A Shortcut to Make More Money While You Sleep

Simon Turner

Mon 31 Mar 2025 7 minutesMost investors’ picture of financial independence involves streams of money flowing their way without any effort on their parts. It’s this lack of effort, this ability to make money while we sleep, that allows us to do all the things we’ve always dreamt of—like travelling or sipping cocktails at the beach.

Buffet concurs: ‘If you don't find a way to make money while you sleep, you will work until you die.’

Whilst making money while you sleep makes intuitive sense to most investors, it can be a challenging goal to achieve amidst the ups and downs of markets—and life.

The good news is that with the right strategy in place there’s a powerful shortcut which can help you accelerate your passive income growth…

How to Make Money while you Sleep

Let’s delve straight in. There are four main steps to making money while you sleep…

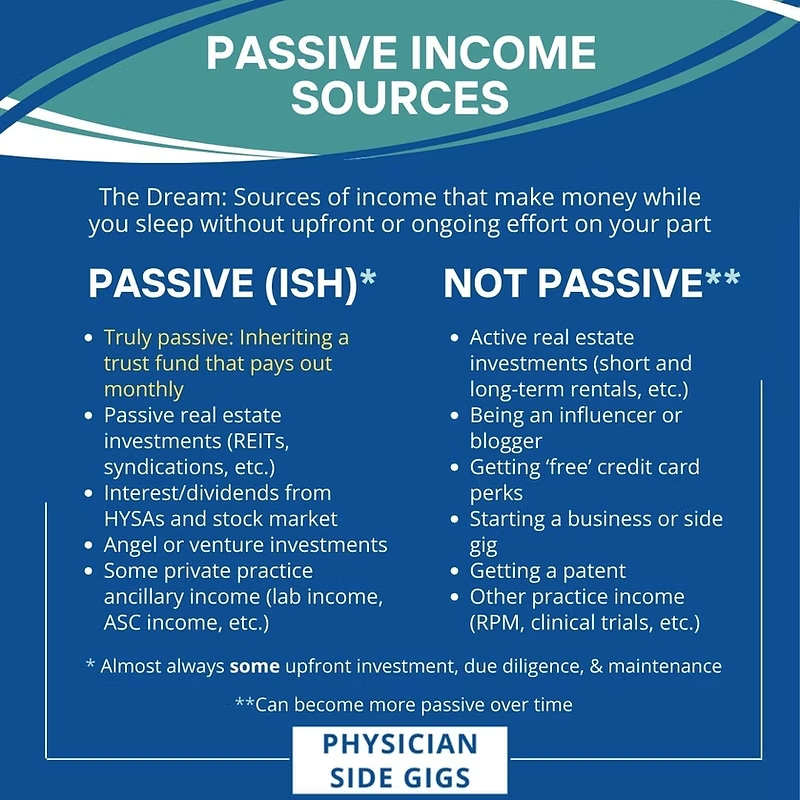

1. Understand what passive income is & what it isn’t

Firstly, understanding what passive income is and isn’t will allow you to focus on the right sort of income, the type that genuinely flows in your direction while you’re sleeping.

So what is passive income?

It’s essentially income that’s paid to investors without any work or effort on their part. It’s income such as dividend and interest payments which investors are paid because they own shares or bonds.

And what isn’t it?

Passive income isn’t income which requires active management like running a business or managing a portfolio of investment properties.

The great attraction of truly passive income is that it allows investors to become financially free, and thus to choose how much they work.

2. Accept that passive income takes hard work to create & create your goal

Next, there’s a hard truth to accept about passive income: creating enough of it to make a difference to your quality of life takes serious hard work and a long-term timeframe. Before you’ve done those hard yards, you aren’t quite ready to sunbathe at the beach on a daily basis.

Start with your goal. As with all financial goal setting, it’s important to decide how much passive income you want to generate and by when. Your goal should be as specific as possible. For example, you may have a 5-year goal of creating enough passive income to pay for your holidays and your children’s school fees.

3. Decide on the types of passive income that align with your risk profile and investment goals

As with all asset allocation decisions, you’ll need to consider your risk profile and broader investment goals to ensure you’re investing in the right places while you build your passive income streams.

In general, there are a few main asset classes which tick most investors’ passive income boxes…

- Dividend stocks, income-focused managed funds & income-focused ETFs

Dividend stocks have long been a go-to asset class for passive-income-focused investors. It makes sense. By identifying a growing business which pays regular dividends to its shareholders, investors can create organically growing streams of passive income which have no end date.

That’s worth thinking about for a moment.

By purchasing the right dividend-paying stocks, and income-focused managed funds and ETFs, investors can gain access to passive income which could continue to grow over the long term.

In addition, equity income is generally protected against the wealth eroding impacts of inflation since companies are often able to pass their rising costs onto their customers.

Franking is also worth bearing in mind since companies paying fully franked income are enabling their investors to generate tax efficient income.

Then there’s the potential capital growth. As a company’s dividend payments rise, its stock price also tends to rise to maintain a similar yield.

So successful dividend investors not only benefit from growing streams of passive income, they are also well-positioned to generate some capital growth as their dividends rise.

In the words of Taylor Kovar, CEO of The Money Couple: ‘Investing is the ultimate game of patience, and “forever assets” like dividend-paying stocks can truly allow you to make money while you sleep. Companies like Procter & Gamble or Johnson & Johnson, with a solid history of paying dividends for decades, are examples of such assets. With their consistent and growing dividends, they can provide a steady stream of passive income. Historically, these stocks have offered investors solid returns, with both firms averaging around a 10% to 12% annual return over the past 30 years.’

- Property

Property is another go-to asset class for investors aiming to grow their passive income.

Having said that, it’s important to understand that directly owning and managing a portfolio of investment properties is not passive income. This requires consistent work from investors and should be regarded as active income.

However, investors can still use property to build their passive income streams by investing in REITs and unlisted property funds. Both types of funds are managed by professionals with the requisite expertise, and pool investors’ funds to invest in a single asset or a portfolio of properties.

Long-term investors can sit back and relax as their property fund dividends arrive each year. In general, income from property trusts is unfranked so tax will be payable.

Fixed income funds and ETFs are also a part of most investors’ passive-income-generating arsenals.

Fixed income funds are pooled investment vehicles that allow investors to access to a diversified portfolio of fixed income instruments managed by professionals with specialist expertise. These funds aim to outperform their benchmarks through active portfolio management.

Fixed income ETFs are exchange-traded funds that provide investors with exposure to a diversified portfolio of bonds reflecting the constituents of an underlying index or benchmark. These passive funds aim to perform in line with their benchmark.

The benefits of investing in fixed income funds and ETFs are ease of access and diversification. In the case of managed funds, access to specialist expertise is an important advantage, while in the case of ETFs, low management fees are a key benefit.

4. Leverage the power of the eighth wonder of the world

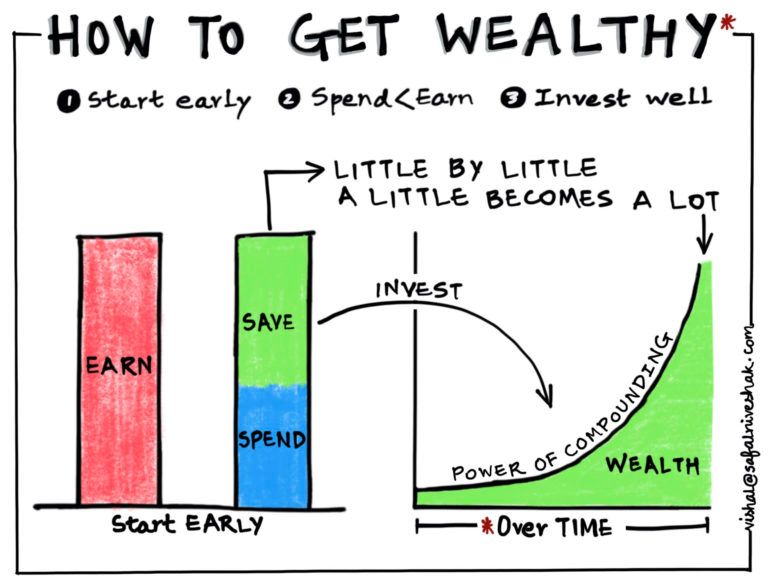

As per Einstein’s famous quote, compounding should be regarded by investors as the eighth wonder of the world. It’s also the powerful shortcut which passive income builders can call upon to increase their passive income streams as fast as possible.

In short, if investors reinvest a portion of their passive income in additional passive income generating opportunities each year, they are positioning themselves to benefit from compounding over the long term.

If you utilise this shortcut, think about the external factors at play driving your passive income growth: a. Your dividends are likely to be rising each year; b. In most market conditions (but not all), you’re likely to be generating some capital gains most years; c. Each year you reinvest, you’re adding to your streams of growing dividends and capital gains.

Whilst the benefits of compounding in this way may not be obvious over short periods of time, once you’ve been following this strategy for 10+ years, the benefits become extraordinary.

Investors should be aware that this strategy depends upon remaining invested and following your long-term investment plan through to its conclusion. In other words, this strategy is only for investors who are able to remain invested and keep reinvesting through the market’s ups and downs.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Passive income creates its own opportunities over time

Focusing on building your passive income streams should be a core part of most investors’ long-term investment plans. The beauty of this strategy is that as your passive income grows, you’re able to utilise the greatest of investment shortcuts, compounding, more and more. It truly is the eighth wonder of the world.

Funds positioned to benefit

ETFs positioned to benefit

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.