Stop Being a Slave to Money: 10 Steps to Financial Independence

Simon Turner

Mon 3 Mar 2025 7 minutesMost investors dream of achieving financial independence. The prospect of controlling your own time, being free to live life on your terms, and reclaiming money’s control over your life are powerful incentives.

However, achieving financial independence isn’t generally achievable in the short term. It’s a big goal which requires long term planning, commitment, and focus. It also depends upon having a positive mind-set, and the emotional control needed to execute a long term plan regardless of market volatility.

For most of us, the benefits of financial independence are worth the effort—and the best day to get started with this journey is today…

Why financial freedom is the ultimate financial goal

Richard Ashcroft perfectly summarises the importance of financial freedom in Bitter Sweet Symphony: ‘Tryna make ends meet, you're a slave to money then you die.’

The truth is most of us work to live rather than live to work. We’re slaves to a financial system which keeps us plugging away year in, year out.

That’s why financial independence is the big carrot so many of us dream of. Margaret Bonnano concurs: ‘Being rich is having money; being wealthy is having time.’

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

10 Steps to Financial Freedom

It’s time to walk through the 10 steps that can help you achieve financial freedom.

Warning: these steps are simple but hard. They require constant focus and attention.

1. Prepare Your Mind-set for Change

If you’ve been trying to achieve financial freedom without success, it’s time to be honest with yourself: it’s time to change.

In the words of Robert Kiyosaki: ‘If you want to be financially free, you need to become a different person than you are today and let go of whatever has held you back in the past.’

2. Educate Yourself

Do you enjoy eating humble pie? It’s time to accept that you don’t know everything.

Once you understand this, there’s a vast world of financial education you can use to accelerate your journey toward financial independence.

As soon as you become a knowledge seeker, you’ll open yourself up to the growth needed to help achieve your goals.

Knowledge is also a powerful defence against financial fraudsters who prey on unsophisticated investors.

3. Assess Your Current Financial Situation

To begin your journey toward financial freedom, you’ll need to know where you are today.

That means being honest about your assets and liabilities, and your income and expenses.

Knowing your current net worth and net income will enable you to track your progress towards your goals.

4. Set Specific Goals & Milestones

For most of us financial freedom is a lovely idea which probably conjures up images of lying at the beach.

However, few investors achieve general goals. The more specific your goals, the higher the likelihood of achieving them.

That brings us to the all-important question: what does financial freedom mean to you?

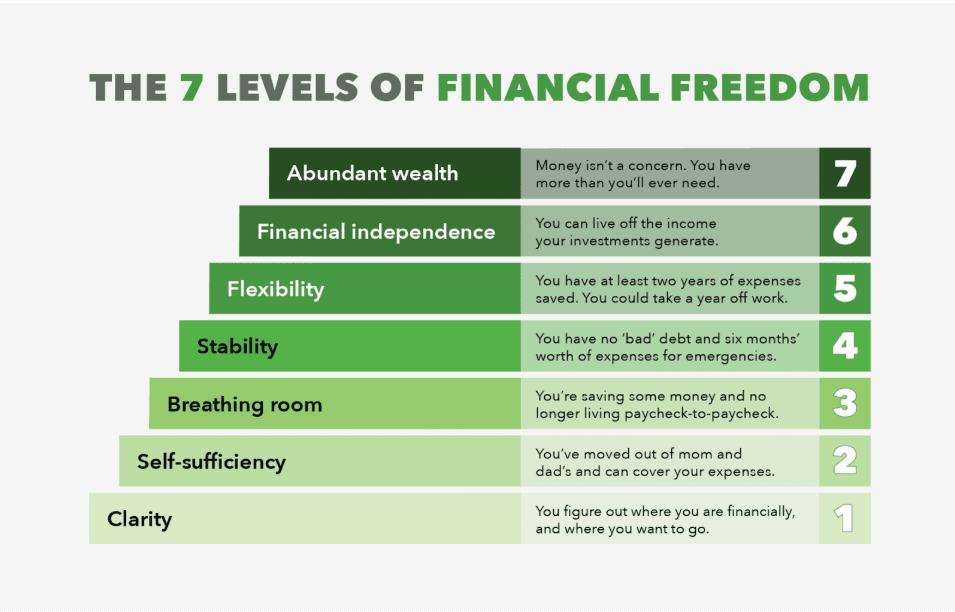

By way of example, here are the most common seven levels of financial freedom with ‘Abundant wealth’ being the end goal most investors are aiming for…

Write down your specific financial freedom goals along with the age you’ll be when you achieve them.

Then work backwards to create milestones en route to your longer term goals.

Important tip: make sure you celebrate these milestones when you reach them.

5. Align & Integrate Your Career Goals

Financial freedom is as much a mind-set as it is a financial state.

In other words, your financial health is inextricably connected with all other parts of your life, including your career.

As a result, it’s important to align and integrate your career goals into your financial freedom plan.

In the short term that may mean working harder. In the words of Manoj Arora: ‘To achieve what 1% of the world's population has (financial freedom), you must be willing to do what only 1% dare to do ... hard work and perseverance of the highest order.’

But over the longer term, the most common career goal consistent with financial freedom is following your passions. In the words of Jen Sincero: ‘Believe that you are worthy of financial freedom. Do something you love and then all you ever have to do is be yourself to succeed.'

6. Create & Stick to a Budget

The next step is budget setting. Many investors find this step tedious, but it’s an essential part of reaching financial independence.

Grant Sabatier explains why: ‘Whenever we spend money instead of investing it, we are actually taking from ourselves—we are taking both the time we spend to make the money and the future freedom it can buy.’

So sticking with a budget and living frugally is a powerful means of ensuring your bills are paid while you’re still saving and investing.

7. Pay off Credit Cards & Consumer Loans

Credit cards and consumer loans are the antithesis of financial freedom and can only delay the achievement of your goals.

In short, avoid them like the plague. And if you have any outstanding consumer debt, pay it off ASAP.

8. Build an Emergency Fund

Most behavioural research shows that having an adequate emergency fund significantly improves investors’ financial health. In fact, many investors find it easier to achieve financial freedom once they’ve established the safety net an emergency fund provides.

So an emergency fund is an essential part of financial freedom and should be prioritised in your plan. Consider automating your savings to ensure you achieve this goal sooner rather than later.

While the target amount is different for everyone, most investors aim to have an emergency fund which covers 3-6 months+ of their living expenses.

9. Invest Wisely

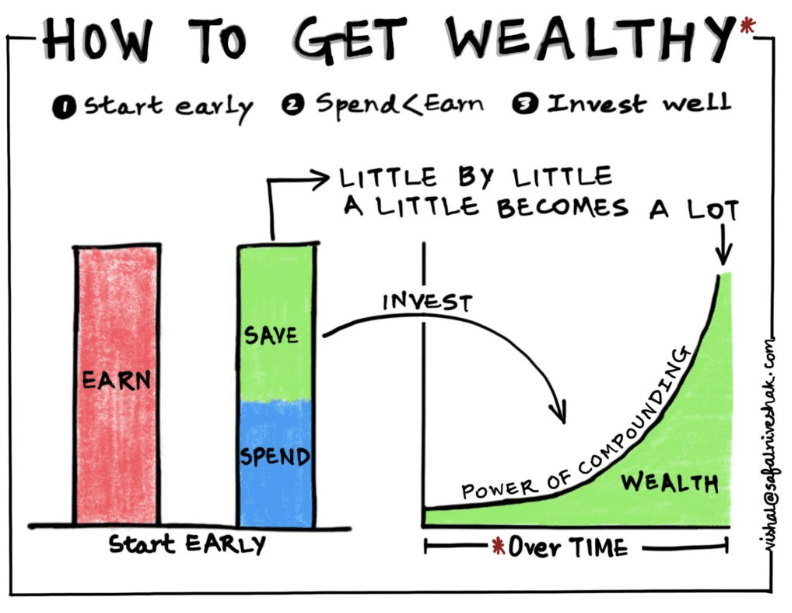

Of course, investing is a core part of the financial independence journey.

In the words of Robert Kiyosaki: ‘The key to financial freedom and great wealth is a person’s ability to convert earned income into passive and/or portfolio income.’

Once you can rely upon your passive portfolio income, you can reinvest a portion of your income each year to achieve even greater wealth and cash flow.

This is where compounding enters the picture as a powerful force for good. Compounding depends upon regular investing and holding for the long term. Also, the earlier you start, the better.

Many investors reach the conclusion that investing in ETFs and funds is the easiest, least stressful long term investment strategy with which to compound their returns. These investment products enable investors to step toward their financial independence goals without the time and worry required by successful stock investing.

10. Rinse and Repeat Powered by a Positive Mind-set

Here’s the hardest part of this plan: you need to keep going every year.

It’s almost impossible to keep going unless you maintain a positive mind-set and a deep-held belief in your plan.

Suze Orman offers some inspiring guidance on that front: ‘Remember to remember your power—everything you've learned with these steps to financial freedom—and put it all into practice every day, because in the grand scheme of life, you'll never really know how things are meant to turn out until they turn out.’

Financial Independence is an Achievable Goal

The good news is achieving financial independence is within all of our reaches. All you need is the right plan, a positive mind-set, and consistent action over the long term.

The bad news is it’s a long hard slog with plenty of ups and downs along the way.

If financial independence is indeed a goal of yours, get started today to ensure you’re not a slave to money when you’re older.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.