Asset Allocation Secrets: The Impact of Shifting Demographics

Simon Turner

Tue 30 Sep 2025 7 minutesMost investors think about demographics as a slow-moving structural force which is useful information, but doesn’t affect short term investment performance. However, over the next decade and beyond, demographics are likely to become a more prominent investment theme.

The ageing population in Australia, Europe, and East Asia is already reshaping global labour supply, savings behaviour, and government policy, and investment markets are starting to pay heed. The relative risk premia of equities, bonds, and housing are likely to be affected by the structural demographic shifts underway.

That means long-term portfolios will need to integrate a demographic lens, not as a thematic bolt-on but as a core asset-allocation input…

What the Numbers Say

The ageing global population is about as structural an investment theme as you’ll come across.

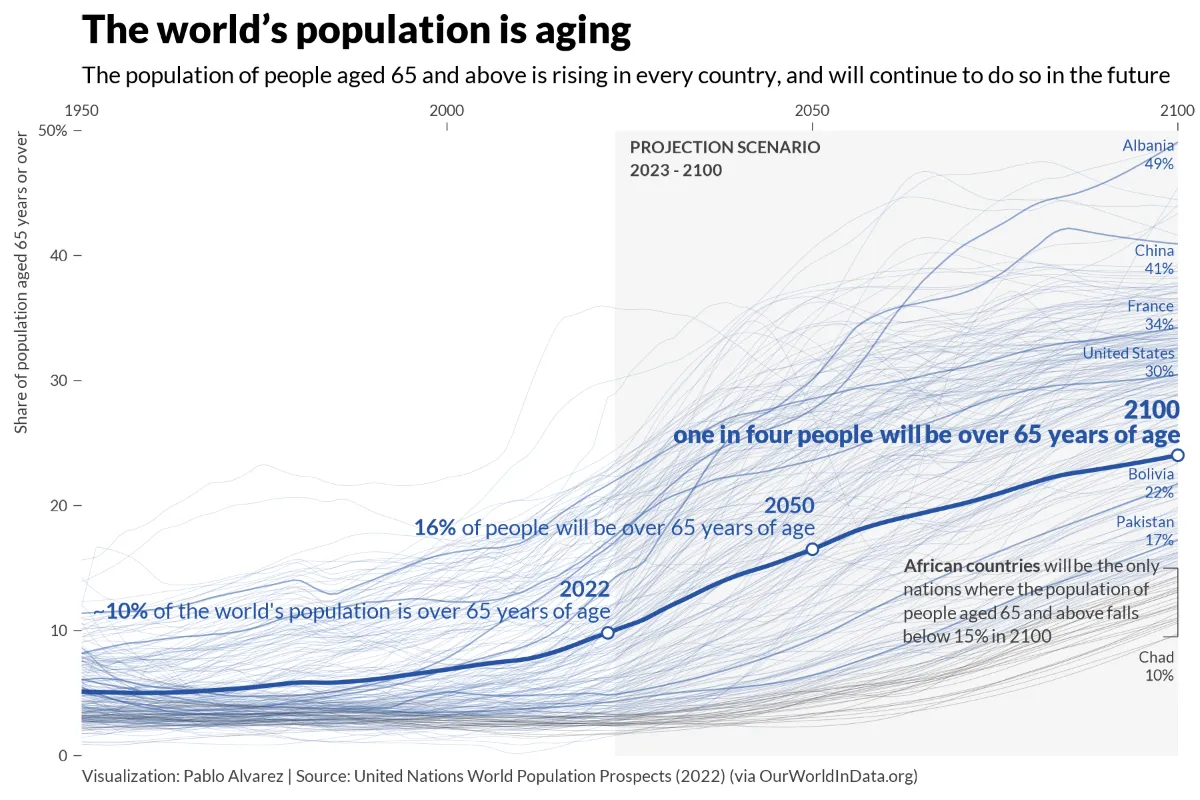

Over 10% of the world’s population are currently over 65 years of age, and by the end of the century that percentage is expected to rise to 25%.

True to the global trend, Australia’s population is ageing fast. The median age has risen from ~33 in the mid-1990s to ~38 today, while the 65+ share has climbed from ~12% to ~17%. Even with migration, official projections have the country’s median age rising into the mid-40s by the 2060s.

Europe is further along the ageing curve. Eurostat expects the EU’s old-age dependency ratio (65+ relative to working age) to jump from ~33% in 2022 to ~60% by 2100.

East Asia is even more extreme. Japan’s old-age dependency is already the highest in the OECD and could approach 80 per 100 workers by mid-century, while Korea’s median age is now in the mid-40s and climbing.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Mechanics of an Ageing Population

As the global population ages, the economic mechanics are straightforward yet profound.

A slower-growing labour force reduces the pool of active workers, while an expanding retiree base weighs on government finances by shrinking tax receipts. At the same time, the older generations shift from building wealth to preserving it, prioritising income stability over growth.

The OECD and ECB both highlight that, absent policy changes, global ageing will lower trend economic growth and strain public finances. Both conditions historically coincide with downward pressure on real interest rates and a rising risk premia across investment markets.

Hence, shifting demographics is evolving into an investment theme all investors need to be aware of.

Asset Class Impacts

Here’s how the ageing population is likely to impact upon the main asset classes:

1. Bonds to Remain in High Demand

The past generation’s fall in real risk-free rates is often framed as a ‘global savings glut.’ Recent research pins a good chunk of that on ageing itself. As the expanding population of retirees have increasingly sought safety, the price of defensive assets have risen leading to suppressed yields. NBER research found that whilst the real returns on safe assets have fallen as the population has aged, the real returns on higher risk assets have not fallen to the same extent, implying a wider equity risk premium (ERP) than demographics-free models would predict.

👉 Investor Takeaway: An ageing population is bullish for bonds. As the population ages, be ready for more frequent bond market rallies into economic growth scares which is likely to lead to structurally tighter term premia. Fixed income funds and ETFs are likely to benefit from leaning into duration as a structural hedge when growth scares surface.

2. Equities on Track for a Higher Risk Premium

In theory, as populations age, the equity risk premium, the compensation investors demand to hold equities over safer assets, should rise. That’s bearish for equities and reflects both slower potential economic growth and the fiscal strain of ageing societies.

Having said that, shifting demographics are set to reshape the equity landscape unevenly across regions. The challenge for investors is not only to benefit from the growth of the silver economy, but also to distinguish between markets where demographics are a manageable challenge and those where they are evolving into an equity ceiling.

In Europe, the pressure on public finances is stark. Without meaningful policy levers such as later retirement, higher female participation, or more immigration, the trade-off will become higher taxes or reduced benefits, neither of which is equity-friendly. Sectors geared toward retirement savings, healthcare, and financial services that thrive on fee income may still find structural support, but broader equity valuations could remain capped by the region’s labour shortages and political headwinds.

Asia presents a more advanced ageing case study, with Japan and Korea showcasing what happens when old-age ratios climb to extraordinary levels. Their experience highlights how ageing societies tend to create safe-asset scarcity, entrench demand for dividend-paying stocks, and anchor valuations in sectors aligned with domestic pensions and healthcare. Investors should expect Asian governments to cycle through policy experiments aimed at raising the retirement age and incentivising child birth. Markets will need to absorb the volatility these policy shifts bring.

In the U.S., the demographic shifts are slower-moving but aligned with the global trend. The large millennial cohort is moving into its prime saving years while the baby boomers continue to drive retirement demand for healthcare and other services. This dual dynamic is raising demand for income-generating assets, and helps explain the corporate rationale for paying dividends in an otherwise growth-oriented equity market.

Australia occupies a middle ground in a global context. The country is set to age later than Europe or Japan but faces a similar trajectory, with the 65+ share rising steadily. Immigration provides a powerful mitigation strategy, although demand is likely to continue rising for healthcare and equities that deliver stable income.

👉 Investor Takeaway: An ageing population is bearish for equities. Equity markets will increasingly be shaped by the politics of retirement, the economics of labour supply, and the resilience of sectors tied to ageing. So make sure your portfolio has sufficient exposure to global healthcare, and income-generating funds and ETFs. Conversely, be selective in your exposure to cyclicals tied to household formation.

3. Property Demographics Cut Both Ways

The usual story is that fewer young property buyers equals weaker housing demand. But that’s an over-simplification. The RBA notes that declining household size, a demographic trend associated with the ageing population, is supporting underlying demand for dwellings even when population growth slows.

In addition, high migration numbers, delayed family formation, and rising longevity all support demand for well-located, age-friendly properties.

Over the longer term, however, regions with shrinking working-age populations may see weaker price and rental dynamics and rising vacancy, while healthcare-adjacent precincts, downsizer-suitable apartments, and ‘15-minute’ suburbs are likely to benefit.

👉 Investor Takeaway: An ageing population is both bullish and bearish for property. Property geographic and typology selection is becoming more important. Focus on age-friendly, well-located assets with resilient rental demand.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Shifting Demographics Matter

Shifting demographics are likely to become a bigger deal across investment markets, but whether they are a headwind or a tailwind depends on whether investors pay heed or ignore it.

For investors willing to price ageing into their strategic asset allocation map, its impact over the coming couple of decades looks more like a chance to own the right risk at the right price.

Interested in Learning More About Asset Allocation? Check Out Our Recent Discussions Here

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.