Private Credit in the Ascendancy

Simon Turner

Wed 5 Mar 2025 4 minutesThere aren’t many asset classes which have grown as consistently as private credit in recent years. More and more investors are allocating a portion of their fixed income capital to this fast growing asset class. For good reason. The solid risk-adjusted returns available in private credit provide welcome stability and predictability to investors’ portfolios.

If you’ve not got private credit exposure, it’s worth investigating the opportunities on offer…

A Maturing Asset Class

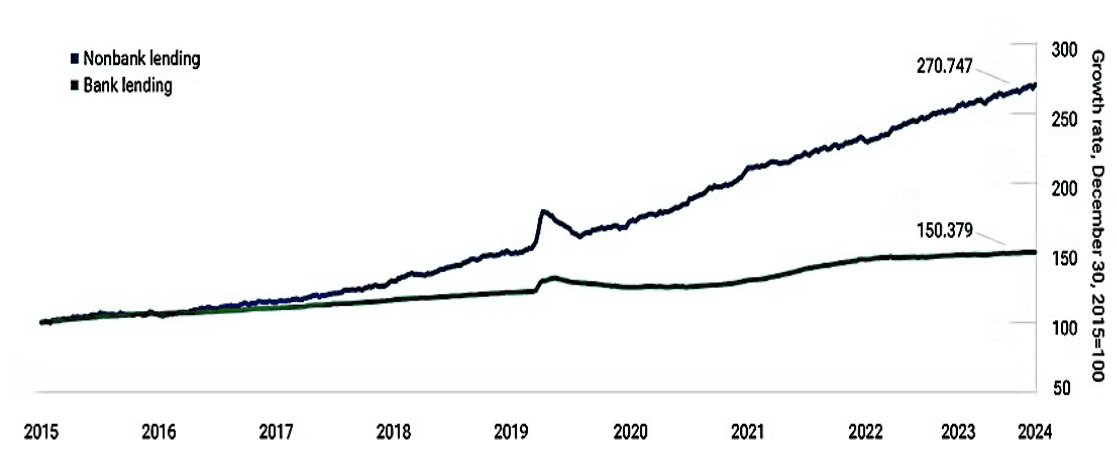

Private credit assets under management have been growing rapidly in recent years, primarily due to rising base rates which make private credit returns more attractive.

2024 was another strong year for the asset class with global inflows of $US209 billion, up 5% versus 2023.

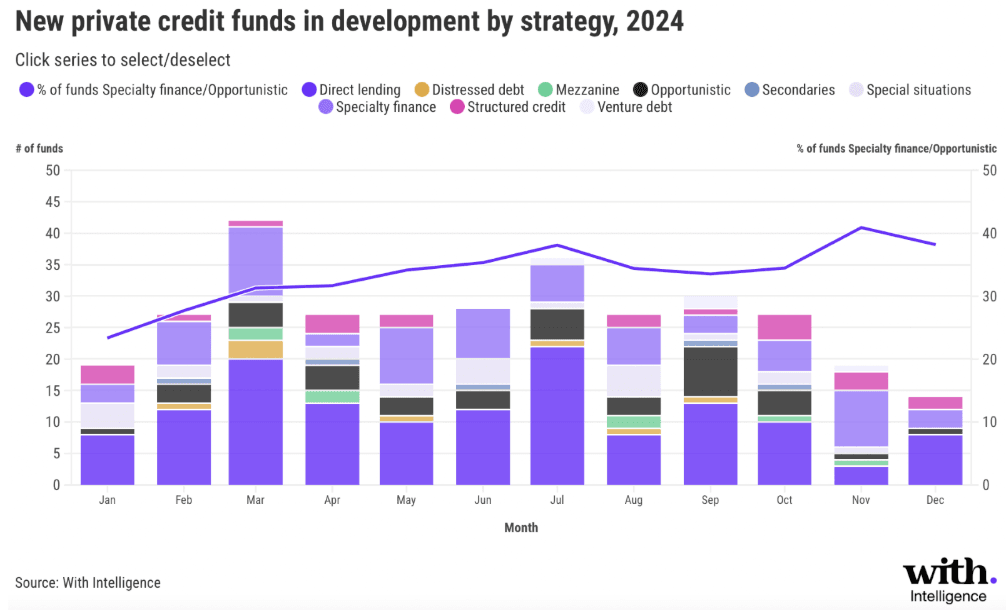

Whilst direct lending dominated as per usual, specialty credit and opportunistic credit strategies accounted for over a third of the year’s new private credit fund launches—as shown below.

It’s a similar story in the local market. Having grown from $35 billion assets under management in 2018 to $188 billion in 2023, it’s fair to say the Australian private credit market has matured into a mainstream asset class which most investors are aware of, and many are exposed to.

As a maturing asset class, there’s a diverse range of private credit opportunities on offer. Not all are created equal, but most are benefitting from rising investor interest.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Structural Growth Drivers at Play

It’s obvious why investors are investing more into private credit funds: to gain access to the attractive risk-adjusted returns on offer without being exposed to the volatility that’s increasingly prevalent in global bond markets.

What’s less understood is why so many borrowers are attracted to private credit.

There are a couple of noteworthy trends on that front.

Firstly, private equity firms are increasingly turning to private credit for funding due to the greater certainty and speed compared to traditional banks.

Secondly, the concept of ‘special situations’ lending is on the rise, whereby private credit is increasingly providing the unique funding needs that traditional banks may find challenging to assess. This allows private credit investors to generate potentially higher returns when proper due diligence is conducted.

Both trends are here to stay, which suggests the sector’s outlook remains bright.

Key Investor Takeaways

Private credit is now a mainstream part of Australia’s fixed income markets. More investors are likely to invest in it as part of their fixed income asset allocation.

Private credit is about generating attractive risk-adjusted returns, but not all opportunities are created equal. Investors need to understand the different sectors and risk profiles involved. For example, senior debt carries lower risk than subordinated loans. A business borrowing at high rates via subordinated loans may actually reflect equity-like characteristics.

Private credit investors are becoming more sophisticated about their exposure to the sector, leading to allocation shifts toward the most attractive risk-adjusted returns on offer.

Investing with a private credit fund manager with a successful long term track record is the optimal strategy for most investors to gain access to this fast growing asset class.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A Staple Asset Class with a Growing Role to Play

The outlook for private credit remains bright as it matures and becomes increasingly mainstream. Its growth drivers are firmly in place for 2025 and beyond.

Investing with a high quality, experienced private credit fund provides investors with the opportunity to optimise their risk-adjusted returns in this increasingly sophisticated asset class.

Private Credit Funds Positioned to Benefit

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.