Australia’s Economic Slide And How to Respond

Simon Turner

Mon 25 Aug 2025 6 minutesThere’s some sobering news to report. Despite being one of the world’s richest nations in personal wealth terms, Australia has slipped to 105th out of 145 countries in Harvard University’s Economic Complexity Index (ECI).

The ECI measures how diverse and advanced a country’s export base is. High complexity is associated with innovation, strong manufacturing, and future growth resilience. Australia’s position, behind Botswana and just ahead of Côte d’Ivoire, reflects its narrow export profile dominated by unprocessed (read: low value-add) resources like iron ore, coal, and lithium.

A decade ago, Australia was already struggling at 93rd position in the ECI. Unfortunately, the situation has worsened with another twelve places dropped since then. This is a deep-set, multi-generational problem which requires a focused, long-term political response.

In the meantime, the challenge for investors is to insulate their portfolios against Australia’s growing economic vulnerabilities...

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Five Strategies to Sidestep Australia’s Economic Complexity Challenges

Australia’s weak and deteriorating economic complexity surely spells longer term economic growth challenges. In a world increasingly defined by competitive rather than comparative advantages, world-leading innovation and manufacturing expertise has never been more valuable.

Whilst this is a concerning situation for the country, from investors’ perspectives there are ways to navigate it. Here are five strategies aimed at ensuring longer term portfolio resilience:

Many Australian investors are overexposed to the local market (otherwise known as home market bias) which leaves them overweight the resources and banking sectors. This over-reliance on raw commodity exports leaves investors exposed to commodity price cycles, geopolitical tensions, and the policy choices of other nations, especially China.

Global funds such as EQT Eight Bays Global Fund can be strategically deployed to capture growth in sectors and regions underrepresented in the local economy while reducing overexposure to commodity-heavy domestic indices like the ASX 200. In particular, owning Global Equity funds and ETFs which provide exposure to knowledge-intensive economies such as Germany, South Korea, and Japan is likely to be a prudent long-term move.

Owning thematic ETFs and funds focused on global technology, robotics, and clean energy which provide diversified access to industries not well represented domestically also enables investors to access offshore growth opportunities.

In the resources sector, don’t just hold the miners. Make sure you’re exposed to the upstream processors and manufacturers who are creating economic value with commodities via global funds.

Focus on higher value-add resources with greater scarcity value. For example, global funds and ETFs that focus on the full value chain of critical minerals (rare earths, advanced materials, and metals processing), from mining to processing to battery manufacturing, help investors benefit from optimised value creation. This strategy also aligns with sovereign capability investment trends.

Build global diversification into your portfolio deliberately. Use global funds and ETFs to access markets with higher ECI scores and innovation intensity. For example, emerging market funds and ETFs tilted toward Asia (but diversified beyond China) can capture the structural rise in complexity across the region.

Country-specific ETFs invested in India, Taiwan, or South Korea allow targeted exposure to these export-oriented manufacturing powerhouses.

Infrastructure funds with global exposure to transport, renewable energy, and utilities can provide the steady income and inflation protection needed to stabilise portfolios during periods of volatility.

Global REIT ETFs and funds provide diversification away from Australia’s concentrated property market and allow investors to tap into growth sectors like logistics warehouses and data centres.

Global defence and aerospace ETFs capture the growth in allied defence spending.

Clean energy and renewables ETFs align with government transition funding and the global energy transition toward low carbon energy sources.

1. Diversify Beyond the ASX’s Resource & Bank Bias

The Australian share market is heavily concentrated in banks and resource companies. With manufacturing representing just 5.1% of Australian GDP, the lowest in the OECD, local equity benchmarks lack breadth in higher-complexity sectors like technology, advanced manufacturing, and biotech. So diversifying globally has never been more important.

Investment Implications:

2. Capture More Value-Add in Commodities

One of Australia’s greatest economic challenges is how little of the commodities value chain is retained locally.

For example, the country earns only 0.53% of the value of the lithium it exports (90% of which goes to China), despite producing half the world’s supply. Most downstream processing and manufacturing happens offshore, particularly in China.

‘The future is a world in which we have to develop sovereign capability in the production of these metals in order to participate on equal terms in global markets.’ University of Technology Sydney economist Roy Green

The key takeaway is that being conscious of where the economic value is created in the commodities production chain is of growing importance to investors.

Investment Implications:

3. Access Growth Economies with Higher Complexity

While Australia’s ECI ranking has fallen, countries like Vietnam, Singapore, and India are climbing up the index. These markets are diversifying into electronics, pharmaceuticals, and advanced manufacturing, areas likely to see structural growth over the long-term.

Investment Implications:

4. Hedge Against Domestic Cyclicality with Alternative Assets

Australia’s economy is sensitive to commodity cycles and housing market swings. Alternative asset funds and ETFs can help dampen the associated portfolio volatility.

Investment Implications:

5. Align with Government-Led Industrial Policy

Recent bailouts and co-investments in steel (Whyalla), smelting (Port Pirie, Hobart), and shipbuilding (Austal) mark a shift toward sovereign capability building. While picking winners at a company level is risky, investors can back broader sectors likely to benefit from policy support.

Investment Implications:

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

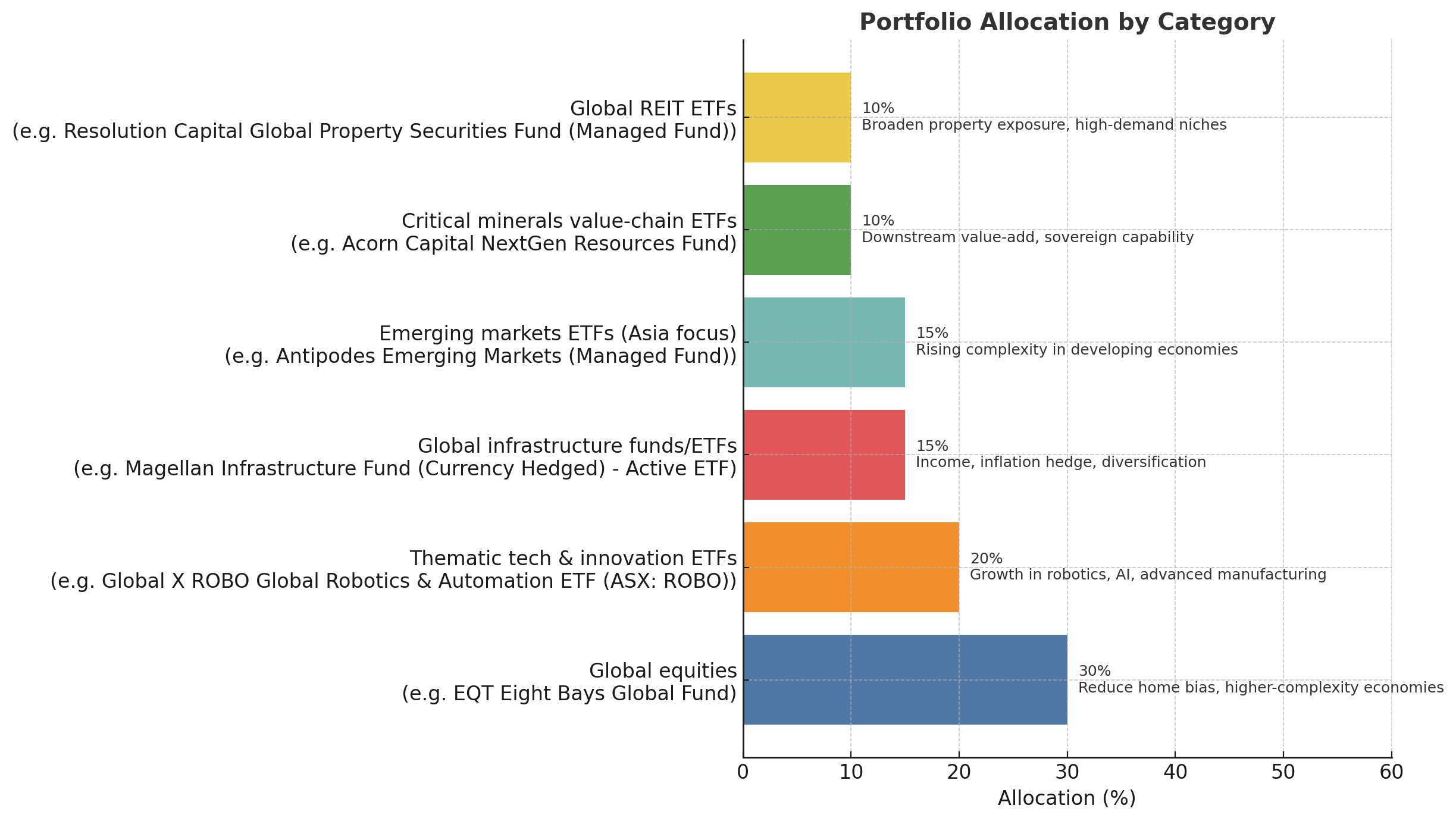

Model Portfolio Tilt for an Aggressive Complexity-Resilient Investor

Ready to take aggressive portfolio action to avoid the longer term implications of Australia’s economic complexity deficit?

Here’s an aggressive globally-focused portfolio aimed at achieving the type of long term growth which may prove elusive in many parts of the local economy in the coming decades:

From Shipping Dirt to Building Depth

Australia’s decline in economic complexity isn’t just an abstract academic ranking. It’s a signal of a narrowing industrial base and growing vulnerability to external shocks. Whilst future policy shifts will hopefully slowly reverse this troublesome trend, investors need to adapt now.

Building a portfolio of global funds and ETFs that thrive despite a low-complexity domestic economy means thinking globally, embracing thematic growth in high-complexity economies and industries, and ensuring you have sufficient exposure to the sectors and geographies Australia currently lacks. It’s about building resilience against Australia’s growing economic vulnerabilities.

You don’t need to wait for the Australian economy to climb back up the economic complexity ladder for your portfolio to follow suit.

Funds Mentioned

Click to watch EQT's Insight Series Podcast

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.