Thinking of Switching Your Super Fund? Here’s What to Check First

Ankita Rai

Thu 16 Oct 2025 6 minutesHave you been thinking about switching your super lately? Maybe your adviser suggested it. Maybe your fund’s merging. Or maybe you’ve just started a new job and, instead of handing over the default super form to HR, you’d rather take control and choose a fund that actually stacks up for your future.

It’s not a decision most people spend much time on. In fact, many Australians never question where their super sits and just stick with their employer’s default fund and hope for the best.

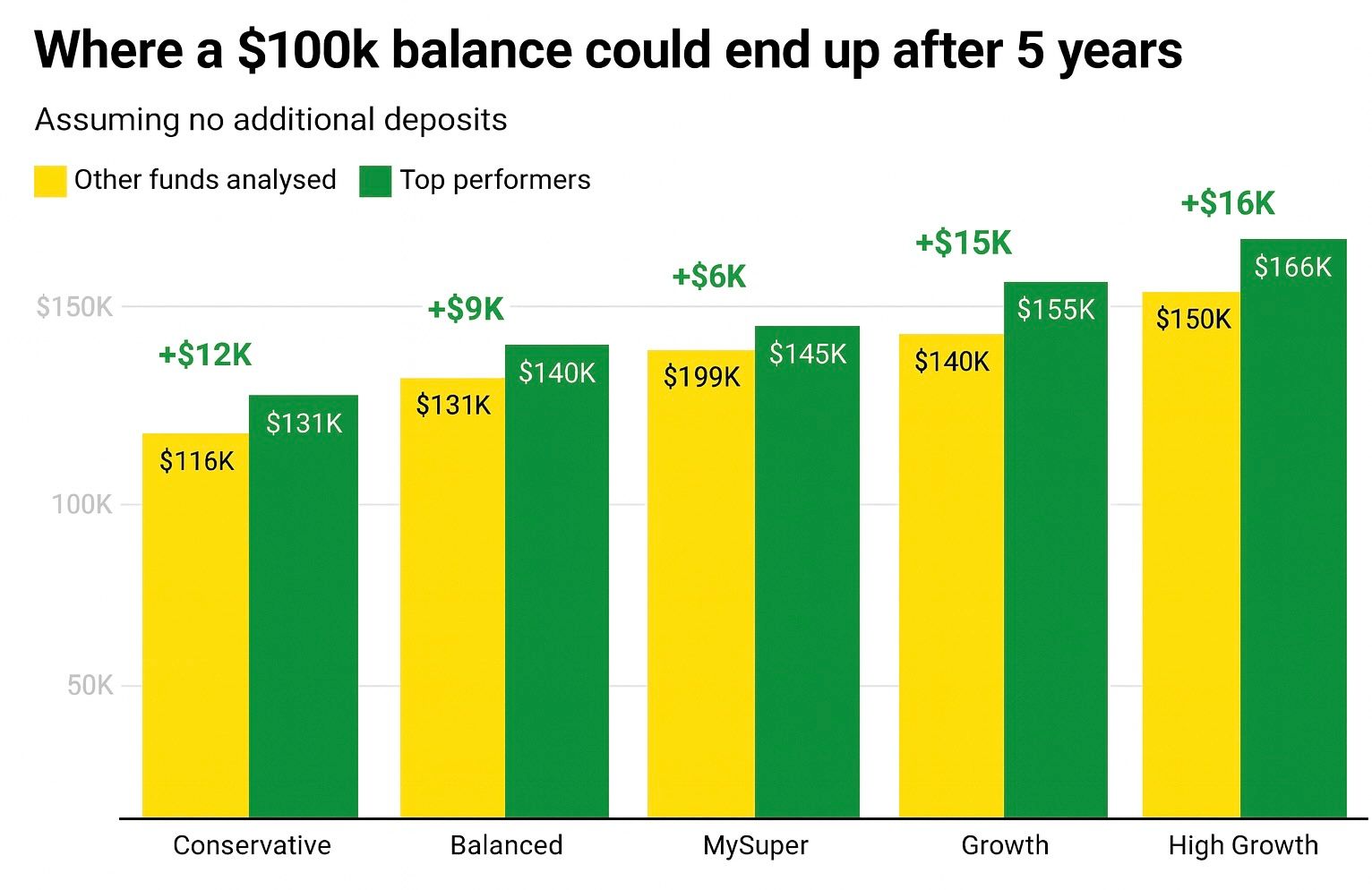

But that inaction can cost you, sometimes, a lot. The 2025 Mozo Superannuation Report found that on a $100,000 starting balance, the gap between a top-performing fund and an average one can range from about $6,000 to nearly $16,000 in just five years.

So, no matter your reason, there’s no better time to take stock of your super and check whether it’s still working for your retirement goals.

Switching super isn’t complicated either. You can contact the new fund directly or do it via MyGov.

But before you make the move, it pays to check both the fund you’re leaving and the one you’re joining to avoid regretting your super choices later.

Here’s what’s worth checking before you make the move...

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

1. Don’t miss your tax deduction

This one slips past a lot of people.

If you’ve made personal super contributions to your current fund and plan to claim a tax deduction, you need to lodge a Notice of Intent to Claim and have it acknowledged before you roll your super over.

If you don’t, you could lose the deduction entirely.

Most people plan to do it around tax time. But the catch here is that once you move your balance, the old fund is closed, and so is your chance to claim.

2. The real costs to consider

Most of us have insurance through our super, usually for life, total and permanent disability, and sometimes income protection too. What many people don’t realise is that when you close your old fund, that insurance usually stops automatically.

If you’ve developed a health condition over time, you might not get the same cover again due to the new illness. So before switching, check exactly what you’re covered for now, whether the new fund can match it, and when that cover actually begins.

Sometimes the easiest way to stay protected is to leave a small balance in your account to pay for existing insurance premiums till you figure it out.

3. You can lose benefits

If you’re lucky enough to be in a defined benefit or untaxed super fund, think twice before leaving.

If you have a defined benefit fund such as the Commonwealth Superannuation Scheme or the Defence Force Retirement and Death Benefits scheme, you’re guaranteed a certain income at retirement. These funds are valuable because they offer something most others don’t: certainty.

Similarly, untaxed super funds such as Constitutionally Protected Funds like West State Super and Gold State Super in Western Australia or Triple S in South Australia don’t tax contributions and investment upfront while your super is in its accumulation phase.

That means more of your money stays invested and your full balance keeps compounding.

Leaving one of these funds means giving up those advantages, which you might not get back.

Also check if your employer pays extra contributions or subsidises insurance in the default fund. Some do, but only if you stay.

And keep an eye out for things like ‘retirement bonuses.’ Some funds pay these if you retire with them.

Also, when you move your super, there’s often a short gap where your money isn’t invested — which means if the market is climbing, you can miss out on growth. Passive Investing Australia suggests that one way to reduce this impact for larger balances is to move the money in stages, such as 25% at a time.

4. Understand your fees and performance

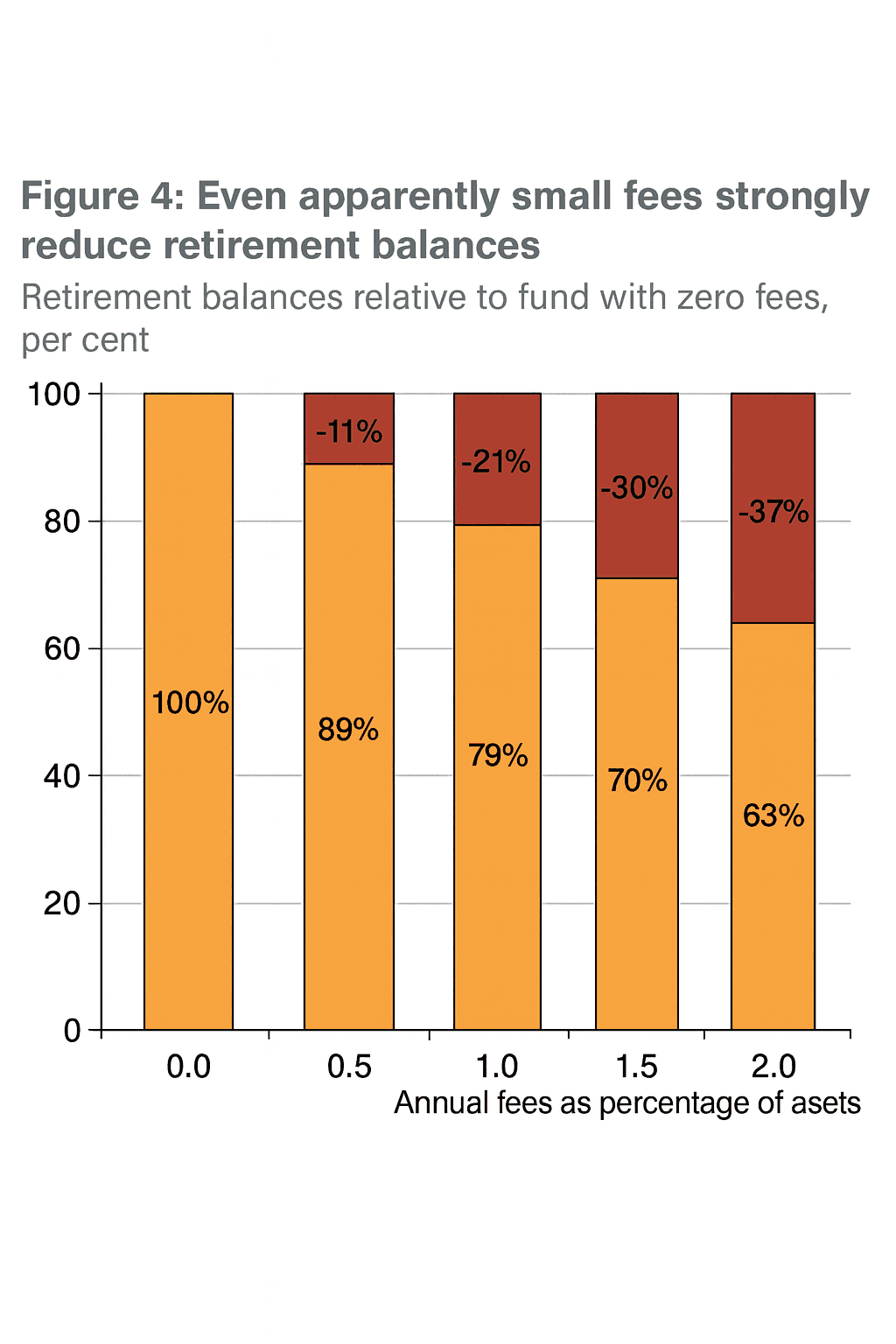

Last but not least, compare the fees. Fees can seem small, but over the long run, they quietly eat away at your super balance. The Productivity Commission found that just a 0.5% difference in annual fees could cost a typical full-time worker around $100,000 by the time they retire.

That’s why it’s worth knowing exactly what you’re paying for and whether your fund is giving you good value in return.

Super funds usually charge a mix of three main fees:

a. Administration fees: the cost of running your account day to day.

b. Investment fees and transaction costs: The ongoing costs of managing your chosen investment option. Some funds even charge a small switching fee if you move between options.

c. Advice fees: These apply only if you use the fund’s in-house advice service, and not all funds offer one.

Of these, investment fees usually make up the biggest chunk.

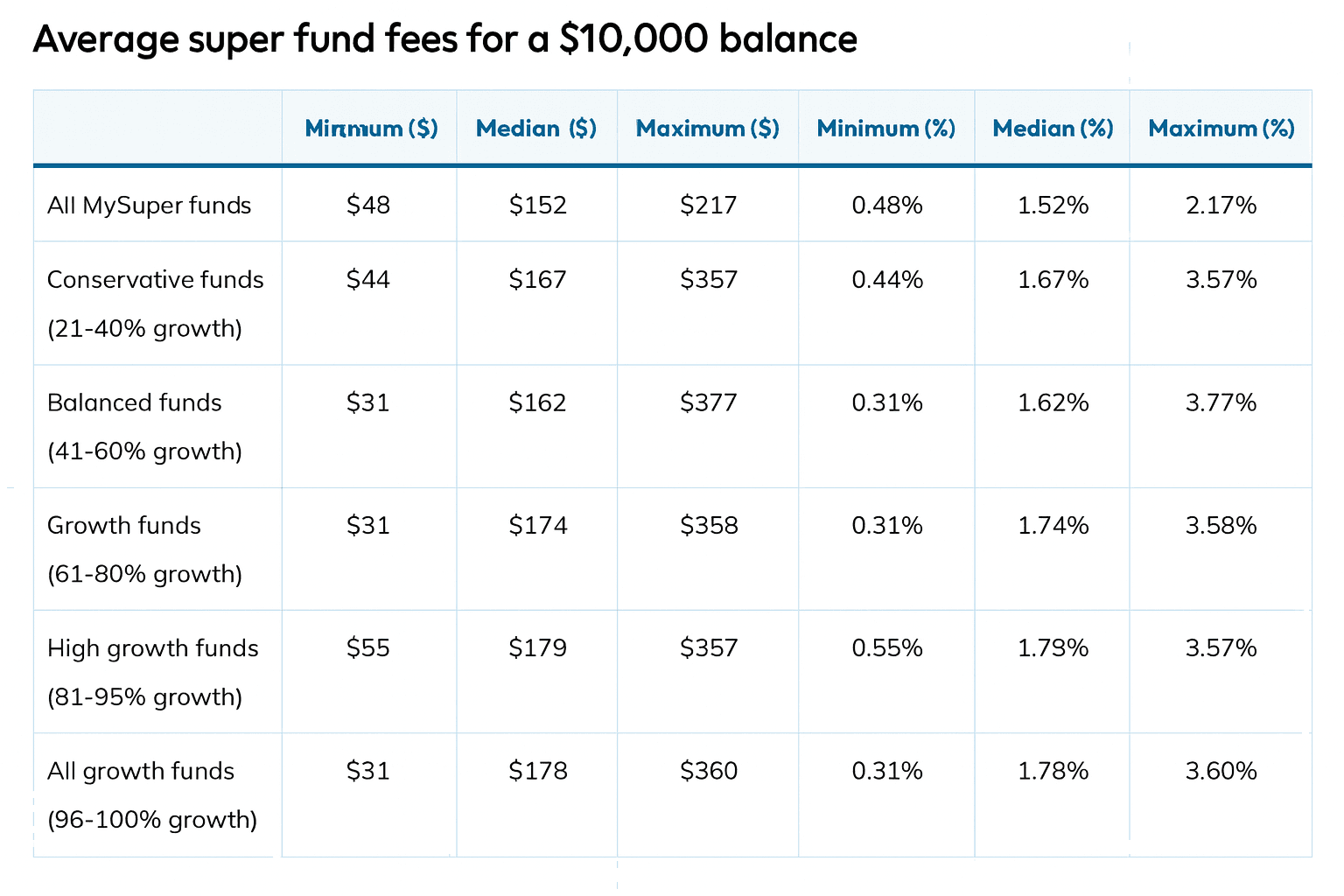

How much you’re charged depends on your balance, age, and the investment option you’ve chosen.

As a guide, someone with about $10,000 in super typically pays around 1.52% in My Super fees, while a member with $250,000 pays closer to 0.9%.

And remember, even a small fee gap compounds over time. Super fees of 1% might sound small, but they’re charged on your whole balance every single year.

A young person today paying fees of 1% instead of 0.5% could lose around extra 10% of their retirement savings over time as shown below.

That’s why comparing fees properly matters. But when you’re reviewing your fund, don’t just chase the cheapest fee. Look at your net returns after fees and tax, and whether the fund’s performance over five to ten years justifies the cost. Sometimes paying a little more for consistency is worth it.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Know yourself first

So, before you go chasing a ‘better’ fund, take a step back and ask what kind of investor you actually are. Think about your approach to super, your risk level, and how that fits your long-term goals.

Don’t switch because your fund had a rough year. Look at its record over five or ten years, across good and bad markets. If it’s consistently underperforming or you’re paying too much in fees, then it’s worth a conversation.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.