Where the Contrarians Are Sniffing for ASX Ideas

Simon Turner

Wed 10 Sep 2025 7 minutesContrarian investing is the discipline of seeking value where others refuse to look. Most investors endorse it in theory, yet few have the nerve to put it into practice. After all, human instinct favours the comfort of the herd. But history shows that contrarian investors often earn superior risk-adjusted returns. Warren Buffett’s maxim about being greedy when others are fearful may be over-quoted, but its truth endures.

Right now, the contrarian setup appears compelling. With the Magnificent Seven having absorbed most global attention and capital in recent years, many other stocks and sectors have been neglected, including on the ASX…

Contrarian Investing Introduced

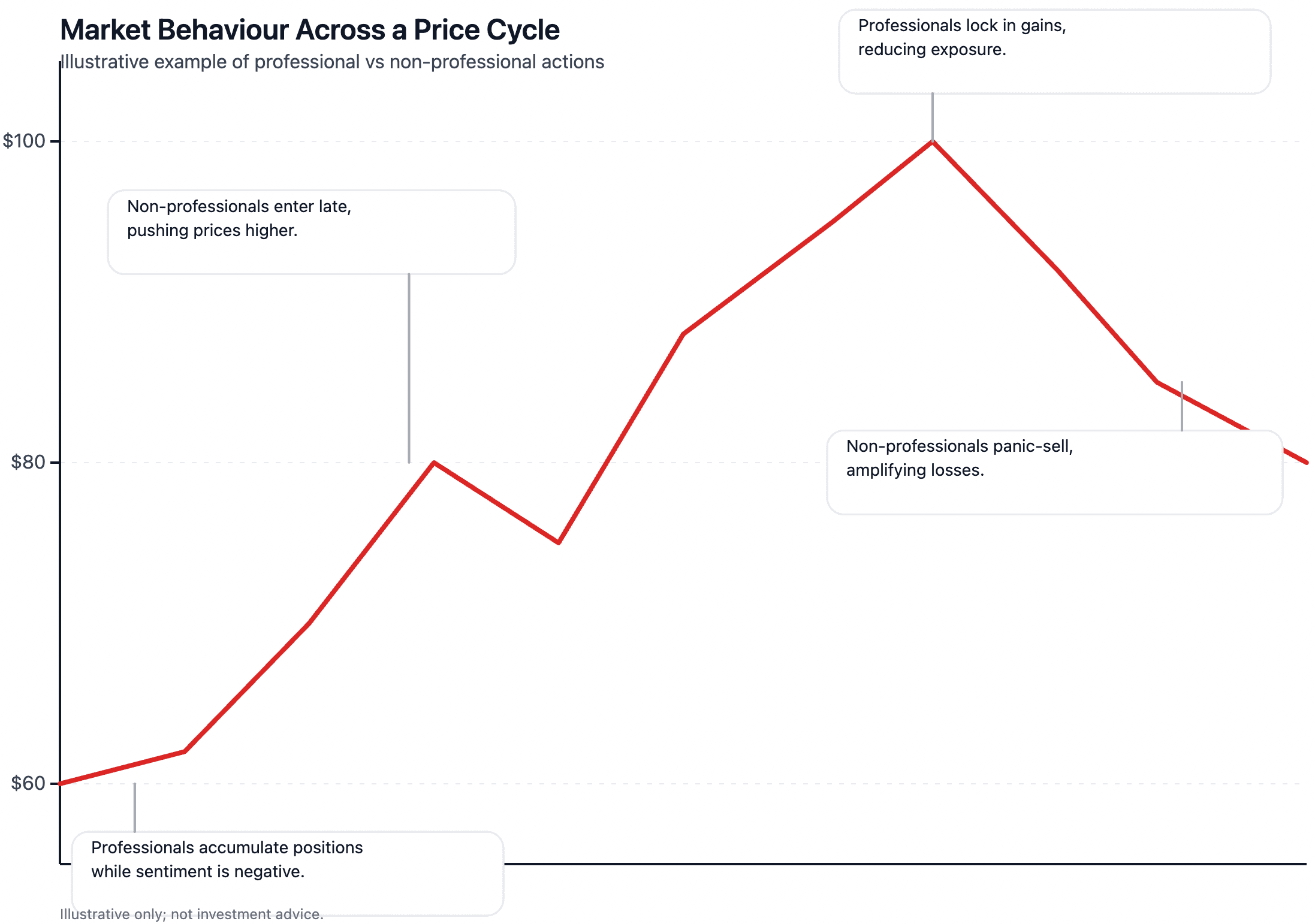

At its core, contrarian investing means buying when sentiment is bleak, selling when euphoria reigns, and distancing one’s strategy from conventional and consensual market trends.

The allure of a contrarian strategy is obvious. By entering positions when prices are deeply depressed, contrarians are able to buy at a discount, increasing the likelihood and size of the upside when broader sentiment realigns with their view.

Empirical research, such as the Falling Knives study by Brandes Institute, confirms that stocks hammered by indiscriminate selling often become contrarian goldmines.

Yet contrarian investing carries some intrinsic drawbacks that won’t surprise most investors who’ve tried it:

It can involve protracted periods of underperformance, because sentiment often gets worse before it improves.

It demands a level of discipline, patience, and mental fortitude that not all investors possess.

However, in disciplined hands it has tended to produce persistent long-term alpha.

Contrarians often outperform during times when exuberance inflates certain sectors at the expense of other sectors. It’s hard to think of a more extreme example of this than the recent performance of the Magnificent Seven, which has surely opened up many relative bargains across the global market.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A Local Example of a Capital-Diverting Stock

You’ll have noticed similar themes on the ASX of late.

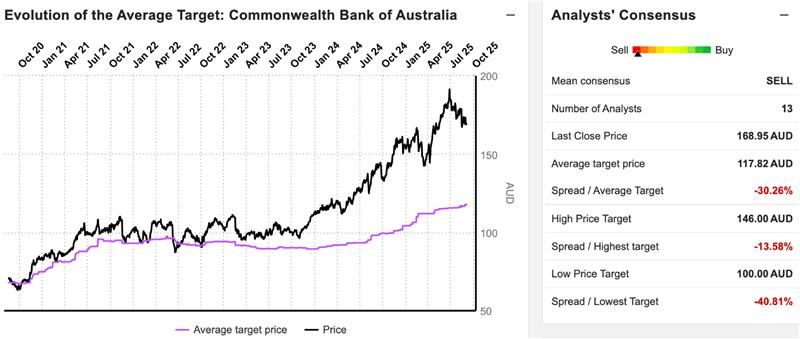

One of the more extreme examples is CBA. According to MarketScreener, CBA is currently trading at 27x next year’s earnings, making it one of, if not the, most expensive banking stocks in the world. That surely spells overvaluation.

Milford Asset Management’s Jason Kururangi sums the CBA situation up well: ‘For the active managers in the Australian market, most would probably consider it the biggest pain of their life. If I had a meaningful position, I’d be taking profits – it’s in bubble territory, for sure.’

CBA is essentially an advertisement for contrarian investing at this juncture. Surely, there are better themes, sectors, and stock opportunities elsewhere on the ASX which are receiving less capital attention as a result of CBA’s overvaluation.

So where are they?

Where the Value is Hiding on the ASX

We’ve identified four segments of the ASX where contrarians have reportedly been sniffing for opportunities of late:

- Resources Sector

The resources sector has underperformed in recent years due to China property weakness and commodity price volatility. Yet iron ore majors and the diversified miners continue to generate strong earnings.

A modest demand rebound could re-rate the sector’s valuations from cyclical lows, particularly amongst the lithium and nickel sectors which are positioned to benefit from the global electric vehicle rollout.

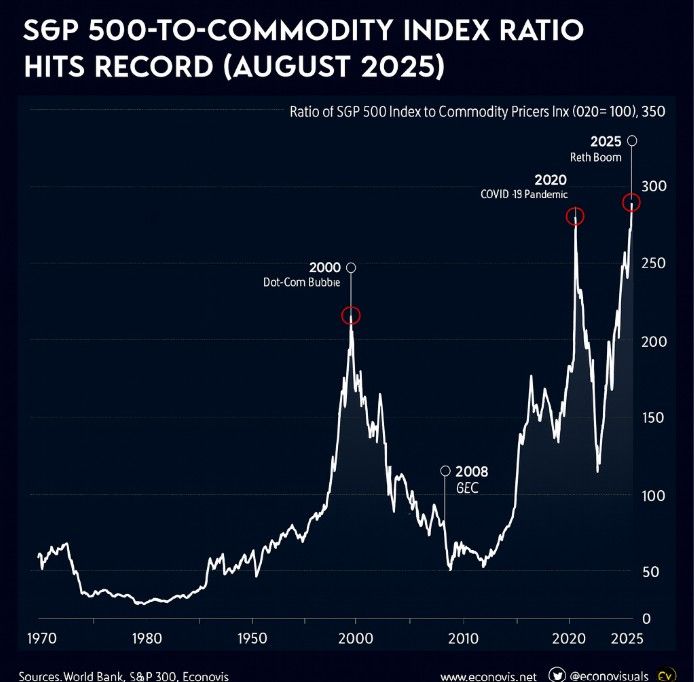

Here’s a single (US) chart which shows the contrarian attractions of the global commodities sector right now:

It’s also noteworthy from a contrarian’s perspective that the major and mid-tier ASX miners are generally trading at conservative multiples relative to their global peers.

Valuations: According to S&P/ASX 200 Materials Index, the resources sector is trading at a forward P/E of 13.5x, and a forward dividend yield of 5.7% (as at 31 July 2025) vs ASX 200’s forward P/E of 20.1x, and its forward yield of 4.2% . That looks attractive ahead of a potential inflection point across the sector.

- Energy Sector

The energy sector remains relatively undervalued despite generating strong free cash flows. The ESG divestment process and demand uncertainty has led to depressed valuation multiples, while LNG and gas infrastructure assets generate resilient, inflation-linked income streams and attractive yields.

Valuations: According to S&P/ASX 200 Energy Index, the energy sector is trading at a forward P/E of 12.8x, and a forward dividend yield of 6.8% (as at 31 July 2025) vs ASX 200’s forward P/E of 20.1x, and its forward yield of 4.2%. Current valuations arguably don’t fairly value the sector’s defensive attributes.

- Small & MidCaps

Smaller companies are notoriously susceptible to investor neglect since they are generally covered by less analysts, liquidity is lower, and many don’t have specialist investor relations managers to keep the market well-informed. That’s precisely the reason this market segment offers so many offer mispriced opportunities.

After years of underperformance due to risk aversion and funding costs, small caps are looking cheap relative to their larger peers.

For example, many quality small-cap exporters, niche industrials, and domestic consumer companies with strong moats are trading at steep discounts to fair value.

Valuations: According to S&P/ASX Mid-Small Index, ASX small caps are trading at a forward P/E of 19.3x vs ASX 200’s forward P/E of 20.1x. Small & mid-caps generally outperform following long drawdowns once liquidity conditions ease, so the current valuation discount may offer an opportunity for longer term investors.

- A-REITs

Commercial property REITs, especially office and retail, bore the brunt of rate hikes and changing work/consumption behaviour. That has left many trading at sharp discounts to Net Tangible Asset (NTA) value, in some cases 20–30%.

However, with another RBA rate cut expected before the end of the year, and more expected in 2026, a market headwind has turned into a tailwind. Commercial property cap rates are expected to trend lower while cash flows recover.

Valuations: According to SPDR S&P/ASX 200 A-REIT Fund, the A-REIT sector is trading at a price/book ratio of 1.2x and a 3% yield, although many A-REITs are trading at sharp discounts to NTA. For contrarian investors, this may offer an attractive margin-of-safety in buying A-REITs (and unlisted property funds for that matter) poised for a revaluation rebound.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Tips for Constructing a Contrarian Portfolio

Ready to follow in Warren Buffet’s contrarian footsteps? Here are three tips which may help:

1. Anchor your portfolio with a Value-Focused Core

Use value-focused funds or ETFs as the core of your contrarian portfolio as value investing tends to be contrarian by nature.

2. Tilt into Niches with High-Conviction Managers

As the saying goes: there’s riches in niches. Add exposure to niche contrarian market segments such as smaller companies through high-conviction managers with a long-term track record of outperforming.

3. Maintain Patience & Discipline

Contrarian windows can remain unfashionable for years. Be ready for volatility along the way as well as delayed gratification. That means being ready to be wrong in the short term.

Be Ready to be Uncomfortable

Like the S&P 500, recent ASX performance has been dominated by a handful of high-fliers such as CBA. This spells opportunity for contrarians. When the herd congregates in the same pastures, value often hides within unloved market segments such as smaller companies, resources, energy, and A-REITs. If that sounds uncomfortable, you’re likely on the right contrarian path.

Contrarian Funds Worth Checking Out

Click to watch Allan Gray's Insight Series Podcast

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.