Want to Avoid the Heavy Cost of Bad Financial Advice? Don’t Skip These Questions

Ankita Rai

Thu 11 Sep 2025 7 minutes‘It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.’

Mark Twain wasn’t talking about financial advice here, but he might as well have been. After all, bad financial advice rarely shows up waving a red flag. More often, it is delivered by a confident adviser who seems to know their stuff, backed by a big-name platform you’ve heard of before. It feels safe, until it isn’t.

No wonder ASIC has issued a warning, urging Australians to be on high alert. Too many advisers are coaxing people, especially self-managed super fund trustees, into complex, high-risk products sitting on platforms run by familiar brands like Macquarie and Colonial First State. Deputy chair Sarah Court even called it unethical conduct ‘on an industrial scale.’

The truth is, you don’t have to look far to see the fallout. The collapse of Dixon Advisory, First Guardian and Shield Master funds has put nearly $1 billion of retirement savings at risk, exposing thousands of investors to losses.

The whole mess is a clear example of the hidden cost of bad advice.

Here’s the dilemma with the issue. Australians need financial advice now more than ever, with ageing populations, larger super balances, and increasingly complex rules around pensions, contributions, and estate planning. But at the same time, the risk of being steered into the wrong products, or paying too much for poor advice, has never been higher.

So if you need financial advice, whether it’s for putting together a retirement savings plan, managing debt, or diversifying your portfolio, the real challenge begins in finding the right person who has your best interests at heart.

The only way to know that is by digging into potential conflicts of interest and asking the right questions before you commit.

Here are five important questions aimed at avoiding bad financial advice:

1. Are you independent?

The first thing you want to know is whether your adviser is legally bound to put your interests first. That’s what being a fiduciary means.

Not all financial advisers are fiduciaries. Many operate under models where they’re only required to recommend something ‘suitable,’ not necessarily what’s best for you.

Note, though, being ‘independently owned’ is not the same as being ‘independent’ under the law.

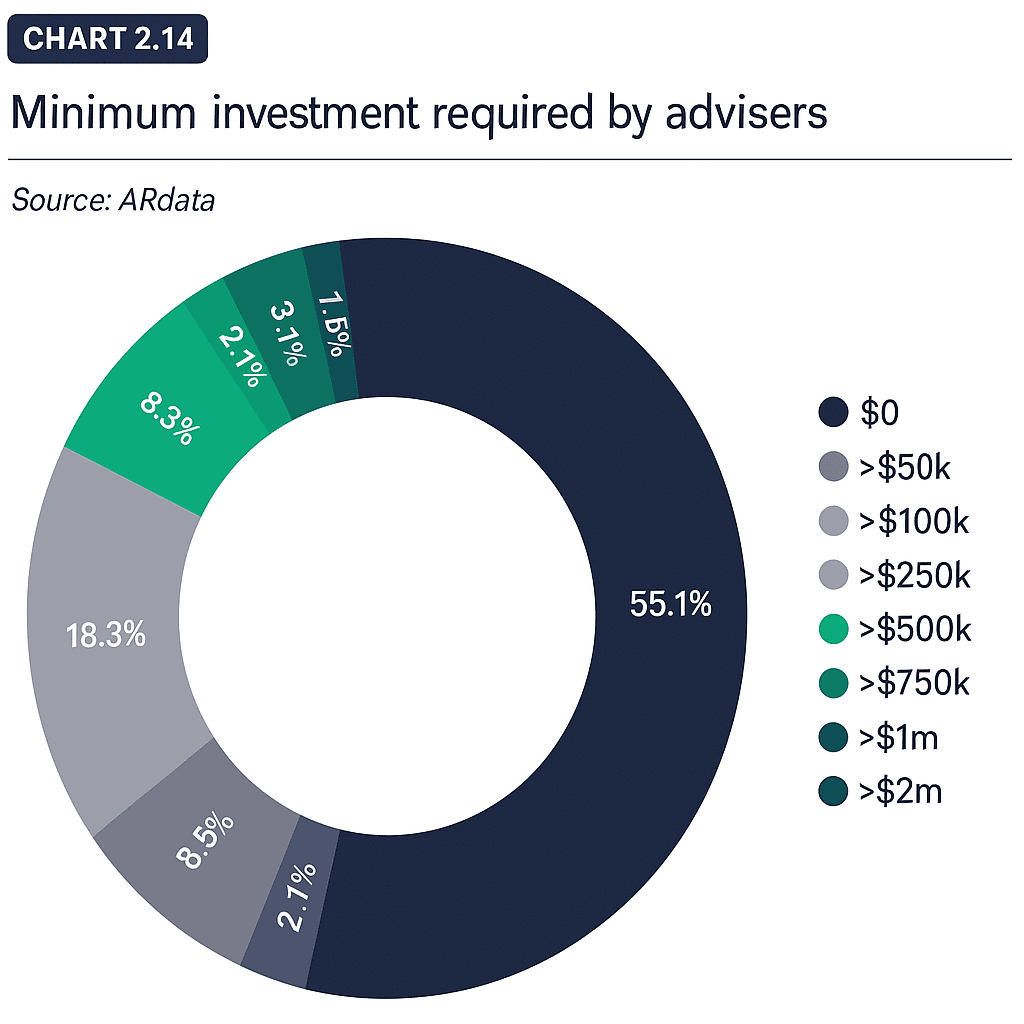

The safest path is to work with a truly independent adviser who has no links to institutions or product providers, and they only charge a fee for the service they provide. But the catch is that these advisors are in high demand, and thus tend to focus on wealthier clients.

Most Australians will encounter advisers who fall into other categories, such as firms owned by senior planners or those tied to big financial institutions. Be especially cautious of institutional ownership, particularly when the same institution also manufactures financial products. That’s where the biggest conflicts of interest tend to creep in.

Even though commissions on investments are banned, many firms still profit from in-house products. These aren’t always bad, but you deserve to know if your adviser is benefiting when you invest.

So, a directly: Are you independent? If not, what’s the conflict? And how will you guarantee your advice is in my best interests?

2.What is your fee structure, and how do you get paid?

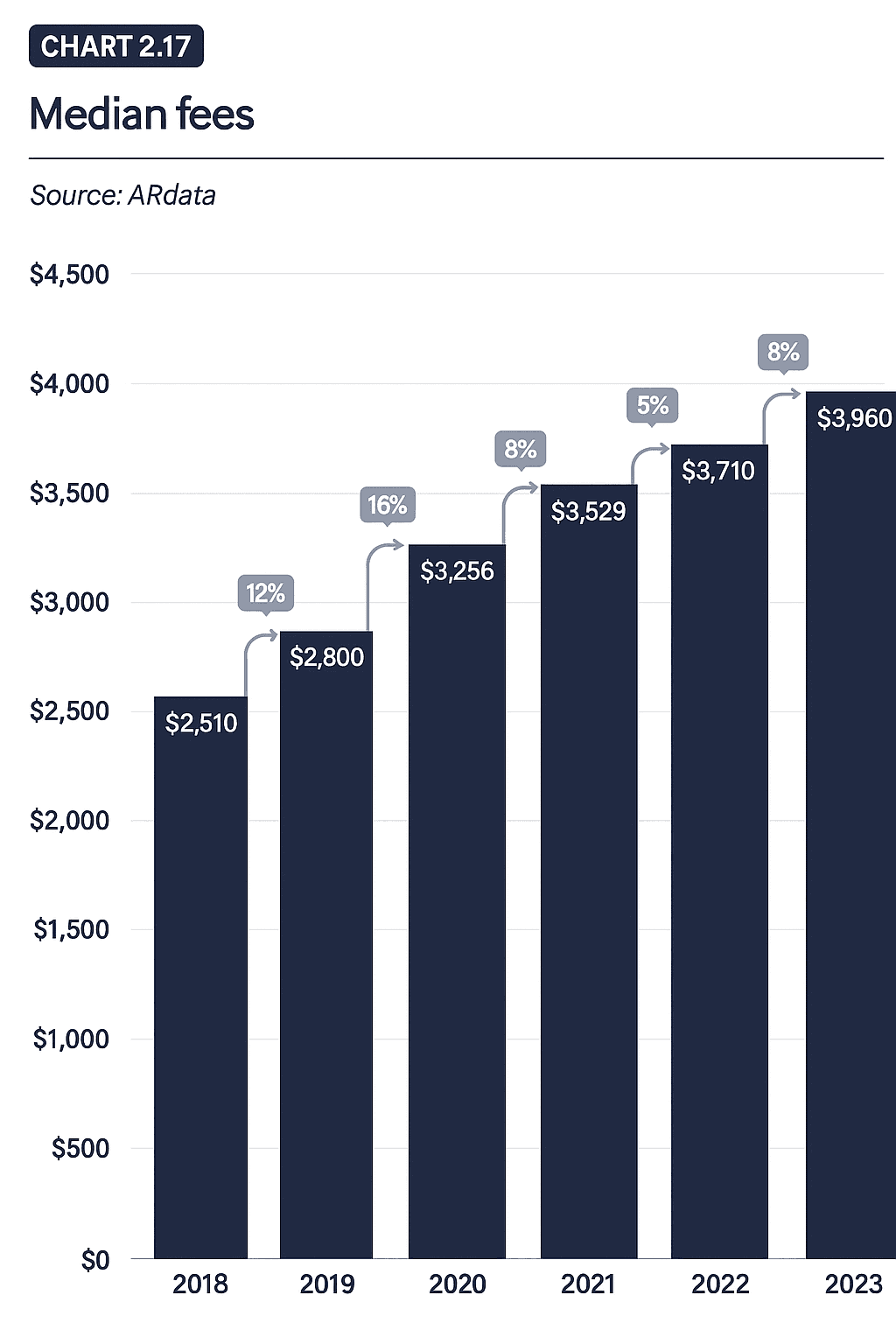

The elephant in the room remains cost accessibility. With the median adviser fee rising to $3,960 p.a. as shown in the chart below, it is important to understand the fees your adviser will charge you and any other income or benefits they may receive.

Ask for a breakdown of all potential costs. Transparency here will protect you from hidden fees and help you assess whether their services deliver good value.

A good adviser will be open and upfront about how they’re paid. While some advisers charge a percentage of assets under management, others prefer to work on a flat fee or hourly rate.

Now here’s the reality check. According to Adviser Ratings, most consumers are comfortable paying around $900 for advice, but only a small share of advisers charge under $1,500 for new clients. Many set higher entry barriers, with a third refusing to take on clients with less than $250,000 invested.

That mismatch between what people expect to pay and what advisers actually charge is worth questioning. Don’t just ask how much. Ask what you’re getting in return. And remember, not everyone needs ongoing advice.

Some people just need a single session to sort out their super, plan for inheritance, or to set retirement goals. Others with larger portfolios may benefit from ongoing advice, particularly for tax planning and retirement income. The main thing is to balance the cost with the value you receive.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

3. Where is your money invested?

It’s fair to ask an adviser what they recommend for you. It’s also fair to ask what they do with their own money. Many fund managers put skin in the game by investing in their own funds, and a good adviser should be willing to tell you whether they back the products and strategies they recommend. Do they favour index funds or actively managed funds? Do they push in-house products, and if so, why?

Most advisers also work with what’s called an Approved Product List, essentially a shortlist of funds and products they’re allowed to recommend. On the surface, it sounds reassuring: a research team checks the products, so clients get the ‘best’ options.

But some lists could be limited to in-house products, or influenced by providers who pay to be included, and may leave out the lowest-fee index funds. If an adviser is steering you toward a product, ask why and how much it is really costing, and clarify your exit strategy if things don’t go to plan.

4. What happens if you retire, sell, or the firm is acquired?

No one can guarantee you won’t lose money, but an adviser should explain how they manage risk. That includes spreading your investments and explaining what happens if a product fails.

Financial advice is a relationship. If you’re paying an adviser on an AUM or retainer basis, you need to know there’s a plan for continuity. What happens if your adviser is nearing retirement, steps away, or their firm gets sold to a larger institution? You don’t want to build trust over years only to be handed off to a stranger without warning.

Ask upfront how your relationship will be managed if they’re no longer in the chair.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. Are you able to invest in line with my beliefs?

Rising ESG investing means many Australians want portfolios in sync with their values, for instance, shunning fossil fuels or supporting social impact. Ask the adviser if they can accommodate.

A good adviser will also take the time to learn who you are as a person and ask questions such as: What are your highest financial goals for the year? Or how do you imagine your retirement?

These kinds of talks are a way of opening up what matters to you and giving the adviser a clear picture of your dreams and worries, as well as an opportunity to build a genuine working relationship.

Why These Questions Matter

Bad advice has cost Australians billions of dollars, and the scars of the recent fund collapses still haunt many retirees.

Asking the right questions before seeking financial advice can help you cut through the glossy promises and understand whether an adviser is truly aligned with your goals.

Because at the end of the day, the truth is no adviser will ever care about your future as much as you do.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.