Commodity ETFs: an ideal portfolio diversifier

Ankita Rai

Fri 17 May 2024 6 minutesMoney has been flowing into commodities this year due to persistent high inflation and geopolitical tensions, prompting investors to seek strategic, inflation-proof assets.

This trend contrasts with consensual expectations from a few months ago when the market expected more in the way of interest rate cuts. But the scenario has shifted, and now expectations of prolonged higher rates, coupled with sticky inflation and a resilient global economy, are bolstering demand for raw materials.

Apart from providing exposure to a wide range of commodities, including energy, metals, and agriculture, commodity ETFs can help investors hedge against inflation and capitalise on global demand trends, all while providing cost-effectiveness and liquidity.

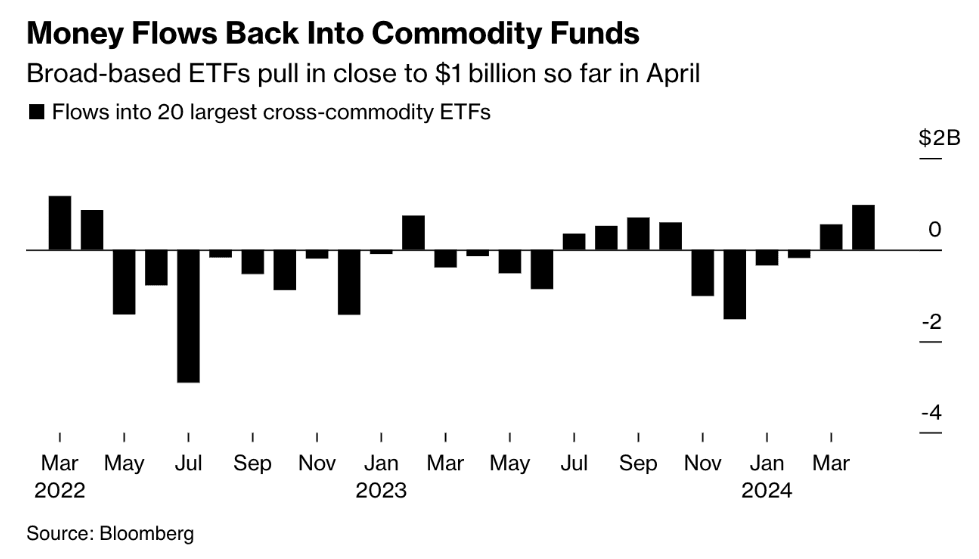

For example, investors poured $970 million into broad-based commodity ETFs in April alone, according to Bloomberg data.

This recent surge has been driven by a rally in precious and base metal prices, with gold hitting an all-time high of US$2,415 an ounce in April, and copper reaching its highest level in two years at almost $US10,000 a tonne.

This commodity price rally has benefited passive investment funds like the VanEck Gold Bullion ETF, which has increased 25% in value since October. Similarly, Global X Physical Gold ETF, Global X Silver Miners, iShares Copper and Metals Mining, USCF Aluminum Strategy, and iShares MSCI Global Gold Miners have all posted double-digit gains so far this year, reflecting heightened investor interest.

A commodities super-cycle may be brewing

Analysts expect commodities to continue rallying with precious metals, base metals, energy, and agriculture all expected to register significant gains.

For example, Citi forecasts that gold, silver, and copper may increase by 5% to 10% in the next three months, and potentially by 15% to 20% over a year. Veteran analyst Jeff Currie is viewing commodities as a win-win for investors regardless of central bank actions.

The current climate of high inflation and heightened geopolitical risk, coupled with broader economic growth has created a perfect environment for commodities. In addition, strong demand, supply tightness, and consumer hedging have all contributed to the recent upward moves in commodity prices.

Compared to the last major commodities supercycle of 2002, which was fuelled by China's extended period of growth, the current resurgence is being driven by broader global economic growth, including rapid urbanisation in developing nations and the resultant growing demand for raw materials.

Additionally, commodities demand is arising from clean-energy investments such as renewables. While commodities like copper, aluminium, lithium and uranium are benefitting from this trend, so will natural gas, coal, oil, and steel, all essential for constructing and maintaining these infrastructures.

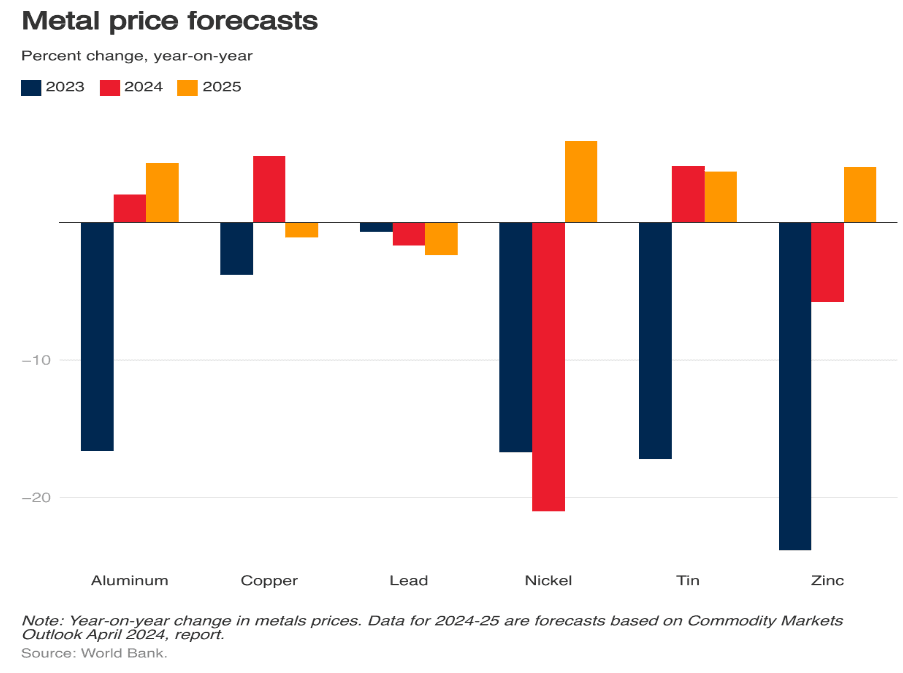

According to the World Bank, metal prices are expected to stay steady this year before slightly increasing in 2025 due to growing global industrial activity and demand for renewable energy technologies.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Do your own research

Despite their potential advantages, commodity ETFs come with unique risks. Understanding the intricacies of these funds is paramount to capitalising on their benefits and minimising their risks.

Here are two key considerations to bear in mind:

1. Understand the fund's strategy: Before investing in a commodity ETF, it's crucial to grasp the fund's investment strategy and underlying assets. Some ETFs, like SPDR Gold Trust and Betashares Gold Bullion ETFs, hold physical commodities such as gold. The advantage of a physical ETF is its direct ownership of the commodity, mitigating tracking risk where the ETF's returns differ from the asset it aims to track.

However, given the difficulty in physically storing most underlying commodities such as oil and wheat, most ETFs are priced off futures contracts such as Betashares Crude Oil Index ETF and Global X Bloomberg Commodities ETF.

While these ETFs tend to be the most common, investors should remain aware of “roll costs,” which occur when rolling short-term contracts into longer ones leads to tracking errors over time.

Then there are equity-based commodity ETFs that hold stocks of companies that mine or produce commodities. These funds can also provide exposure to commodities like lithium, uranium, copper, gold, natural gas, and oil. While it's not the same as a physically-backed fund, the equity alternative offers transparency and eliminates the possibility of regulatory limits that could affect future trading. Examples include ETFs like Betashares Global Uranium ETF and iShares MSCI Agriculture Producers ETF, which provide investors with exposure to uranium and agricultural commodities, respectively.

2. Assess volatility: Commodity prices often experience significant fluctuations due to factors like unpredictable weather patterns and geopolitical tensions. As a result, commodity ETFs are known for their volatility, influenced by supply-demand dynamics and external events.

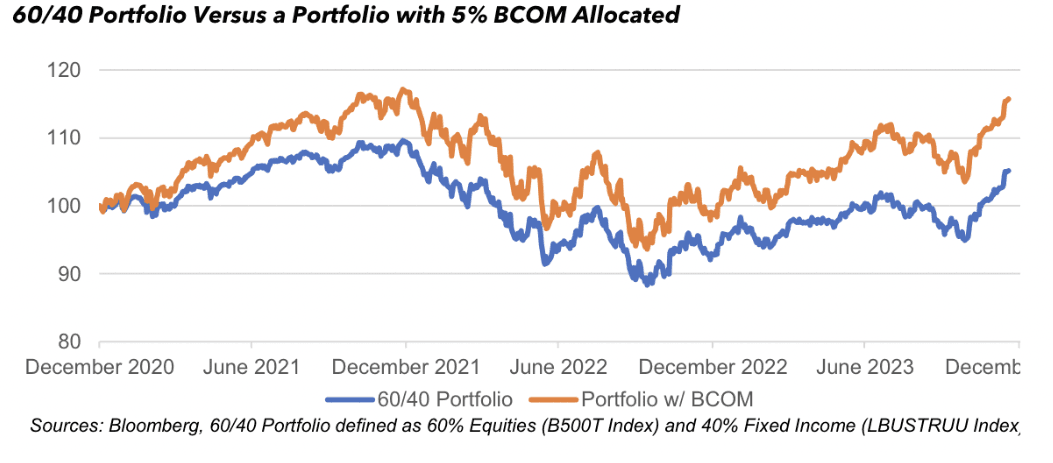

Investors can mitigate this risk by diversifying across ETFs tracking broadly diversified commodity indices. For example, consider opting for ETFs that track broad commodities like the Global X Bloomberg Commodity ETF. This ETF follows the leading commodity benchmark, Bloomberg Commodity Index (BCOM), which tracks a range of commodities across six broad sectors such as energy, metals, grains. By doing so, investors can avoid the risks and volatility associated with trying to select individual winners.

Diversification may help reduce overall portfolio fluctuations with even a relatively small allocation. For example, a standard 5% commodities allocation can improve portfolio performance as shown below.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Capitalising on commodities momentum

The criteria for a supercycle typically involve high demand, abundant supply, and elevated prices. Although these factors aren't currently aligned, indications suggest we may be on the brink of a commodity supercycle.

Therefore, it's crucial to prepare strategically. While commodity ETFs provide avenues for diversification and inflation protection, staying attentive to market shifts is key. With diligent planning and risk assessment, commodity ETFs can serve as valuable assets within a balanced investment strategy.

Key takeaways for investors

Commodity ETFs provide investors with exposure to a diverse range of commodities such as energy, metals, and agriculture, and offer valuable diversification benefits. Additionally, commodities have a proven track record as effective inflation hedges, making them an attractive option in inflationary environments.

Analysts anticipate continued commodity price strength, particularly in sectors like precious metals, base metals, and agriculture. Factors such as high inflation, global economic growth, and clean-energy investments are driving this trend.

Amidst this favourable outlook, it's crucial for investors to grasp the intricacies of commodity ETFs. Understanding their underlying strategies and assessing volatility is paramount prior to investment.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.