Dos and Don'ts of Investing an Inheritance

Ankita Rai

Thu 27 Feb 2025 5 minutesHave you recently inherited wealth—or expect to? If so, you’re probably wondering: what’s the smartest way to use this money?

An inheritance can be a game-changer for your financial future. It has the potential to create long-term security, grow your wealth, and even provide for future generations. But without a clear strategy, it can disappear faster than expected.

Studies show that 70% of intergenerational wealth transfers fail—not because of bad luck, but because of rushed decisions, emotional spending, and poor planning.

Most people think receiving an inheritance will automatically improve their financial situation. But what really determines the resulting financial success is how you manage it.

How Australians spend their inheritance

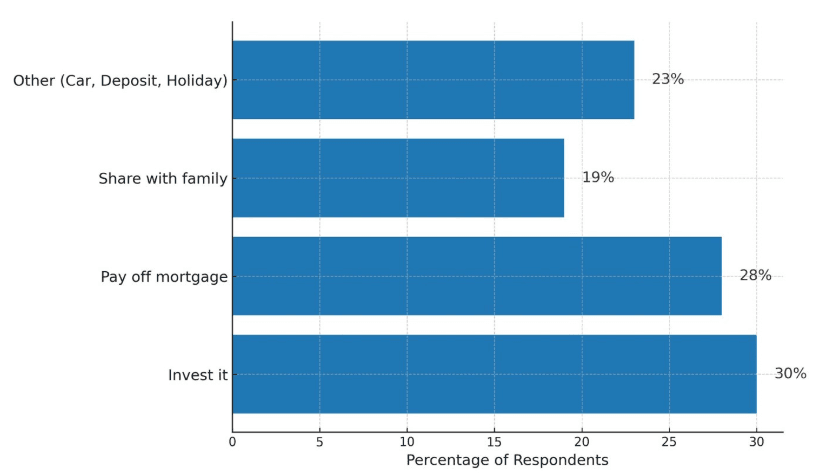

A Perpetual survey found that 30% of beneficiaries invest their inheritance, 28% pay off a mortgage, and 19% share it with family. Others use it to buy a car, place it in a term deposit, or take a holiday.

There’s no single right way to use an inheritance. The key is aligning it with your long-term financial goals rather than making quick, emotional decisions.

For some, this means investing for future growth. For others, it might mean paying off debt, building an emergency fund, or securing their children’s future. Whatever your situation, taking time to assess your age, risk tolerance, and overall financial position will help you make the best decision.

Where should your inheritance go?

Once you’ve taken the time to understand your inheritance, the next step is figuring out how to incorporate it into your financial strategy. Simply merging it into your portfolio without a plan could throw off your asset allocation, introduce unnecessary risks, or lead to unexpected tax liabilities.

Here are four considerations which may help…

1. Investing in Superannuation

Since 80% of inherited wealth goes to people over 50, many beneficiaries are already approaching or in retirement. If this applies to you, contributing to superannuation can be a tax-effective way to build long-term wealth.

This approach offers several advantages, including lower concessional tax rates on earnings and contributions, as well as tax-free withdrawals after age 60.

However, understanding the contribution rules is essential, as there are limits to how much you can contribute, and this also depends on your existing super balance.

2. Asset allocation: Does your inheritance fit your portfolio?

Inherited assets were chosen based on someone else’s financial goals, which may not align with your own. For example, you might inherit stocks in industries you typically avoid or a portfolio that disrupts your investment strategy.

If your inheritance doesn’t fit your existing plan, consider reallocating assets to match your financial objectives, gradually selling assets to manage capital gains tax, and using the proceeds for other financial goals, such as reducing debt or reinvesting in diversified holdings.

An inheritance can shift your portfolio’s risk profile, so taking the time to rebalance it ensures that it works for you, not against you.

3. Diversification: Spreading risk and maximising returns

Inheriting a portfolio heavily concentrated in a single asset class—such as Australian shares or real estate—can leave you overexposed to market risks. If your inheritance significantly alters your investment mix, it may be time to rebalance and diversify.

With more capital, you may now have access to alternative investments, such as private equity, hedge funds, or commercial real estate. While these assets offer higher return potential, they also carry greater complexity, risk, and lower liquidity.

A well-diversified investment mix, tailored to your financial goals, can help maximise returns while managing risk.

4. Tax implications

Beyond cash, most inherited assets—such as shares and property—come with tax implications, depending on when they were originally acquired and when they are sold.

Australia does not have an inheritance tax, but capital gains tax applies when you sell inherited assets. Changes in your financial position may also affect your tax obligations, especially if your inheritance generates income, dividends, or rental returns.

Tax planning can help reduce liabilities and structure your assets efficiently, so it’s worth speaking to a financial or tax adviser.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What not to do with an inheritance

An inheritance can provide long-term stability, but poor decisions can deplete it quickly.

Avoiding these common mistakes will help ensure it supports your financial well-being…

1. Spending without a plan

It’s tempting to see an inheritance as ‘extra money’ and splurge on a new car, luxury holiday, or home upgrade. While these purchases may bring short-term satisfaction, they don’t contribute to lasting financial security.

2. Ignoring debt and taxes

Before making financial moves, assess existing debts like credit cards or a mortgage. Paying off high-interest loans can improve cash flow and create room for future investments

Setting aside funds for unexpected expenses and consulting a tax professional can help avoid financial strain down the road.

3. Making uninformed investment decisions

Rushing into investments can be risky. Avoid speculative choices and overconcentration in a single asset class. A diversified approach can better align with long-term financial goals.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Building lasting wealth from inheritance

An inheritance isn’t just about receiving money—it’s about making it work for you. Whether your goal is retirement security, growing your wealth, or supporting future generations, a thoughtful plan can ensure your inheritance becomes a long-term asset.

By taking a strategic approach—investing wisely, managing risks, and considering tax implications — you can turn your inheritance into lasting financial security rather than a short-lived windfall.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.