than 90% of APRA-regulated funds have either merged or exited over the past two decades—accelerating the rise of megafunds managing over $100 billion.

As a result, eight industry super funds now dominate the landscape, controlling nearly 60% of total assets. The two largest—AustralianSuper and Australian Retirement Trust—manage over $650 billion combined and capture more than half of all new inflows.

The average super fund is now larger, more sophisticated, and better resourced than ever. For investors, this often translates into lower fees, better service, and access to global-scale investment opportunities.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. The Global Allocation Shift

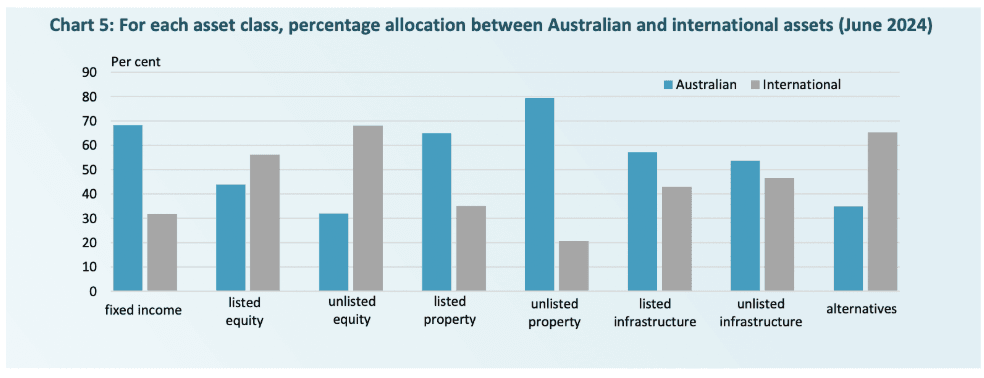

Super funds have traditionally focused on domestic equities and property. But as their size has grown, diversification has become essential—not just to enhance returns, but to manage concentration risk in Australia’s relatively small domestic market.

International equities now make up around 30% of large fund portfolios. This shift isn’t just tactical—it reflects a long-term strategy to access sectors like technology and healthcare, which are underrepresented on the ASX.

In fact, as of June 2024, super funds held higher allocations to international assets across listed equities, unlisted equities, and alternatives, while domestic assets still dominate fixed income, property, and infrastructure.

For investors, global diversification opens the door to broader opportunities—many of which are difficult to access through local markets alone.

3. Private Assets and Infrastructure on the Rise

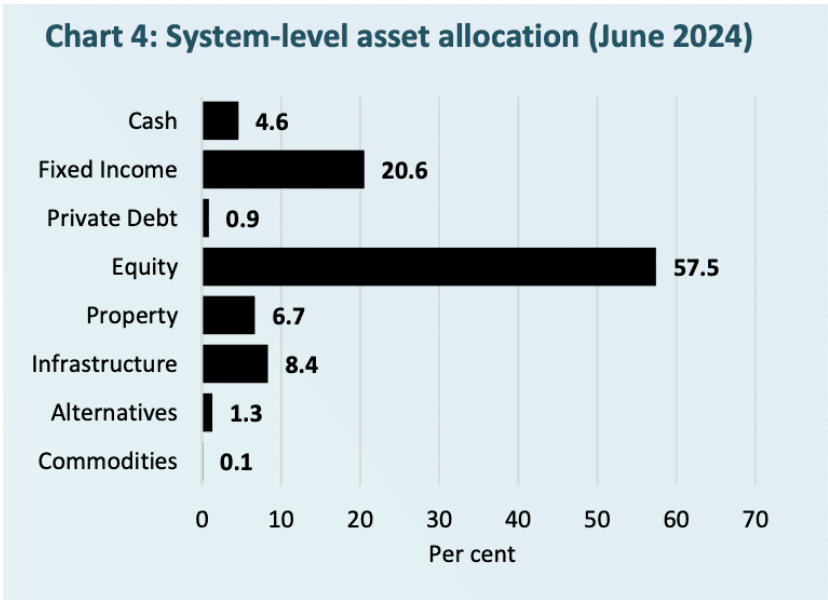

With billions in new super contributions each year, large funds are turning to private markets—particularly infrastructure, private equity, and real estate—to deploy more capital at scale.

Unlisted assets represent a meaningful share of portfolios. Super funds often hold direct stakes in toll roads, airports, and energy networks—investments that offer stability, inflation-linked income, and long-term returns.

While equities remain the dominant asset class (57.5% of total portfolios as shown in the chart below), private investments are gaining ground.

Unlisted assets account for 8% of equity holdings, 62% of property, and 84% of infrastructure—underscoring their appeal for diversification, illiquidity premia, and steady cash flows.

For super members, this translates into exposure to high-quality assets that would otherwise be difficult to access individually.

4. Digital Advice and Personalisation Step Up

Digital transformation is reshaping how super funds engage with members, with a growing focus on advice, personalisation, and accessibility.

Following the Quality of Advice Review, many funds have rolled out digital solutions to help members with investment decisions and retirement income planning.

These tools are often supported by triage models that guide members to the appropriate level of support—ranging from self-directed tools to comprehensive advice services. For example, Hostplus, Insignia, AMP, and CFS have all launched digital advice offerings.

AI-driven automation is also helping reduce error rates and streamline transactions, with most interactions now handled digitally.

As portfolios become more complex, robust digital infrastructure will be essential to scaling advice and improving long-term retirement outcomes.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. SMSFs Evolve with Tech and Outsourcing

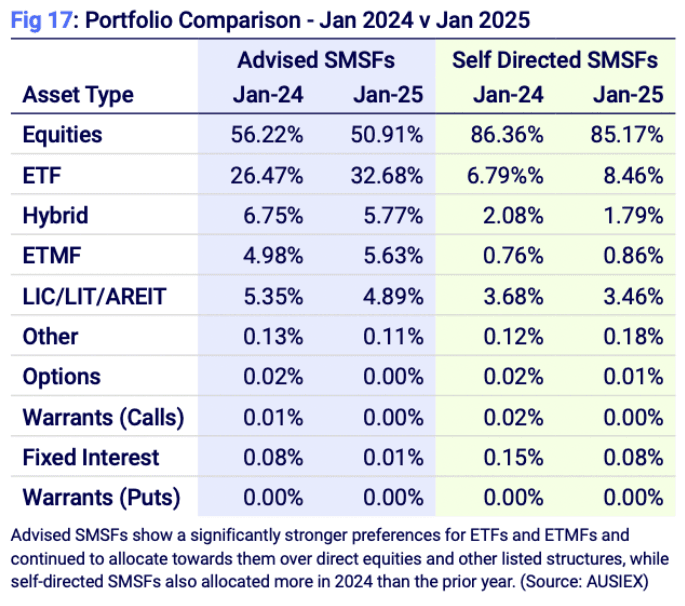

SMSFs collectively manage over $1 trillion in assets, with growth fuelled by smarter tools, professional support, and more proactive decision-making.

Outsourcing has become a popular strategy, as many trustees turn to full-service administration to simplify operations and cut costs—often saving 30–40% compared to managing everything in-house.

Technology is central to this shift. Platforms like CLASS and BGL have streamlined administration by integrating AI, automating compliance, and enhancing audit workflows. These efficiencies are making SMSFs more accessible—even for those who might not have considered going self-managed before.

On the investment front, strategies are becoming more diversified and forward-looking. Global equities, ESG-aligned options, and even crypto are gaining traction among SMSF investors.

ETFs are a key driver of that trend. According to AUSIEX, ETFs now account for nearly a third (32.7%) of advised SMSF portfolios—up from just over a quarter a year ago.

6. Regulatory Pressure and the 2025 Tax Shift

No conversation about super is complete without considering regulatory developments. One of the biggest upcoming changes is the increase in tax on earnings from 15% to 30% for super balances above $3 million, set to take effect in July 2025.

While this affects a relatively small portion of members, the impact will be most felt by high-balance SMSFs—especially those holding direct property or other illiquid assets, where managing tax obligations can be more complex.

The change is already prompting strategic reviews and rebalancing. It’s a clear sign that regulation is not just a compliance matter—it’s a key driver of investment structure, tax planning, and long-term wealth strategy.

A System in Transformation

Australia’s $4.2 trillion super system is evolving fast. Structural consolidation, digital innovation, shifting investment strategies, and policy reforms are changing how funds operate—and how investors need to respond.

Whether you’re a member of a large super fund or running your own SMSF, staying engaged isn’t optional—it’s essential.

With smarter tools, lower costs, and more tailored support, investors have more power than ever to shape their retirement outcomes.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.