Asset Allocation Secrets: What Australia’s New Climate Goal Means for Investors

Simon Turner

Wed 15 Oct 2025 8 minutesWhether or not you’re focused on the environmental implications of climate change, it’s a significant investment theme that’s here to stay.

Few would argue with the COP28 pledge to triple global renewable capacity by 2030 being the longer term direction of travel. Add into the mix Australia’s new 2035 climate goal of cutting emissions 62–70% below 2005 levels, and climate change is positioned to power a generation-long capex cycle.

For most investors, climate change now warrants a separate seat at the table in their asset allocation discussions…

The Global Climate is Warming Faster than Expected

First, some confronting news.

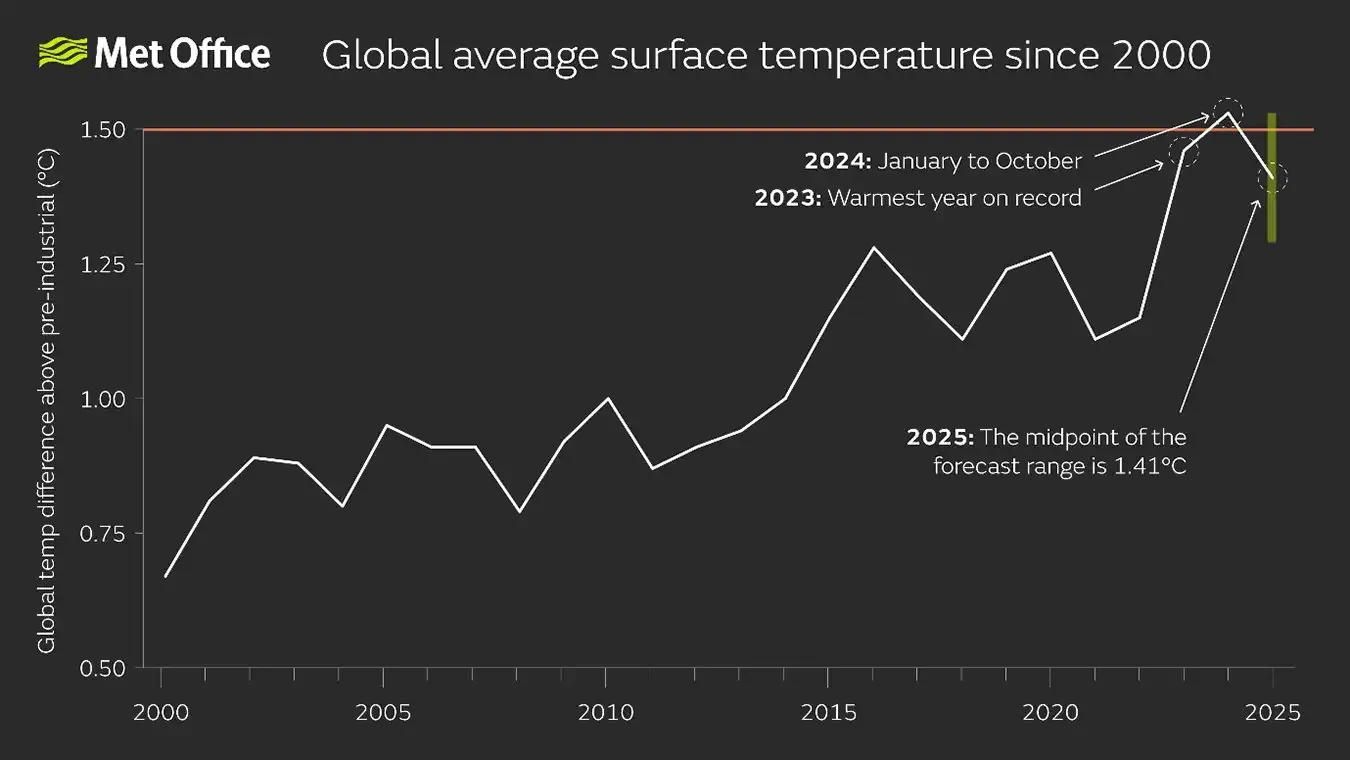

The Paris Agreement originally aimed to limit global warming to well below 2°C, and preferably to 1.5°C, versus pre-industrial levels.

Sadly, we are already at around 1.5°C of global warming with that ominous forecast actually being exceeded in 2024.

So the battle against global climate change is being lost, and at a faster pace than expected.

That spells rising global climate change impacts, including in Australia.

It also means that climate change mitigation and adaptation is of rising importance to the health and safety of the global population, and thus investors at large.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Australia’s Shifting Climate Goalposts

Australia’s climate policy is evolving.

The Australian government recently accepted independent advice from the Climate Change Authority and set a new 2035 emissions-reduction target of 62%–70% below 2005 levels, alongside a Net Zero Plan and sector blueprints. That target now anchors the government’s policy signals across energy, industry, transport, buildings, land use and finance.

Scale is the name of the game in this plan. As explained in Climateworks recent research on the issue: ‘Australia has the technologies to meet and exceed its new emissions target—the task is deployment at scale.’

Whilst positivity is needed, most experts agree these targets are ambitious and require a monumental shift versus what’s been occurring in recent years. As Erwin Jackson, Head of Australian Programs at Climateworks, warns: ‘We are at the foothills of Everest.’

Guided by this updated plan, Australia’s near-term climate playbook is to: accelerate renewables, modernise electricity use, lift home and building efficiency, clean up transport, build capacity in critical minerals and low-carbon liquid fuels, and scale new industrial tech with a $5bn Net Zero Fund and a CEFC top-up.

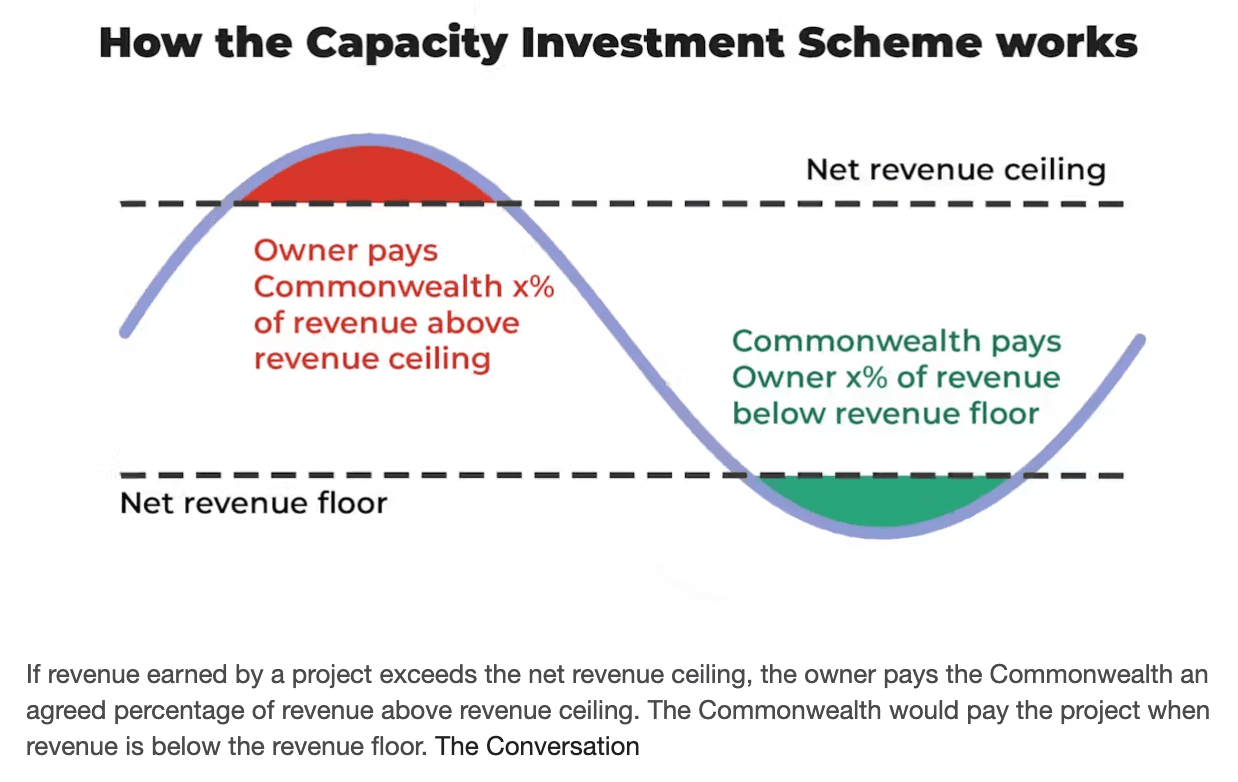

Renewables remain front and centre in the plan. The Government is targeting 82% renewable electricity by 2030, backed by the Capacity Investment Scheme (CIS) as a means of de-risking electricity generation and storage.

In parallel, the AEMO 2024 Integrated System Plan confirms that the lowest-cost route to a net-zero power system is renewables connected by new transmission, firmed by storage, and backed by gas for reliability. It identifies ~10,000 km of new transmission by 2050 under its core scenarios.

The government’s emissions and emissions disclosure regulation is also playing catch-up. The reformed Safeguard Mechanism (in force since 1st July 2023) assumes baseline emissions declines through 2030 for Australia’s largest facilities. In addition, mandatory ISSB-aligned climate reporting commenced for large entities from 1st January 2025. In response, ASIC created a new regulatory guide helping companies comply with their current and future sustainability reporting obligations.

These rules are already feeding into financing costs, benchmark eligibility, and stewardship strategies.

The Savvy Investor’s Climate Change Playbook

Most investors get it. Climate change is a big deal which will affect all of us to varying degrees. What’s less understood is the importance of integrating climate change into your asset allocation plan to ensure you benefit from the associated business opportunities whilst mitigating against the long list of climate change-related risks.

Below is an integrated climate change playbook aimed at optimising risk-adjusted returns as the energy transition accelerates:

1. Energy Supply & Storage: The Backbone Trade

The Capacity Investment Scheme (CIS) and Integrated System Plan (ISP) lock in multi-decade grid expansion, targeting 82% renewables by 2030 and more than 10,000 km of new transmission lines.

That’s great news for utilities, engineering companies, grid-hardware suppliers, and battery developers, while many regulated and contracted infrastructure providers will also benefit.

At the same time, execution risks such as community consent, permitting, and inflationary pressures remain material. Hence, diversification remains paramount.

👉 Takeaway: Investors are likely to benefit by building diversified exposure through infrastructure & utilities funds and ETFs, and clean-energy funds and ETFs with proven through-the-cycle track records. However, avoiding single-project funds is likely to be prudent until the overwhelming grid bottlenecks clear.

2. Electrification & Efficiency: From Optional to Mandatory

Sectoral decarbonisation plans and new building standards have turned energy efficiency into a compliance cost, rather than a choice.

The main sectors positioned to benefit from this investment theme are: heating, ventilation, and air conditioning upgrades, smart-control systems, efficient appliances, and retrofit services backed by Clean Energy Finance Corporation funding.

👉 Takeaway: For exposure to this opportunity, investors should focus on global or domestic funds & ETFs tilted to building-efficiency and electrification technology. These funds effectively convert regulatory mandates into annuity-like growth.

3. Transport Transition: Beyond EVs

The New Vehicle Efficiency Standard will transform Australia’s auto market, driving capital into charging infrastructure, depot electrification, grid upgrades and low-carbon fuels.

Fleet electrifiers, component suppliers and hydrogen innovators still have the opportunity to develop an early-mover advantage in these emerging markets.

👉 Takeaway: Investors can capture the transport decarbonisation opportunity via EV infrastructure and battery-technology funds & ETFs, not just electric carmakers such as the notoriously expensive Tesla.

4. Critical Minerals: Quality Over Quantity

The Australian Government’s Critical Minerals Strategy is backing domestic lithium, rare earths, graphite and high-purity silica processing.

The local winners will likely have secure offtake agreements, strong balance sheets, and mid-stream refining or separation expertise.

👉 Takeaway: Most resources investors would agree that quality beats quantity, although diversification across high quality assets is an important risk control. So investing in targeted and diversified resources funds & ETFs is an effective means of optimising your risk-adjusted returns in this space.

5. Carbon Disclosure & Stewardship: Capital Repricing Underway

Emissions reporting is here to stay. That means mandatory ISSB-aligned reporting and expanded Safeguard obligations are likely to lift financing costs for high-emission firms, and vice versa.

So investors should expect wider valuation dispersion across most sectors, particularly amongst the heavy emitters. The upshot is that low-carbon leaders are more likely to attract cheaper capital and better index inclusions.

👉 Takeaway: Investing in climate-leader-focused ETFs & funds will help ensure investors integrate emissions intensity and disclosure metrics as alpha tailwinds rather than headwinds.

6. Resources & Energy Exports: The Twin Curve

Australia’s export mix is battling the contrasting forces of fossil-fuel declines and critical-minerals growth. Government policy favours domestic processing and low-carbon fuels, yet diesel reliance remains a cost drag for miners.

👉 Takeaway: Steer your capital toward sectors positioned for structural growth care of climate change policy, and away from those positioned for structural declines. That means focusing on funds and ETFs which are: underweight legacy fossil exporters, and overweight low-carbon materials and vertically integrated processors.

7. Adaptation & Resilience: The New Real Asset Theme

In a world which is warming faster than expected, adaptation is more important than ever. On that note, the National Climate Risk Assessment highlights the importance of adaptation investment in water, transport, communications, and construction materials.

Insurance and real-asset pricing is already embedding physical adaptation-risk valuation differentials, and this will become a more important investment theme looking forward.

👉 Takeaway: Investors can benefit by investing in infrastructure, property and resilience-themed funds & ETFs targeting adaptation capex and resilient supply chains.

8. Global Competition & Cost Curves: Stay Benchmark-Aware

Asia, particularly China, dominates the global clean-energy manufacturing markets. That means Australian clean-energy projects must compete on the Chinese cost curve, while global renewables and grid investment scales new heights.

👉 Takeaway: Use global clean-energy or semiconductor funds & ETFs to ensure your clean-energy exposure and supply-chain value capture is global, rather than local.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Climate Change is a Core Asset Allocation Input

Australia’s new 2035 climate target is expected to usher in a multi-trillion-dollar reallocation of capital from fossil assets to electrified infrastructure, renewables, efficiency, and resilience-focused assets.

Savvy investors are taking note by tilting their asset allocation plans toward the funds and ETFs positioned for structural growth as a result of the energy transition, and away from the funds and ETFs heavily exposed to rising climate-change-related risks. All the while, sustainability disclosure and stewardship is increasingly separating the transition leaders from the laggards.

The climate policy scaffolding is in. Understanding, due diligence, and action will determine whether it’s a headwind or a tailwind for your portfolio.

Interested in Learning More About Asset Allocation? Check Out Our Recent Discussions Here

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.