Why You Need a Financial Plan ASAP

Ankita Rai

Thu 20 Feb 2025 6 minutesThe financial landscape is changing at an unprecedented pace, making it more critical than ever for Australian investors to have a solid investment plan. Over the past year, major forces such as AI-driven tech optimism and geopolitical uncertainty have reshaped global markets.

The local market also faces risks, including an ageing population, slowing productivity, geopolitical tensions, US tariff fears, and increasing regulatory scrutiny in areas like ESG and renewable energy.

Without a clear financial plan, investors risk being caught off guard by market corrections, sectoral shifts, or sudden policy changes that could erode returns.

Yet, putting off financial planning is a mistake too many investors make, assuming they’ll have time to sort it out later. However, with markets evolving rapidly, waiting could mean missing key opportunities or exposing portfolios to unnecessary risks.

The benefits of having a strong financial plan

A financial plan offers a 360-degree view of your finances, bringing together your assets, liabilities, and investments all in one place. It helps you set goals and make informed decisions based on your personal circumstances.

Research conducted by the Financial Planning Association of Australia shows that those with a structured financial plan are more likely to feel financially secure. The report highlights common financial regrets, including not saving enough (37%), making poor financial decisions (30%), and not investing enough (19%). Each can have lasting effects on long-term financial stability.

A well-structured financial plan helps you avoid these common pitfalls by providing clarity, direction, and a strategy to grow and protect your wealth.

Here’s why having a financial plan is essential right now:

1. Helps you navigate uncertainty

The Economic Policy Uncertainty Index has more than doubled since early 2024, reflecting rising concerns over interest rates, and global instability. In Q3 2024, the Australian economy barely grew, rising just 0.3%, while annual growth slowed to 0.8%—the weakest since the pandemic.

In times like these, having a financial plan with clear financial goals is essential. It keeps your focus on what’s within your control—like asset allocation—rather than external noise, helping you build a resilient portfolio.

2. Provides a margin of safety for life’s unpredictability

We all know life can throw curveballs when we least expect them. From global pandemics to personal health issues, a robust investment plan prepares you for the unexpected. A plan that accounts for market corrections, inflation, or longer life expectancy creates a buffer when things don’t go as planned.

Building a margin of safety protects your financial security from unexpected events. The more safeguards you put in place, the more resilient your plan becomes.

3. Paves the way for clear, goal-oriented decision-making

With so many investment options, how do you know which one is right for you? A financial plan provides a clear roadmap, breaking down big financial goals—like retirement, homeownership, or education funding—into smaller, actionable steps.

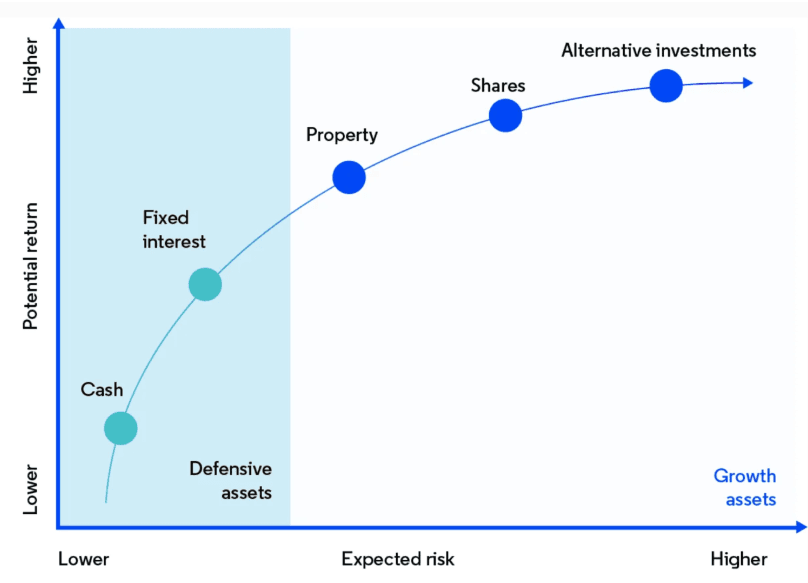

Strategic asset allocation helps spread investments across stocks, bonds, real estate, and cash based on your risk tolerance and long-term objectives, reducing the risk of emotional decision-making.

For example, growth-focused investors generally prioritise equities for higher potential returns, while balanced investors mix stocks and fixed income for stability. More conservative investors focus on capital preservation with lower-risk assets.

The right asset mix and a disciplined approach can keep you focused and help avoid short-term temptations.

4. Tracks your progress and build confidence

Once you have a plan, regularly tracking your progress helps you see how small, consistent actions lead to significant results. This can help build confidence in your financial future.

For example, reaching milestones like paying off debt, increasing your investment portfolio, or achieving a set return on your investment can offer a sense of accomplishment. Each of these small wins reinforces the belief that your financial goals are within reach, motivating you to stay the course.

5. Ensures your family’s financial stability and reduces stress

A financial plan doesn’t just protect you; it protects your loved ones too. For families and couples, open conversations about finances and mutual goals can reduce misunderstandings and conflicts. It ensures everyone is aligned on shared priorities, making it easier to achieve collective goals.

Moreover, for individuals, a financial plan can serve as a reassurance that their future, including their retirement and healthcare needs, is secure.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Making an investment plan

The first step in building a solid financial plan is assessing your financial position—taking a 360-degree view of assets and liabilities to determine how much you can invest while recognising the trade-off between risk and return.

Simply put, higher returns come with higher risk, while lower-risk investments offer more stability but modest returns. There are no shortcuts; high returns with low risk do not exist.

Equally important is setting clear, measurable goals, whether it’s buying a home, funding retirement, or building long-term wealth. Categorising goals into short-, medium-, and long-term horizons ensure they align with the right investment strategies.

The optimal asset mix depends on your financial objectives and risk tolerance, but regularly reviewing and rebalancing your portfolio is key to staying on track.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Financial freedom starts with a plan

A strong investment strategy isn’t just about stability—it’s about adaptability. Markets evolve, economic conditions shift, and personal circumstances change, but a well-structured financial plan keeps you focused on what matters most—financial security and wealth-building.

By managing risk wisely, staying flexible, and focusing on long-term gains, you can create a foundation for lasting financial success. True financial freedom doesn’t come from chasing short-term wins but from having the clarity and control to build wealth on your own terms.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.