What If the ASX Loses its Monopoly Status

Simon Turner

Mon 29 Sep 2025 6 minutesYou may have heard that ASIC is in the final stages of potentially allowing a competing stock exchange into the Australian market, long monopolised by the ASX. The potential new entrant is Cboe Australia, the Australian arm of Cboe Global Markets, a Chicago-based financial trading group. If they do enter the market, it spells change and opportunity for investors…

Change is Afoot in Australian Markets

Cboe Australia has been stepping towards its goal of operating an Australian listing market for a few years now.

It acquired Chi-X Australia in 2021 and rebranded in early 2022. Since then, the company has been operating mostly as an alternative trading venue for ASX-listed securities, exchange traded products (ETPs), warrants, etc. It does not yet have the capacity or regulatory approval to host IPOs.

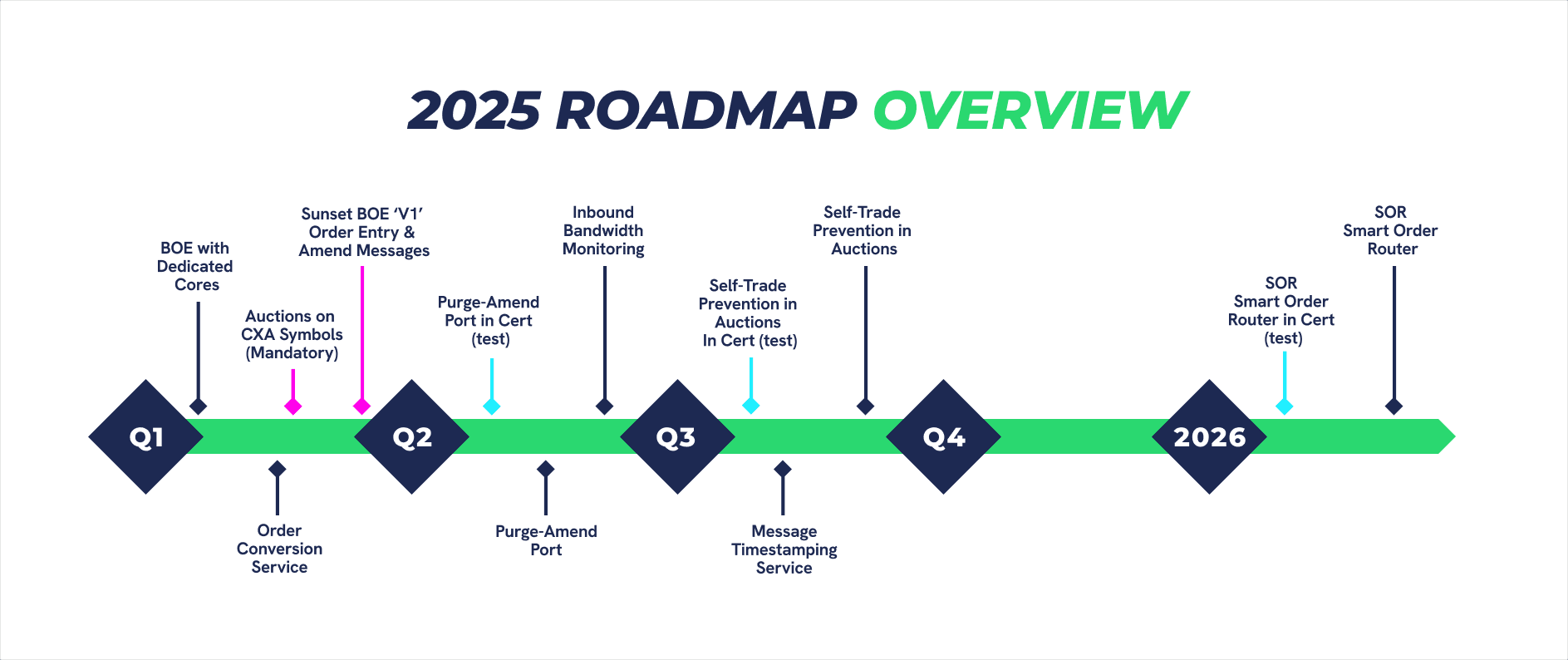

Cboe Australia is looking to change that situation in the coming months. The company has submitted an application to ASIC for a listing market licence which would allow companies to list, including via IPOs, on its platform. ASIC is in the final stages of considering this application. Cboe Australia has been laying the foundations to switch on its listings operation by migrating its technology (of the former Chi-X infrastructure) to its global platform, and launching new trading mechanisms.

The company has published consultation papers laying out their proposed new listing rules and frameworks. Their objective is to maximise the number of domestic and foreign companies, and closed-ended investments such as LICs and REITs, that list on their Australian platform and intra-list across their global network.

Given Cboe Australia’s move is occurring concurrent with recent ASX operational failures, Australia’s stagnant IPO market, and ASIC’s broader push for greater competition, innovation, and foreign capital flows, the company appears likely to gain regulatory approval as a full listing venue in competition with the ASX.

Regarding timing, Cboe Australia has indicated that its ‘Corporate Listing’ function is planned for the second half of 2025, subject to approvals.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What Cboe Australia is Proposing

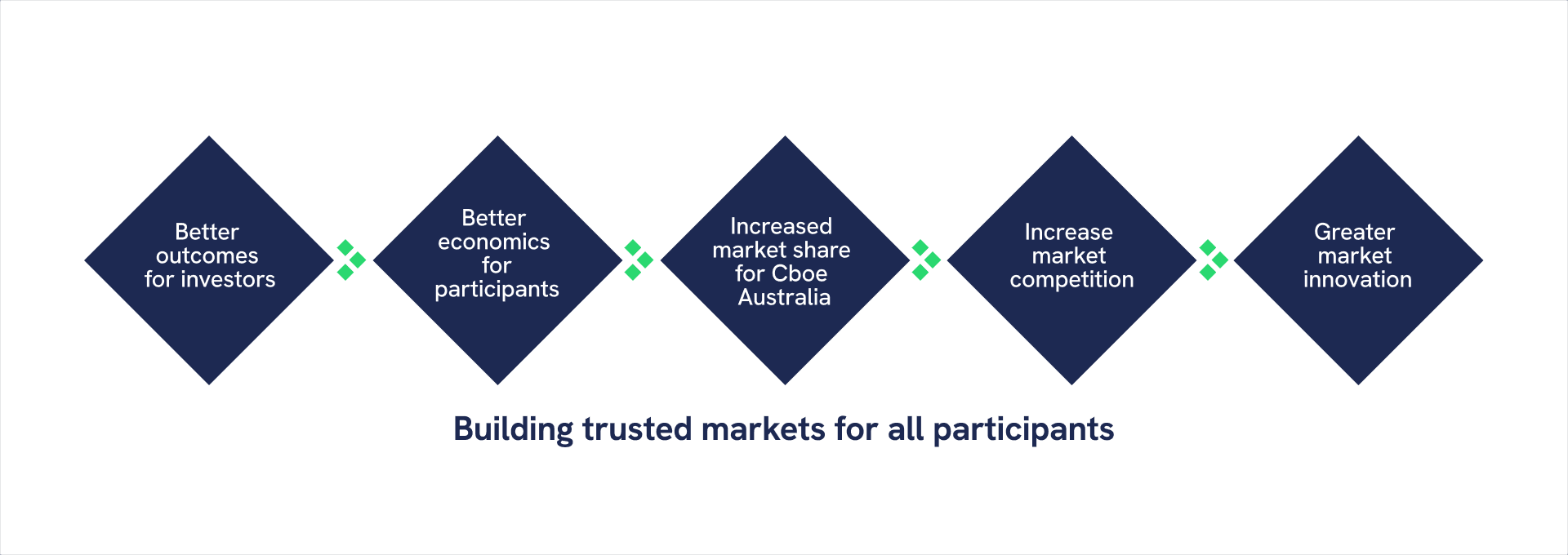

When a new competitor enters any market, their gaining market share depends on developing clear competitive advantages.

On that note, Cboe Australia is already preparing to differentiate its offering versus the ASX on a few key fronts:

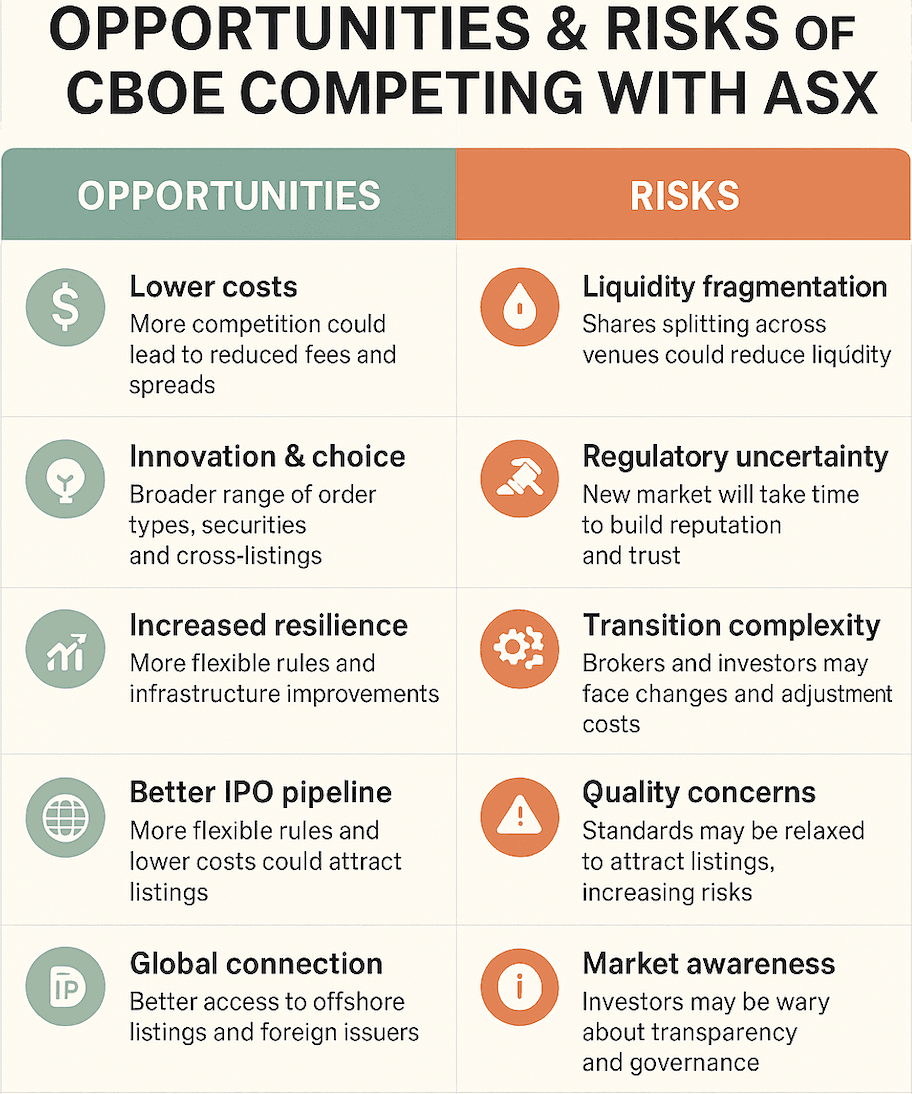

- Lower costs

Reports suggest Cboe Australia intends to offer listing & transaction fees that are 20-40% cheaper than ASX fees. That’s good news for the Australian corporate world.

- Flexible listing rules

Cboe Australia’s consultation papers suggest they are planning more flexible listing frameworks, including allowing intra-listings by foreign and domestic companies, closed-ended investment structures, or simpler dual structures.

- Modern technology & innovation

Cboe Australia has already migrated to its global tech platform, which improves its performance, latency, feature sets, etc. It is also rolling out new tools such as opening/closing auction enhancements and better order book mechanisms.

- More choice for investors & issuers

For companies considering an IPO, having a choice beyond the ASX could lead to more competitive terms. For investors, more venues for trading, raises the prospect of better execution, lower costs, and more product diversity.

If Cboe Australia execute their plan as expected, it’s likely to translate into a number of opportunities and risks for investors to be aware of:

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Impacts of Cboe Australia’s Likely Entry

Cboe’s likely entry into the Australian market represents more than a competitive duel with ASX. It would set into motion profound change across Australia’s investment ecosystem.

The most obvious impact will be on the ASX. Long criticised for its operational delays and reputational missteps, the entrance of a new competitor will up the pressure on the ASX to modernise. The threat of losing listings or being forced to cut fees is likely to provide a powerful catalyst for long-overdue reform. So investors can expect the ASX to accelerate its infrastructure and governance upgrades in order to protect its dominance.

For companies raising capital, Cboe Australia’s potential entry would introduce genuine choice for the first time in decades. That’s likely to translate into lower costs and fresh approaches to disclosure and governance that reflect global best practice. That would mean a lower cost of equity issuance and transaction expenses, with the savings flowing through to issuers and investors alike.

The international reach of Cboe would also add a global dimension to the domestic market which has been lacking up until now. If Cboe Australia succeeds in creating cross-listing pathways and enticing foreign issuers to list here, Australia could see a broader array of companies, sectors, and international investors participating. The result may be not only deeper liquidity but also a structural shift in how capital flows into the country.

This could well represent an important step toward becoming of a more competitive, globally integrated marketplace that could reframe how Australian equities are valued and accessed.

💡 Tip: If Cboe Australia gains regulatory approval as expected, make sure your broker supports Cboe trading seamlessly, as routing or settlement differences can affect execution. Also, if that happens, pay close attention to liquidity, governance, and disclosure standards before investing.

Positive Change Could Be Close

The fact that Cboe Australia is stepping up to become a fully-fledged stock exchange is a major development. It’s likely to be good news for Australian investors and companies alike with Cboe Australia bringing more choice, cost savings, and greater listing flexibility. For the ASX and the local market more broadly, this is a push toward modernisation, competition, and overdue reform.

If all goes smoothly, we might see the first IPOs on Cboe Australia in late 2025, and from then on, a more competitive two-exchange market is set to evolve.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.