Why Australian economic growth has ground to a halt

Simon Turner

Thu 9 May 2024 5 minutesWorryingly, Australian economic growth decreased each quarter of 2023 so the economy has been in deceleration mode for some time now. The economy only grew 0.2% in Q4 2023, and 1.5% for 2023. Given the population has been growing faster than that, Australia has been in a per capita recession for some time now. In fact, this is the slowest rate of Australian economic growth since way back in the 1990s (excluding the pandemic and the GST introduction).

In case you’re wondering why the Aussie economy is languishing while the global economy continues to grow at a decent clip, we take a look under the hood for a guide as to what’s coming next…

Australia’s economic challenges

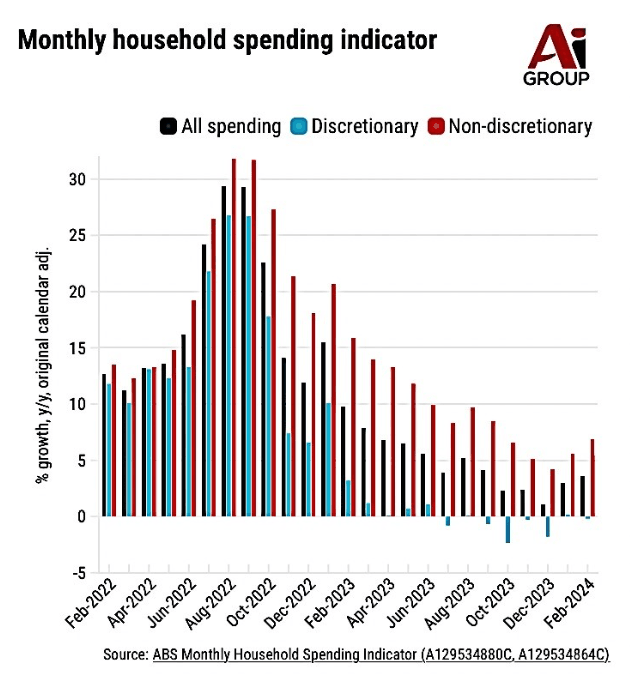

Let’s cut to the chase. Household spending is at the heart of Australia’s economic woes. It has been anaemic for some time now and grew by only 0.1% in the fourth quarter of 2023 (the latest available data). That minuscule growth was driven by essential purchases like electricity, food, rent, and healthcare rather than discretionary spend.

The slowdown in household spending was particularly pronounced after the post-pandemic spending boom:

The only minor bright spots in the Australian economy during Q4 2023 were net exports and government spending. If you exclude these two, Australia’s domestic sector actually contracted by 0.5%. It’s hard to find a positive way to frame this state of affairs. Consumers are in a negative state of mind at present.

The central banker shaped elephant in the room

With consumer confidence languishing like this, there’s an elephant in the room that can’t be ignored … has the RBA raised rates too far and too fast?

At this point, there’s no escaping the likelihood that the RBA’s unerring focus on using cash rates to control inflation may have led to unintended consequences for the Australian economy. For example, higher interest rates have undoubtedly led to a fall in new home building which has in turn accentuated the undersupply of residential property and higher rents.

The RBA no doubt knows what’s required to make an omelette, but the list of perverse outcomes in response to higher interest rates are arguably more pronounced than they expected. Let’s hope they know what they’re doing.

What’s next for the Aussie economy?

The RBA expects more short term economic pain for a while.

They are forecasting a continued economic slowdown during the first half of calendar 2024 with only 1.3% growth followed by a gradual recovery thereafter. Economic growth in the second calendar half of 2024 is expected to be 1.8% followed by 2.1% in the first calendar half of 2025 and 2.3% in the second calendar half.

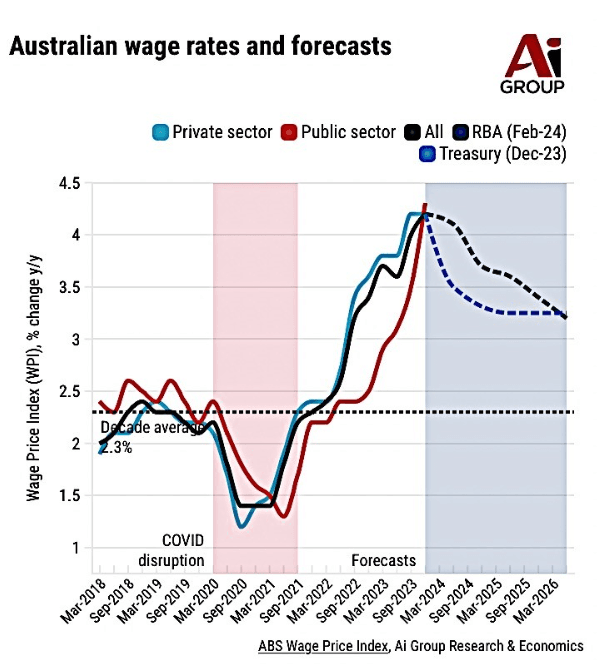

So if the RBA’s forecasts are to be believed, the worst of the economic slowdown is almost behind us and there’s light due to emerge on the horizon in the coming months. Supportive of this view is the recent pickup in wages per employee:

Unfortunately, there’s a but—and it involves the RBA’s coming rate decisions.

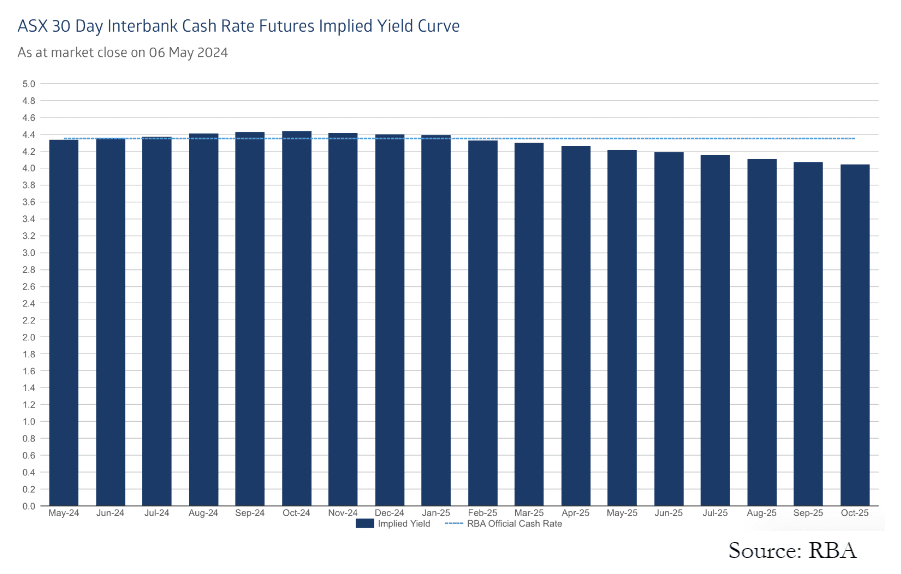

The implied futures curve reveals the market’s current expectations on that front versus the RBA’s current cash rate of 4.35%. As shown below, the market is now pricing in one more rate rise by the end of 2024 followed by a cutting cycle from early 2025. In other words, in recent months there’s been a shift away the expectation of a rate cut or two by the end of the year.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

If the RBA exactly follows this playbook, there’s a risk of more short term economic pain before conditions improve. We’ve already seen how that plays out. However, the RBA may choose to maintain rates steady rather than adding to the nation’s economic woes. Arguably, it will be more digestible for markets if they were to delay the next rate cutting cycle rather than raising rates one more time. Watch this space.

The Aussie economy will one day rise from the ashes

The Aussie economy has a long term track record of growing come hell or high water so the recent per capita recession is at odds with the economy’s character and structure. The good news is bad news doesn’t tend to last forever. Depending on the RBA’s actions, there are compelling reasons to believe economic growth will improve from 2025 onwards.

Key takeaways for investors:

-The RBA’s actions are having unintended consequences on the economy so what they do next is likely to also impact positively or negatively on Australian economic growth, at least in the short term.

-The market has now priced in a rate rise by the end of 2024. If the RBA follows this playbook, there may be more short term economic pain to come.

-Identifying growth areas of the Australian economy is unusually challenging at present. Consumer exposed sectors are likely to remain in the doldrums in the foreseeable future, but if and when the RBA starts cutting rates, a consumer headwind is likely to become a tailwind.

-There are compelling reasons to believe the Australian economy will recover from 2025.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.