Time to Diversify: Multi-Asset Investing is Ready to Shine

Simon Turner

Wed 26 Mar 2025 5 minutesThe concept of diversification has long been foundational to most investment strategies. However, the rise of the Magnificent 7 in recent years seemed to disprove its benefits to large swathes of the global investment community. As a result, millions of investors have been ‘all-in’ on the same trade.

That was then and this is now. The world has changed in profound ways since Trump’s inauguration, and markets have been reminded of the benefits of diversification.

The stage is surely set for a resurgence in multi-asset investing…

What is Multi-Asset Investing?

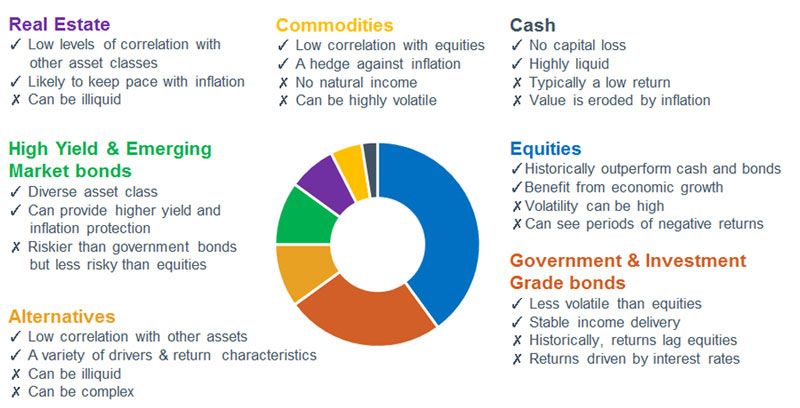

Multi-asset investing involves diversifying across a variety of asset classes – such as stocks, bonds, real estate, credit, alternatives, commodities, and cash – with the objective of creating a balanced and broadly diversified portfolio.

Multi-asset portfolios tend to outperform during periods of market volatility due to the benefits of asset class diversification, while they often underperform single-asset-class equity funds during periods of market strength.

Investors choose multi-asset funds to ensure they can weather all market conditions while generating solid risk-adjusted long-term returns.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Four Sides of the Multi-Asset Opportunity

The current multi-asset opportunity has four main sides to it…

1. Over-concentration in the US remains a significant market risk.

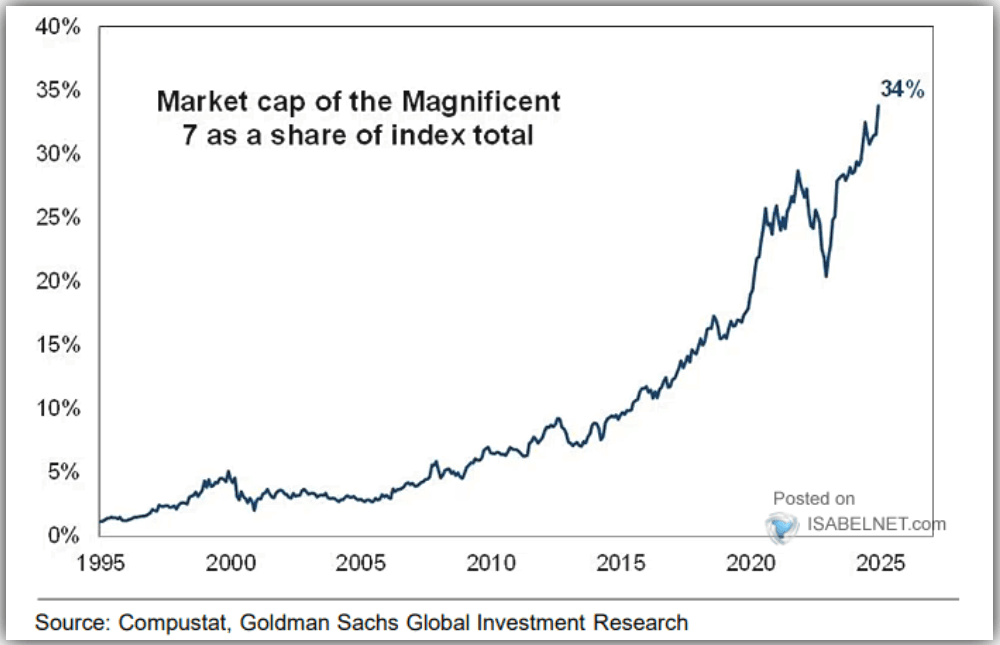

Firstly, many investors aren’t as diversified as they should be at this juncture. We can largely thank the inexorable rise in the Magnificent 7 for that.

As shown below, the Magnificent 7 accounts for a massive 34% of the S&P 500’s value.

That represents serious concentration risk. Whilst this is happening in the US market, it’s a global issue given the extent of international buying of these same stocks.

Here’s the rub: investing in the same stocks as the rest of the herd is rarely a successful strategy. In other words, now seems to be a good time to be diversified across asset classes and stocks. Now seems like an ideal time to be multi-asset investing.

2. Money market reinvestment risk is high.

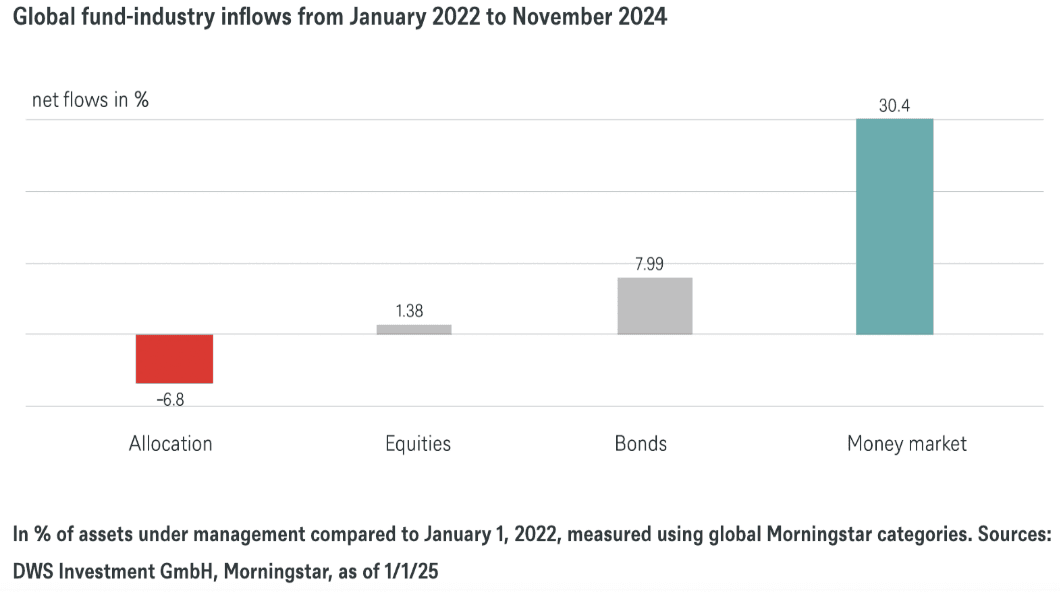

Secondly, after the recent rise in interest rates, there’s currently an unusual amount of cash sitting in global money market funds. In fact, global money markets have seen much larger inflows over the past three years than either equities or bonds—as shown below.

These significant money market inflows make intuitive sense. With the higher interest rates on offer, investors have chosen to generate relatively risk-free returns on a growing portion of their collective portfolios.

However, with interest rates expected to decrease over the coming year or two in most developed markets, reinvestment risk on the huge stash of money market investments is high.

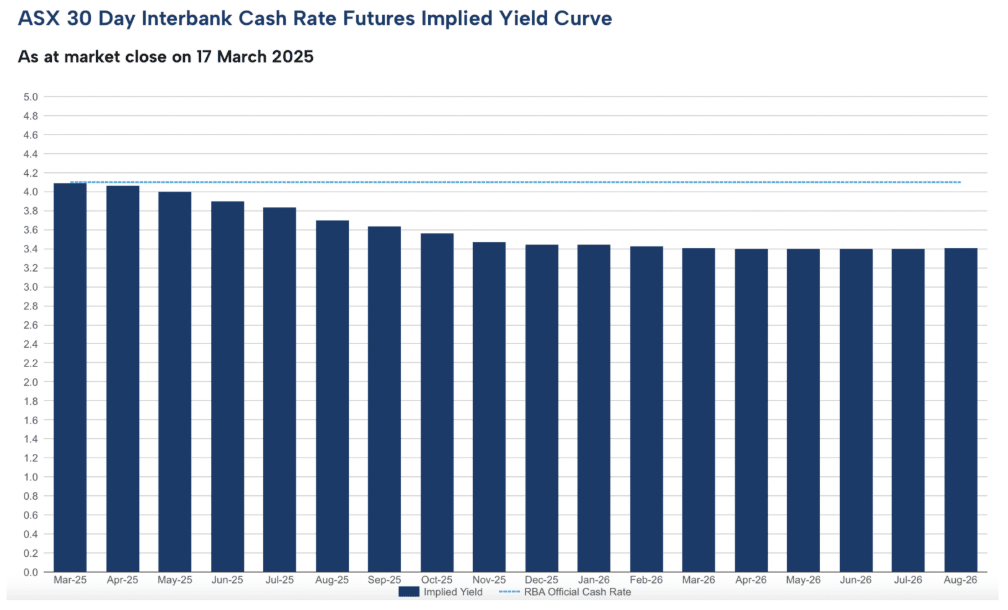

For example, RBA cash rates are expected to fall from the current 4.1% to 3.45% by the end of 2025.

That means there’s likely to be a significant amount of local money looking for relatively low risk investment homes as rates fall.

It’s not just falling rates that are a problem for global money market investors. The bigger issue is that money market funds have generally underperformed most other asset classes over the long term, and have generally lost value in real terms during inflationary periods.

This translates into a particularly attractive opportunity for multi-asset investing given the sector’s focus on generating solid risk-adjusted returns in all market conditions.

3. The equities-bonds dance warrants inclusion of both these mainstream asset classes.

As most investors are aware, it’s hard to achieve solid long-term performance without a significant equities weighting, particularly in an inflationary environment.

However, an all-equity strategy is beyond the risk tolerance of many investors. That’s why it’s so important for investors aiming for consistent returns to also invest in bonds.

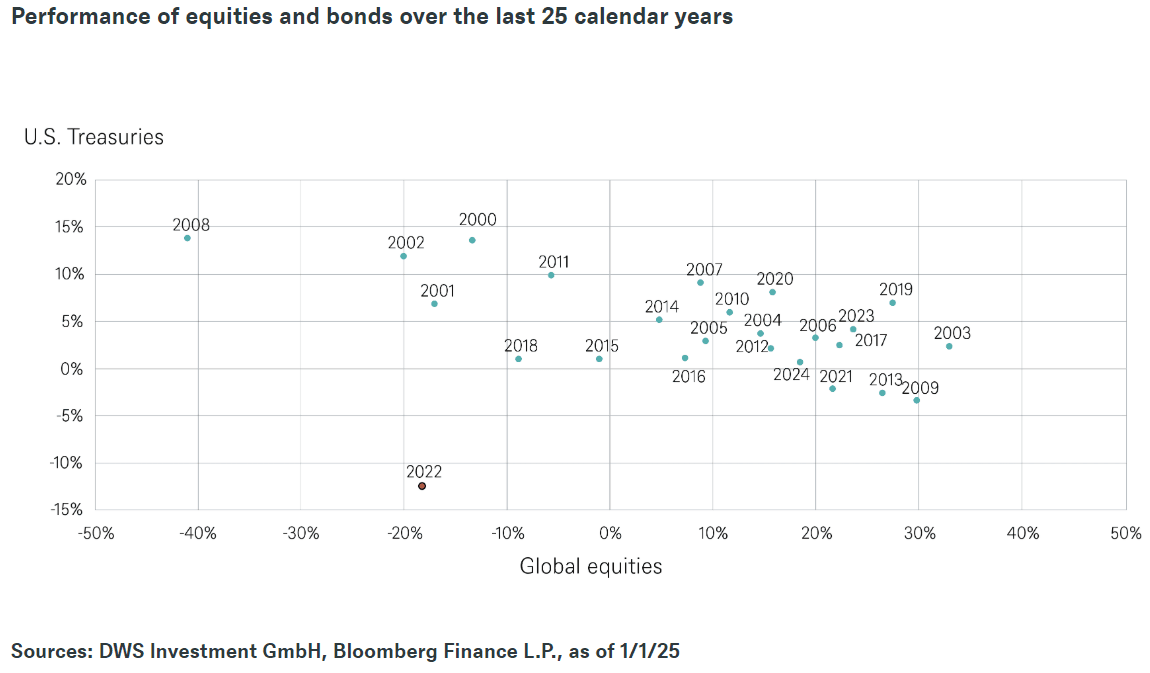

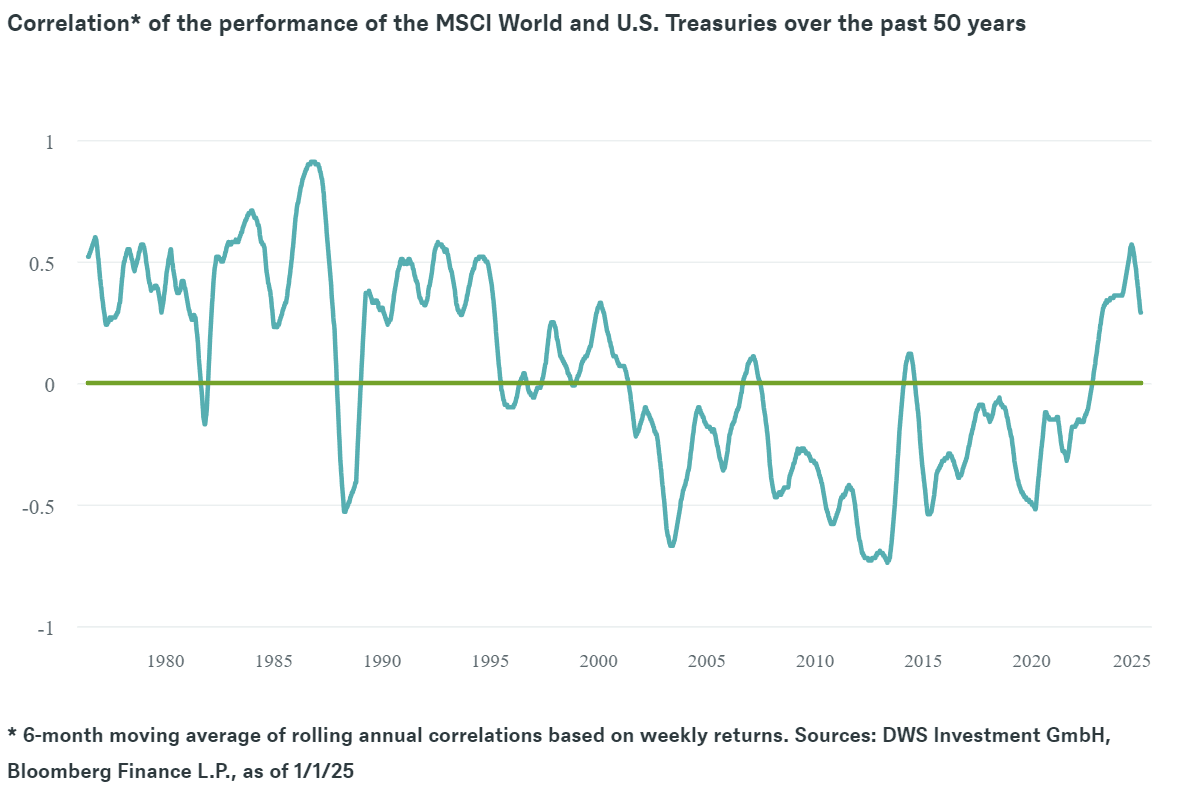

As shown below, the relationship between bond and equities returns is far from static, but in the years when equities fell, bonds generally acted as a safety buffer by generating a positive return.

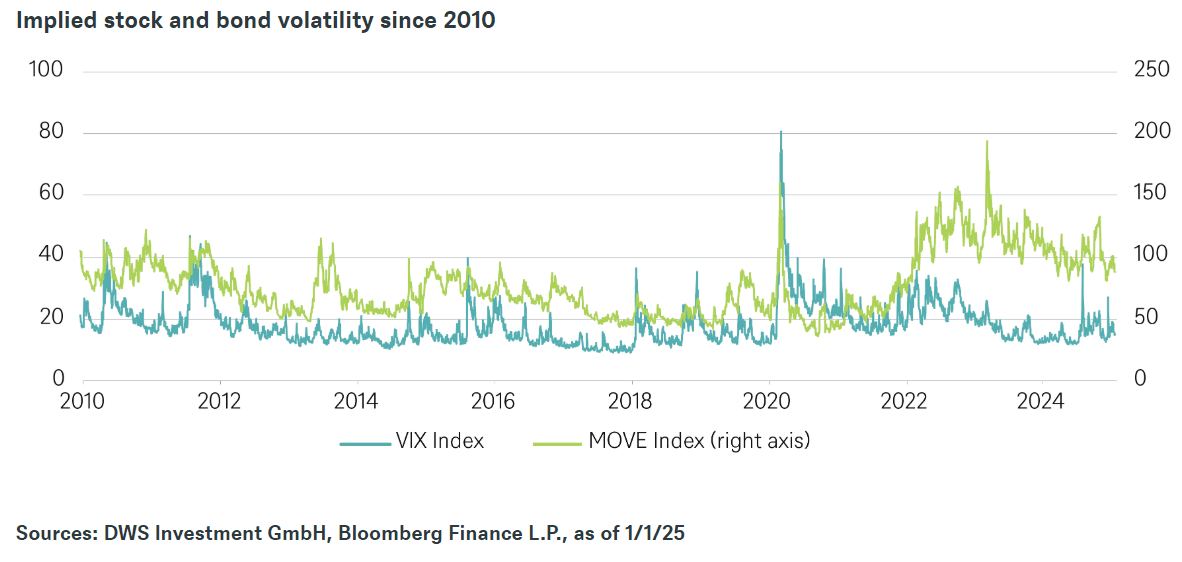

The counter-argument revolves around the fact that recent bond market volatility remains well above the historical average of the last decade reflecting uncertainties about growth, inflation and monetary policy, as well as the deterioration in government debt ratios.

With bond market volatility runner higher of late, the correlation of stocks and bonds has also been running higher in recent years. However, that correlation appears to have peaked, at least in the short term. That’s another argument in favour of multi-asset investing.

4. The efficient frontier never lies.

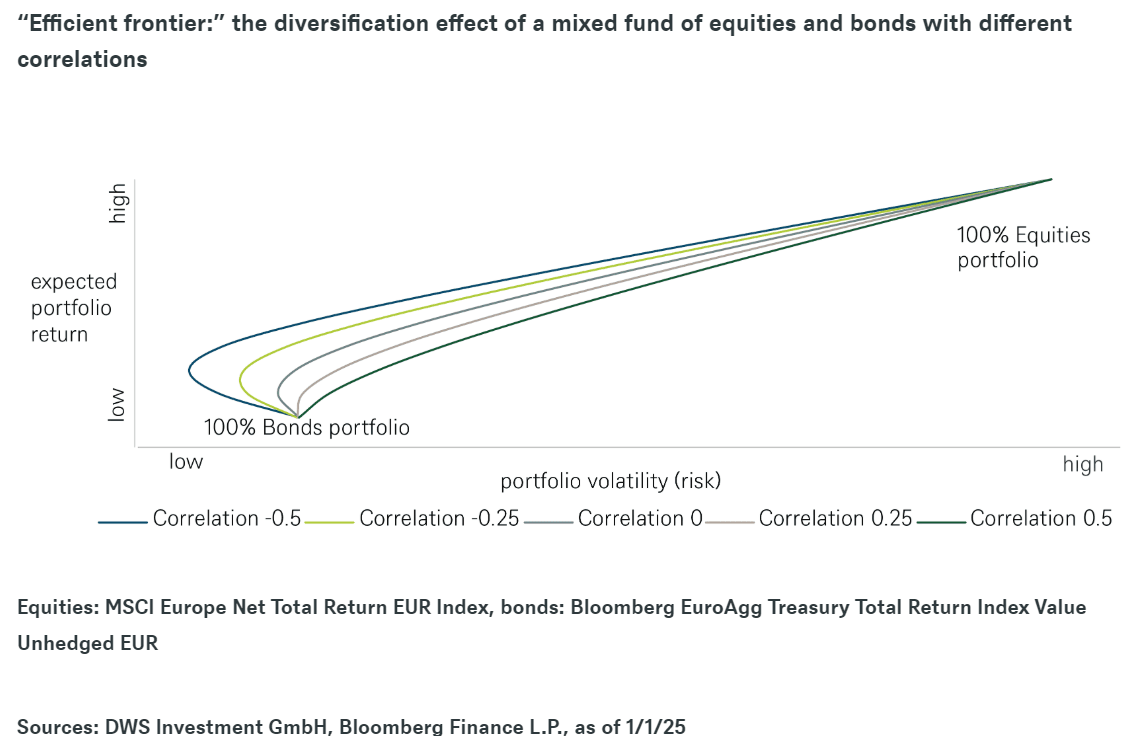

The beauty of diversification is that when you combine multiple asset classes, portfolio risk is lower than the average of its components. The combination is effectively more resilient than the sum of its parts.

As shown below, the efficient frontier (the portfolios expected to deliver the highest return for defined levels of risk) shifts to the left when a portfolio includes assets of lower correlations, thus improving a portfolio’s risk-return profile.

In short, a multi-asset portfolio has the potential to deliver attractive risk-adjusted returns by identifying and skilfully leveraging diversifying factors.

Case closed. The benefits of multi-asset investing are compelling—particularly so at this juncture.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Multi-Asset Investing’s Time in the Sun has Arrived

In the aftermath of the Magnificent 7 and money market funds both sucking an enormous amount of capital from global investment markets, the time to diversify appears to have arrived.

Multi-asset funds offer investors the opportunity to own multiple assets with low correlations to ensure the delivery of solid but stable risk-adjusted returns. The benefits of this approach have rarely been more relevant.

Funds positioned to benefit

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.