Navigating Turbulent Times: A Bond Investor's Perspective

Tim Lea

Fri 28 Feb 2025 6 minutesMultifaceted geopolitical and economic tensions threaten to disrupt the delicate balance of the world order. Economic forecasts, once predictable, now fluctuate like erratic cyclonic winds. The threats of recession are delicately balanced with interest rate policies that continue to reduce inflation. The threat of tariffs, like an unexpected frost, is decimating established supply chains, creating trade wars. The slowing growth of China casts a long shadow over commodity prices, easing our local markets into the shade. Finally, we have The Trump Effect, whereby long-held economic and geopolitical policies are being upended to create a new world disorder.

Altogether, there is a deep sense of unease amongst investors. It’s a stark warning that we may be facing significant and unpredictable headwinds in 2025. Hence, many investors want predictability and investment safe havens that provide protection from future storms.

As Gold lives up to its safe haven role, getting ever closer to its recent all-time high, is it time to consider another traditional safe harbour: Bonds?

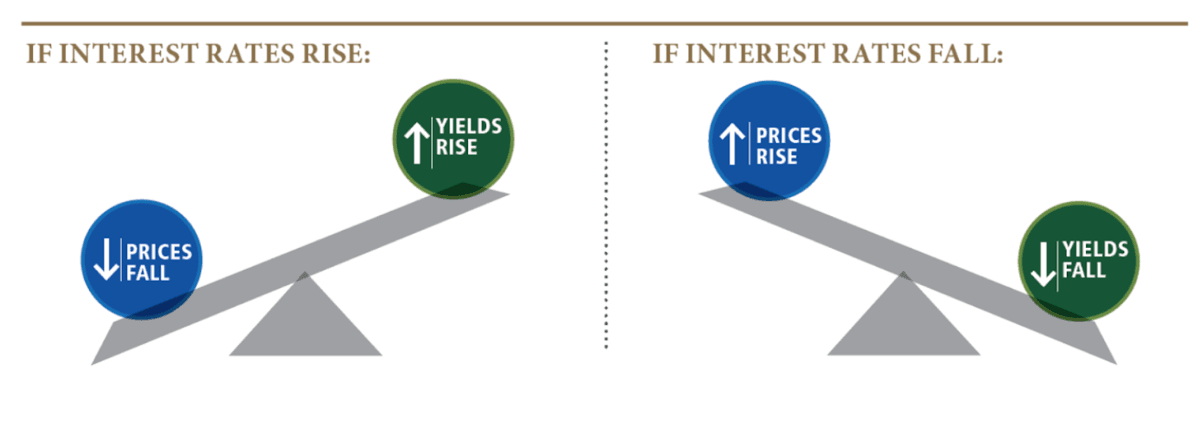

Bonds have long been considered defensive assets. Investors harness their power through the predictable stream of interest income while all around is in turmoil. However, while interest payments may remain consistent, the pricing of bonds can become volatile.

The Significant Drivers of Bond Prices

There are four key forces driving bond prices:

1. Changes in central bank interest rates: These rates influence borrowing costs for all, which in turn affects economic growth and inflation. Increased rates mean bond prices typically fall.

2. Inflation expectations: Higher inflation erodes the real returns of bonds, making them less attractive to investors. Increased inflation expectations typically see bond prices fall.

3. Economic growth: Strong economic growth can lead to higher inflation and increased demand for credit driving up pressure for increased interest rates, putting downward pressure on bond prices. Weak economic growth increases demand for safe-haven assets like bonds, typically pushing up bond prices.

4. Geopolitical risks: An uncertain geopolitical outlook can lead investors to seek safe-haven assets such as bonds, driving up bond prices.

Within Australia, local bond prices are also sensitive to:

1. RBA policy rates: The RBA’s cash rate directly impacts bond yields and prices.

2. Australian economic data: Economic data can lead to expectations of inflation and interest rates, influencing bond prices.

3. Global economic conditions: As a small, open economy, Australia is heavily influenced by global economic conditions, especially in China, which is currently facing deep economic challenges. These forces influence the RBAs’ interest rate policy and the country’s economic growth.

4. Investor sentiment: Changes in investor sentiment towards Australia or the global economy can also affect demand for Australian bonds.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Experts' Views on the State of the Global Bond Markets

The current geopolitical and economic uncertainty makes it challenging to predict how bond prices will perform this year, so let’s call in some global experts for help.

Mohamed El-Eria is my go-to person for opinion on global markets. El-Erian is the chief economist at Allianz, and is a seasoned commentator who is called upon frequently for media soundbites. In his 2025 Economic Outlook Video he felt the US economy is experiencing a "no-landing" scenario, with robust growth and persistent inflation. This presents challenges for the Federal Reserve, which is unlikely to achieve its 2% inflation target in the near future. El-Erian suggests that a higher inflation target of 2.5% to 3% would be more appropriate in the current economic environment, although he acknowledges that the Fed may be hesitant to explicitly change its target due to past misses.

If El-Eria’s opinions are vindicated, the dynamic over interest rates will create even bigger rifts between Trump and the “independent” Federal Open Market Committee (FOMC or “the Fed”), which sets interest rate policy. Trump has openly stated he wants reduced interest rates, but the FOMC doesn’t concur given last month’s inflation uptick. If Trump railroads his agenda as he is prone to do - markets are likely to react quickly and decisively.

As for European markets, John Taylor, Head of European Fixed Income at AllianceBernstein, acknowledged in a recent article the challenges facing European bond markets. He believes many European nations are struggling to generate meaningful post-pandemic growth, “and an external shock could push the region into recession”. While remaining cautious, he feels strongly that markets will be highly sensitive to political and economic news—and particularly to any breaking news on US tariff proposals.

As for Australia, we have some positive short and medium-term tailwinds. HSBC’s Andrew Duncan highlights Australia “is drawing attention from international credit investors like never before.” Rising demand for Australia’s debt coincides with a backdrop of solid economic fundamentals, with annual economic growth expected to be amongst the strongest in the G-20 (2.3% in 2025, according to Moody’s Senior Analyst Saranga Ranashinghe).

Bonds have a role to play in an uncertain world

With the current global economic and geopolitical landscape, it’s worth expecting the unexpected.

With Europe precariously balanced, an external shock could bring about recession. And the fireworks that are likely to pan out between the Fed and the Trump administration will likely lead to bond market volatility, especially if any explosive news occurs.

For more aggressive investors, this could be an ideal time to hold some cash with which to seize upon short-term bond market opportunities as they appear.

For longer-term investors, it leaves us with Australia as the silent, probable bond market winner in 2025, given the longer-term tailwinds and the tyranny of distance from the major sources of geopolitical tensions.

Bond funds and ETFs are the easiest, most accessible way for most investors to gain access to this opportunity.

Funds & ETFs positioned to benefit

Disclaimer: This article is prepared by Tim Lea. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.