What happened to the commodities supercycle?

Simon Turner

Thu 15 Jun 2023 6 minutesThroughout 2022, investors were reminded by a number of market experts that most commodities were in chronic undersupply. “Buy the chemical table”, was the advice given by more than one strategist who believed we were at the start of a new commodities supercycle.

However, at this point in 2023 the tune across markets has changed. There’s no longer the same amount of collective enthusiasm for commodities, nor the consensual belief that we’re at the beginning of a new commodities supercycle. So what happened? And what’s coming next for commodities?

How to recognise a commodities supercycle

Let’s start by discussing what a commodities supercycle looks like.

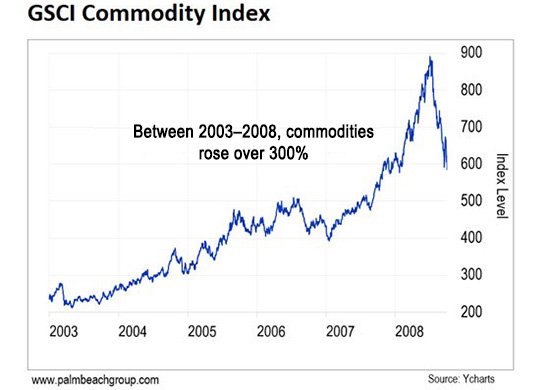

The last commodities supercycle occurred between 2003 and 2008 when booming Chinese economic growth provided a powerful and seemingly insatiable demand driver for a vast array of resources. As shown in the chart below, it was a lucrative time to be a commodities investor.

One of the lessons that period reminded markets is that there are three key ingredients in a commodities supercycle:

1. Surging commodity prices;

2. Surging commodity demand;

3. Surging commodity supply.

Most investors expect higher demand and prices at the beginning of a commodities supercycle, while surging supply is often a supercycle ingredient which results from surging demand and prices.

The reason being the market’s consensual belief in the commodities supercycle leads to more capital being invested into new supply.

The precursor to surging supply is often structural commodity deficits which need to be addressed to meet increasing demand. Capital tends to support new supply growth at scale when all the investment ducks are aligned, particularly confidence that the market can absorb the new supply being invested in.

This investment short termism ignores the multi-year lead time between the investment in commodity exploration and the production of saleable commodities. Hence, commodity supercycles can last for many years.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How today’s commodity markets measure up

Let’s use these three supercycle ingredients to test where commodity markets are in 2023…

1. Surging prices? Negative. Commodity prices have generally been trending downwards since the start of the year. As shown below, commodity bellwether copper is down 12% over the past year after a volatile 2022.

2. Surging demand? Negative. Commodity demand is mixed year to date but it’s generally been flat or slightly weaker rather than surging—particularly for transport fuels.

3. Surging supply? Negative. Commodity supply remains weak in most commodities and is likely to remain so in the foreseeable future due to a lack of investment into new commodity supply across the board.

There’s no escaping the fact that commodity markets fail the commodities supercycle test at this point in time. Despite all the talk about the birth of a post-pandemic commodities supercycle, we’re not there yet.

Why not a supercycle?

Two words explain why commodity markets are unsupercycled right now…mean reversion.

The demand destruction caused by the pandemic, global supply chain shocks, and ongoing Russian sanctions have led to an unusually uncertain and cautious commodity pricing environment. Most market participants are still awaiting the dust to settle after one of the less predictable economic episodes in recent history, while aggressive central bank tightening has amplified that market uncertainty.

The market is divided between those who believe central banks will win the fight against inflation which implies a bearish commodities outlook—and those who believe commodities and other inflationary drivers are largely outside of central bankers’ control at this point in time.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

So what’s next for commodities?

Looking beyond the central bank focused noise, it could be that the long predicted commodities supercycle is still due at the station—just later than expected.

The key initial driver for any commodities supercycle is strong demand growth. That’s exactly what we’re facing in the coming few years due to continued global population growth and the low per capita consumption of commodities in emerging markets.

For example, India’s 1.4 billion population remain at a relatively early stage in their journey toward the establishment of a large and wealthy middle class. This is the case for many emerging market countries with large commodity-hungry populations. The implications for long term commodity demand growth are significant.

Then there’s the energy transition which is arguably going to supercharge demand for a number of commodities in ways beyond the market’s current comprehension.

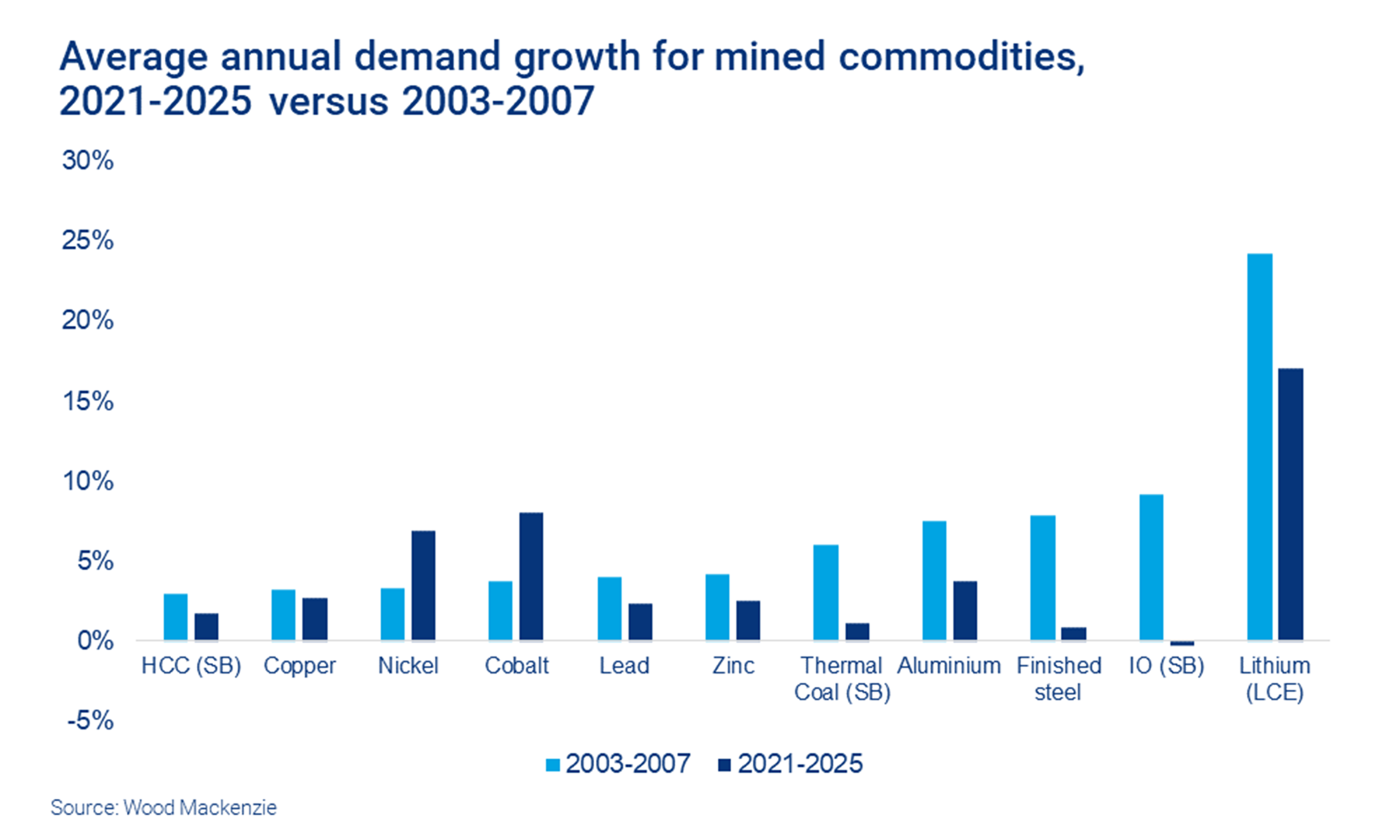

As shown in Wood Mackenzie’s 2021-2025 forecasts below, demand growth for key energy transition commodities such as nickel and cobalt dwarf comparable figures during the 2003-2007 commodities supercycle, while demand growth for lithium is expected to remain particularly strong in the coming years.

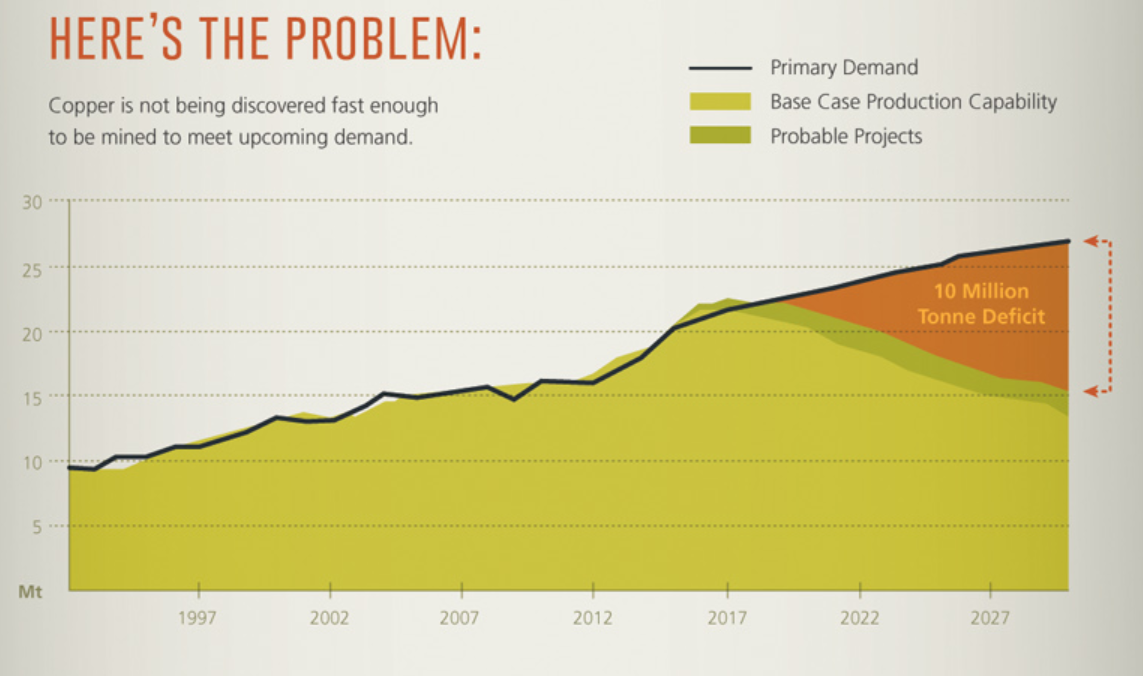

Commodity supply growth is also a key factor looking forward—and the supply outlook is bullish for many commodities. For example, Wood MacKenzie is forecasting significant copper deficits until 2030 reflecting ongoing production disruptions in Peru (responsible for 10% of global supply) and higher energy transition-related demand.

The combination of these factors suggest a commodities supercycle could indeed be in the making. And with the energy transition adding to the expected natural demand growth we’re on track for, the next commodities supercycle may be larger and more prolonged than the 2003-2007 one.

Look forward rather than backwards

The key point for investors is to look forward rather than backwards.

The ingredients for a demand driven commodities supercycle are arguably already in place while supply of a number of commodities such as copper are likely to remain constrained for many years.

While the exact timing of the next commodities supercycle is hard to predict due to the uncertain macro environment, investors are likely to be rewarded for investing in commodities which benefit from the ongoing energy transition and the emergence of a thriving middle class across emerging markets. For example, lithium, cobalt, nickel, and copper. Investors are also likely to be rewarded for thinking long term about these structural trends.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.