8 Money-Making Strategies in the Recovering Commercial Property Market

Simon Turner

Wed 27 Aug 2025 8 minutesAustralia’s commercial property sector is in the midst of transformation. Long gone are the times when the hottest markets were congregated in the country’s most populated city centres. Regional hubs like Wollongong, Newcastle, Ipswich, and the Sunshine Coast have emerged as major post-pandemic winners.

There’s much more at play in this fast-recovering sector as money-making in commercial property becomes a greater focus for investors…

The Lowdown on Australian Commercial Property

Australia is now the world’s sixth most active commercial real estate market, climbing three places in 2024 with a 57% surge in total investment volumes in USD terms.

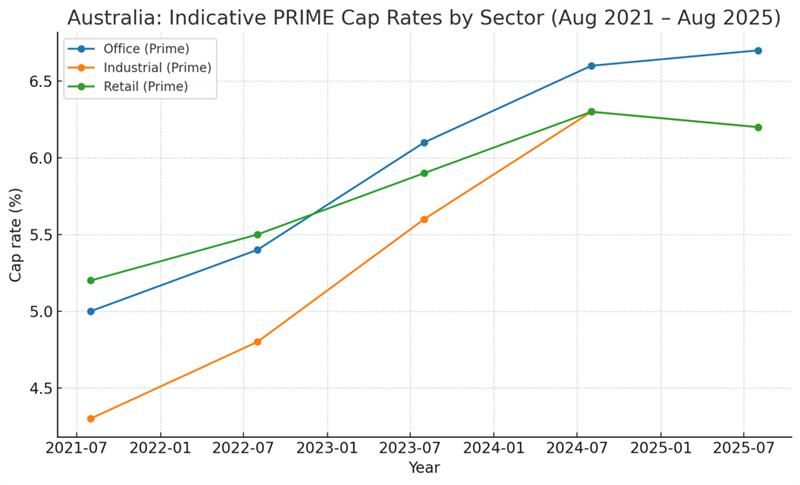

Both local and global investors are increasingly attracted by Australia’s political stability, transparent markets, and resilient demand drivers. As shown below, cap rates appear to have peaked in the industrial and retail sectors, whilst the office sector is also showing signs of bottoming.

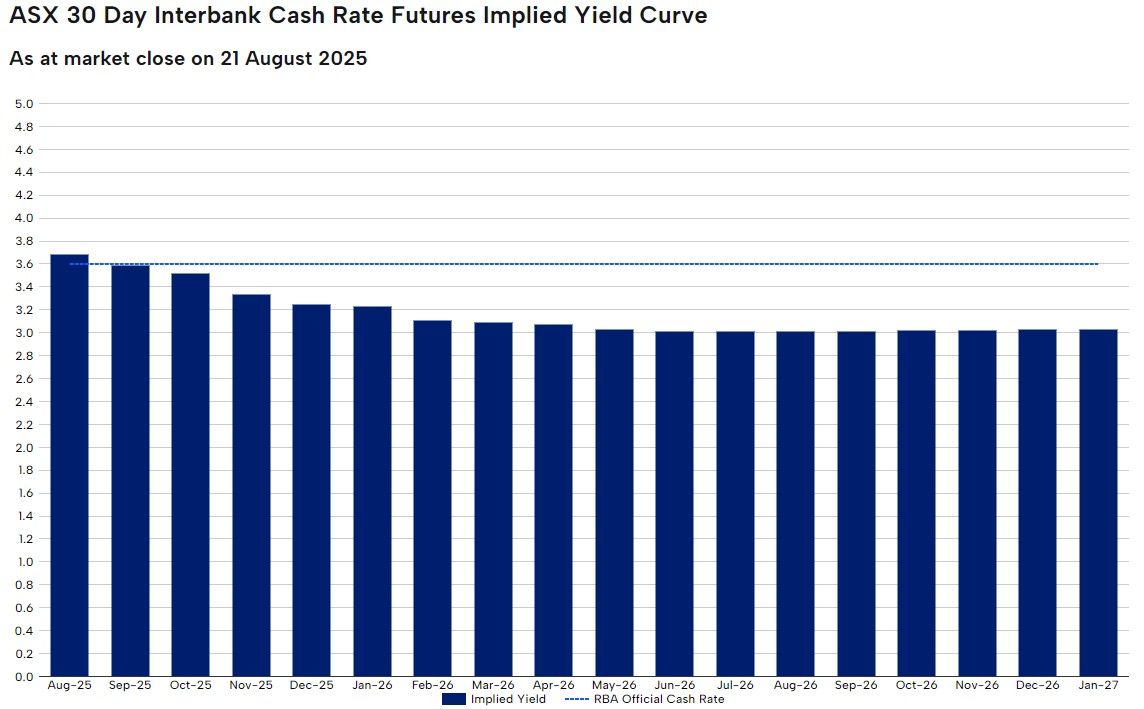

Official RBA rates are front and centre in this shift. With most forecasters expecting another 25 basis point rate cut by the end of 2025, and another in early 2026, commercial property valuations are likely to have a solid tailwind behind them.

If rates fall as expected, further commercial property cap rate declines are likely in the coming months and years.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Making Hay as the Sun Shines Again on Commercial Property

With commercial property valuations once again in the ascendancy, now’s arguably a good time to ensure you’re well-positioned to make money in this defensive out-of-favour sector.

Here are eight strategies aimed at maximising your risk-adjusted returns in commercial property…

Experience-driven design: Offices with wellness zones, collaboration areas, and flexible seating are now standard expectations rather than bonuses.

Decentralised hubs: Secondary cities like Newcastle and Wollongong are emerging as magnets for tenants priced out of expensive city centres but still requiring strong infrastructure and lifestyle appeal.

Tech-enabled assets: From smart access systems to energy-efficient lighting, buildings that make working frictionless also retain tenants for longer.

Rising rents: Net industrial rents are forecast to grow by 4% this year, providing dependable income growth.

Regional advantage: Growing regional hubs like Newcastle and Wollongong, with their proximity to ports and motorways, are ideal for last-mile logistics and regional distribution. Competitive land pricing in regional hubs outside of major allows investors to deploy capital at lower thresholds while still capturing strong rental demand.

Lower capex compared to greenfield developments.

Faster delivery to market.

Strong tenant demand for unique, adaptable spaces.

Data centres: Australia is emerging as a regional hub for cloud and AI infrastructure, with demand outpacing supply. Long leases with institutional tenants translate into reliable income streams for data centres.

Cold storage: With the rise of pharma logistics and food delivery networks, cold storage is becoming a scarce, high-yielding sub-sector.

Affordability with growth upside: Entry prices remain significantly below capital city levels.

Strategic infrastructure: Port access, highway connectivity, and strong local workforces underpin the growing tenant appeal of regional hubs.

Government tailwinds: Councils are actively encouraging regional business development with grants and zoning incentives.

Shorter lease terms (6–12 months) aligned with business outcomes.

Plug-and-play fit-outs which reduce downtime.

Shared, lower cost amenities from gyms to breakout kitchens.

1. Within the Office Sector, Focus on Smart, Flexible Assets

Just a few years ago, many declared the office sector dead. Today, that narrative is outdated. As the role of hybrid working stabilises in the mix, offices are being reinvented as high value places of work.

Cushman & Wakefield forecasts Australian office investment to rise 36% to $13.3 billion this year, reflecting this renewed confidence.

It’s noteworthy that the nature of office demand has shifted. Investors who think in terms of ‘experience’ rather than just ‘space’ are the ones set to prosper.

For example, tenants now expect:

For investors, the office investing game has transitioned to investing in assets which capture premiums for superior amenities, as well as backing the regional hubs with the demographic tailwinds behind them.

2. In Industrial & Logistics, Leveraging the Regional Advantage is Valuable

If offices are staging a comeback, industrial and logistics never left the stage.

The sector is forecast to grow 40% in 2025, with investments projected to hit $10 billion.

Demand is being driven by e-commerce growth, reshoring of supply chains, and infrastructure upgrades. With national vacancy rates at a record-low 2.5%, competition remains intense.

Here are two of the main themes at play:

Looking forward, industrial is expected to remain the ‘defensive growth’ story of commercial property: income-driven, resilient to economic cycles, and underpinned by structural tailwinds.

3. Adaptive Reuse = Profit in Reinvention

One of the more common questions being asked by commercial property investors of late is: why build from scratch when you can repurpose?

Adaptive reuse has become one of the most profitable plays in commercial property, particularly in markets rich with legacy assets.

There are countless adaptive reuse opportunities out there. For example, old warehouses can be morphed into co-working hubs. Vacant retail strips can be transformed into micro-breweries, medical suites, or creative studios.

These types of opportunities are abundant when councils lean into zoning flexibility, and businesses increasingly prize character alongside function.

Investors in adaptive reuse projects benefit from:

The returns are also impressive. Adaptive reuse can deliver solid, diversified returns while enhancing a project’s ESG credentials by avoiding demolition waste.

4. ESG = Green Dividends

Sustainability is no longer a commercial property niche. It’s an important profit lever.

Knight Frank’s Active Capital Report shows that green-rated assets in Australia achieve 8–12% rental premiums and lease up faster than non-certified buildings.

The reason is clear: institutional tenants are embedding ESG into their mandates. That means landlords without a comprehensive ESG strategy face the risk of owning obsolete assets.

Policy incentives reinforce this opportunity. Green loans, concessional financing, and tax breaks make ESG-driven upgrades more viable as investors in funds with sustainable portfolios are seeing improved risk-adjusted returns.

5. Tech-Enabled Assets = Smarter, Cheaper, More Valuable

Commercial property has evolved into a technology-driven business.

Smart locks, automated HVAC systems, IoT-driven energy monitoring, and AI-enabled predictive maintenance have become must-haves for many tenants.

It’s easy to see why. Tech-equipped buildings consistently command valuation uplifts, thanks to the reduced operational costs, higher tenant satisfaction and retention, and future-proofing against obsolescence.

For property funds, tech-enabled upgrades are often low-cost, high-return capex decisions that directly enhance their risk-adjusted returns.

6. Niche Assets Such as Data & Cold Storage are in High Demand

There are a number of specialised property niches which are delivering above-market returns, and are worthy of investor attention.

For example:

Both niches are attractive to funds seeking diversification and exposure to secular growth. They both benefit from lower tenant churn and above-average yields, which are appealing to conservative investors.

7. Regional Hubs are the New Prime Assets

Sydney and Melbourne may dominate the headlines, but regional hubs are where many of 2025’s most attractive risk-adjusted opportunities lie.

Well-positioned regional hubs such as Wollongong and Newcastle offer:

This trend is here to stay. Lifestyle migration, particularly post-pandemic, continues to funnel skilled populations into these regions, boosting demand for well-located office, retail, and logistics properties.

8. Flexible Leasing = Higher Occupancy

Rigid 10-year lease structures are becoming much less common in the commercial property world. Tenants want adaptability, and landlords who offer it are being rewarded with lower vacancy rates.

In high demand are:

The results speak for themselves. Funds that back their tenants by adopting flexible models are seeing their occupancy rates outperform market averages.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Turning Trends into Returns

The resurgence of the commercial property sector, the profitability of adaptive reuse, ESG premiums, and the rise of tech-enabled smart buildings all point toward a market in which specialist investors who act decisively will generate the strongest returns.

The playbook for commercial property funds is clear: embrace regional growth, diversify across sectors, back sustainability and technology, and lean into flexible models. The result is likely to be a portfolio of assets positioned for many years of return compounding.

Diversified Commercial Property Funds Worth Checking Out

Click to watch Castlerock's Insight Series Podcast

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.