The bond bear may not be ready to hibernate

Simon Turner

Wed 22 May 2024 6 minutesWe’re entering uncharted territory with the current global bond bear market both in terms of duration and magnitude. For an asset class which had previously been incorporated into the vast majority of portfolios primarily for its defensive attributes, this bear market has raised serious questions about how investors should view bonds looking forward.

Whilst bonds are currently offering investors higher yields than for many years, the key issue for the asset class is whether inflation and interest rates really have peaked.

A brutal bear market

By most measures, this global bond bear market has been the worst ever.

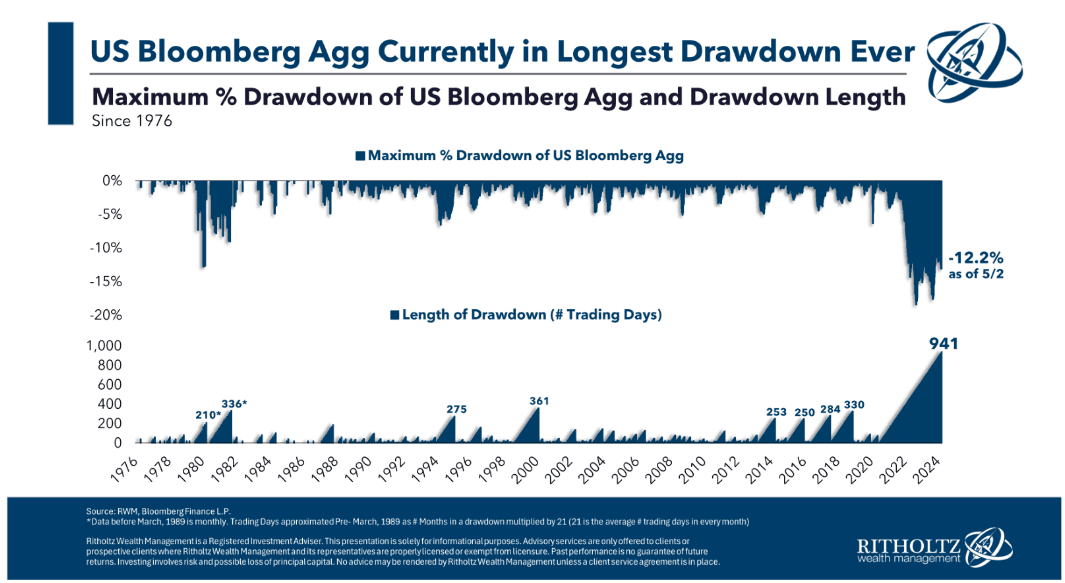

The Bloomberg Aggregate Bond Index has experienced its largest drawdown since its inception way back in 1976—both in terms of magnitude and length of time:

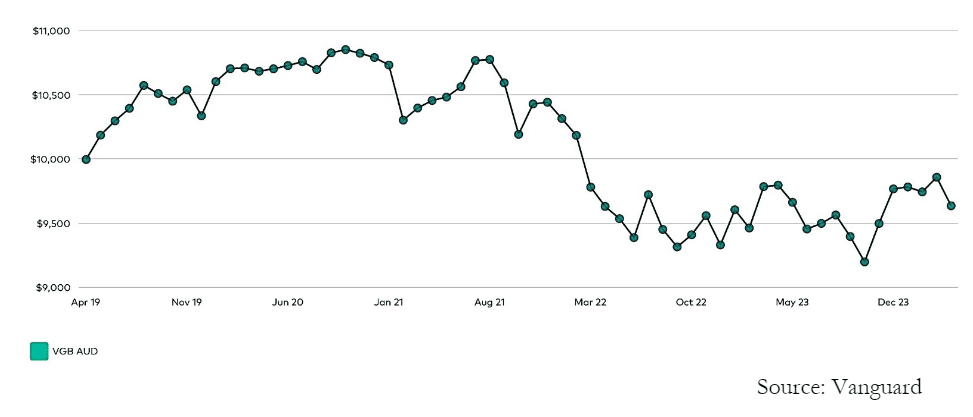

The situation is similar in Australia with the Vanguard Australian Government Bond ETF generating a total return of -3% p.a. over the past 3 years:

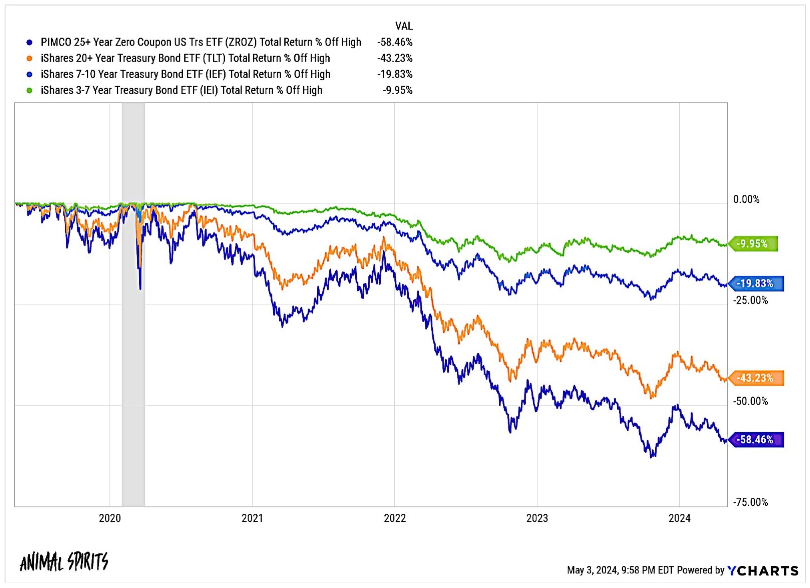

Recent performance has been even worse in the higher duration (more sensitive to interest rates) parts of the global bond market where the declines from highs have been enormous:

In each of these cases, the real returns are worse than the numbers suggest because inflation has been eroding the value of bond investors’ capital and income.

Bond investors’ arch-nemesis

By now, it’s not a mystery to most investors why bonds have been underperforming for so long: higher inflation and interest rates.

For good reason, inflation is the number bond investors tend to watch like a hawk.

Not only does rising inflation erode the value of bond investors’ capital and income, it also tends to lead to higher interest rates and thus lower bond values. As we all witnessed, developed world central bankers responded to the return of inflation by raising rates at the fastest pace in history.

Higher interest rates also mean bond investors receive higher coupon payments, but bond values are generally a lot more sensitive on the downside to rising rates than the additional yield. In other words, higher inflation generally leads to bond bear markets—as we’ve witnessed over the past three years.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Has the inflation monster been conquered?

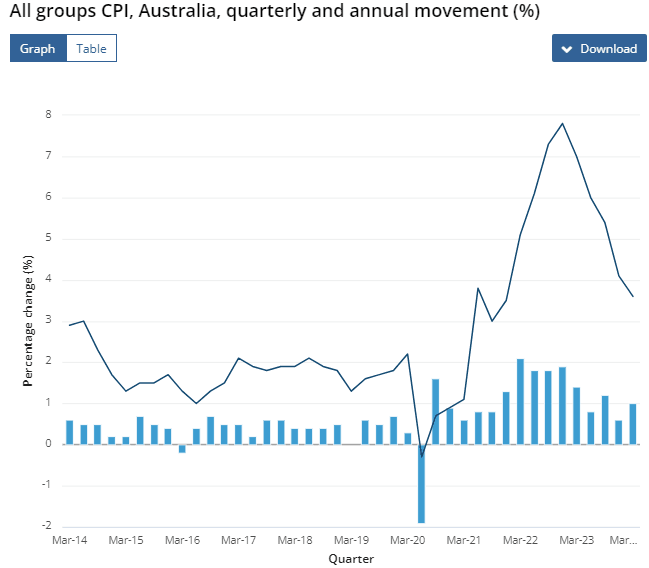

The RBA and many Australian economists believe inflation has indeed been tamed. Their optimism was justified by the Q1 2024 data which showed Australian CPI growth fell to 3.6% and is trending downwards:

It’s good news. Unfortunately, there’s a but. No matter what the RBA and other central bankers do, inflation is strongly influenced by global commodity prices. The interconnectedness of the global economy has wrong-footed many a central banker on this front in the past.

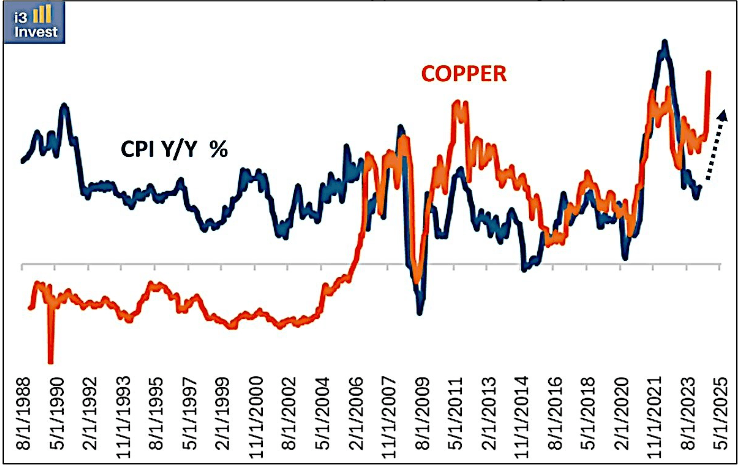

The bad news is the leading commodity price indicators are trending upwards:

So at this juncture, it appears premature to assume that global and Australian inflation, and thus interest rates, have peaked. That means it’s also probably premature to assume that the global bond bear market is over.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The American elephant in the room

There’s more sobering news.

The US Treasury remains a major risk to the global bond market since it is such a large bond issuer, and the US 10-year Treasury yield is regarded as a global bond pricing benchmark.

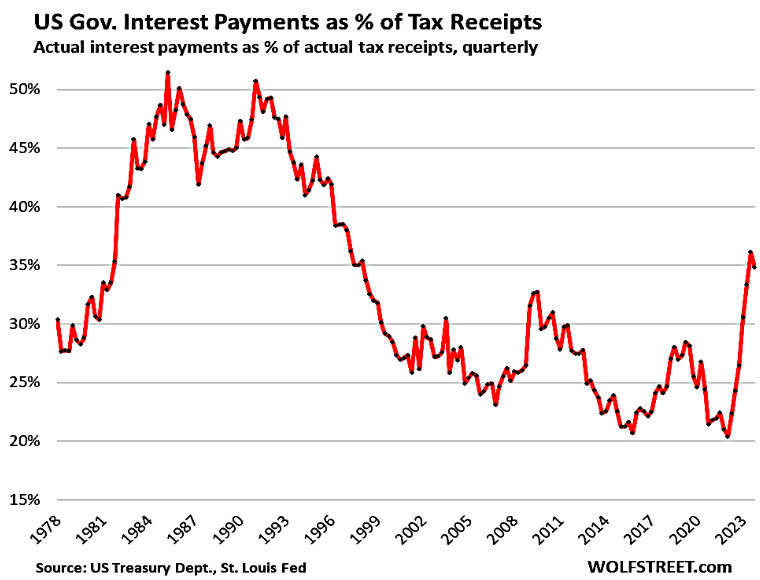

The problem is the US Treasury is continuing to issue huge quantities of bonds at a yield which arguably understates the risks faced by the US Government, particularly the risk of the government sustainably managing their mounting interest bill—which recently reached 36% of tax receipts:

The oldest rule in finance can’t be ignored: higher risk needs to be compensated with a higher return.

So if higher inflation were to eventually translate into higher interest rates, the US Treasury would be affected on multiple fronts. Firstly, their interest payments would continue to skyrocket as a percentage of tax receipts. Secondly, financial markets would view the US Government’s risk profile as higher since their debt mountain would be harder to manage, which would lead to investors demanding higher yields. Thirdly, this vicious cycle would continue, leading to higher interest rates, lower bond prices, and a precarious outlook for the government of the world’s largest economy. Let’s not even get started on the knock-on effects.

Given we’re talking about the US this risk shouldn’t be ignored. It could be a big deal for bond markets (and all markets) in the coming years.

Where’s the panic?

Notably, the elephants in the room aren’t causing a stampede.

In comparison with flighty, short-term-driven equity investors, bond investors are a calm lot. If equity markets were three years into the worst ever bear market, newspaper headlines would likely be all doom and gloom. But that’s not been the case with this bond bear market. When was the last time you even read about the subject?

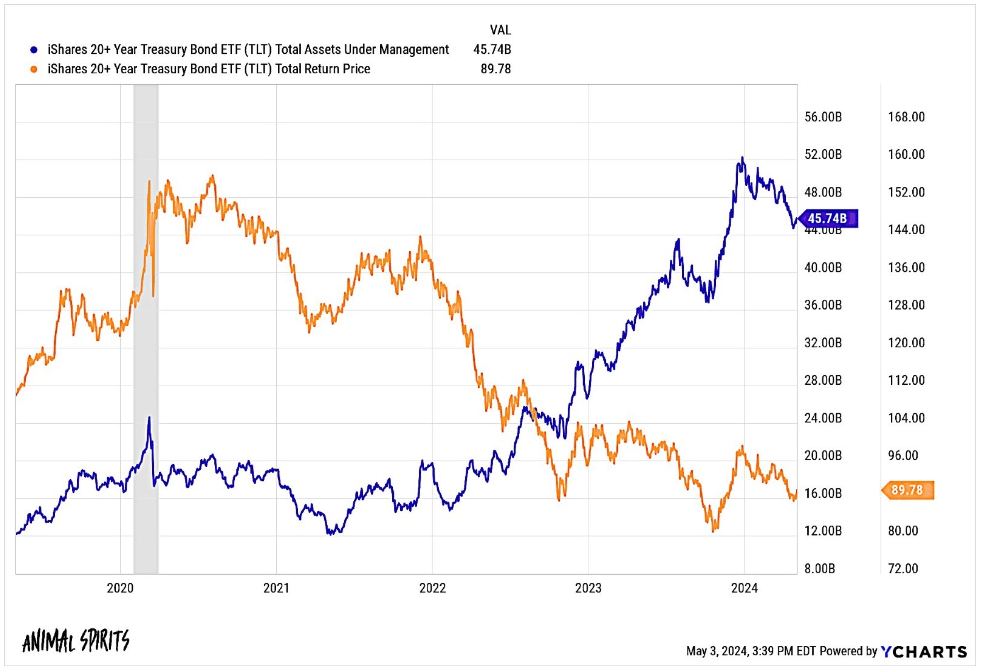

Rather than running for the exits, most bond investors have been inspired by the higher yields on offer to increase their exposure:

So at this juncture, it’s clear most bond investors are relatively relaxed about the risks posed by inflation and the sustainability of US Government debt levels. All we can assume is that the prospect of impending rate cuts is overriding these factors for many.

The bond bear may not be ready to hibernate

Global bond investors have a stronger hand than they did three years ago in the form of high yields. A 5%+ yield provides better compensation for the risks of investing in this asset class than the miniscule yields the market had to contend with for so long.

Despite the lack of panic amongst bond investors, the reasons behind the worst bond bear market in history are arguably ongoing: higher inflation and higher interest rates. That’s not to say there definitely won’t be a rate cut or two by the RBA and the Fed in the short term, but the longer term inflationary trend remains ominous. Time will tell whether the smart money should be as relaxed about the inflationary outlook as it appears to be.

Investors are likely to be rewarded for accepting that bonds are less likely to trade with defensive attributes whilst inflation remains elevated, and lower duration bonds (less sensitive to interest rates) may still provide the optimal exposure to the asset class.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.