A financial win that will immediately improve your quality of life

Simon Turner

Mon 24 Feb 2025 4 minutesDo you want a simple financial wellness win that’s likely to dramatically improve your quality of life?

If you’re like most investors, you’ll say yes for the simple reason that financial wellness is such an important part of physical and mental wellbeing. Prioritising it is integral to most successful long term investment plans…

Financial wellness matters

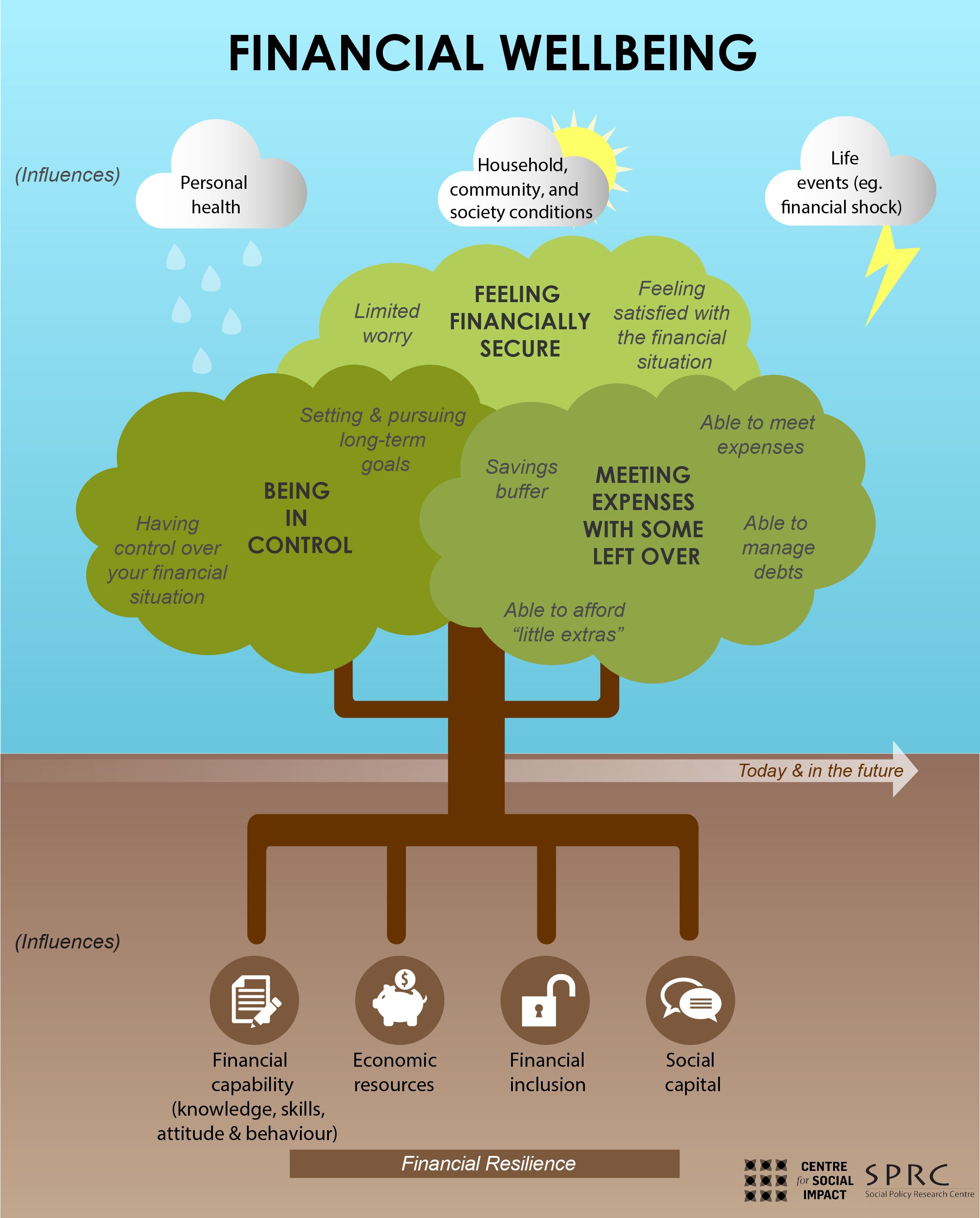

Financial wellness has a profound impact on our emotional wellbeing.

According to the Australian Psychological Society, Australians’ number one stress is money. It’s inextricably connected with the state of our relationships, and is often quoted as a leading cause of divorce.

The Consumer Financial Protection Bureau in the US believes that positive financial behaviours are a precursor to financial wellbeing. For example, through positive financial behaviours like paying down a mortgage, improved financial wellness is a likely outcome.

In short, big financial improvements are the result of small everyday changes.

Recent Morningstar behavioural research provides a more nuanced view of financial wellness. It shows that objective realities like having enough income to meet current and future financial needs contributes to financial wellbeing, but not as much as most people think.

Interestingly, it’s feelings of financial security, being able to enjoy one’s life, and being in control of one’s finances which are shown to contribute more to financial wellness.

How to tick these financial wellness boxes is, of course, different for everyone.

The key is to understand where you are today, and where you want your financial health to be in the future.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A financial win worth focusing on

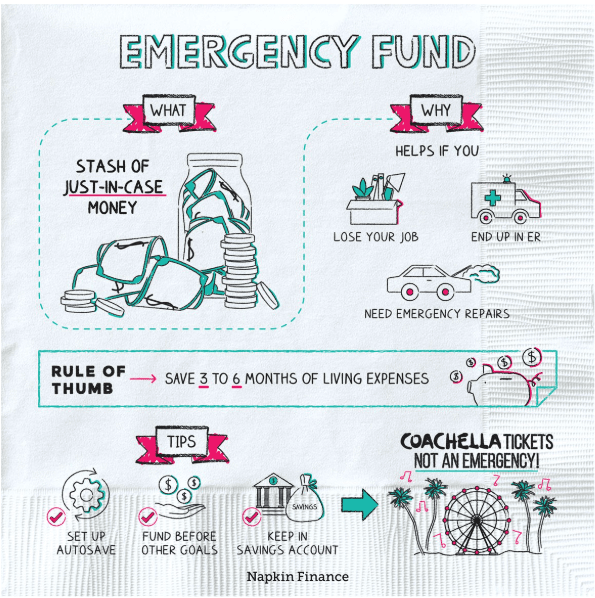

There’s one simple financial wellness win which is likely to make a significant difference to most people’s quality of life … building up an adequate emergency fund.

Having an adequate emergency fund offers a multitude of benefits such as protecting against financial shocks, while giving people the confidence they need to feel more capable and comfortable in planning for the future.

The ideal amount to save for an emergency fund is different for everyone.

For example, one person may feel financially secure holding six months of emergency savings whereas another may need two years of emergency savings in the bank to have peace of mind.

Despite these positive benefits, many people struggle to establish an adequate emergency fund.

Morningstar’s research revealed that only 41% of those surveyed had a fully funded emergency fund, and those who did not have an emergency fund were making very little progress towards establishing one. Most had not reached half their target, and 25% had no emergency savings at all.

In short, this is an area more investors should focus on. Whatever your ‘peace of mind’ emergency fund number is, prioritising it as a financial goal is likely to lead to significant positive changes in your life.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A positive change which leads to more positive changes

There’s more good news beyond the immediate benefits of establishing an emergency fund. The ripple effects of small changes are hard to overstate.

For example, building an adequate emergency fund can give people the confidence they need to feel capable and comfortable planning for the future, which can accelerate a positive feedback loop.

In other words, good financial behaviours tend to follow good financial behaviours as investors continue to chase the positive feelings financial wellness inspires in them.

The other profound change that tends to follow is that investors often understand that they’re in a better financial position than they thought they were. Believe it or not, this appreciation process is often a bigger challenge for wealthier investors to accept. Call it the winner’s curse.

A financial wellness no-brainer

So the question to ask yourself is: do you have an emergency fund which covers 3-6 months+ (or whatever your target is) of living expenses?

If your answer is yes, well done. You’ve taken a financial step which is critical to your physical and mental wellbeing.

But if your answer is no, as it is for 59% of investors, prioritising the goal of setting up an emergency fund may provide you with more peace of mind than you any other financial goal. It may also lead to a positive chain reaction of financial behaviours that improves your financial wellness and quality of life in profound ways.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.