Asset Allocation Secrets: The Liquidity Illusion

Simon Turner

Mon 15 Sep 2025 7 minutesHave you ever invested in a fund with the expectation that you’ll be able to sell your stake at a fair price, only to discover liquidity was non-existent when you eventually tried to sell? Welcome to the liquidity illusion, the time-worn tendency for investors to run for the exits at exactly the same moment only to discover the exit is closed.

The upshot is that whilst markets are buoyant, like they are now, it’s vital to incorporate realistic liquidity assumptions into your asset allocation plan. After all, you don’t want to be wrong-footed by the liquidity illusion during the next market selloff.

Traditional Liquidity Buckets Introduced

In short, liquidity is the ability to sell an asset in return for cash.

When thinking about liquidity, asset allocators have long bucketed the main asset classes by their time-to-cash:

- Cash, term deposits, and government bonds: Near-instant liquidity is generally expected.

- Listed equities and investment-grade credit: Liquid intraday is usually regarded as achievable, but only when markets function normally.

- High-yield and emerging-market credit: Episodic liquidity is generally assumed, although most investors are aware it can disappear during periods of market stress.

- Private equity, private credit, and unlisted property: These assets are usually regarded as structurally illiquid, and effectively locked up for years.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Deconstructing the Liquidity Illusion

The liquidity assumptions mentioned above provide a baseline view of normal market liquidity, but they ignore the way liquidity actually behaves during market downturns. That’s when the liquidity illusion is most dangerous for unsuspecting investors.

So let’s deconstruct the liquidity illusion by updating a number of these assumptions:

1. ETFs provide liquidity, but not at par during extreme market events.

The boom in ETFs has been partially driven by their superior liquidity compared with unlisted funds. True to expectations, in March 2020 markets froze during the pandemic selloff, yet ETFs kept trading. They gave investors a way out when nothing else did.

But the cost of that liquidity was steep. Many ETFs traded at discounts to their NAVs, particularly within the apparently defensive bond sector due to the illiquid nature of the underlying assets.

👉 Investor Takeaway: ETFs do indeed offer superior liquidity versus other fund structures, but don’t assume you’ll be able to achieve NAV-par trades during an extreme market selloff. Discounts to NAV are the price of exit when everyone else is running for the door.

2. Flash-crash risk has risen across global equity markets.

One of the most significant shifts in market behaviour in recent years has been the rising role of AI in driving trading decisions.

This evolution has important implications for liquidity since AI tends to amplify the fear and greed driving markets. That translates into more pronounced fear during extreme market events, and accentuated selling pressure.

👉 Investor Takeaway: Investors should be ready for more short, sharp selloffs (and subsequent recoveries), as we experienced earlier this year. Also be aware that regulators can and do halt trading when volatility spikes during flash crashes, as they did during 2020. The mistake to avoid is believing daily liquidity equals guaranteed liquidity during periods of market panic.

3. Smooth unlisted fund valuations can hide underlying fragility.

Unlisted funds valuations often appear to be more defensive than their listed peers during market selloffs, but it’s important to understand that this is just a delay in valuation adjustment rather than real valuation support.

For example, when rates rose in 2022–23, listed A-REITs dropped by 30–40%, while their unlisted peers’ valuations barely moved—until they were marked down months later. This lag gave investors false comfort and masked the real risks they were exposed to.

👉 Investor Takeaway: Smooth unlisted fund NAVs during market selloffs aren’t signs of stability, they’re delayed volatility. So use listed proxies as early signals of what’s really going on. The mistake to avoid is complacency with appraisal-based valuations of unlisted funds.

4. Unlisted fund liquidity terms require greater investor scrutiny.

One of the misleading issues with liquidity has been the way some unlisted funds have communicated about it. By marketing daily or monthly redemption cycles without having a robust mechanism to ensure that’s realistically deliverable, many investors have been wrong-footed.

For example, after Brexit, many UK property funds marketed as offering daily liquidity froze all redemptions as they couldn’t sell assets quickly enough.

In response, most developed market regulators now recommend 90–180-day notice periods for unlisted funds. This is a live issue in Australia. APRA’s 2024 review of super funds revealed gaps in liquidity governance across the unlisted fund universe.

👉 Investor Takeaway: A daily or monthly redemption cycle is not guaranteed liquidity. It’s just a queue made visible by gates and notice periods. The mistake to avoid is ignoring a fund’s past use of gates, queues, or swing pricing during extreme market events. In short, demand best-practice governance from your unlisted fund managers in the form of: transparent liquidity budgets, regular independent valuations, reporting on redemption queues, and tested liquidity tools.

5. The private credit boom brings with it hidden liquidity risks.

Private credit is booming as an alternative funding source, having grown into a $US2 trillion global market, with ~$A40bn invested in Australia.

When an unlisted asset class becomes this large this fast, it’s worth remaining vigilant about liquidity due diligence. The risk is not just illiquidity, but also capital calls clustering across managers during market downturns which forces asset sales at the worst possible time.

👉 Investor Takeaway: Unlisted private credit funds are exposed to illiquid assets and thus should be regarded as illiquid. The mistake to avoid is underestimating hidden calls for liquidity from other private market investors/funds exposed to the same loans.

6. Freezing can be the fairest option.

Being gated, or having redemptions frozen, is a scary concept for most unlisted fund investors. Case in point: during the GFC, many mortgage and property funds gated their investors. That caused investor shock at the time.

However, as ASIC has acknowledged since, redemption freezes can protect investors by preventing a fire-sales of the underlying assets. In other words, during extreme market events they can be in investors’ best interests.

👉 Investor Takeaway: A redemption freeze is not necessarily a manager failure. It can be helpful in preserving value for investors who remain in the fund. The mistake to avoid is assuming redemption rights are absolute.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Be Proactive: Liquidity Budgeting

Beyond learning the above lessons, the best safeguard against the liquidity illusion is to budget your liquidity risk (like any other market risk).

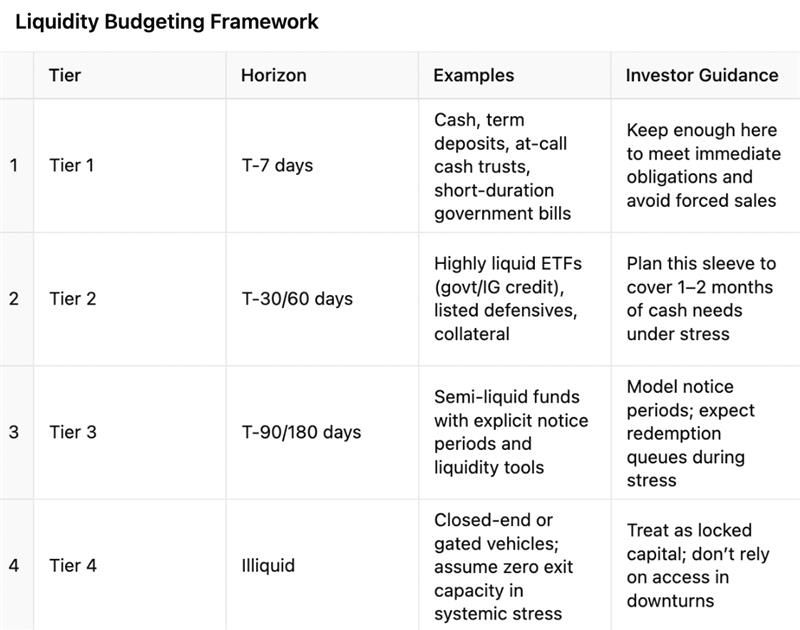

On that note, here’s a useful liquidity budgeting framework to map your expected and stressed cash needs against a tiered ladder of liquidity exposures:

Using this ladder, stress-test your portfolio over 90- and 180-day horizons. For example, if 20% of your portfolio were to be gated for six months, ensure your portfolio’s liquidity footprint remains robust. Also, consider establishing triggers such as widening credit spreads or steep A-REIT drawdowns that serve to pause new illiquid commitments until your liquidity buffers are re-established.

Look Past the Illusion When It Matters

Liquidity illusions flourish in calm and buoyant markets. Like now. But history proves that liquidity disappears at the very moment it’s most valuable.

The solution isn’t to avoid illiquid assets altogether, but to budget your liquidity realistically, and accept that valuation volatility is the price of genuine exit capacity.

If you assume liquidity will vanish when stress hits and plan accordingly, you won’t just avoid costly surprises. You’ll be ready to act when others become forced sellers. That’s the stuff of dreams for long-term investors who are proactive and prepared.

Interested in Learning More About Asset Allocation? Check Out Our Recent Discussions Here

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.