Why the Bucket Strategy Still Works After Nearly 40 Years

Ankita Rai

Thu 2 Oct 2025 5 minutesRetirement can be a surprisingly rewarding chapter, financially speaking. But only if you have a solid plan in place that covers not only your day-to-day expenses but also safeguards your wealth when the markets get volatile.

That’s easier said than done. After all, some of the biggest threats to retirement, like longevity risk (which is the risk of outliving our savings) and sequence-of-returns risk (where a market drop happens early in retirement), can really take a toll on your nest egg and derail even the best-laid plans.

In fact, losses loom larger than gains, as behavioural economists Daniel Kahneman and Amos Tversky famously observed. And that effect is felt even more sharply in retirement, when the sting of watching your balance fall cuts deeper because there’s less time to bounce back.

So, what’s the best way to create a retirement strategy that weathers market ups and downs, delivers reliable income, while also helping prevent emotionally charged decisions?

One approach that has stood the test of time is the bucket strategy. First outlined by US economist and professor Harold Evensky back in 1985, it helps retirees manage their spending and keep growing their wealth, without the stress of selling assets when markets fall.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How Does the Bucket Strategy Work?

Many retirees lean on income-first models, chasing dividends or term deposits to cover their lifestyle. The bucket strategy flips that thinking on its head.

The idea is simple. Money you’ll need soon sits in cash, while funds you won’t need for years can be invested in assets with more potential to grow.

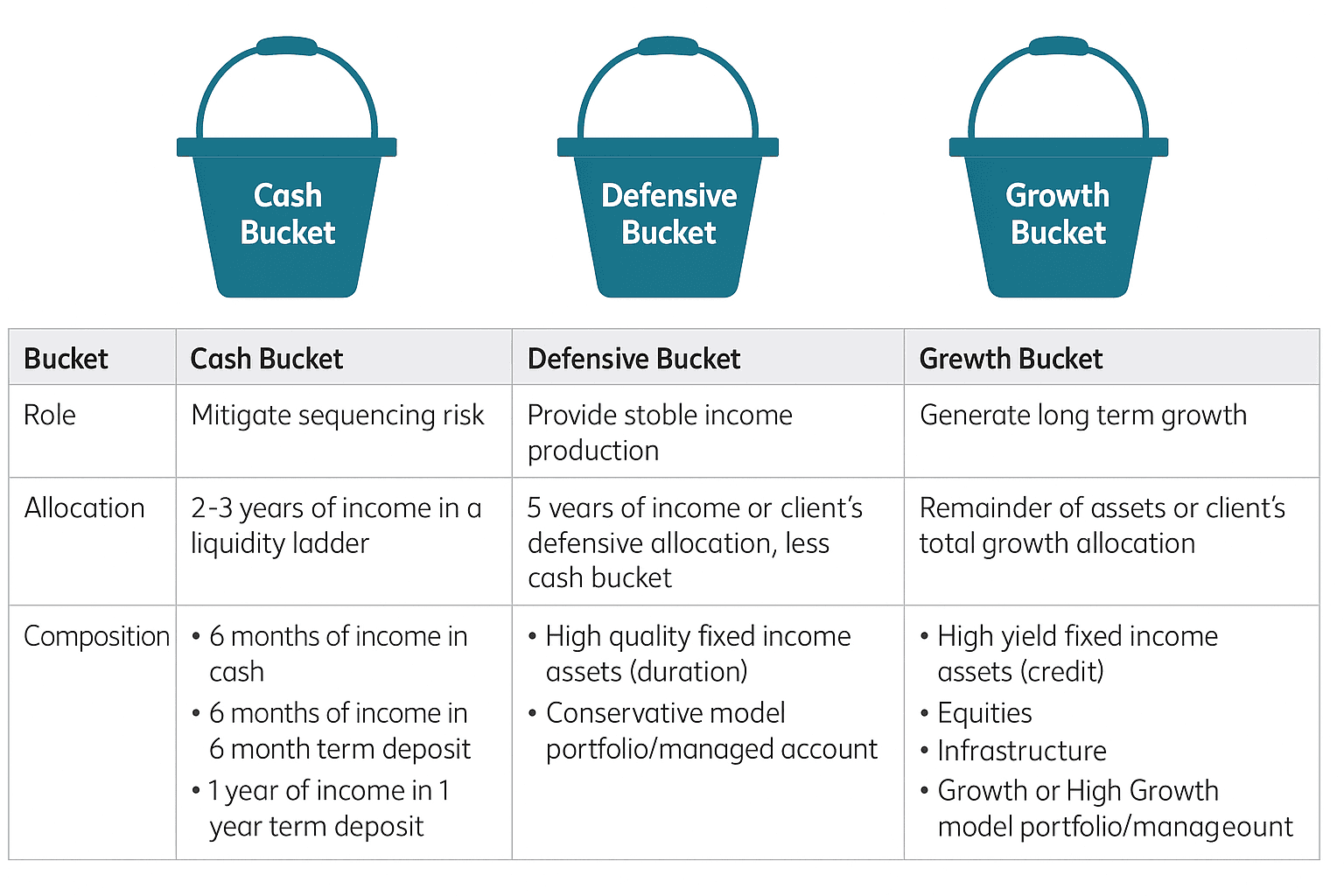

In practice, it’s like dividing your savings into three buckets: short term, medium term, and long term, each with a different purpose, level of risk, and degree of liquidity.

Original bucketing strategy (example)

Here bucket one is your safety net. Think of it as a cushion that gives your long-term investments the breathing room they need to recover after a downturn.

Without that cushion, retirees can slip into reverse dollar-cost averaging, meaning selling more when prices are low just to cover withdrawals, which can quietly drain their savings over time.

Here’s how the three-bucket approach plays out in practice:

- Bucket 1: Cash for today.

This is your everyday spending pool. It usually holds one to three years of living expenses in high-interest savings accounts, term deposits, or other short-term cash investments. The goal here isn’t to chase yield but to provide stable and reliable income.

- Bucket 2: Income for the medium term.

This bucket serves as a bridge between your immediate needs and your long-term goals, holding funds you might need in the next four to six years. Typical investments here might include bonds, conservative funds, fixed income, or dividend-paying stocks. Its role is to generate steady income and, when needed, top up bucket 1.

- Bucket Three: Growth for the long term.

This is where equities, growth funds and alternatives reside. Its purpose is to compound, counter inflation, and protect against longevity risk. When markets are strong, gains are harvested here to refill the other buckets. When markets fall, it remains untouched, and you draw from your safer options.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

When Your Bucket Springs a Leak

Still, no strategy is foolproof.

While the bucket strategy is particularly useful when you’re setting up your retirement portfolio with different time frames, it does require some effort to set up and a good dose of discipline to keep it going.

You’ll have to figure out how much to allocate to each bucket, select the right mix of assets, and perhaps the toughest part, stick to a solid rebalancing plan.

Another hurdle is finding the right balance between short-term safety and long-term growth. If your allocations are driven only by near-term expenses, you can end up investing more in bucket one and two, which might stifle growth and you risk of outliving your money.

In fact, for this strategy to really work, buckets two and three need to have exposure to growth assets. But if you’re a conservative investor, this might feel a bit unsettling, making it tough, if not impossible, to stick to the strategy consistently.

Ultimately, bucketing is just a way to allocate assets based on time horizons and liquidity. The real starting point is to clarify your retirement income goals, then work backwards to figure out the returns you’ll need and how to structure each bucket to support that income.

Why the Bucket Strategy Still Matters

The bucket strategy’s four-decade survival shows that it’s more than just a way to structure retirement savings. It also acts as a behavioural tool, helping to take the emotion out of investing.

In fact, it can be a helpful overlay, no matter what drawdown strategy you’re using for retirement.

It’s this ability to sit alongside any retirement drawdown approach that makes it a useful framework to plan your spending, while leaving markets to do what they’ve always done: rise, fall, and recover.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.