Unlock Better Returns by Understanding your Position on the ‘Spendthrift-Tightwad Spectrum’

Simon Turner

Sun 13 Jul 2025 7 minutesA personal question for you: do you view yourself as a have or a have not? Your answer probably has nothing to do with your actual net worth. It’s probably more tied to your position on the wonderfully named ‘spendthrift-tightwad’ spectrum.

The truth is how wealthy we feel and behave is all in our heads. In fact, it’s often the wealthiest investors who feel the most pressure financially. Not only do they often feel pressure to protect and grow their net wealth, in many cases they feel pressure to become habitual tightwads. As you can imagine, this mind-set is not aligned with feeling wealthy.

It’s time to look in the mirror to ensure you’re not like the majority of investors who are badly positioned on the ‘spendthrift-tightwad’ spectrum…

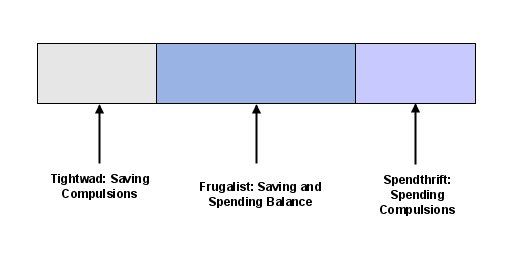

The Tightwad-Spendthrift Spectrum Introduced

Behavioural scientist Scott Rick has done extensive research into what he calls the ‘spendthrift-tightwad’ spectrum. This is important information since investor’s money personality directly influences their investment behaviour, from risk tolerance to cash flow decisions.

According to Rick, most people fall somewhere between two psychological extremes:

- Tightwads: These individuals experience pain or discomfort when spending money. It’s not just about being frugal. They find parting ways with their cash to be psychologically aversive, so they risk never enjoying the wealth they worked so hard to build. Rick’s findings show that tightwads are often older, more educated, and highly analytical.

- Spendthrifts: On the opposite end, these individuals feel little or no resistance to spending and often overconsume without planning to. Saving is a real challenge for spendthrifts, so they risk outliving their capital without the financial freedom they dreamt of in retirement.

Rick’s research shows that neither tightwads or spendthrifts tend to achieve optimal financial outcomes. Tightwads are generally too risk averse to generate solid returns, while spendthrifts generally spend rather than save their money.

Thankfully, there’s also a third group known as Frugalists who lie in the middle of the spectrum where better financial outcomes tend to grow from:

- Frugalists: These people are the ones most likely to be living their financial dreams. They are able to save money but they are also able to spend it. With their healthy attitude toward money, frugalists are able to save and invest to grow their wealth over the long term.

So where are you positioned on the ‘spendthrift-tightwad’ spectrum? An honest, self-aware answer can be transformative information for anyone aiming to optimise their financial outcomes while living a happy, stress-free live.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Meet a Tightwad: The Cautionary Tale of Hetty Green

Let’s meet a tightwad for context on this end of the spectrum.

Hetty Green was once the richest woman in America. She was also famously miserly. Despite her immense wealth, Hetty apparently lived on cold porridge to save on heating costs. Worse, she reportedly delayed the required medical care for her son’s injured leg while she searched for a free medical clinic. The upshot was her son’s leg had to be amputated. The stories go on, but none of them reveal a woman who enjoyed her wealth in the slightest.

Hetty was undoubtedly a savvy investor, but her life serves as a cautionary tale about what wealth can turn into without the capacity to enjoy it. It certainly isn’t financial success. It’s a psychological trap.

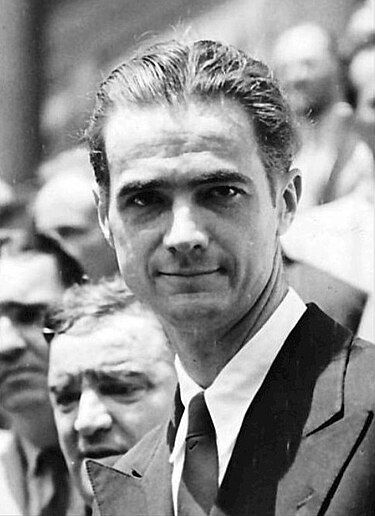

Meet a Spendthrift: The Cautionary Tale of Howard Hughes

Now, let’s meet a spendthrift as the other end of the spectrum is equally grim.

Howard Hughes, once one of the wealthiest men in the world, was a visionary aviator and film producer. Despite his vast fortune, Hughes became increasingly erratic and reclusive. He spent lavishly on failed projects such as the massive but impractical ‘Spruce Goose’ aircraft. He also indulged in eccentric habits that involved paying for entire hotel floors and teams of caretakers.

In short, Howard’s unchecked spending and paranoia eroded his financial empire. By the time of his death in 1976, his estate was mired in legal disputes, and much of his wealth had vanished. His life surely serves as a cautionary tale of how a fortune can be decimated by obsessive overspending.

Applying This Insight to Your Investing Strategy

Hopefully those stories inspire you not to follow in the footsteps of either Hetty Green or Howard Hughes.

The key takeaway is that whether you’re managing a self-managed super fund, navigating capital gains, or balancing income-generating assets with growth strategies, your money mind-set will influence every decision you make.

Here’s how you can put this knowledge into action:

1. Be Honest About Your Biases

Ask yourself: Are you reluctant to spend, even when you can afford to?

Or do you often overextend and justify your spending with the short-term pleasure it gives you?

For most investors, answering questions like these will tell them where they lie on the ‘spendthrift-tightwad’ spectrum. If not, a qualified financial advisor can help identify your behavioural tendencies and build systems to account for them.

2. Build Flexibility into Your Investment Plan

A sound investment plan isn’t rigid. It accommodates and adjusts around your life’s circumstances and what you are like as a person.

Whether you’re booking a trip to Europe, helping your children with a house deposit, or upgrading the family car, healthy discretionary spending can, and should, be factored into your financial framework.

3. Define Your ‘Why’

Here’s a simple truth which many investors forget: money is in itself not the goal; it’s the tool that enables other goals to happen.

So ask yourself: what does a ‘rich life’ mean to you? Is it about freedom, legacy, impact, or enjoyment?

Being clear on what you want will enable you to anchor your financial decisions in purpose, which will help you offset both impulsive and overly cautious behaviour.

4. Use Your Personality, Don’t Be Ruled by It

When all else fails, it can also be helpful to manage your financial personality with a view to moving toward the middle of the spectrum, the Frugality position from which good financial things grow.

For example, if you’re a tightwad, schedule periodic ‘permission to spend’ reviews: occasions where you re-evaluate whether you’re delaying gratification to a fault. Remember that allowing yourself to enjoy your wealth can be just as important as building it.

Or, if you’re spendthrift, set up automate savings and use goal-based investing to give your money a job before it disappears into lifestyle creep.

The key is to be proactive and focused on offsetting any extreme financial behaviours which aren’t helping you.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Self-Awareness is an Investment Superpower

Great investors aren’t just analytical. They’re also self-aware. By understanding your unique relationship with money, you’ll not only make better investment decisions, you’ll also enjoy the journey a lot more. Whether you’re building wealth, preserving it, or preparing to pass it on, the key is aligning your money with your mind-set.

Sometimes, that means saving each year. Other times it means saying yes to the beach house, the campervan, or the family holiday, not because you’re being reckless, but because you planned for it. Otherwise, what’s the point?

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.