The technology shifts helping your fund managers make you more money

Simon Turner

Thu 16 May 2024 7 minutesOne of the longer term criticisms of the active fund management industry is its chronic underinvestment in product research and innovation. But time catches up with all of us. There was only so long active fund managers were going to avoid investing in products which match up with modern day investors’ needs and expectations.

As a result, technological change is finally arriving in the active fund management world and is making up for lost time. Arguably, this emerging wave of technological advancement is going to divide the industry between those who embrace it and those who continue to ignore it.

From an investor’s perspective, this evolution translates into opportunity which it will pay to be aware of and exposed to.

Fund managers haven’t been in a rush to change

Until recently, the fund management industry has largely escaped much of the technology-driven change typical of most industries.

It’s easy to see why. In the main, most funds carry the same names and strategies as during the pre-internet days. Asset class definitions have remained largely static for decades, whilst the end result of a portfolio of stocks which match the asset class definition and tick the investment process boxes is also roughly the same.

But what if the products much of the active fund management sector is offering are no longer as fit for purpose?

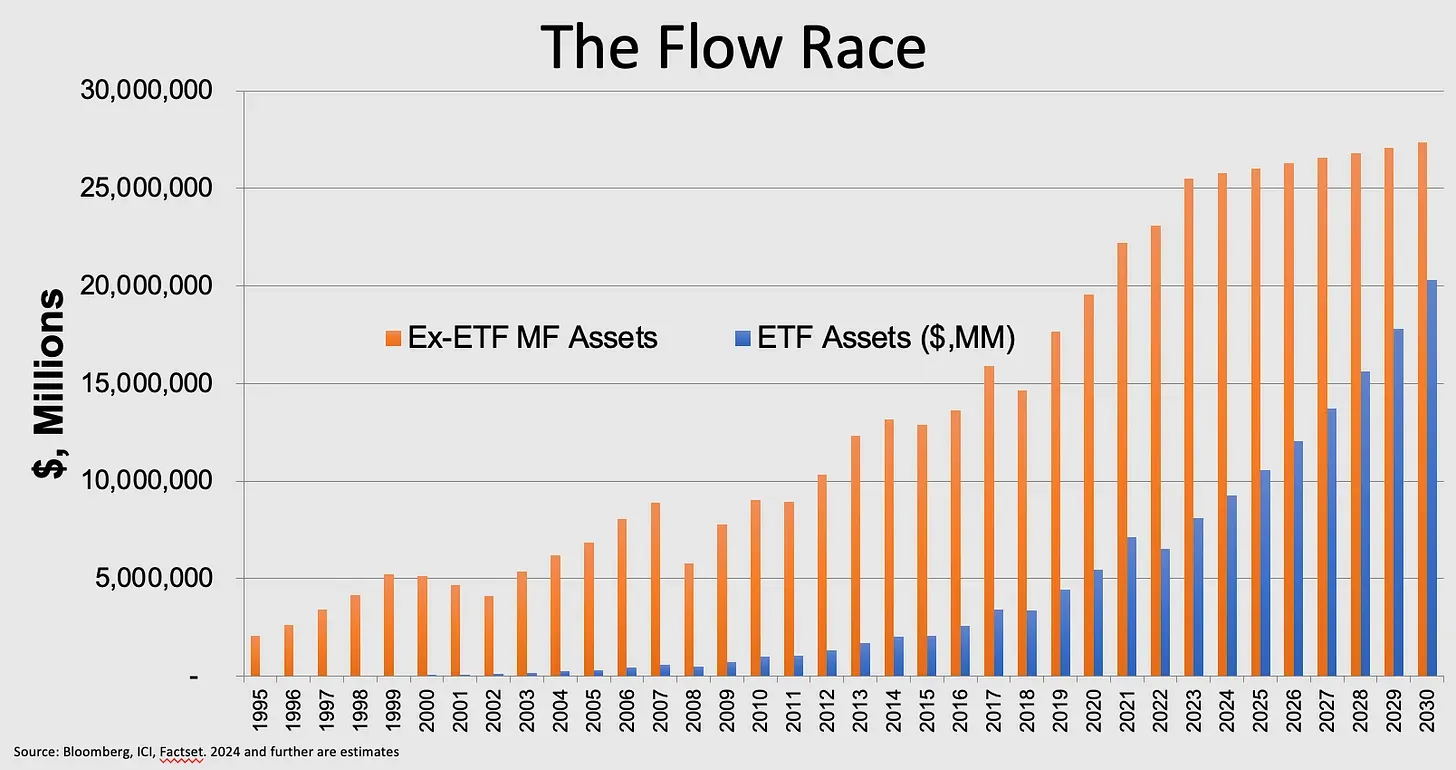

What if all those decades of neglecting research and development in favour of treating their business models more as cash cows has left the sector vulnerable to market share loss to alternative investment products such as ETFs? There’s no arguing with the numbers on that front. ETFs have been taking market share from active funds for years and are expected to continue doing so:

Technology to the rescue

That was then. This is now, a time when forward-thinking active fund managers are embracing technology in ways the sector tended to avoid in the past.

For example, some of the major technological changes currently afoot include:

1. Artificial intelligence (AI) integration

You’ll have heard of the many ways in which AI is changing life as we know it. It’s the same in active fund management where AI-driven machine learning is meeting big data in game-changing ways across the entire value chain.

For example, AI is increasingly being used for predictive market modelling and portfolio management optimisation based upon the instant processing of huge amounts of data. When done effectively, this process translates into additional alpha generation potential, particularly whilst the usage of AI is in its infancy as it is. Longer term, this window is likely to close when AI integration becomes more commonplace and the opportunity erodes. Having said that, the early leaders in integrating AI into their investment processes are likely to continue utilising AI to generate investment edge by remaining a step or two ahead of the crowd.

In other words, the early bird will get the worm.

2. Blockchain usage

Blockchain is a distributed ledger or database of shared records. The potential applications of the blockchain technology have become clearer in recent years, and there are plenty of potential upsides for active fund managers in this space.

For example, one of the greatest advantages blockchain offers the corporate world is the ability to improve the transparency and efficiency of business processes. For fund managers, this translates into improved data and identity security, as well as more efficient reporting and compliance functions. That means lower costs and potentially lower fees.

3. Data, data, data

The fund management sector has long been dependent upon data analysis for risk and portfolio management analysis, but large swathes of the industry have avoided incorporating market data into planning the most launch-able, profitable, and scalable investment strategies. In the past, these decisions were based more upon market observations rather than extensive data. But with the quality of the available financial, ESG, risk, and other data increasing exponentially, the potential for fund managers to make better informed product launch and management decisions has never been better.

For example, forward-thinking fund managers are now able to better assess investors’ unmet needs, and they are better able to assess the competitive landscape of available investment products with meaningful data. So not only can fund managers prove up the business case behind investment products better than before, they can also more accurately assess the alpha generation potential of a strategy prior to launch.

This is known as innovation alpha, and it signals an era when fund manager product launches could be more reflective of outperformance opportunities.

4. API (application programming interfaces) usage

APIs are software interfaces that allow applications to communicate with one another, and are already commonplace in the banking sector. More recently, the fund management industry has started using APIs to connect with their custodians and administrators. This makes it faster and cheaper for fund managers to deploy their investment solutions. Once again, that translates into lower costs and potentially lower fees.

5. Cloud migration & remote working technologies

The pandemic highlighted to all fund managers the importance of migrating to the cloud and ensuring their employees can work remotely. This makes sense from a cost management perspective, and it also ensures business flexibility which is essential for all fund managers, particularly those aiming to scale new product launches.

The list goes on. Suffice to say, there are currently many opportunities for active fund managers to use technology to improve their investment and business model performance to the benefit of their investors and shareholders alike.

Change = opportunity for investors

With so much change afoot, there are two noteworthy takeaways for prospective fund investors:

1. Technology leadership is increasingly a competitive advantage: Active fund managers who are embracing the power of AI and other emerging technologies are more likely to benefit from an early mover advantage and the associated alpha generation potential. So keep an eye out for fund managers who are focused on using technology to build their competitive advantages to the benefit of their investors. When these technology-driven fund managers launch new products, the alpha innovation potential may be notably higher than for more traditional managers. As such, when an active fund manager is launching a new product, it’s prudent to ask about their pre-launch data findings, the competitive landscape, and the fund’s innovation alpha potential.

2. Fee pressure becoming more sustainable: Fund managers who are utilising cost saving technologies such as blockchain and APIs are becoming more cost efficient which means they’ll be well positioned to lower their fees longer term. Given fee pressure is a long term challenge for active fund managers with lower fee ETFs taking market share, active funds managers who can lower their operating costs are best positioned to continue scaling while remaining profitable.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Change has officially arrived in active fund management

The changes technology is bringing to the active fund management industry are great news for fund investors. For the foreseeable future, it translates into higher alpha generation and fee reduction potential for fund managers who build a competitive advantage by becoming technology leaders. Arguably, this is the industry’s opportunity to wrestle back some of the market share it’s been losing to ETFs by showcasing more innovation-driven value add.

The signs investors should watch out for in prospective active fund managers are competitive fee structures, solid track records which reference technology advancement, and forward-looking management teams who are actively embracing technological change for all it offers their investors and shareholders.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.